When you invest your hard-earned money, you expect trust, transparency, and top-notch service.

JM Financial, a name that resonates with decades of legacy in India’s financial sector, promises just that. But what happens when JM Financial complaints start surfacing?

Clients often complain about delayed payouts, unexpected charges, or unauthorised trades. These worries aren’t just statistics. They are real caution signs that every investor deserves to understand.

In this blog, we dive deep into JM Financial complaints. We’ll uncover what investors have faced, how these issues affect your portfolio, and what steps you can take if you find yourself grappling with similar challenges.

Knowing the story behind these complaints is the first step toward protecting your investments and making informed decisions in an unpredictable market.

JM Financial Limited

JM Financial Services Ltd stands as a prominent full-service brokerage under the JM Financial Group. It has a strong foundation in investment banking, wealth management, and institutional equities. Now, it caters to retail, HNI, and corporate clients across NSE, BSE, and other exchanges.

The firm offers equity trading, F&O, commodities, margin facilities, and research-backed advisory services through its platforms.

NSE data for 2025-26 shows JM Financial with 1,14,720 active clients and 87 complaints, out of which 80 have already been resolved. The success rate of the company is 91%.

On the surface, these figures suggest efficiency. Yet for affected investors, even one unresolved JM Financial complaint means sleepless nights chasing resolutions amid busy support lines and procedural hurdles.

While complaint numbers stay low relative to scale, each unresolved case erodes trust. Clients often cite slow grievance follow-ups, pushing escalations. Small lapses like unclear fee structures or delayed KYC updates snowball in high-volume operations.

Every day, traders must stay vigilant, as stats hide the real frustration of time lost and opportunities missed.

JM Financial Complaint Details

JM Financial complaints cluster around familiar patterns seen across full-service brokers. NSE/BSE logs highlight these main types:

- Type I/II: Delays in payments or securities delivery, often during volatile settlements when funds hang in limbo.

- Type IV: Unauthorised/high-risk trades, especially in F&O or MTF, where clients claim RMs pushed aggressive strategies without full disclosure.

- Type V: Service issues like platform glitches, unresponsive RMs, or contract note discrepancies that confuse ledger balances.

- Type IX: Miscellaneous concerns, including excess brokerage, margin shortfalls, or e-margin activation mix-ups leading to surprise charges.

Online forums echo these frustrations. Investors report payout delays stretching weeks, app crashes mid-session, and brokerage hikes applied without clear notices.

With 87 NSE complaints in 2025-26, volume remains manageable, but resolution gaps frustrate retail users navigating formal escalations.

JM Financial Arbitrations

With JM Financials, as with any broker of this size, disagreements can sometimes arise between clients and the firm.

When these issues aren’t sorted through standard support channels, they may go to arbitration. Below are some such arbitration cases involving JM Financials:

