“They promised 12% returns. I got locked funds and a destroyed credit score instead.”

When thousands of Indians trusted LendBox with their savings, they expected safety and transparency.

What they got was a nightmare of frozen withdrawals, fake loan entries, and complete radio silence from customer support.

Let’s hear directly from the victims.

LendBox User Complaints

LendBox (Transactree Technologies Private Limited) is an RBI-registered P2P lending platform launched in 2015.

They partnered with MobiKwik in 2022 to offer “MobiKwik Xtra”, promising flexible withdrawals and attractive returns.

However, after the RBI’s August 2024 guidelines, everything changed.

Withdrawals were restricted, funds got locked, and investor confidence took a hit.

As complaints started surfacing across forums and user platforms, many investors began asking a serious question: is LendBox safe?

What followed was a flood of complaints. Real money stuck. Real lives affected.

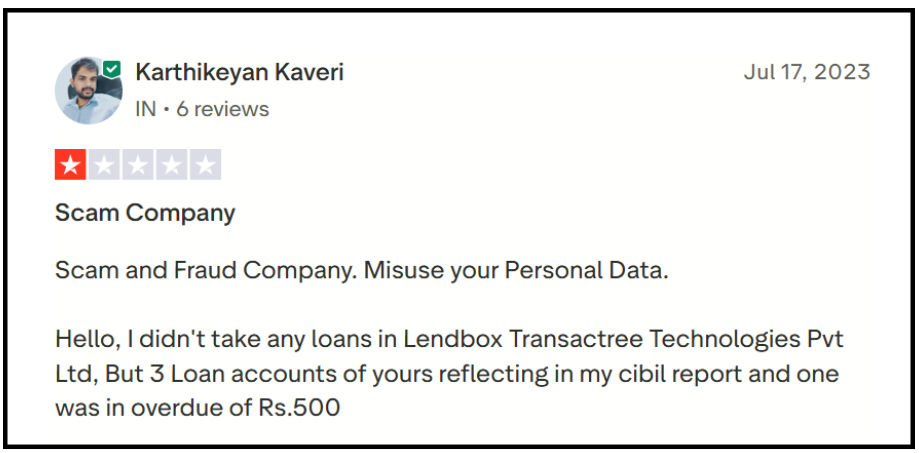

Complaint 1: Fake Loans Appearing on CIBIL Reports

Karthikeyan Kaveri faced this issue when he checked his CIBIL score.

Three loan accounts appeared on his credit report: Loan Account 778144 (₹2,000), Loan Account 817656 (₹2,000), and Loan Account 889848L (₹1,000 with ₹500 overdue).

He never took any loans from LendBox, yet his credit score showed him as a defaulter, destroying his chances of getting a home loan.

Another user, Angelise Shimray, faced this issue differently. A fake loan of ₹100 appeared on her CIBIL with zero balance but an active status for 5 years.

Despite multiple emails and calls, nobody from LendBox responded, leaving her credit score damaged indefinitely.

