In an age where every financial decision can make or break a dream. Investors are searching for not just advice, but someone they can truly trust.

In India’s dynamic financial landscape, Manoj Jethanand Varyani, a SEBI-registered investment advisor, often stands at the center of such conversations. His name surfaces among those who aim to decode the complexities of money and turn them into measurable success.

But beneath the surface of numbers and strategies lies a question that intrigues every investor: how do we measure an advisor’s credibility when the stakes are our life’s savings?

The world of advisory services is built on trust but tested by transparency. Advisors like Manoj Varyani operate within the ever-watchful framework of SEBI, balancing high-stakes decisions with stringent compliance rules.

Their success stories are often celebrated, but their challenges, especially those tied to complaints and SEBI orders, reveal the deeper reality of how the financial system maintains fairness.

In this blog, we will discuss the complaints against Manoj Varyani so that you can make an informed decision.

Who is Manoj Varyani?

Manoj Varyani is a SEBI-registered investment advisor (INA000015419).

His work likely involves developing personalized advisory strategies, assisting clients with portfolio management, and guiding them through complex investment products.

This professional setup, if run diligently, can help investors align their risk appetite with long-term financial goals.

However, as investment markets expand and client expectations evolve, challenges can emerge. In the advisory domain, transparency and consistent communication are not optional, but they are essential.

If clients feel misinformed or experience losses they believe were not adequately explained, dissatisfaction naturally follows.

That is why even a well-credentialed advisor can find themselves at the receiving end of investor complaints, whether justified or not.

What matters most then is how these complaints are handled by the advisor and by SEBI’s structured grievance mechanisms.

Manoj Varyani Complaints

Investor complaints in the financial advisory industry often stem from core concerns like, lack of clarity in recommendations, expectations about returns, delayed responses to queries, or alleged misrepresentation of products.

Even among registered advisors such as Manoj Varyani, such complaints, when they surface, serve as cautionary examples of the importance of following SEBI’s conduct standards.

Manoj Varyani SEBI Orders

In some cases, SEBI may issue orders or directions under its regulatory powers if substantial evidence indicates non-compliance with its registered advisor guidelines.

These could range from advisory warnings to temporary suspensions or penalties, depending on the gravity of the alleged violation.

While every SEBI-registered entity, like Manoj Varyan, must operate within the principles of integrity and fairness, regulators intervene only when complaints evolve into verified breaches of compliance procedures.

Here are some orders passed by SEBI:

1. SEBI Slaps ₹2 Lakh Fine on Manoj Varyani

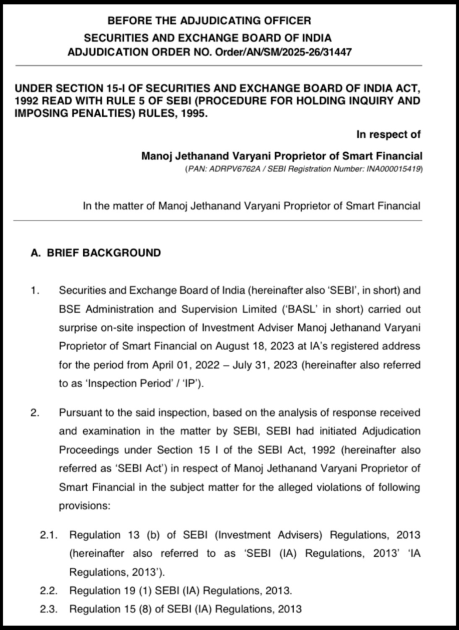

SEBI issued an adjudication order against Manoj Jethanand Varyani (Proprietor, Smart Financial) following a surprise on-site inspection by SEBI and BASL on August 18, 2023, covering April 2022–July 2023.

Why Filed?

The proceedings stemmed from multiple alleged violations of SEBI Investment Advisers Regulations, 2013, including:

- Non-disclosure of persons associated with investment advice (Reg. 13(b))

- Failure to maintain/provide records like client onboarding, risk profiling, suitability processes, and agreements during inspection (Regs. 19(1), 15(8), 16, 17, 18)

- Exceeding client limits without proof (Reg. 13(e)),

- Non-cooperation (Schedule III clauses)

- Improper fee collection (Reg. 15A).

What SEBI Did?