A. Arbitration on Internal Shortage Close-Out Pricing

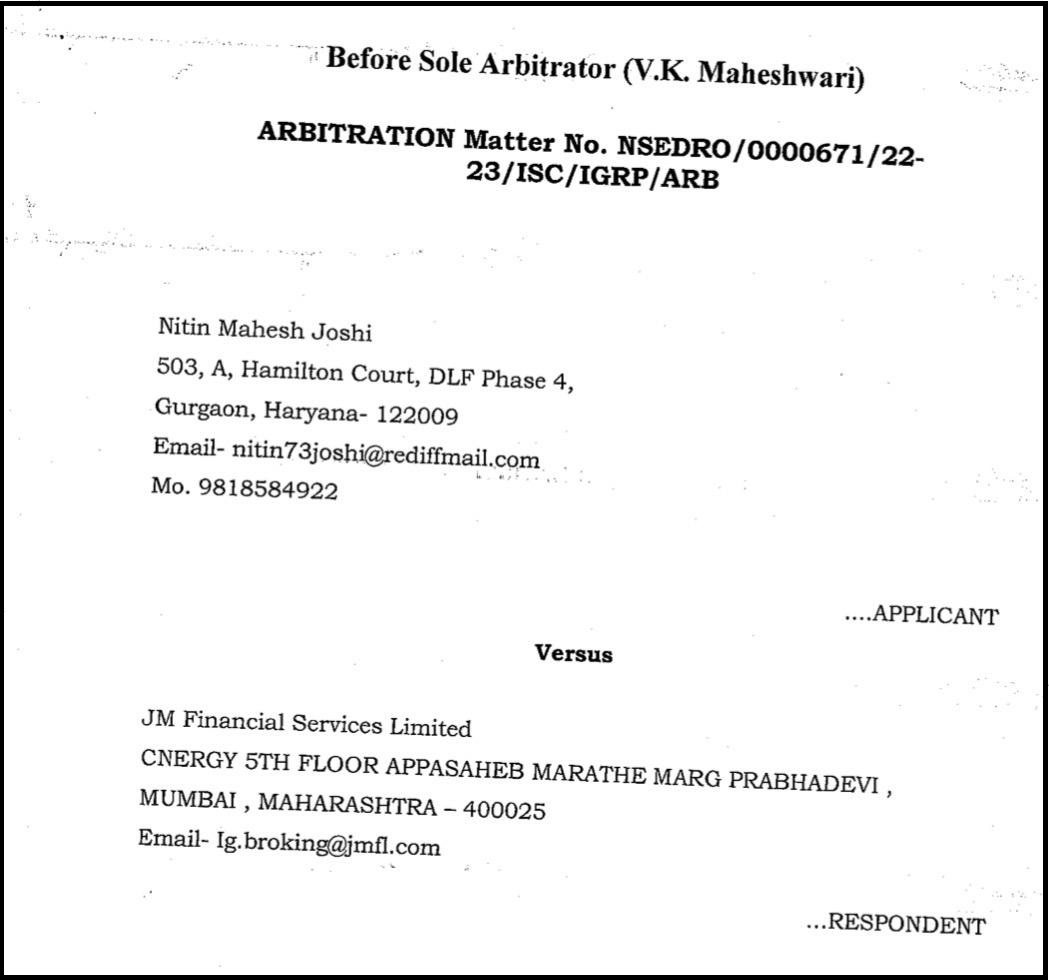

JM Financial Services Limited faced NSE arbitration from investor Nitin Mahesh Joshi over incorrect close-out pricing for 1,300 Unified Phosphorous Ltd (UPL) PUT option shares bought at a Rs 720 strike price expiring February 24, 2022.

Delivery failed due to an internal shortage; broker closed out at Rs 665.45 auction price.

What Went Wrong?

The investor paid full funds and received a Rs 7,750 premium. Broker closed out position March 3, 2022 via auction settlement #2022008 AT at Rs 665.45, below purchase price.

Client demanded 20% above the closing price per SEBI circular SMDPolicyIECG554896 (1996). Broker applied internal policy (3% above closing for Nifty/Sensex stocks), claiming SEBI 2009 mandated broker-specific rules.

The tribunal ruled that internal policy cannot override SEBI guidelines or apply without client fault.