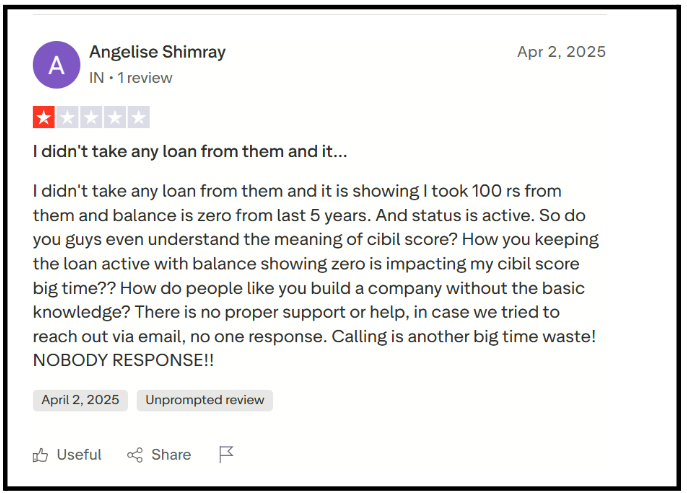

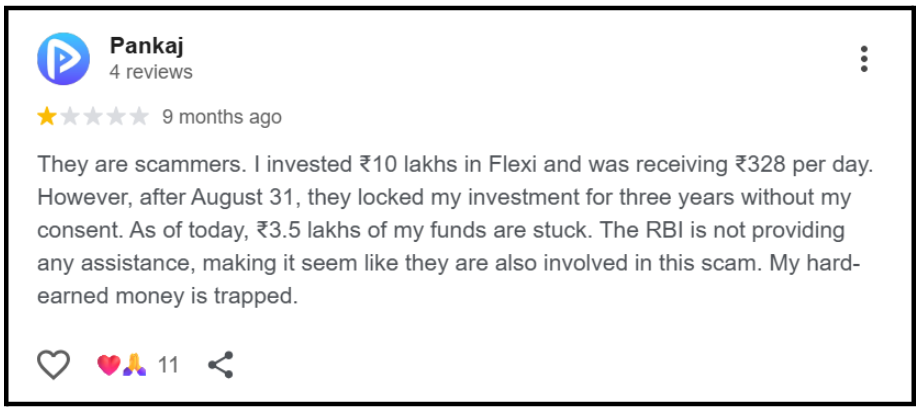

Complaint 2: Money Locked Without Consent

Pankaj faced this issue with a much larger amount.

He invested ₹10 lakh in Flexi and was receiving ₹328 per day.

LendBox locked his entire investment for three years without consent, leaving ₹3.5 lakh of his funds stuck with no access.

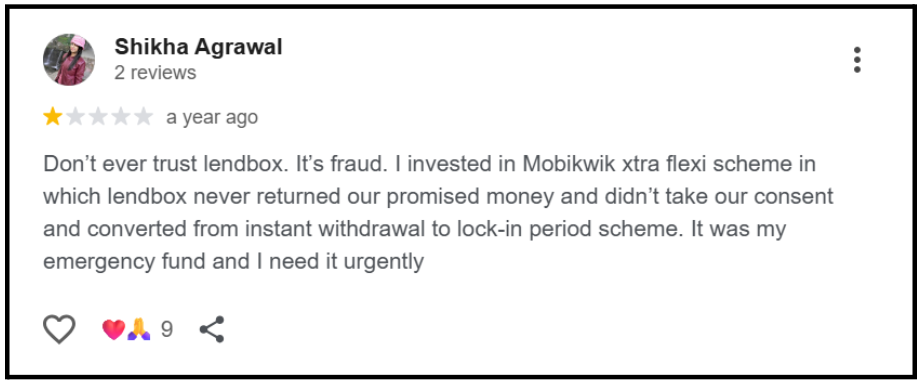

Shikha Agrawal faced this issue with her emergency fund. She invested in the MobiKwik Xtra Flexi scheme, expecting an instant withdrawal facility.

When she urgently needed her emergency money, LendBox had converted it to a lock-in period scheme without her consent, leaving her helpless.

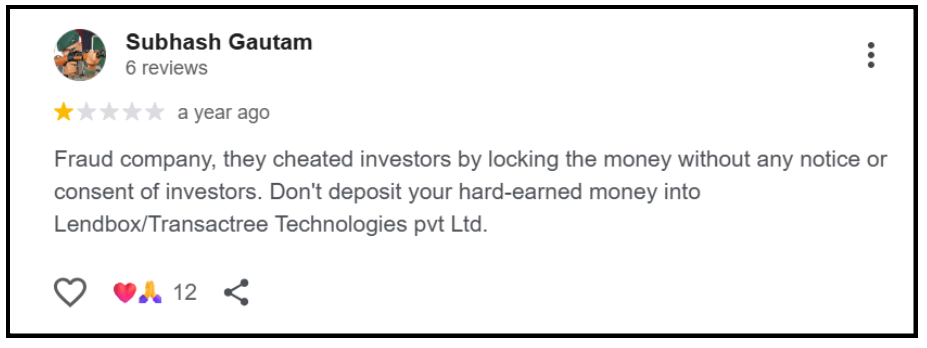

Subhash Gautam faced this issue and warned others strongly. LendBox cheated investors by locking money without any notice or consent.

He directly calls them a fraud company and advises people not to deposit hard-earned money into Lendbox/Transactree Technologies.

