“I can see my money. I can see my returns. But I can’t withdraw it.”

Imagine logging into your investment app.

Your dashboard shows ₹10 lakh. Plus ₹1.2 lakh returns. Everything looks perfect. You click withdraw. Request denied.

This is the reality for thousands of Indians who trusted LendBox with their hard-earned money, one of the many real-world examples that highlight the dangers of cyber crime in today’s digital investment space.

Before you even think about investing ₹1 in this platform, read what we found.

LendBox Review

LendBox calls itself a peer-to-peer lending platform. Think of it like this. You have extra money. Someone needs a loan.

LendBox connects both of you. You lend them money. They pay interest. You earn returns.

The promise? Earn up to 14% annual returns.

Much better than your 6% bank FD, right?

Company details:

- Real name: Transactree Technologies Private Limited

- Started: 2015

- Founders: Ekmmeet Singh, Bhuvan Rustagi, Jatin Malwal

- Headquarters: Based in New Delhi, India

Everything looked legitimate on the surface. But as you’ll see, looks can be deceiving.

How Does LendBox Operate?

LendBox offers a dual platform. You can either lend money to earn returns or apply for a loan when you need funds.

Both services are available through their website and mobile app.

| LEND NOW (For Investors) | APPLY FOR A LOAN (For Borrowers) |

| Step 1: Register with PAN card and address proof | Step 1: Download app and complete registration |

| Step 2: Complete paperless KYC verification | Step 4: Create loan listing with the amount and purpose |

| Step 3: Choose borrowers based on risk categories | Step 3: Platform assesses credit through multiple data points |

| Step 4: Set investment amount and preferred tenure | Step 4: Create loan listing with amount and purpose |

| Step 5: Money deployed across multiple borrowers | Step 5: Wait for lender proposals and accept offers |

| Step 6: Receive monthly EMIs (principal + interest) | Step 6: Receive funds and start monthly EMI repayments |

| Step 7: Re-lend or withdraw | Step 7: Complete repayment or face penalty charges |

Sounds smooth, right? On paper, it all makes sense.

But here’s what they don’t show you in this flowchart.

What happens when:

- Borrowers default?

- You want to withdraw but can’t?

- Platform changes rules overnight?

- Your money gets stuck for years?

That’s where the real story begins.

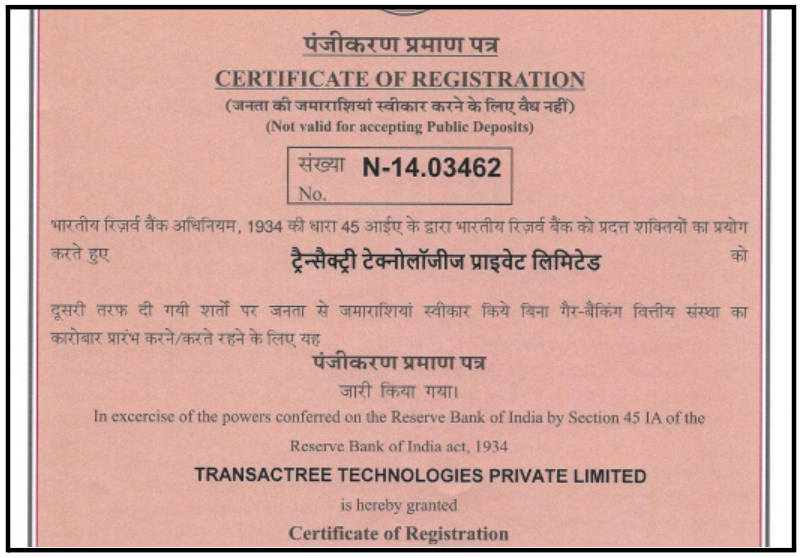

Is LendBox Registered?

Yes, LendBox is officially registered. They hold NBFC-P2P (Non-Banking Financial Company – Peer to Peer) certification from RBI.

Registration details:

- RBI Registration Number: N-13.03335

- License Type: NBFC-P2P

- Regulator: Reserve Bank of India

This means they’re legally allowed to operate as a peer-to-peer lending platform in India. So far, so good.

But here’s what most people don’t understand. Having a license doesn’t mean you’re safe.

The ₹40 lakh penalty that’s coming next? That happened AFTER registration. While they were still licensed.

The LendBox MobiKwik Connection

In 2022, LendBox partnered with MobiKwik. You know MobiKwik. The payment wallet app. Trusted brand. Millions of users.

They launched a product called “MobiKwik Xtra.”

The promise was beautiful:

- Invest your spare cash

- Earn 12% returns

- Withdraw anytime you want

That last point was the game-changer. Other investments lock your money. Fixed deposits have penalties.

But this?

Total flexibility. Or so they said.

The ₹40 Lakh Penalty on LendBox

RBI released new P2P lending guidelines in August 2024. These rules were meant to protect investors like you. More transparency. Better safety.