Penalty Imposed

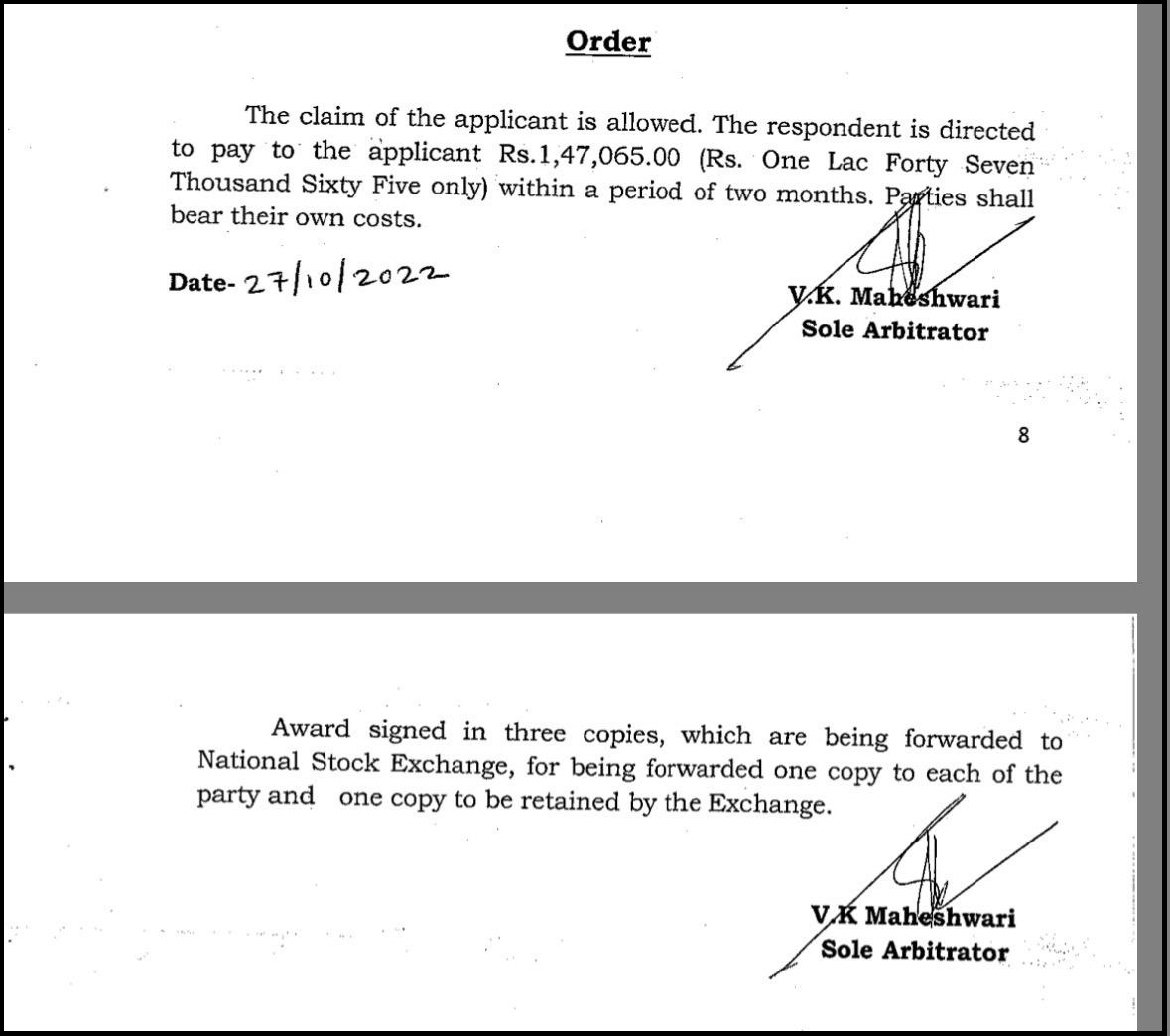

Full claim of Rs 1,47,065 awarded on October 27, 2022. Broker ordered to pay within 2 months. No premium set-off or costs. IGRP rejection overturned.

Key Takeaways

- SEBI circulars trump broker internal policies for close-outs.

- Demand 20% above the closing price proof in shortage disputes.

- Client fault required for broker-specific rules; internal shortages follow SEBI norms.

- File promptly after auction notices with circular references.

- PCM is not a necessary party in broker-client disputes.

JM Financial SEBI Orders

Apart from arbitrations filed against the company, various orders have been released by SEBI.

