A platform with RBI certification can still ruin your finances. The question isn’t just “real or fake”, it’s “real but dangerous.”

You’ve seen the ads. 14% returns. RBI registered. MobiKwik partnership. Looks legitimate.

But then you read the reviews. Locked funds. Fake CIBIL entries. Missing withdrawals. Suddenly, you’re confused.

Is LendBox a genuine business?

Let’s investigate with facts, not assumptions.

Is LendBox Legal?

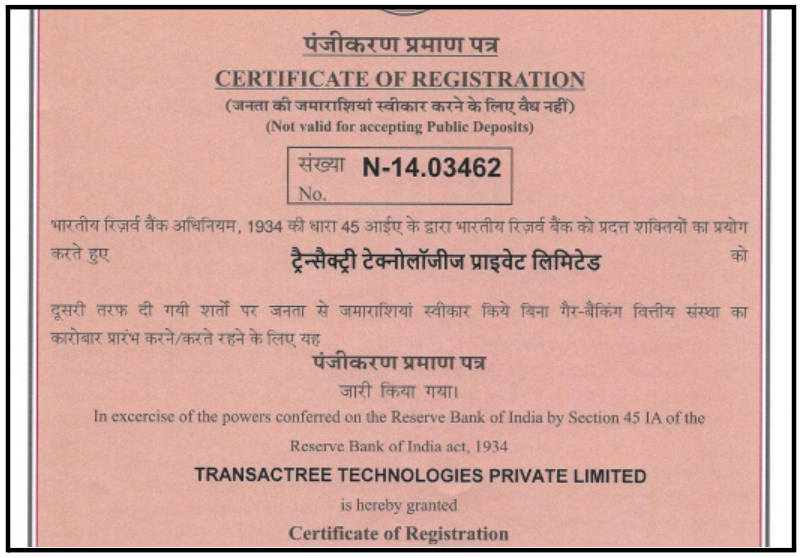

LendBox operates under Transactree Technologies Private Limited. This company legally exists with the Ministry of Corporate Affairs registration.

Founded in 2015, the entity has:

- Three named founders: Ekmeet Singh, Bhuvan Rustagi, Jatin Malwal

- Physical office locations in New Delhi

Received NBFC-P2P certification in 2019. This certification carries registration number N-13.03335, verifiable on RBI’s official records.

So, based on the above information, it seems to be a real platform. The company, founders, and registration genuinely exist.

Is LendBox Safe?

Real Transactions or Accounting Tricks?

When you invest ₹1 lakh in LendBox, does it actually go to borrowers? Or does it sit in some account, generating nothing?

According to Inc42’s report, the ₹10 crore fraud revealed actual money movement.

Scammers deposited funds, withdrew them, filed chargebacks, and got refunds.

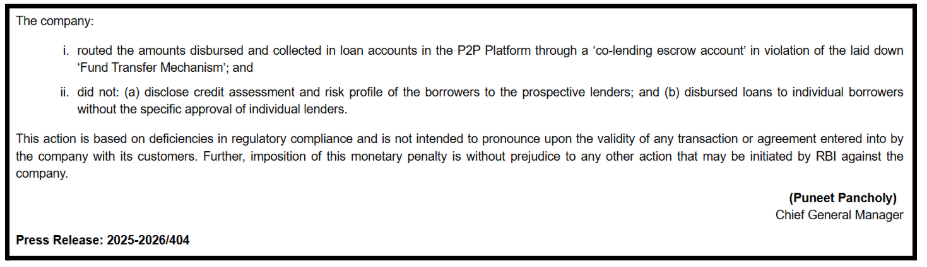

However, according to the RBI’s penalty documentation, funds were routed through unauthorized co-lending escrow accounts instead of proper P2P channels.

This gives an indication that although Money transactions are real, but routing mechanisms were unauthorized channels.

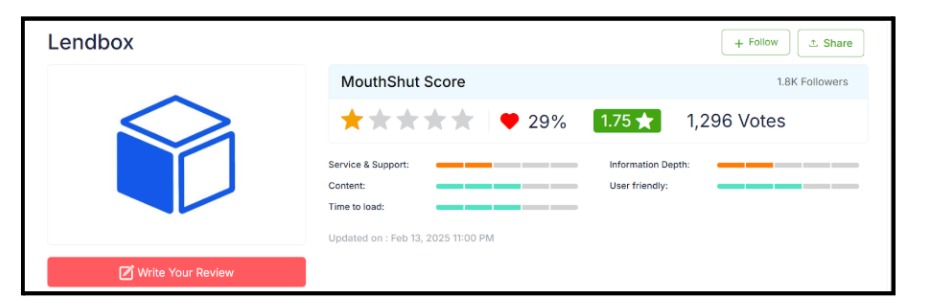

Other than this, LendBox has extremely low ratings despite a large number of reviews.