Complaint 3: Withdrawal Requests Denied or Money Missing

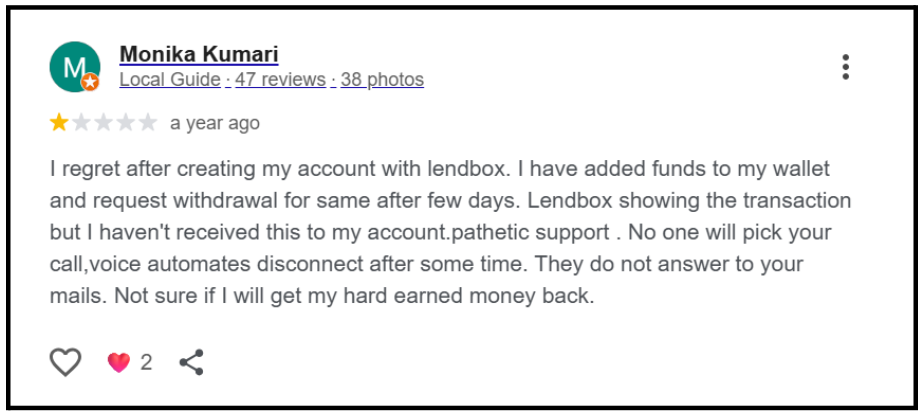

Monika Kumari faced this issue when trying to withdraw her funds. She added funds to her LendBox wallet and requested a withdrawal after a few days.

While LendBox shows the transaction as processed on their dashboard, the money never reached her bank account, and customer support never picks calls or responds to emails.

Complaint 4: Zero Customer Support Response

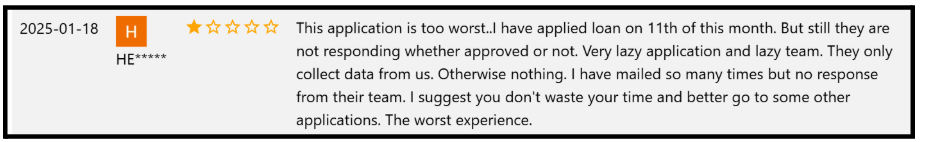

A user faced this issue while applying for a loan. They applied for a loan on January 11th but received no response on the approval status.

The team is extremely lazy, only collecting user data without providing any service, and multiple emails went unanswered.

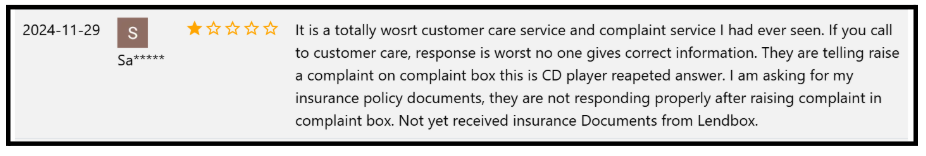

Another user faced this issue while trying to get insurance documents. When calling support, no one gives correct information, and the repeated response is to “raise a complaint in the complaint box.”

Even after raising complaints, they never received their insurance policy documents from LendBox.

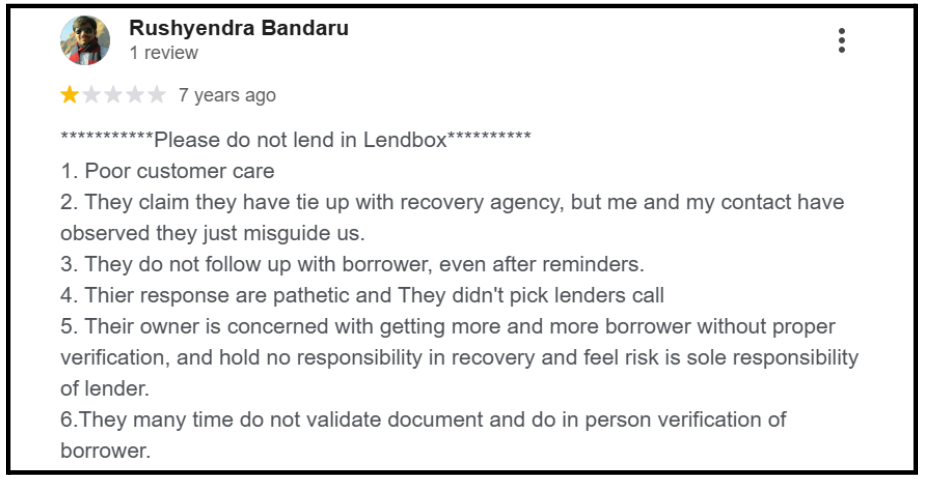

Rushyendra Bandaru listed multiple problems: poor customer care, misleading claims about recovery agency tie-ups, no follow-up with borrowers and many more.