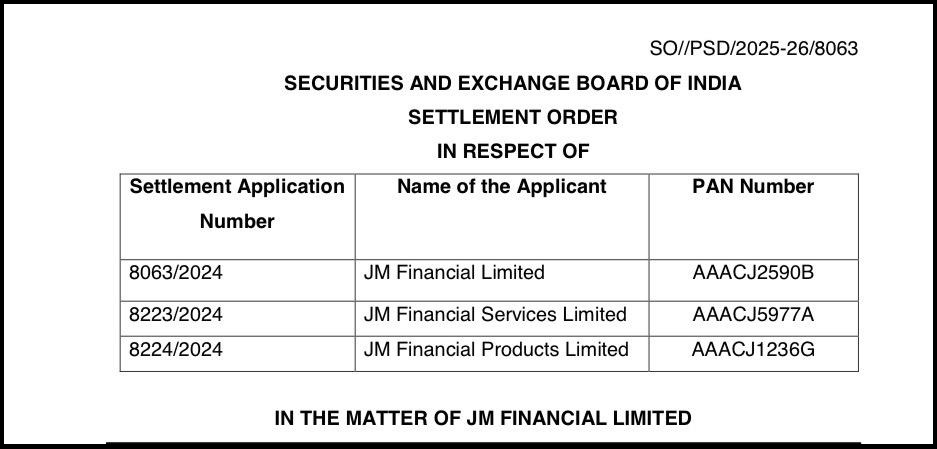

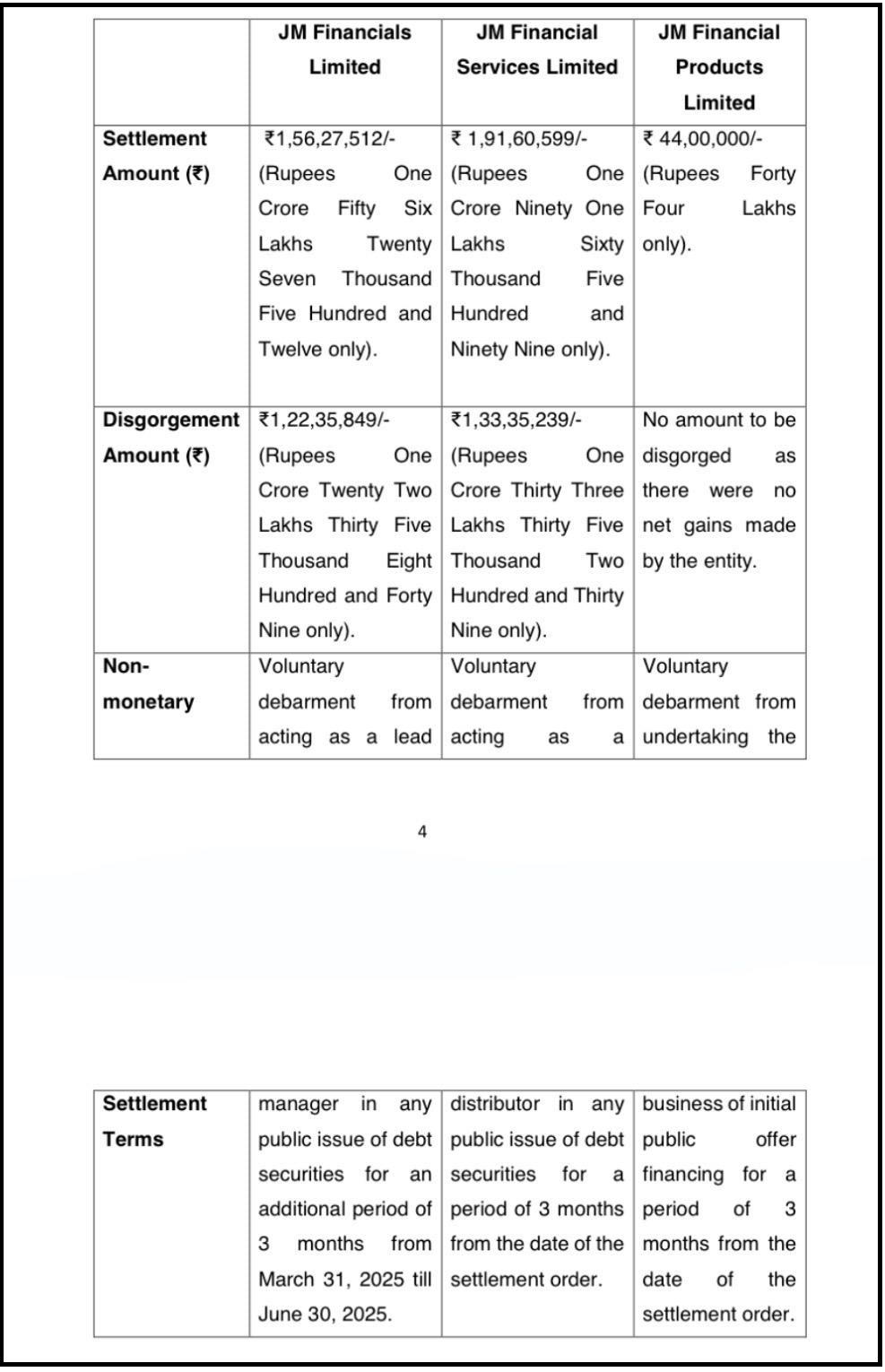

A. SEBI Settles JM Financial NCD Fraud Scheme with ₹3.91 Crore Penalty and Debarments

JM Financial entities allegedly created a scheme to guarantee profits for 1,008 clients in Piramal Enterprises Limited’s (PEL) 2023 NCD public issue.

JM Financial Products Limited (JMFPL) lent money at 10% interest to these clients (also JM Financial Services Limited customers) for bidding 11,34,000 NCDs via Power of Attorney.

On listing day (November 7, 2023), JMFPL repurchased the NCDs at a fixed higher price, ensuring client exits with gains before offloading at a loss, netting the group ₹1.99 crore.

