If you’re Googling “is XM broker regulated”, you’re not just being curious.

You’re actually asking: “Is this broker safe to trust with money or not?”

So let’s unpack that properly, in simple language.

XM Broker

Now, who’s actually behind XM? Ownership reveals a great deal about a company’s seriousness.

XM is owned by Trading Point Holdings Ltd, a private limited company incorporated in Cyprus.

Under that holding company, you have:

- Trading Point of Financial Instruments Ltd: serves EU/EEA clients (CySEC-regulated).

- Trading Point of Financial Instruments Pty Ltd: serves Australian clients (ASIC).

- Trading Point MENA Limited: Middle East (DFSA).

- XM Global Limited: many international clients outside those regions.

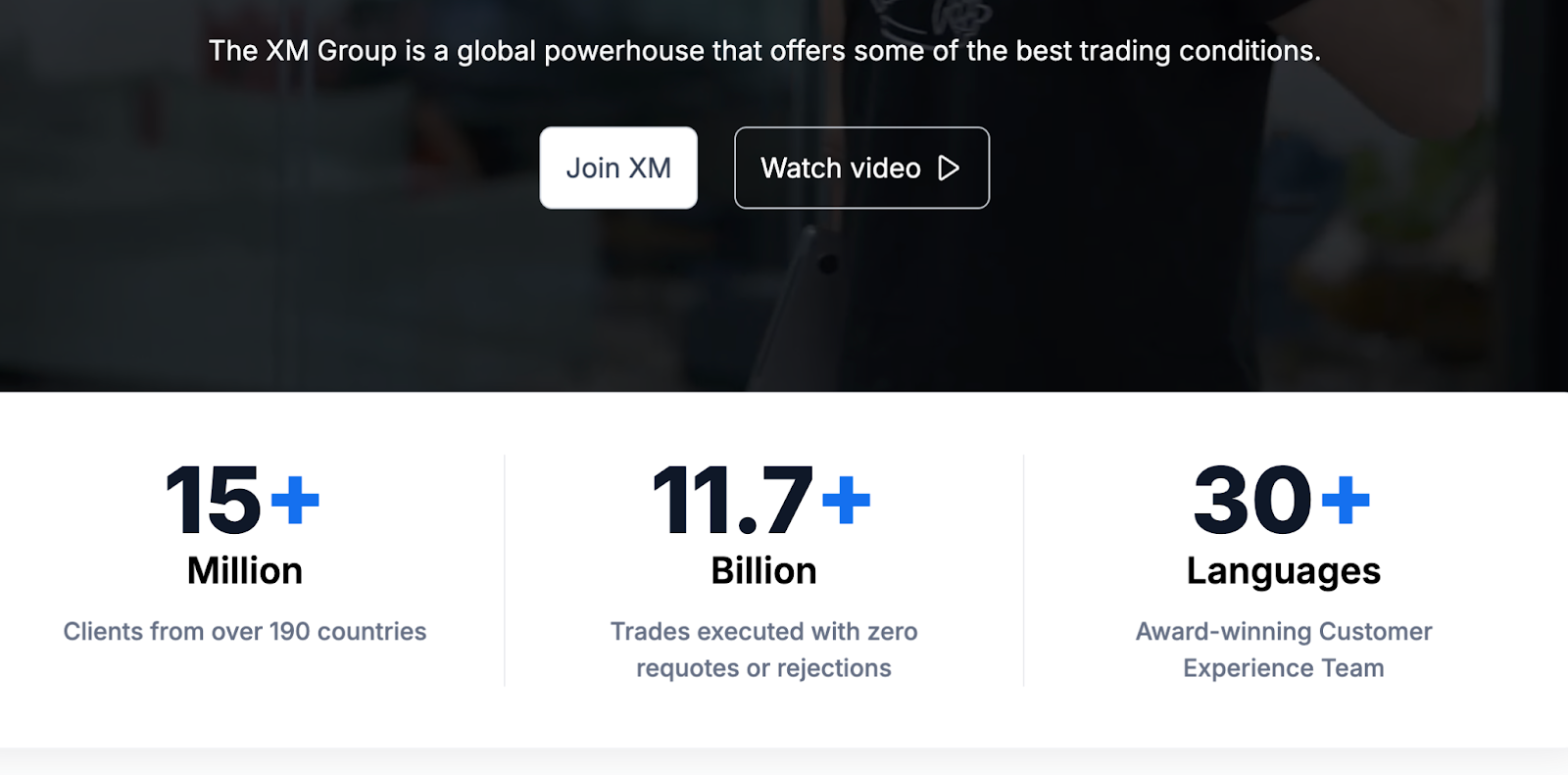

The group started around 2009, and today XM claims:

- 15+ million clients

- From 190+ countries

- Billions of trades executed

So this isn’t some one-person Telegram “broker”. It’s a large, structured company with multiple regulated entities.

However, as big as it is, for Indian users, there’s still the same catch: you deal with XM Global/offshore, not a SEBI-licensed local branch.

Is XM Broker Regulated in India?

Let’s start with the direct part.

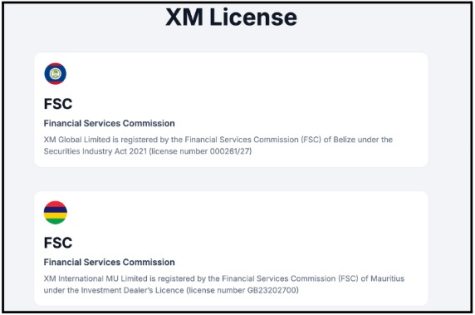

Yes, XM is a regulated broker, but not in India.

