With the growing demand for instant loans and quick financial assistance, many online platforms claim to offer easy money with minimal checks.

Yes Finance is one such name that often appears in online searches and social media promotions.

However, before trusting any financial platform, it is critical to understand who they are, how they operate, and whether they are actually legitimate.

This blog breaks down what Yes Finance claims to be, user experiences, and the major red flags you should be aware of.

Yes Finance

Yes Finance presents itself as an online financial service provider, mainly offering loans or monetary assistance through digital channels. It claims to simplify borrowing by promising fast approvals, minimal documentation, and quick disbursal.

However, beyond these claims, there is very limited publicly available information about the company’s legal identity, registration, or regulatory compliance.

This lack of transparency is often the first warning sign for users.

Yes Finance Login

Yes Finance typically operates through online communication such as websites, WhatsApp messages, or calls. Users are asked to “log in” or share personal details to start the loan process.

In many reported cases, the login or onboarding process involves sharing sensitive information even before any verified loan terms are provided.

Users should be extremely cautious at this stage, as legitimate financial institutions follow strict onboarding and disclosure procedures.

Is Yes Finance Legit in India?

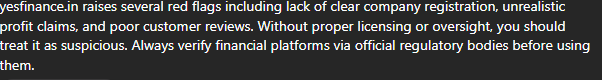

Based on verification checks and Yes Finance complaints, it does not appear to meet the standards of a legitimate financial service provider.

1. No Physical Office Address

There is no verifiable office location or branch address shared by the platform. Legitimate finance companies always disclose their registered office details.

2. No Company Registration Details

Users are unable to find:

- RBI registration or NBFC license

- ROC registration details

- Company Identification Number (CIN)

Operating without visible regulatory approval is a major red flag in the financial sector.

3. No Active Customer Support

Another major concern is the lack of responsive customer support. Once payments are made or issues arise, users report that calls and messages go unanswered, leaving them with no resolution.

This can easily fall under the Loan app frauds happening in India.

Yes Finance is Real or Not

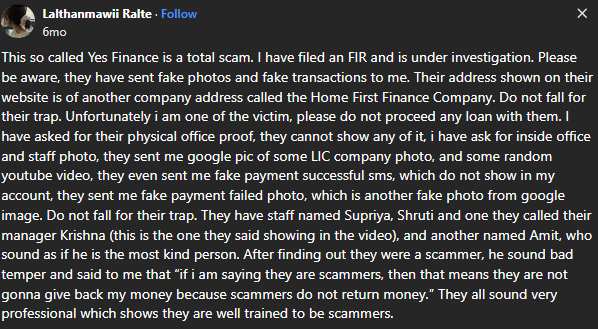

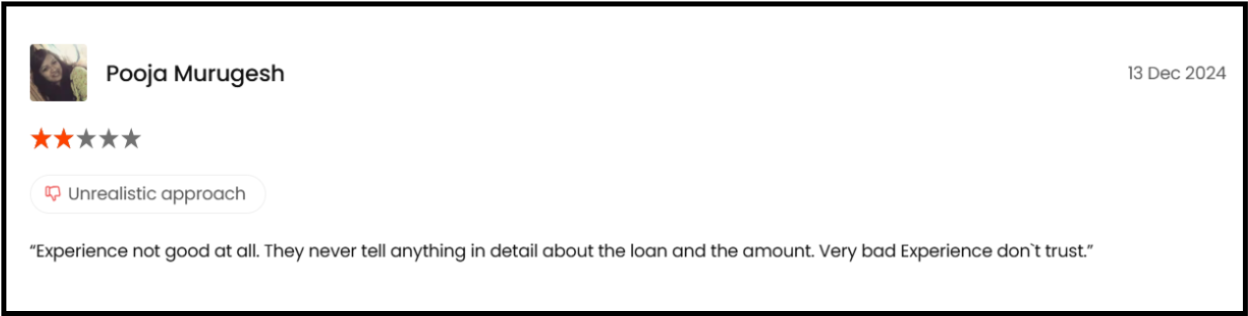

User reviews around Yes Finance raise important questions about whether the platform operates transparently and legitimately.