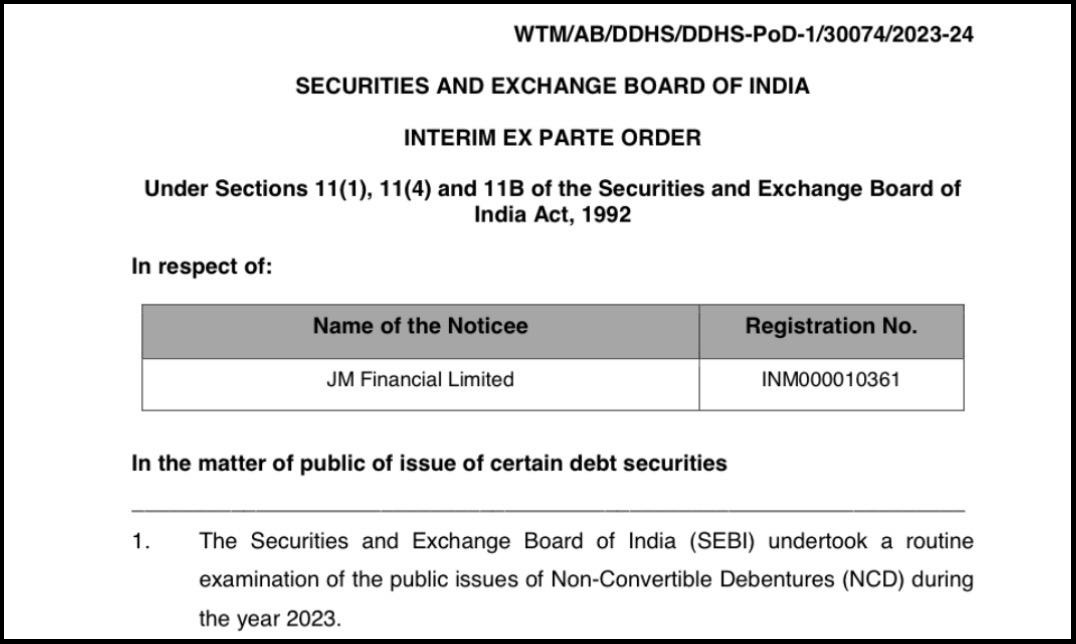

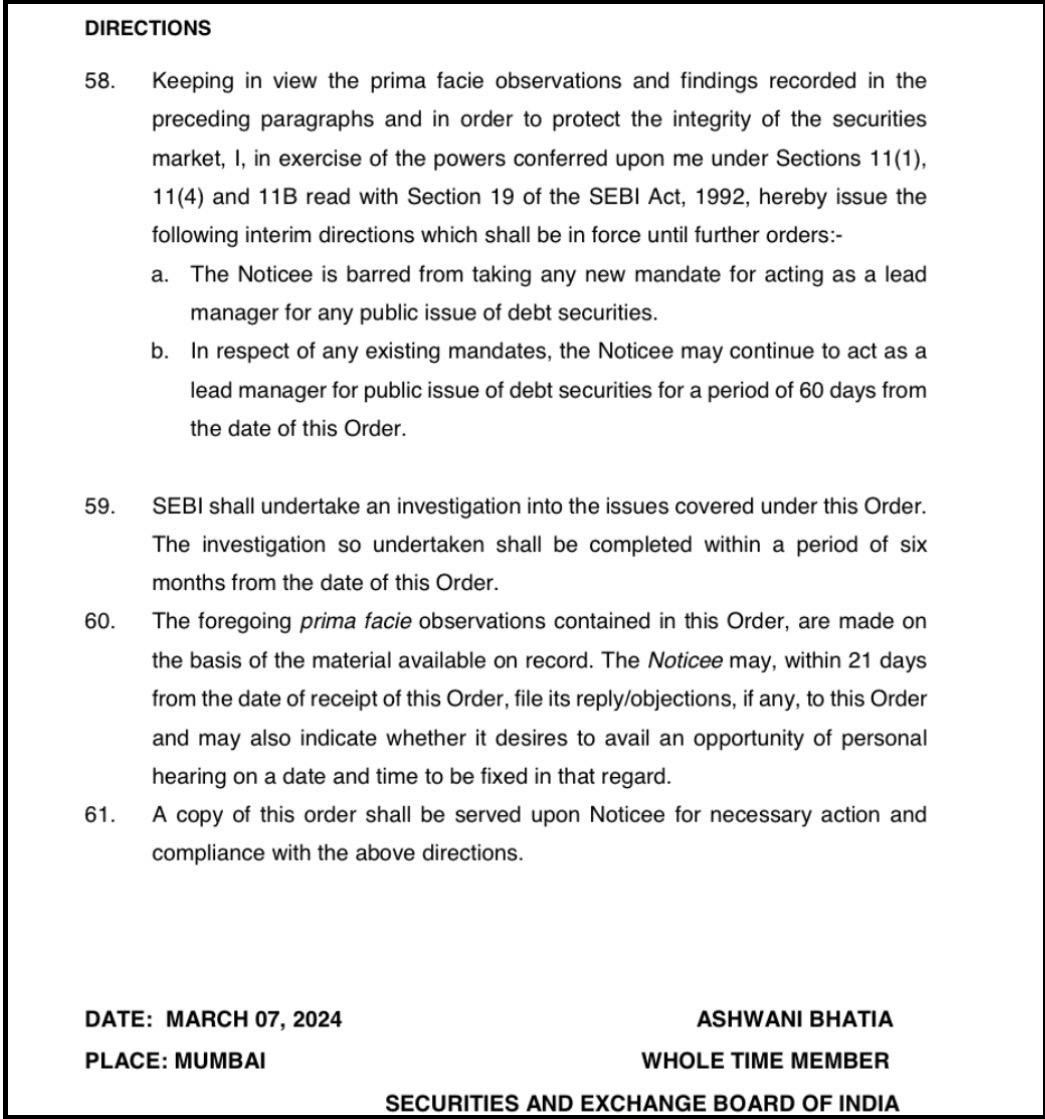

SEBI’s Actions

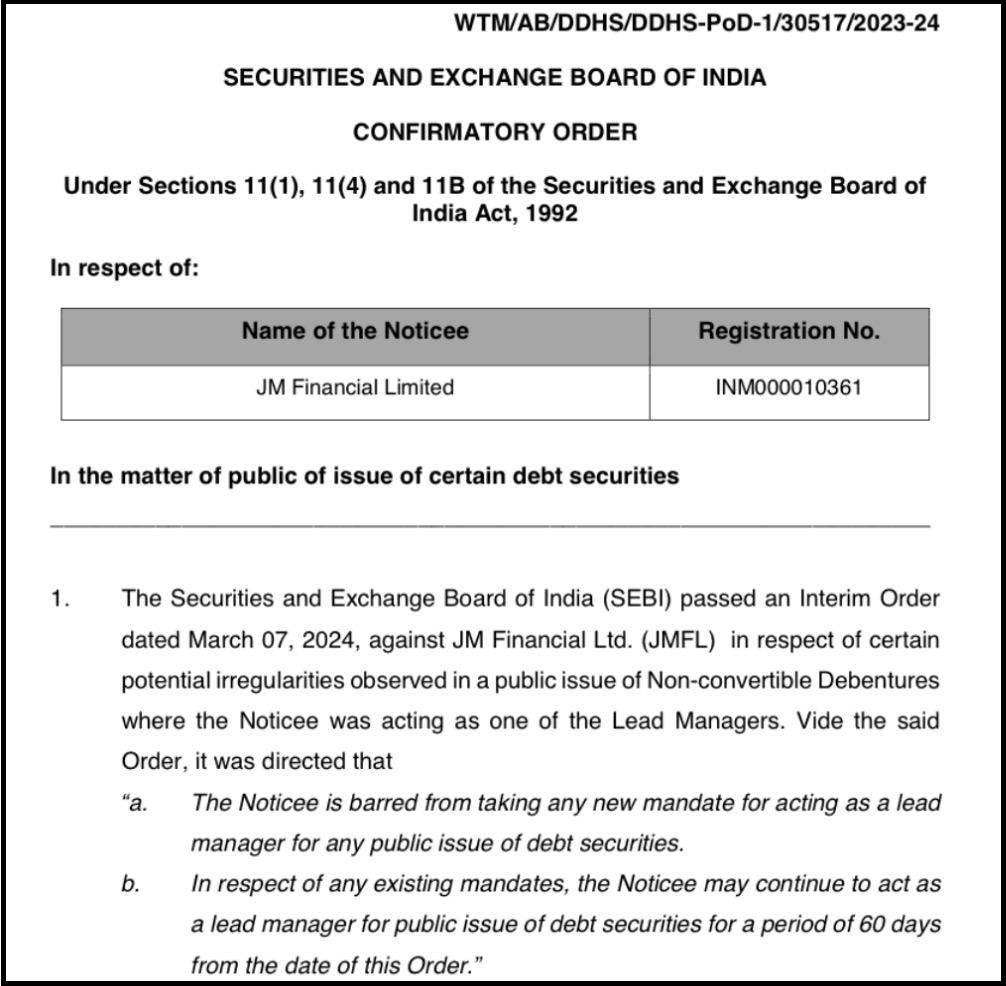