But here’s what LendBox did. They stopped all “anytime withdrawals.”

But wait. It gets worse.

They re-invested ₹7000 crore without asking anyone

Think about that amount. That’s not a small mistake. That’s thousands of families’ savings. Business capital. Emergency funds. Retirement money.

All locked.

Now we get to the serious part. In May 2025, RBI slapped LendBox with a ₹40 lakh penalty.

Violations by LendBox

Let us break down a few violations of what they did wrong:

- Playing with Your Money Routes

What they should do: Send your money directly through proper P2P channels.

What they did: Routed funds through unauthorized co-lending escrow accounts.

In simple words?

Your money went through bank accounts it shouldn’t have. Why would they do this unless something shady was happening?

- Hiding Borrower Information

What they should do: Show you who’s borrowing your money. Their credit score. Their repayment history. Risk profile.

What they did: Nothing. Zero disclosure.

You were lending money blindfolded. No idea if the borrower could repay or not.

- Lending Your Money Without Asking

This one’s mind-blowing.

What they should do: Ask for your permission before lending out your money.

What they did: Just lent it anyway.

According to the RBI’s report, they disbursed loans without getting specific approvals from lenders. Your money was being given to borrowers without you even knowing.

The scrutiny happened in September 2023. LendBox got a show-cause notice. They tried explaining. RBI didn’t buy it. Penalty confirmed.

LendBox Complaints

Let’s stop talking numbers. Let’s talk about real Indians who got trapped.

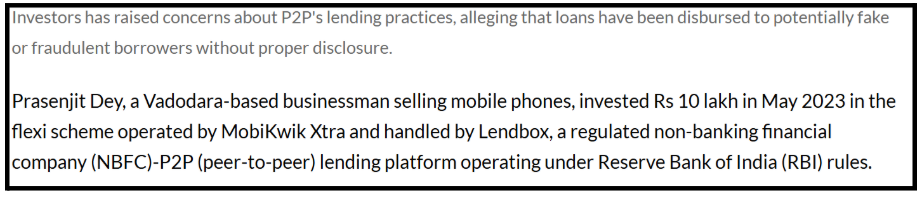

Case 1: The Vadodara Businessman

Prasenjit Dey from Vadodara invested ₹10 lakh in May 2023.

He was promised flexible withdrawals. Anytime he needs money, just withdraw. That’s what the contract said.

Then September 2024 came. His money got locked. Till when? May 2026.

Three years. His working capital is stuck. He’s running a business. He needs that cash flow. But LendBox just locked it.

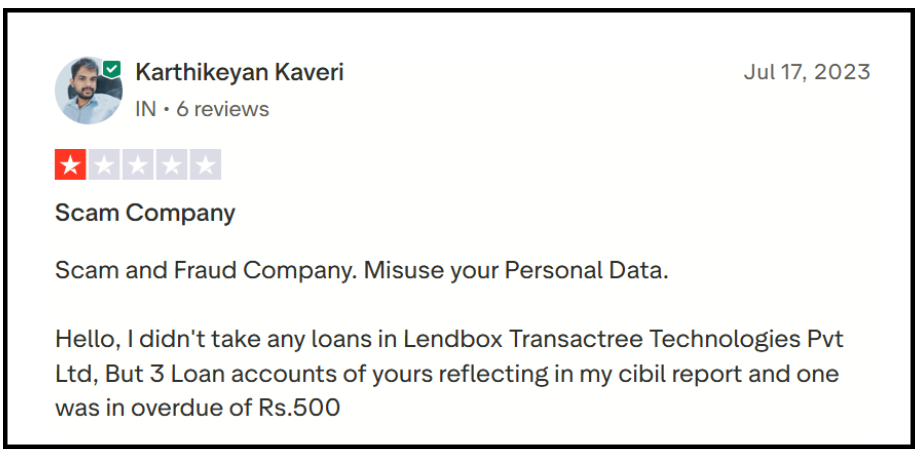

Case 2: The CIBIL Score Problem

Karthikeyan Kaveri checked his CIBIL score for a home loan.

He found three loan accounts from LendBox:

- Loan Account 778144: ₹2,000 (Closed)

- Loan Account 817656: ₹2,000 (Active)

- Loan Account 889848: ₹1,000 (₹500 overdue)

The problem? He never took any loan from LendBox.

But his CIBIL showed he’s a defaulter. His home loan got rejected.

His credit score was destroyed. All because of loans he never took.

LendBox later clarified that these were issued by MobiKwik by mistake. But the damage was done.