While it presents itself as a quick loan provider, recurring patterns in user experiences suggest gaps that are difficult to ignore.

1. Fake Loan Credit Confirmations

Several users report receiving screenshots or messages claiming that loan amounts were credited, even though no money actually reached their bank accounts.

These alleged confirmations are often followed by demands for further payments, which casts doubt on whether the transactions are genuine or merely used to build false trust.

2. Repeated Demands for Advance Payments

A major legitimacy concern is the insistence on multiple advance payments. Users mention being asked to pay processing fees, verification charges, or account activation costs before any loan is disbursed.

Legitimate or real financial institutions usually deduct fees from the sanctioned loan amount rather than requesting repeated upfront transfers.

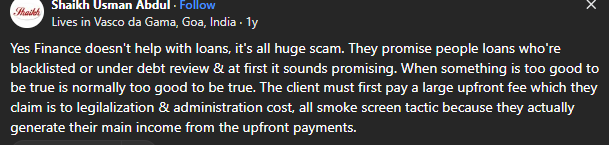

3. Unrealistic Loan Promises

Reviews often highlight promises such as guaranteed approval, instant loans without checks, or no impact on credit history.

Such assurances are not typical of regulated lenders and often signal aggressive marketing tactics rather than a compliant lending process.

4. Missing Loan Documentation and Terms

Another major warning sign is the complete absence of clear loan details.

Many users report that they were never provided with written agreements or official contracts outlining interest rates, repayment schedules, or the total amount payable.

If you want to avoid loan scams, you must remember that legitimate lenders are legally required to be transparent.

Without formal documentation, it becomes nearly impossible to verify the legitimacy of the debt or hold the platform accountable when things go wrong.

Entering into a financial agreement without a paper trail isn’t just risky; it is an open invitation for a scammer to change the rules at your expense.

Taken together, these user reviews suggest that while Yes Finance may appear accessible, its practices raise serious doubts about transparency and regulatory compliance.

How to Report Yes Finance?

If you have interacted with Yes Finance or suffered financial loss, act immediately:

- Stop making any further payments

- Do not share additional personal, banking, or OTP details

Report the issue through official channels:

- Report a complaint in Cyber Crime: File a complaint with screenshots, call logs, and payment proofs

- Cyber Crime Helpline: Dial toll-free helpline number

- Consumer Grievance Platforms: Report misleading or fraudulent financial practices

- Your Bank: Inform them immediately if any transaction has occurred

Always preserve evidence such as messages, emails, UPI IDs, phone numbers, and payment receipts.

Need Help?

If you are unsure whether a platform like Yes Finance is genuine or if you feel pressured to make payments, seek help immediately. You can reach out to us.

Our team supports you in collecting and preserving evidence such as payment proofs, chats, call records, and screenshots.

We also assist with drafting clear complaints, guiding you on where and how to file them, and explaining the follow-up process with banks, platforms, and authorities.

Early guidance can limit further losses and ensure your case is reported through the right legal and regulatory channels.

Conclusion

Based on multiple user reviews and observed red flags, Yes Finance raises serious concerns about legitimacy and trustworthiness.

The lack of clear registration details, absence of legal disclosures, and repeated reports of upfront fee demands and fake transaction claims point to a high-risk platform that users should avoid.

Another worrying pattern is how such platforms often target financially stressed individuals with urgency-driven promises.

By pushing quick approvals and creating pressure to pay fees immediately, users are discouraged from asking questions or verifying details, exactly when caution is most needed.

When dealing with any online finance platform, caution is essential.

Always verify licensing and registration, avoid paying money upfront, insist on written loan terms, and stay alert to promises of guaranteed approvals.

Your financial safety depends on awareness. When something feels unclear or too good to be true, it usually is.