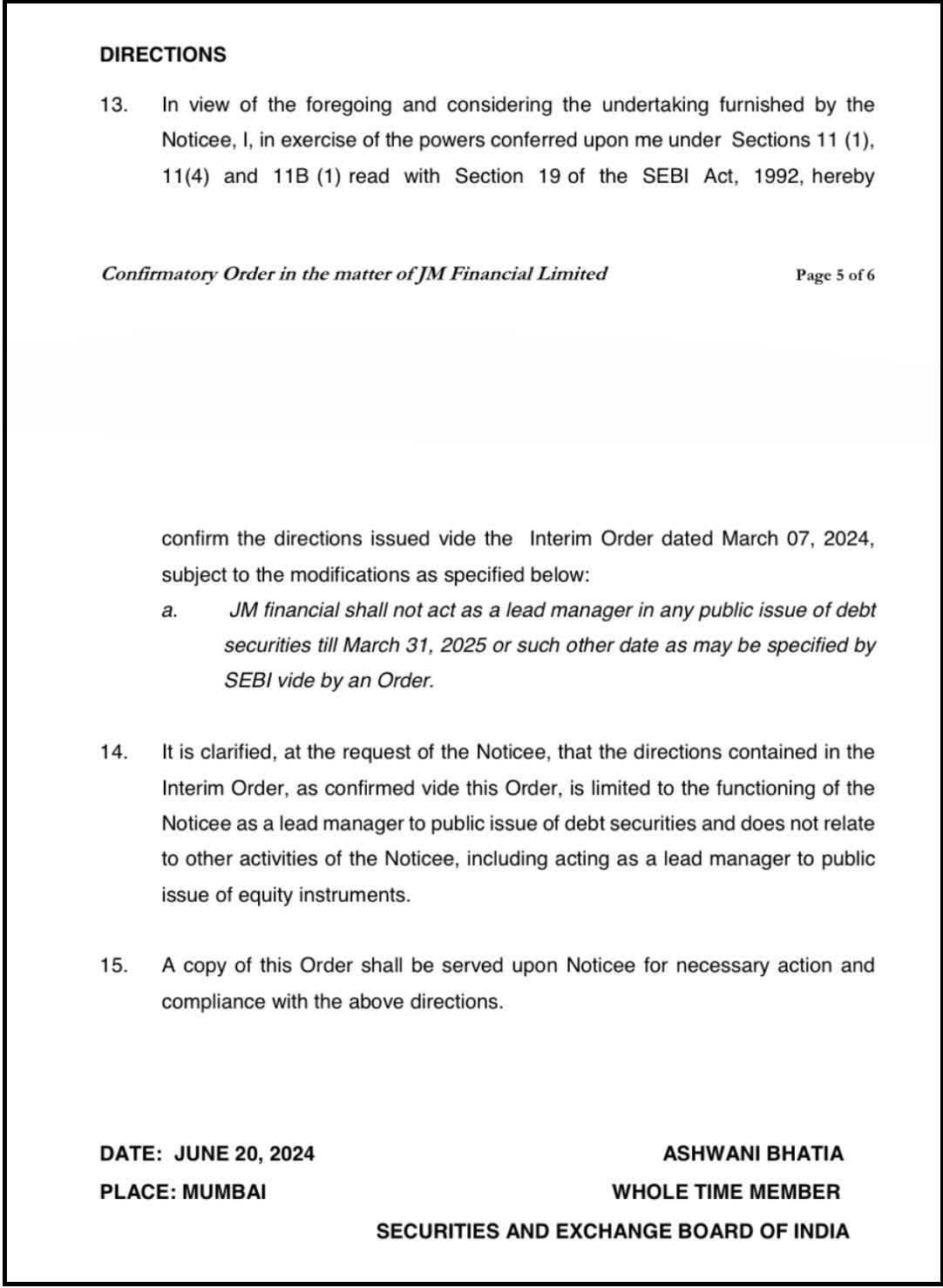

SEBI investigated sharp retail sell-offs in PEL NCDs and issued an interim ex parte order on March 7, 2024. This resulted in barring JM Financial Limited (lead manager) from new debt mandates, confirmed June 20, 2024, until March 31, 2025.