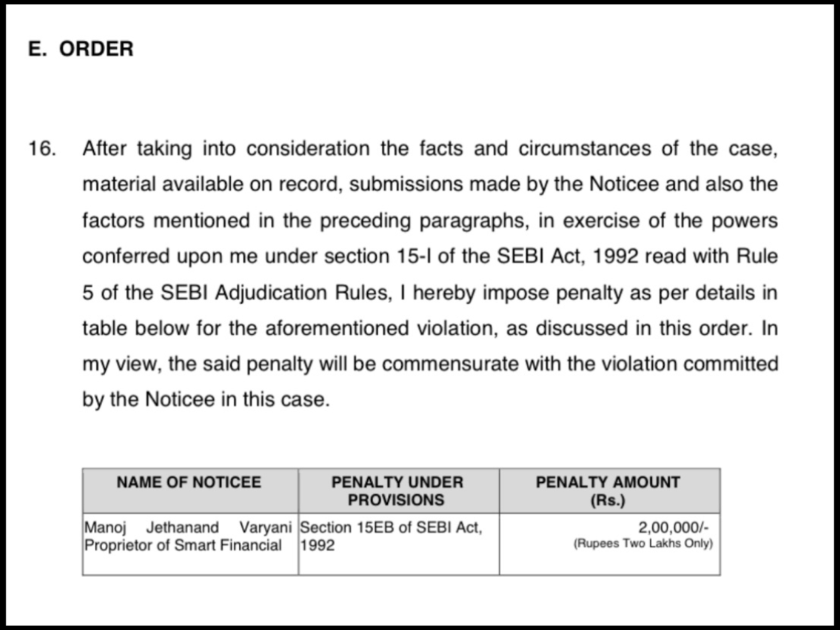

After issuing a Show Cause Notice and hearing Varyani’s replies (citing office renovation and prior PIQ submissions), the Adjudicating Officer found only one proven violation, i.e., non-disclosure under Reg. 13(b).

Most others were given the benefit of the doubt due to insufficient evidence. SEBI imposed a penalty of ₹2,00,000 under Section 15EB of the SEBI Act.

Key Learnings for Investors

- You should always verify advisors’ SEBI compliance via SCORES and public orders.

- Demand transparent records (risk profiles, agreements) upfront.

- Promptly report issues as inspections ensure accountability, but documentation protects you.

2. Arms-Length Violation Exposed in Dual IA Setup

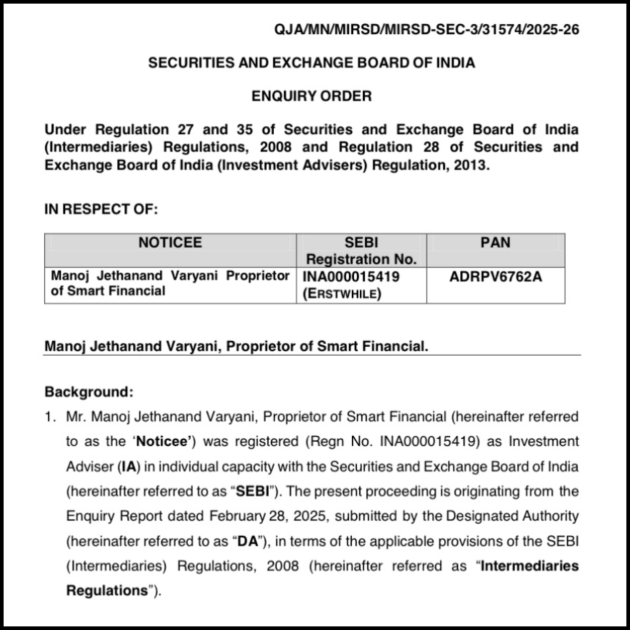

SEBI issued an Enquiry Order against Manoj Jethanand Varyani following a 2023 inspection and Designated Authority report.

Why Filed?

Stemming from the same Aug 18, 2023 SEBI inspection, it alleged Varyani failed to maintain “arms-length” separation between his individual IA (Smart Financial) and corporate IA (Bestway Smart Financial Pvt Ltd), where he held 70% shares, served as a director and Principal Officer in both entities, and shared office premises without proper cost segregation during the 18-month overlap.

What SEBI Did?

