When investors search for Sameer Pande or Nifty Pro, they’re usually looking for that one dependable guide who can steer them through the unpredictable stock market with confident calls and high accuracy claims.

His name, closely linked with Nifty Pro, frequently appears in Telegram groups and trading websites, attracting hopeful traders with bold promises of “90% success rates” and steady profits, no matter how volatile the market becomes.

But what starts as excitement can quickly turn into frustration when the results don’t match the hype.

This blog pulls back the curtain on Sameer Pande and Niftypro Trading Research, examining his background, the mounting complaints, SEBI’s firm actions, arbitration outcomes, and the key news stories that shaped his reputation.

The story here isn’t about labeling anyone outright but about empowering you with facts so you can make informed choices.

Research analysts play a big role in investor decisions, yet even SEBI-registered ones face scrutiny if rules slip.

We’ll walk through real user experiences, regulatory findings, and media coverage step by step. By the end, you’ll know exactly what to watch for and how to protect yourself.

Ready to dig in?

Nifty Pro Review

Nifty Pro Trading Research, operated by Sameer Pande, positions himself as a seasoned SEBI-registered research analyst based out of Nagpur, Maharashtra.

His registration number INH000009649 confirms active status as of recent lists, meaning he meets basic qualifications like net worth deposits and compliance undertakings.

On LinkedIn, Pande describes his role as self-employed, highlighting education from G.H. Raisoni College and a focus on equity research alerts.

Packages range from basic to premium (up to ₹15,000 annually), delivered via Telegram or email, with disclaimers noting no guaranteed returns, which is standard for RAs.

The site’s investor charter echoes SEBI mandates, stressing research objectivity and no trading conflicts.

Nifty Pro Complaints

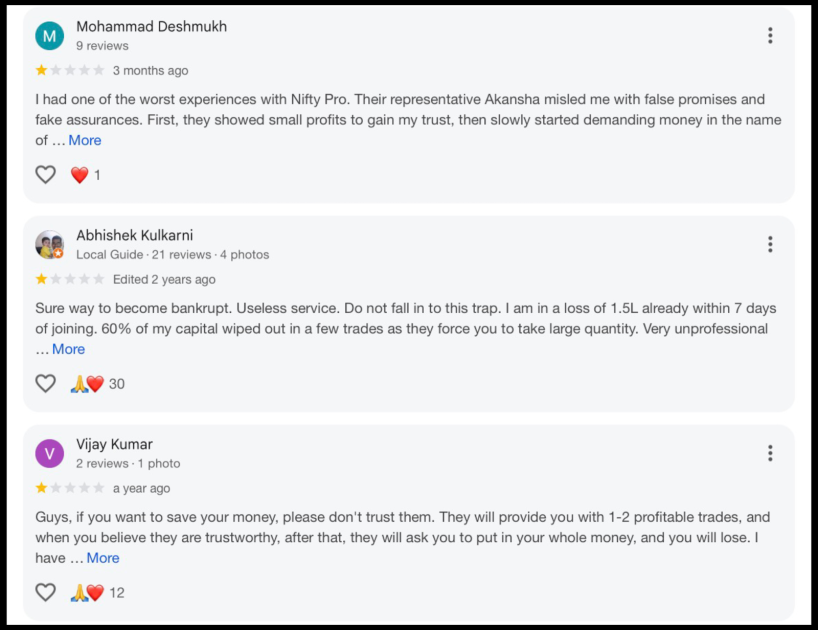

Complaints against Sameer Pande and Niftypro centre on unmet expectations from high-stakes promises, with users reporting losses tied to poorly managed tips and shifting fee structures.

On Google, reviewers describe Nifty Pro as a service that starts with small profits to win trust and then slowly pushes for more and more money.

One user says 60% of his capital was wiped out in just a few trades because he was forced to take large quantities, calling it a “sure way to become bankrupt.”

Another warns that they first give one or two profitable trades and later ask you to put in your whole money, after which you face heavy losses.