According to its own regulation page, XM is a group of companies under the Trading Point brand. Different entities are regulated in different regions,

Other group entities are also regulated in places like Australia and Dubai, through separate companies under the same parent.

So yes, this is a properly regulated forex/CFD broker at an international level. It’s not an anonymous betting site with zero licences.

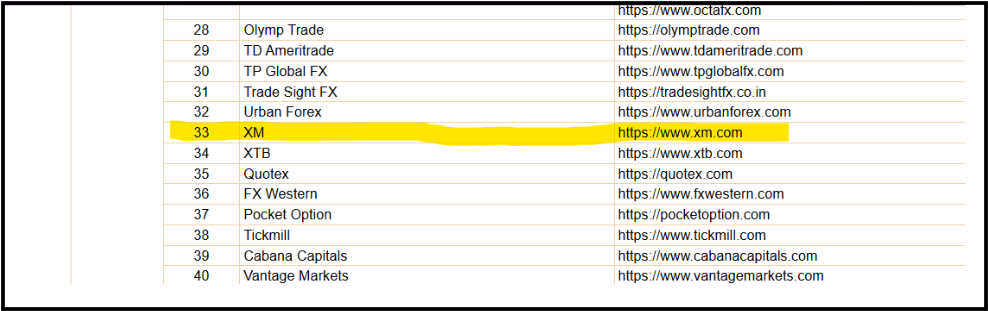

XM is not registered with SEBI and is not supervised by RBI for Indian retail trading. Several India-focused reviews clearly state that XM is globally regulated, but for Indian users, it operates in a legal grey zone.

Why “grey zone”?

Because:

- Under FEMA and RBI rules, Indian residents are not officially allowed to trade leveraged forex (like EUR/USD, GBP/JPY, etc.) through offshore brokers.

- SEBI has warned in the past against using unregistered foreign platforms for margin FX and derivatives.

- Yet, brokers like XM still accept Indian clients via their offshore entities, and Indians can technically open accounts online.

So what does that mean in plain words?

- You can open an account if you’re in India,

- but SEBI rules do not protect you,

- and you may be going against the spirit of Indian forex regulations.

If something goes wrong, like XM Broker withdrawal disputes or sudden account closures, you will be dealing with an offshore entity, not a SEBI-regulated Indian broker.

Sounds risky, doesn’t it?

XM Broker Complaints

Some big international review sites call XM a “trusted” broker with strong education and decent platforms, but not always the cheapest pricing.

However, other sources point out real issues:

- One client-feedback article notes that although XM is regulated, it still receives many complaints about withdrawals, alleged price manipulation, and poor customer support.

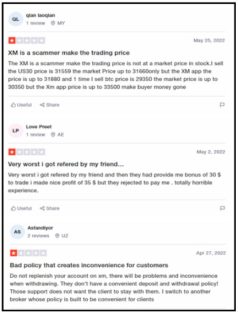

- Users accuse XM of being a “scammer” by manipulating trading prices for instruments like US30 and Bitcoin, claiming the app’s prices were significantly different from market prices, leading to financial losses for the user.

- All three user reviews in the following image can conclude that the XM trading app is unreliable, potentially fraudulent, or has severely poor customer service and withdrawal policies.

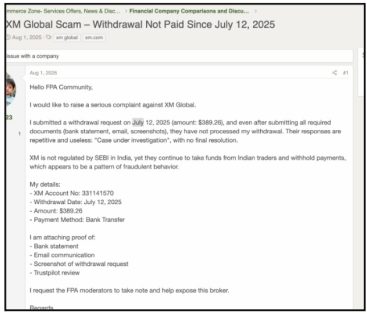

- A ForexPeaceArmy case in 2025 describes an Indian trader claiming a withdrawal not paid since July 12, 2025, and calling XM Global a scam in their personal experience.

- On Reddit, some users from other countries even say their central banks have warned about XM, calling it “a scam nowadays,” and accusing it of making conditions so that traders lose.

Of course, not every complaint means the broker is evil. Sometimes people ignore rules, abuse bonuses, or misunderstand risk.

But if you’re sitting in India, reading all this, it obviously doesn’t feel “simple and safe”, does it?

How to File Forex Trading Complaints?

If you are already facing problems with an offshore broker like XM in India:

- You can raise a formal complaint with the broker’s regulator (such as CySEC or FSC), depending on which entity holds your account.

- You can file a cyber crime complaint.

- You can contact the local cyber cell if you suspect fraud.

- And you should keep every email, statement, and screenshot safe as proof and contact local police.

Need Help?

If you’ve installed a trading or betting app like XM brokers, you don’t have to handle it alone.

Register with us and learn how to report suspicious platforms instead of just ignoring them. We help you further along with recovering losses.

Conclusion

XM is undeniably a big name in global forex and CFD trading. It has millions of users, multiple regulated entities, and more than a decade of industry experience.

On paper, that sounds reassuring. But for Indian traders, the reality isn’t that straightforward.

Since XM operates in India through an offshore entity rather than a SEBI-regulated one, you’re stepping into a space where the usual legal protections simply don’t apply, especially once you proceed with the XM Broker login and start trading.

Add to that the rising number of user complaints about withdrawals, price discrepancies, and customer support issues, and it becomes clear that caution isn’t optional; it’s essential.