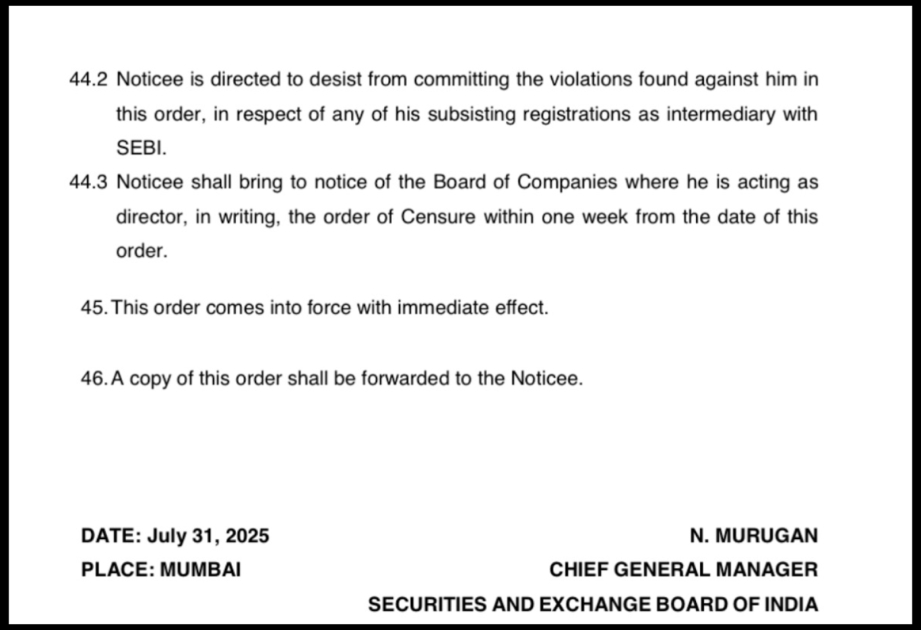

After SCN’s hearings and bank statement reviews that showed no proof of separate PO salary or office cost-sharing, SEBI rejected Varyani’s claims of no post-Apr 2023 activity and renovation excuses.

Issued regulatory censure under Reg. 27/35 Intermediaries Regulations; directed him to desist from violations in future roles and notify companies where he’s a director.

SEBI directives serve as key mechanisms of balance. They ensure investors have a voice and advisors have a chance to defend their actions.

The transparency of this process ultimately builds trust, reminding both clients and advisors that accountability is an ongoing obligation in the financial ecosystem.

How to File Complaint Against Manoj Varyani?

If you’re facing issues with Manoj Varyani and don’t know where to begin, you can register with us, and we’ll guide you through every step of the process.

We make the complaint journey simpler so you don’t feel stuck or alone.

- Documentation assistance

We help you gather, organize, and structure all the necessary documents related to Manoj Varyani, such as trade statements, ledger reports, contract notes, emails, screenshots, call logs, and any agreements.

This documentation is essential to support your case with clear and verifiable evidence.

- Drafting your complaint

Our team prepares well‑structured and clearly written complaint drafts tailored to the requirements of NSE, BSE, SEBI SCORES, SMART ODR, or any other relevant forum.

A properly drafted complaint minimizes the chances of rejection or delay due to issues of clarity, format, or language.

- Filing and escalation support

We offer step‑by‑step assistance while you file your complaint on platforms like SCORES or SMART ODR to ensure every detail is completed correctly.

If your matter requires escalation beyond the adviser, we guide you through the proper escalation channels, including contact with the exchange or the next dispute‑resolution level.

- Case tracking and arbitration help

Conclusion

The case of Manoj Varyani offers a microcosm of the broader investment advisory landscape in India, which is dynamic, evolving, and shaped by both opportunity and oversight.

While complaints and order issues highlight moments of dispute, they also underline how strong regulatory systems, such as SEBI, safeguard investor interests.

In financial markets, trust is currency. Advisors earn it through transparent conduct; investors reinforce it by staying informed.

Whether through precautions taken by clients or the vigilance maintained by SEBI, the ecosystem works best when both sides collaborate for fairness.

Advisors like Manoj Varyani operate in an environment that demands integrity at every step because, ultimately, responsible advice doesn’t just grow wealth; it sustains confidence in India’s financial future.