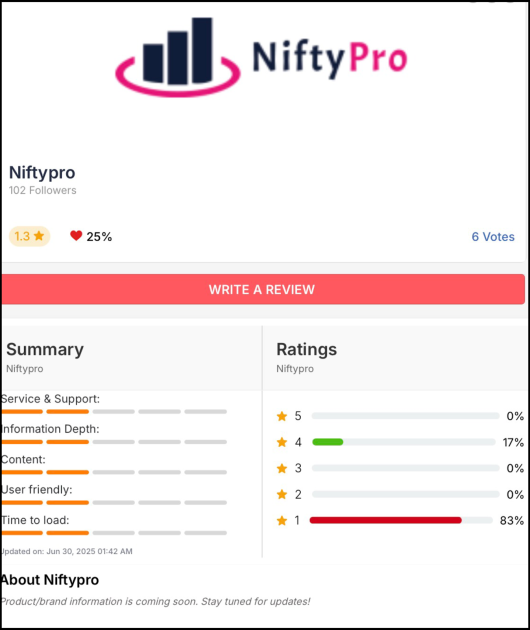

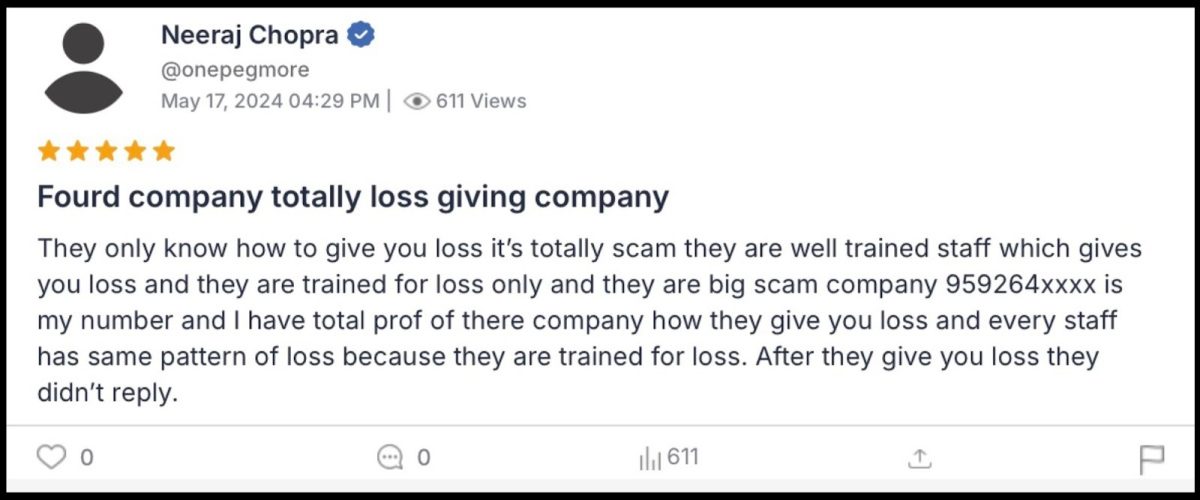

On Mouthshut, the language is even stronger. There are 6 reviews in total, and all are negative. Star rating over here is 1.5 out of 5 stars.

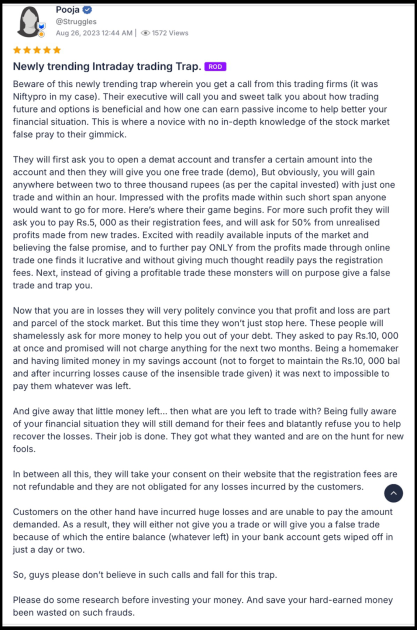

One detailed review calls it a “newly trending intraday trading trap,” explaining how a free demo trade shows profit, then a ₹5,000 fee is taken, and after that, losing tips and repeated demands for more money begin.