Across platforms, the rating stays around 1–1.7 stars, even after 900+ reviews and 1,000+ votes.

A high volume of reviewers repeatedly label the platform as fraudulent.

When so many users share similar complaints, it becomes difficult to ignore. Such consistently poor feedback makes LendBox highly suspicious for investors.

So, if LendBox was completely fake, this money would simply vanish.

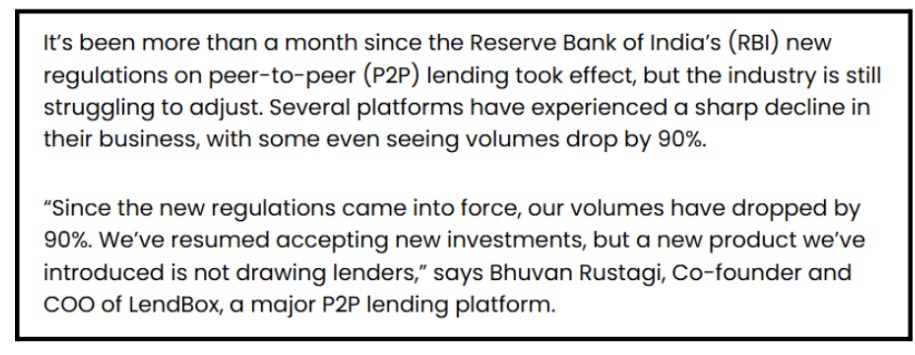

But according to a Business Today report from October 2024, the funds exist but are stuck in compliance restructuring with a 90% volume collapse.

LendBox Complaints

Let’s get into the real user complaints against Lendbox, where users claimed and raised issues about their fake promises.

Complaint 1: “Withdraw Anytime”

Marketing materials prominently featured “anytime withdrawal” as a core benefit. This was the primary selling point of MobiKwik Xtra powered by LendBox.

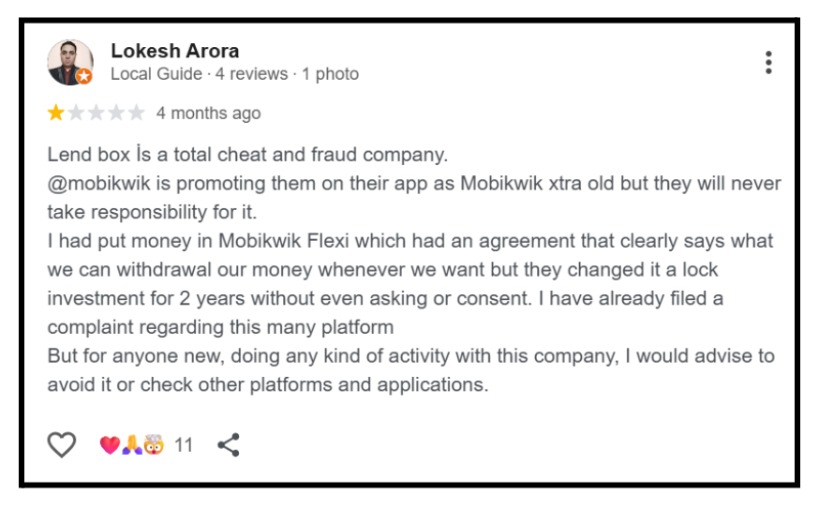

However, according to a Google Review by Lokesh Arora, his agreement clearly stated flexible withdrawals. Then LendBox changed this to 2-year lock-in without asking.