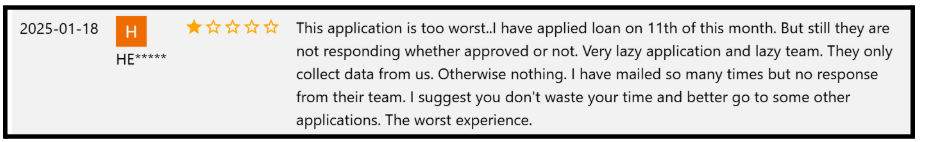

Case 3: App Doesn’t Process Loans

The user said they applied for a loan, but the app did nothing except collect their personal data.

The problem?

Weeks went by with no response or update, and the team never communicated, leaving the applicant stuck and frustrated.

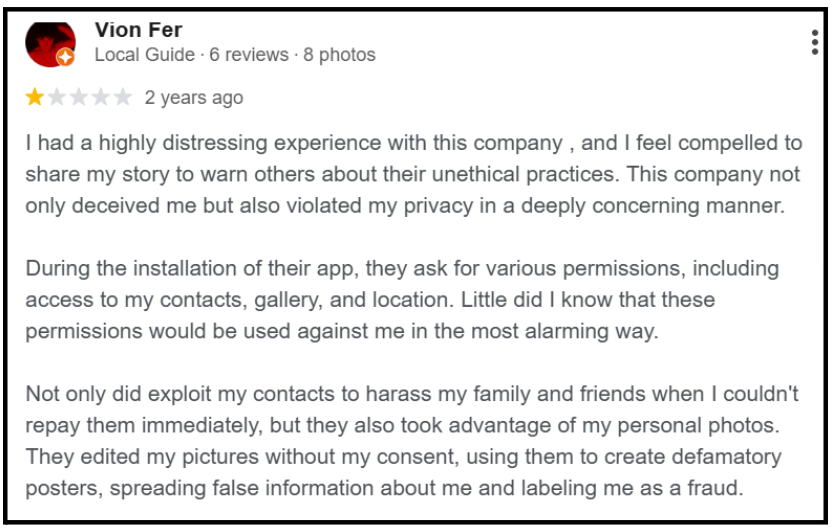

Case 4: Privacy Abuse & No Customer Support

After installing the LendBox app, the user granted permissions for contacts, gallery, and location. He says these permissions were later misused.

When he couldn’t repay immediately:

- His family and friends were harassed using his contact list

- His personal photos were accessed and edited without consent

- Defamatory posters were created, falsely labelling him a fraud

The result was severe mental stress and reputational damage.

And when he sought help, there was no customer support at all, no response, no resolution, no accountability.

This leaves many wondering: LendBox is real or fake.

While it operates as an investment platform, negative returns and regulatory issues make it highly questionable.

How to Report Investment Scams?

If you’re stuck, here’s exactly what to do:

Step 1: File an Official Complaint with LendBox

Go to their website.

Write a detailed complaint. Include:

- Your account details

- Investment date and amount

- What went wrong

They claim a 24-hour investigation. Keep proof of filing.

Step 2: Escalate to RBI Ombudsman

If LendBox doesn’t respond in 30 days:

- Select complaint category: NBFC

- Upload all documents

RBI takes NBFC complaints seriously, especially if there’s already a penalty history.

Step 3: File a Cyber Crime Complaint

If you suspect fraud (such as CIBIL manipulation), file an FIR.

This is especially important if:

- Your CIBIL report shows loans you never took.

- Your personal data is being misused.

- The money trail appears suspicious.

Need Help?

Is your money stuck in LendBox? Facing withdrawal issues? CIBIL score damaged?

You’re not alone. Thousands of Indian investors are trapped in the same situation.

How Our Team Can Help You?

1. Legal Consultation & Strategy We’ll review your case, analyze your contract terms, and create a customized legal strategy to recover your funds.

2. Documentation Assistance We help you organize all critical evidence, like emails, screenshots, transaction statements, withdrawal requests, and original contracts.

3. RBI Complaint Filing We guide you through the entire RBI Ombudsman process.

4. Media Escalation Sometimes public pressure works faster than official complaints. We connect your case with financial journalists.

If you’re facing issues with LendBox, register with us immediately.

Don’t wait. Don’t suffer silently. The longer you delay, the harder recovery becomes.

Every complaint matters. Every voice counts. Together, we can hold LendBox accountable and fight for your hard-earned money.

Conclusion

After deep research into RBI documents, press reports, and verified user complaints, the verdict is clear: LendBox is not safe for your money.

The ₹40 lakh RBI penalty, ₹10 crore fraud loss, and ₹7000 crore locked funds aren’t coincidences; they’re patterns of serious operational failures.

Registration doesn’t equal safety. A license doesn’t guarantee ethics. Your principal matters more than promised returns.

Situations like this are becoming increasingly common amid rising cyber crimes in India, where digital platforms exploit trust while operating in regulatory grey areas.

Make informed decisions. Protect your financial future.

And remember, when thousands of investors can’t access their own money, that’s not just bad luck. That’s a systemic problem you should not avoid.