Another user bluntly calls it a “totally loss-giving company,” saying the staff seem trained only to make clients lose and then stop responding once the damage is done.

From these reviews, common investors should learn three simple things:

- First, never trust anyone who promises easy or quick profits from trading, as early profits can be part of the trap.

- Second, be very careful before paying any registration or tip fee; once money is paid, refunds are rare, and calls may suddenly stop.

- Third, always do your own research, use only SEBI-registered entities, and remember that if so many people are calling a service a scam, it is safer to walk away than to risk your hard‑earned savings.

Platforms like SEBI SCORES log multiple entries, often about inaccurate advice lacking stop-losses or research depth, leading to substantial capital erosion.

Watch out, investors, track these, showing unresolved issues despite grievance policies.

Sounds like a pattern worth noting, right?

Nifty Pro Arbitrations

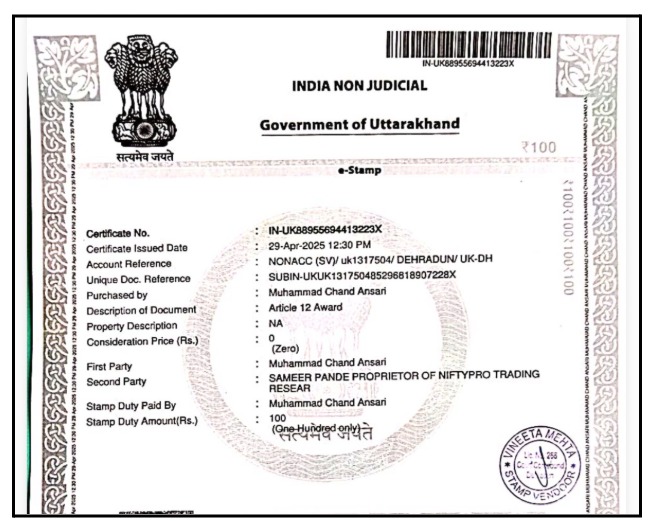

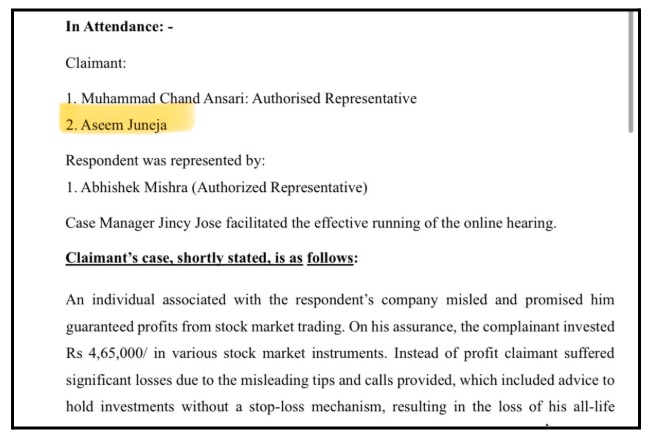

A standout case involves investor Chand Ansari, who paid ₹55,000 upfront in March 2025 for a profit-sharing deal with 30% of gains promised, with no fees if unprofitable.

The arbitration was fought by us on behalf of our client.

Tips rolled in without risk controls; markets dipped, losses piled up, yet the firm reclassified it as a “non-refundable service fee.” Audio recordings captured the initial verbal assurances, proving deception.