Complaint 5: Hidden Charges Not Disclosed

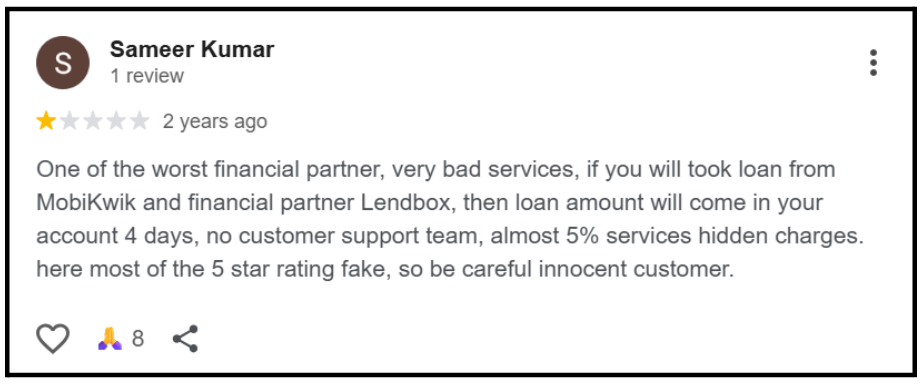

Sameer Kumar faced this issue after taking a loan. When he took a loan through LendBox, the amount took 4 days to reach his account.

He discovered almost 5% hidden service charges that were never disclosed upfront, with no customer support team to address concerns and mostly fake 5-star ratings to mislead innocent customers.

Complaint 6: Privacy Violations and Harassment

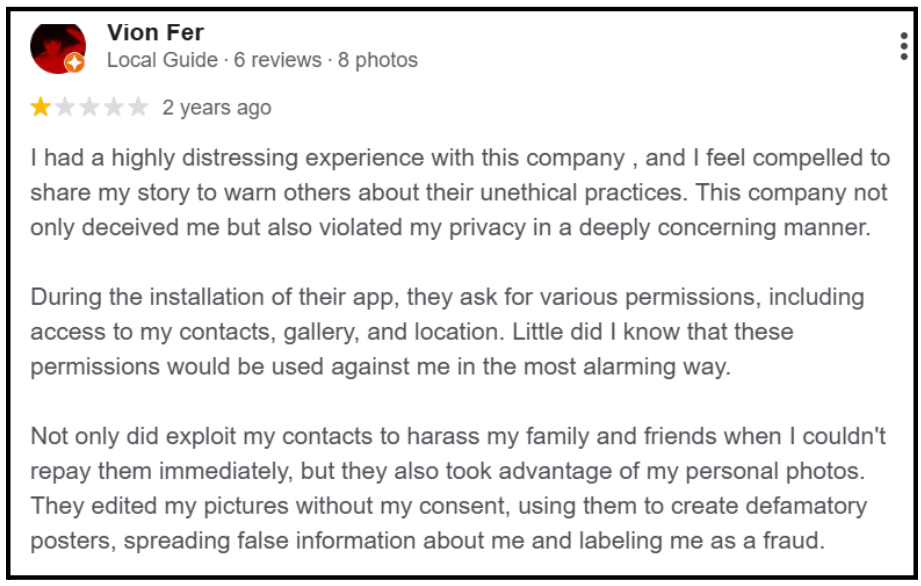

Vion Fer faced this issue in an extremely distressing manner. During app installation, LendBox asked for permissions to access contacts, gallery, and location.

When repayment was delayed, they exploited the contacts list to harass family and friends, took personal photos without consent, edited pictures to create defamatory posters, and spread false information labelling the user as a fraud.