After settlement applications, SEBI approved the terms on September 19, 2025. JM entities paid more than ₹3.91 crore in settlements/disgorgement and accepted 3-month voluntary debarments from debt roles, closing proceedings without admissions.

B. NCD Scam Exposed, Lead Manager Ban Until 2025

SEBI issued the confirmatory order against JM Financial Limited due to potential irregularities in a public issue of non-convertible debentures (NCDs) where JM Financial acted as a lead manager.

A large portion of the issue went to retail investors, many of whom sold their allotments on the listing day to JM Financial Products Limited (JMFPL), a group NBFC that provided funding and held power of attorney for these investors’ accounts.

This raised concerns of incentivising retail participation with assured exits, undermining market integrity and price discovery.

SEBI’s Actions

SEBI first passed an interim order on March 7, 2024, barring JM Financial from new lead manager mandates for public debt issues and limiting existing ones to 60 days.

After hearings and JM Financial’s voluntary undertakings, which included no new debt mandates until March 31, 2025, discontinuing IPO financing, and system improvements.

SEBI confirmed the directions on June 20, 2024, with the ban extended until March 31, 2025 or further notice. The order clarifies it applies only to debt securities, not equity issues.

C. SEBI Bars JM Financial Over NCD Manipulation

SEBI issued an interim order on March 7, 2024, against JM Financial Limited for orchestrating a scheme in a Rs. 533 crore NCD issue in 2023.

JM Financial group entities funded 1,016 retail investors with Rs. 121.4 crore loans, got them to bid en masse via one broker branch.

Then, allotted NCDs, then bought them back on listing day at premiums for uniform profits (Rs. 1,500-2,000 each), artificially inflating subscriptions and distorting price discovery despite undersubscription.

SEBI Actions

Barred JMFL from new debt lead manager mandates immediately (existing for 60 days). SEBI ordered a 6-month probe under SEBI Act Sections 111/114/11B for PFUTP violations and Merchant Banker code breaches. RBI separately stopped the group’s NBFC from NCD financing.

Thus, these orders and arbitrations show that any violation committed by a registered broker can go against them.

But it also teaches us that investors must be very careful when investing their money. Your safety is in your own hands.

What to Do If You Have an Issue with JM Financials?

If you’re facing issues with your broker and don’t know where to begin, you can register with us, and we’ll guide you through every step of the process.

Here’s what we specifically help you with:

- Documentation Assistance

We help you gather, organise, and structure all the necessary documents, trade statements, ledger reports, contract notes, call logs, screenshots, and emails, so your case is backed with solid evidence. - Drafting Your Complaint

Our team prepares clear, well-formatted complaint drafts that fit the exact requirements of NSE, BSE, SEBI SCORES, and SMART ODR. This ensures your complaint is understood properly and not rejected due to formatting issues. - Platform Filing Support

Whether it’s SCORES or SMART ODR, we guide you through the submission process and ensure every detail is filled in correctly to avoid delays. - Escalation Guidance

If your complaint needs to be escalated beyond the broker, we show you the right path, whether it’s going to the exchange or preparing for the next stage. - Case Management from Start to Finish

Once you’re registered with us, we track your case, remind you of deadlines, and help you respond to any queries asked by regulators or exchanges. - Support During Counselling & Arbitration

If your case moves to counselling or arbitration, we assist you in preparing your statements and documents so you feel confident and ready.

By registering with us, you don’t have to struggle with complicated procedures, drafting confusion, or paperwork stress.

We make the process smoother, clearer, and faster, so you can focus on recovery while we handle the technical work.

Conclusion

JM Securities is a trusted broker that many rely on for their investments. But mistakes can happen to anyone, and those errors can impact your savings deeply.

The good news is, when complaints are valid, people do get their money back. Step one is always to file that complaint.

If you face any issues with JM Securities or any other broker, don’t wait around. Act quickly to protect your investments.

If the complaint process feels too complicated, remember, we’re here to make it easier for you.