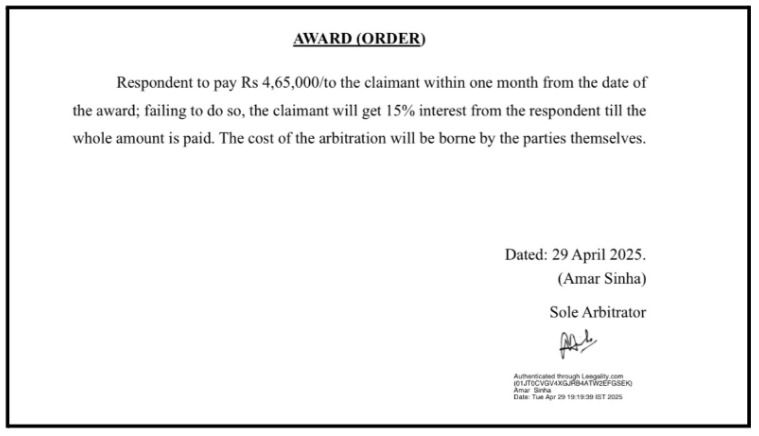

Ansari escalated via SCORES, landing in arbitration. The arbitrator Amar Sinha awarded full ₹4.65 lakhs plus 15% interest on April 29, 2025, citing illegal profit-sharing (banned for RAs) and evidence mismatches.

Our client had presented all the proofs, and thus, we were able to guide him and provide justice.

These actions underscore SEBI’s zero-tolerance policy. RAs must avoid assured returns, use real testimonials, and maintain neutrality.

This isn’t isolated; similar feedback echoes on socials about unresponsive support and hidden SCORES links on the site.

Common threads include aggressive Telegram promotions ignoring disclaimers, fabricated success stories to lure sign-ups, and pressure to hold losing positions. These issues erode trust, prompting regulatory eyes.

Transitioning from complaints, SEBI stepped in decisively.