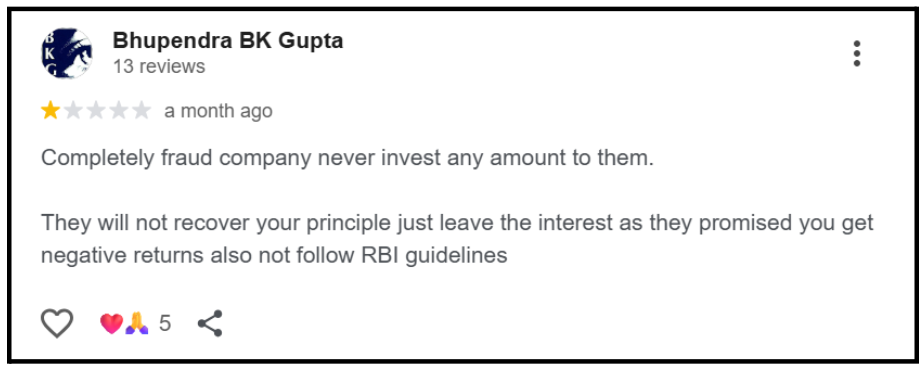

Complaint 7: Not Following RBI Guidelines

Bhupendra BK Gupta faced this issue with his investments.

According to his review, LendBox is a completely fraudulent company that won’t recover your principal amount.

He claims they only provide negative returns instead of promised interest and, most importantly, don’t follow RBI guidelines despite being an RBI-registered platform.

This complaint aligns with the official RBI penalty of ₹40 lakh imposed in May 2025 for violations, including unauthorized escrow account usage, failure to disclose credit assessments to lenders, and disbursing loans without specific approvals from lenders.

For many affected users, this has led to a growing question: LendBox is real or fake?

While it functions as an investment platform, regulatory violations and negative returns raise serious trust concerns.

What Makes These Complaints Credible?

These aren’t just random negative reviews or baseless accusations.

Multiple factors prove their credibility:

- Official RBI Penalty: According to RBI’s press release dated May 23, 2025, LendBox was penalized ₹40 lakh for proven violations.

The scrutiny was conducted in September 2023, and after reviewing LendBox’s submissions, RBI confirmed the violations, validating user complaints about improper operations.

- Consistency Across Time: Problems existed 7 years ago and continue today in 2025. This proves systemic operational failures rather than temporary issues.

- Media Coverage: According to MoneyControl journalist Kayezad Adajania’s post, mainstream financial media have covered investor complaints with specific cases of Prasenjit Dey (₹10 lakh stuck) and CA Deepak Shah (₹40 lakh stuck).

- System Vulnerabilities Proven: According to the Inc42 report, ₹10 crore was lost to fraud due to system errors that 457 scammer accounts exploited.

LendBox itself filed an FIR acknowledging the system error, proving their platform has serious security flaws.

How to Report Investment Scams?

If you’re facing similar issues, here’s your action plan:

Step 1: File an Official Complaint with LendBox

Visit their website.

Include:

- Your account details

- Specific issue (locked funds/CIBIL/withdrawal)

- Timeline of events

- What resolution do you want

Step 2: Escalate to RBI Ombudsman

If no response in 30 days:

- Category: NBFC complaints

- Upload all documents

- Mention: RBI Registration Number N-13.03335

Step 3: File a Cyber Crime Complaint

For serious issues like:

- CIBIL manipulation

- Privacy violations

- Data misuse

- Harassment

Step 4: CIBIL Dispute Resolution

If fake loans appear:

- Raise a dispute for incorrect loan entries

- Attach LendBox complaint acknowledgement

- Follow up every 30 days

Need Help?

Stuck with LendBox complaints? You don’t have to fight alone.

What Our Team Offers?

1. Case Evaluation: Share your complaint details. We’ll assess the strength of your case and recommend the best course of action.

2. Documentation Support: We help organise your evidence properly for RBI complaints, consumer court, or legal notices.

Register now. Fight back. Recover your money.

Conclusion

The complaints against LendBox reveal a platform failing at every level, from customer service to regulatory compliance.

These aren’t isolated incidents but documented patterns affecting thousands of Indians. The RBI penalty of ₹40 lakh validates what users have been saying for years.

If you’re facing similar issues, don’t suffer silently. File complaints, escalate to authorities, and seek legal help. Your money matters, your credit score matters, and your voice matters.

Together, we can hold LendBox accountable and prevent others from falling into the same trap. Document everything, take action today, and remember, you’re not alone in this fight.