In a world where everything is just a tap away, the promise of “instant cash” feels almost irresistible. One click, quick approval, and money in your account. Sounds perfect, right? But what if that easy money comes at a terrifying cost?

For thousands of users, the U Money app didn’t turn out to be a financial lifeline. It became a full-blown nightmare. So, if you’re wondering, “Is the U Money app safe?” The answer, based on chilling user experiences, can be complicated to answer.

Behind the polished app interface and tempting loan offers lies a darker reality that many borrowers never saw coming. Users have reported being trapped in a cycle of fear, subjected to extreme harassment, threats, and even blackmail.

Disturbing allegations include morphed photos being used as weapons, abusive calls at all hours, and relentless pressure tactics designed to break borrowers mentally and emotionally.

This blog pulls back the curtain on the disturbing world of predatory loan apps, shining a harsh spotlight on U Money and the alarming experiences shared by its users.

If you’ve ever been tempted by quick cash with “easy terms,” this is a story you need to read before convenience turns into chaos.

Is U Money App Safe in India?

The term “U Money” actually refers to two very different things, and mistaking one for the other can be a life-changing error.

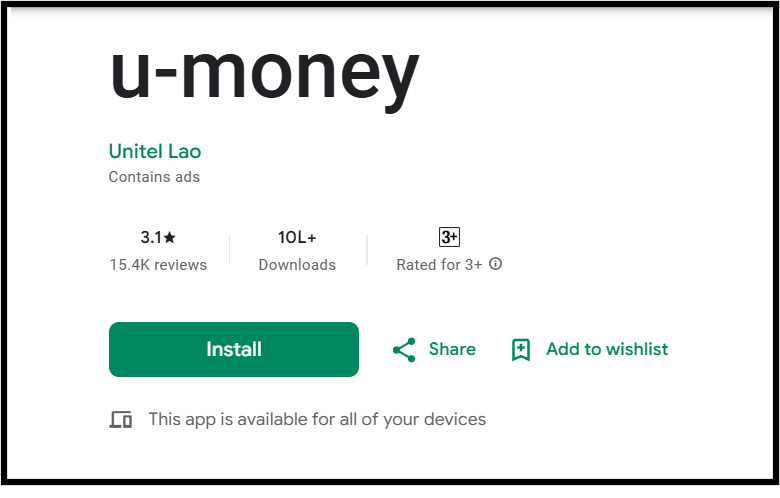

There is a financial service called u-money (developed by Star Telecom/Unitel), primarily used in Southeast Asia for paying bills and transferring money.

However, several fraudulent “instant loan” applications have surfaced on third-party sites and even briefly on the Google Play Store using the name “U Money” or similar variations. These are unregulated, predatory lending platforms that do not follow banking guidelines.

The “loan” version of these apps promises quick cash with zero documentation. However, the price you pay isn’t just interest. It’s your privacy and mental peace.

U Money App Users Reviews

When we look at the Google Play Store and consumer forums, the feedback for the U Money is chilling. To answer the question “Is U Money app safe?”The evidence suggests a resounding NO.

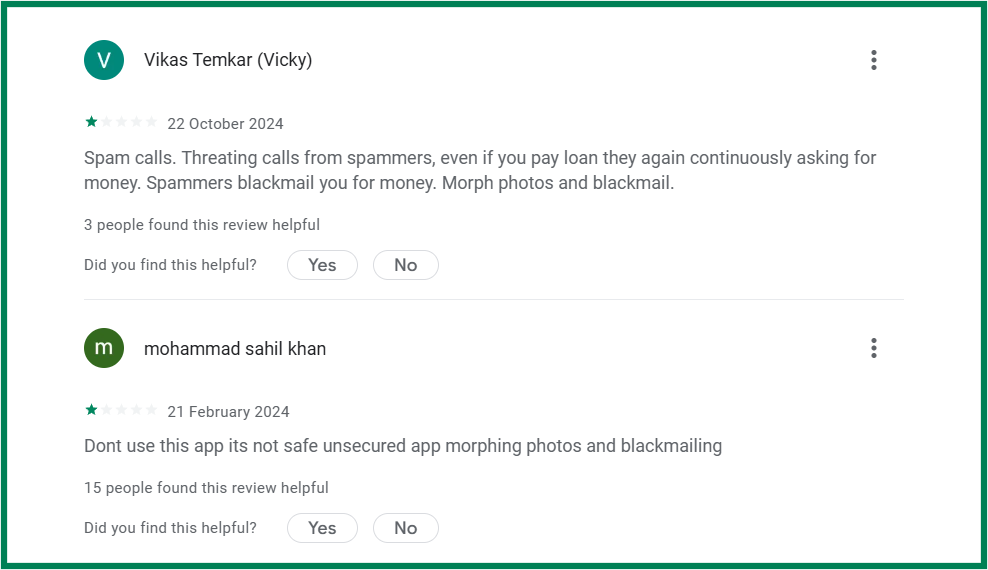

Users report that the moment they install the app, their phones are bombarded with spam calls. Even if a user pays back the loan in full, the calls do not stop. Spammers allegedly continue to demand “penalty fees” or “processing charges,” using aggressive and abusive language.

This is the most dangerous aspect reported by victims.

These apps often require access to your Gallery and Contacts to function. Once they have your photos, scam artists use AI to morph your face onto obscene or nude images.

They then threaten to send these photos to your entire contact list, including your parents, boss, and friends, unless you pay an exorbitant amount of money.

If an app asks for access to your Contacts and Gallery for a simple loan, it is a massive red flag. Legitimate banks do not need to see your private photos to verify your creditworthiness.

Hence, before downloading the U Money app, you need to think twice. Is it worth your time and peace or it will haunt you!

How To Report U Money App?

If you have already fallen victim to these tactics, do not pay the blackmailers. Paying once often leads to them asking for more.

Instead, follow these steps immediately:

- Go to the app’s page, click the three dots in the top right, and select “Flag as inappropriate.” Choose “Harmful to device or data” or “Hateful or abusive content.”

- File a complaint in Cyber Crime.

- Save screenshots of the threatening messages, the morphed photos (as evidence), and the transaction IDs.

- Lodge a complaint with the local police.

Need help?

Register with us. Our expert team will guide you to get a recovery if you are scammed by fraudulent apps.

Conclusion

So, is the U Money app safe?

The short answer is: it depends on which U Money you’re talking about.

If the “U Money” you stumbled upon is a loan app popping up in ads or search results, flashing promises of instant cash with zero hassle, that’s a massive red flag.

Many of these apps are not just unsafe. They’re outright dangerous. Users have reported horrifying tactics like morphing personal photos, threatening calls, and blackmail, all of which are criminal acts. No emergency, no temptation of quick money, is worth the trauma of being harassed or publicly shamed.

The safest rule? Stick to well-known, regulated banking or financial institutions. And before you even think of hitting the download button, pause and do one simple thing: read the Google Play reviews, especially the 1-star ones.

They often reveal what glossy ads won’t. A few minutes of checking reviews can save you months of stress. When it comes to your privacy and dignity, caution is always cheaper than regret.