SEBI Orders Against Nifty Pro

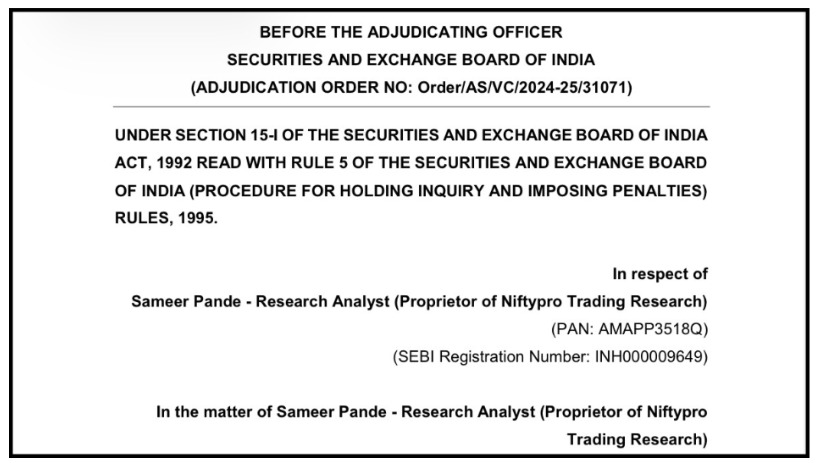

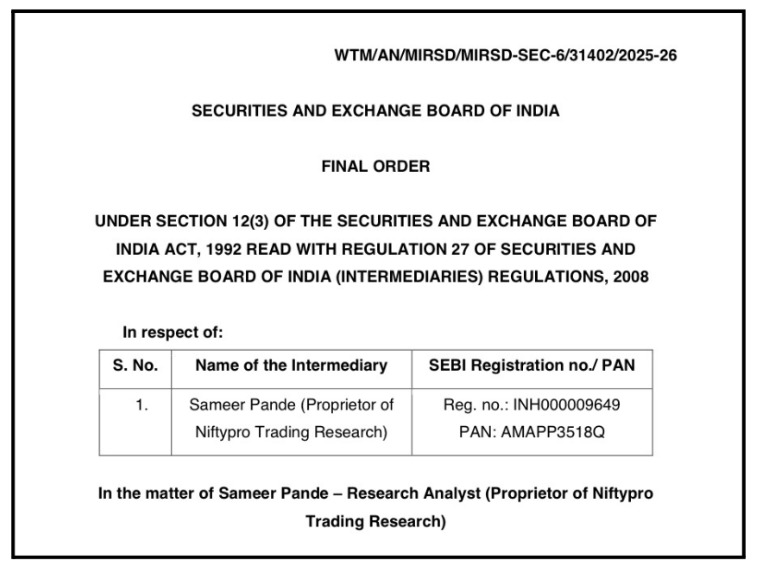

On 24 December 2024, SEBI issued an enforcement/adjudication order against Sameer Pande, proprietor of Niftypro Trading Research.

The action was taken after SEBI found that Niftypro misled investors by making guaranteed/assured returns claims and false marketing, in violation of SEBI rules.

Despite being a registered Research Analyst (RA), Niftypro’s website and marketing promised high, quick, and “assured” profits; for example, statements such as “90% accuracy,” “consistent profits regardless of market volatility,” or daily profit expectations.

Such claims are strictly prohibited under SEBI’s advertising and conduct rules for RAs.

The 50-page document details site and Telegram content promising “consistent profits irrespective of volatility,” banned testimonials portraying fake clients with massive gains, and prohibited past performance boasts. A single footer disclaimer was deemed inadequate cover.

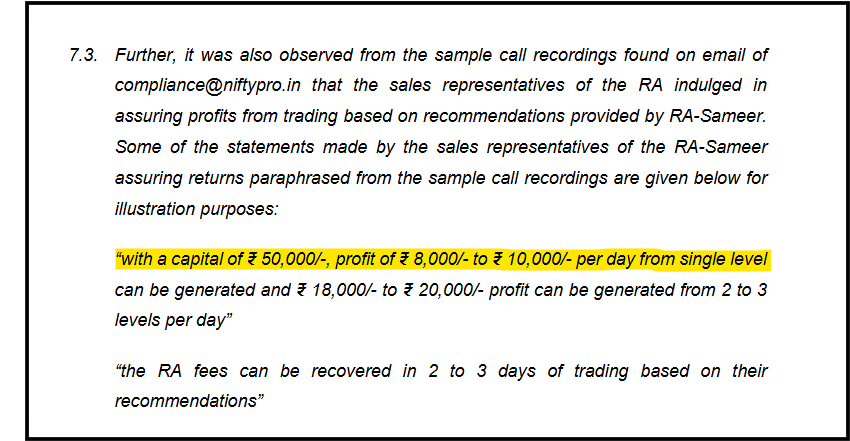

SEBI’s investigation found that sales representatives were assuring clients profits like “₹8,000–₹10,000 per day on ₹50,000 investment,” which is clearly unrealistic and deceptive.

Even if such profit projections were in internal lead-sheets or call logs and not part of the public advertisement, SEBI still considered them misleading because they were communicated to clients

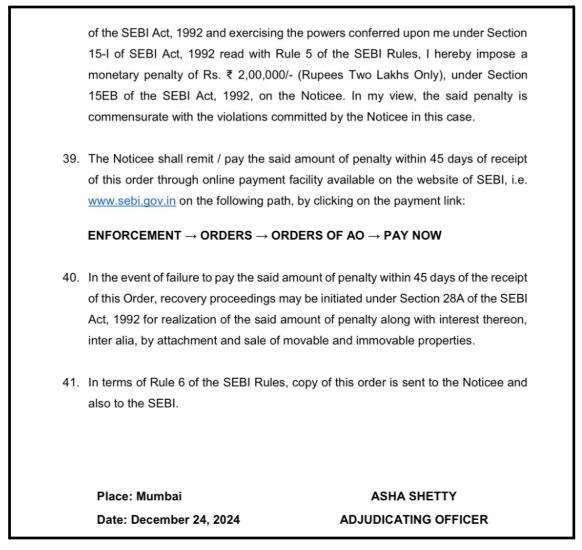

Penalty: SEBI imposed a monetary penalty of ₹2 Lakh on Sameer Pande / Niftypro. The order stated that Niftypro had failed its “fiduciary duty” to clients as an RA.