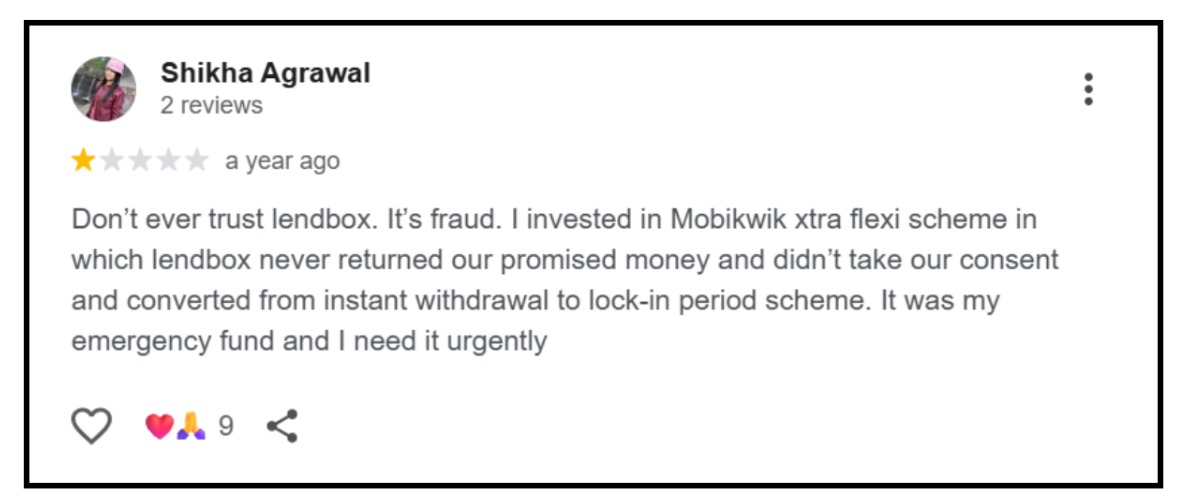

Another user, Shikha Agrawal, invested in the flexi scheme for emergency fund access. When emergencies came, access was denied.

The promise was fake. Flexibility never existed beyond marketing copy.

Complaint 2: “Advanced Credit Assessment”

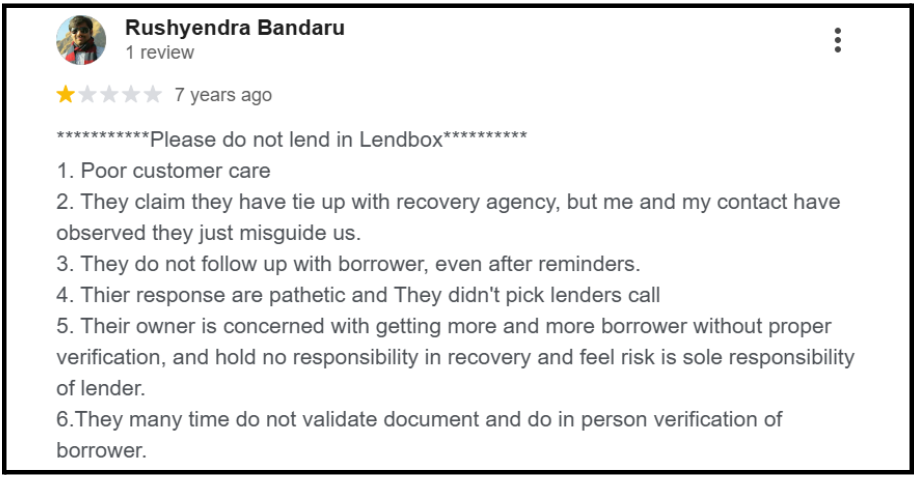

The platform claims to screen borrowers through 250+ data points with rigorous verification. Sounds thorough and protective for lenders.

According to Rushyendra Bandaru, he observed that they don’t validate documents properly and avoid in-person verification of borrowers.

The owner focused on acquiring borrowers without proper checks while placing all risk on lenders.

The RBI penalty order dated May 23, 2025, revealed that LendBox failed to disclose credit assessments to lenders and disbursed loans without specific approvals.

Truth assessment: The screening process claims were fake or poorly implemented.

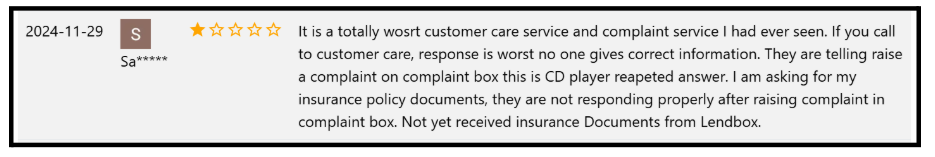

Complaint 3: “24-Hour Complaint Resolution”

Website claims promise quick investigation and resolution of investor concerns within 24 hours.

According to the review, repeated complaint box submissions about insurance documents went unanswered for months.

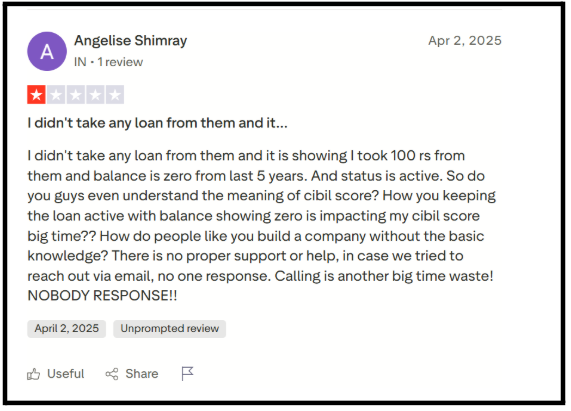

According to the Trustpilot review by Angelise Shimray, she faced fake CIBIL loan entries. Despite emails and calls, nobody responded. She wrote in capitals: “NOBODY RESPONSE!!”