The order also required Niftypro to remove misleading content from its website/app and cease using prohibited language or claims.

Interestingly, although the violations were serious, SEBI opted for a regulatory censure (rather than a lifetime ban), noting that no widespread investor complaints had yet surfaced and that Niftypro had already made some remedial changes.

Another order was found against Sameer Pande, where he misled investors about profit potential. His website claimed 90% accuracy and promised “consistent profits irrespective of volatility.”

His sales team made specific profit promises like “₹50,000 capital = ₹8,000-10,000 daily profit” and said membership fees could be recovered in 2-3 days.

He used misleading testimonials without proper disclaimers. All this violated SEBI’s regulations that prohibit research analysts from guaranteeing returns.

What SEBI Did?

SEBI inspected Niftypro Trading Research (May 2022-January 2024) and found violations.

After Sameer’s response, formal enquiry proceedings began with a Designated Authority investigating. He got a hearing on August 13, 2024, to defend himself.

SEBI reviewed website content, call recordings, and internal documents showing his team’s promises to clients.

The DA found him guilty of violating the Research Analysts Regulations and the Advertisement Circular. SEBI issued a final regulatory censure against him.

Key Takeaways

Research analysts can never promise guaranteed profits or specific returns. Even saying “you can make” certain amounts is a violation.

Disclaimers don’t excuse misleading claims made upfront. Internal documents like call recordings count as evidence. Any communication through a website or phone that misleads investors about certain gains violates SEBI rules and counts as fraud in securities dealings.

Thus, SEBI regularly keeps a check on the registered entities so that any scam can be prevented.

But you, as an investor, must choose to spend your money wisely.

How to File a Complaint Against a Research Analyst?

If you encounter problems with Sameer Pande or any other research analyst, follow these straightforward steps to seek a resolution.

Step 1: Register Your Complaint With Us

Contact us right away and provide all the details of your issue with the research analyst. We take care of documenting your case thoroughly and accurately from the start.

Step 2: Consult Our Case Manager

We set up a dedicated call with one of our experienced case managers. They review your unique circumstances, assess the strength of your complaint, and walk you through the full path to resolution.

Step 3: Draft a Strong Complaint

Our experts assist in preparing a detailed and well-structured complaint letter. Every key fact, evidence, and supporting document gets included to make your case compelling.

Step 4: Engage the Research Analyst

We support you in reaching out to the research analyst directly. This ensures clear communication and opens the door for an amicable solution.

Step 5: File a complaint with SCORES

We provide hands-on guidance for filing on the SEBI SCORES platform. All details are verified for accuracy, with proper attachments and submission protocols followed.

Step 6: Access SMART ODR Assistance

Should SCORES not yield results, we step in for SMART ODR support. This includes helping you sign up on the ODR portal, gathering required documents, aiding in conciliation sessions, and advocating strongly on your behalf.

Step 7: Navigate Arbitration if Needed

For cases requiring arbitration, we offer complete support. This covers preparing the application, assembling solid evidence, and accompanying you through every phase until closure.

Conclusion

Handling complaints against research analysts demands familiarity with the right channels.

SEBI offers investors several options, beginning with direct outreach, progressing to SCORES, then SMART ODR, and arbitration as the final step.

Going solo through these processes can prove daunting.

With professional help, you can file SEBI complaints against fraudsters very smoothly, ensuring complaints are properly prepared and pursued, turning potential rejections into successful outcomes.

Your rights as an investor are safeguarded under SEBI regulations.

Embrace these tools confidently for legitimate concerns.