Truth assessment: The 24-hour resolution promise is completely fake.

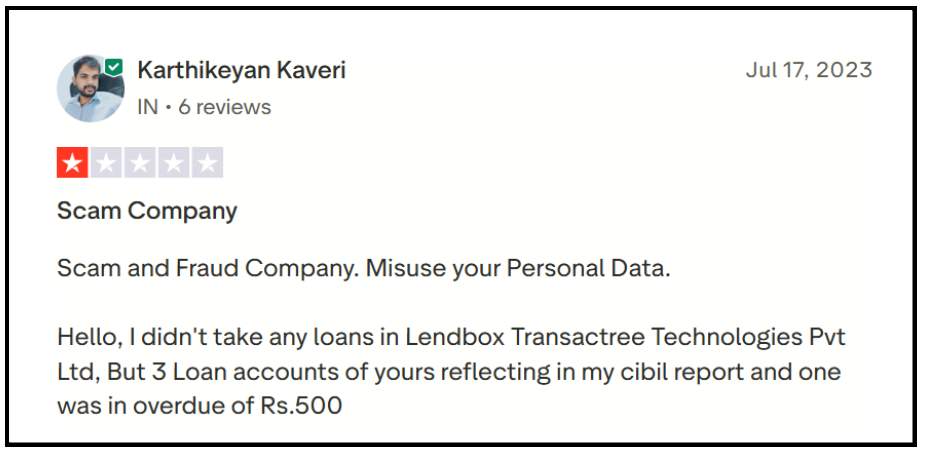

Complaint 4: Fake Loan Entries

This crosses into genuinely fraudulent territory. According to a Trustpilot review by Karthikeyan Kaveri dated July 17, 2023, three loan accounts appeared on his CIBIL report:

- Loan Account 778144: ₹2,000

- Loan Account 817656: ₹2,000

- Loan Account 889848L: ₹1,000 with overdue status

He never applied for these loans. Never received money. Yet CIBIL showed him as a borrower and defaulter.

Truth assessment: These CIBIL entries are fake and potentially fraudulent.

How to Report Investment Scams?

If you are facing fund blockage, delayed withdrawals, or suspect unfair practices, it’s important to report the issue through the correct channels and in the right order.

For Locked Funds You Can’t Access

- Step 1: Email LendBox with withdrawal request (documented proof)

- Step 2: After 30 days, no response, file an RBI complaint

- Step 3: Simultaneously file a consumer court case

- Step 4: Legal notice for breach of contract

- Step 5: Connect with other investors for a class action

For Suspected Fraudulent Practices

- Step 1: Gather evidence (emails, screenshots, contracts, statements)

- Step 2: File a Cyber Crime Complaint.

- Step 3: Report to RBI with specific violation details

Need Help?

Is your money stuck in LendBox?

The platform claims “technical issues” or “RBI guideline compliance.” Are these real reasons or fake stalling tactics?

Our Analysis Services

1. Document Verification: We analyze your contracts, communications, and transaction records to identify breaches, fake promises, or real violations that strengthen your case.

2. Legal Route Mapping: Real platform status means certain legal avenues work better. We identify whether RBI complaints, consumer court, or civil litigation offers the fastest resolution.

3. Evidence Building: We help compile irrefutable documentation proving fake promises vs original commitments, essential for successful legal claims.

4. CIBIL Fraud Resolution: If fake loans appear, we guide aggressive dispute processes, legal notices, and regulatory complaints until complete removal.

5. Recovery Strategy: Based on whether issues stem from real compliance problems or fake excuses, we develop customized recovery approaches.

Don’t let confusion between “real company” and “fake practices” paralyze you into inaction. Register with us today.

Conclusion

The question “Is LendBox real or fake?” demands a nuanced answer that many investors find unsatisfying. They want simple: scam or legit. Reality is complicated.

LendBox exists as a genuine corporate entity with authentic licensing, real technology, and verifiable operations. In this technical sense, it’s absolutely real.

But the platform’s practices, locked funds without consent, fake CIBIL entries, vanishing support, and broken promises exhibit characteristics associated with fraudulent operations.

This combination creates maximum danger. Investors see real credentials and trust the platform, only to discover that operational reality contradicts every promise made.

The practical truth: Real infrastructure doesn’t guarantee real reliability. Judge platforms by outcomes they deliver, not credentials they display.

Make decisions based on evidence, not marketing. Your financial security depends on recognizing when “real” credentials mask fake dependability.