Got a problem with your Demat account? NSDL not responding to your queries? Transaction stuck without explanation?

You’re definitely not alone here. Thousands of investors face NSDL-related issues monthly.

But here’s the good part: there’s a proper system to fix them.

Let us show you exactly how.

Common Types of NSDL Complaints

According to SEBI regulations, NSDL operates under strict compliance norms. They undergo regular inspections. Your securities are legally protected.

Moreover, NSDL maintains an Investor Protection Fund. This covers losses from DP (Depository Participant) fraud.

Sounds reassuring, right?

But there are a few instances where users have faced certain issues and losses due to NSDL glitches.

Here are a few common complaints reported against NSDL:

1. PAN Card Related Complaints

According to Consumer Complaints India, PAN services generate the maximum complaints.

Users report issues like applications stuck showing “Application Submitted” status for 45+ days despite payment deduction.

Another frequent problem involves e-KYC failures.

Users complain that after completing payment, the system shows “Your e-KYC-based request has failed, hence you cannot proceed with the application with e-KYC mode”.

Money gets deducted. But the application doesn’t process.

2. Demat Account Access Issues

According to Reddit discussions, demat-related complaints involve nominee details not saving.

Password reset failures show errors like “Pending Reset IPin/Re-Issue of IPin request is already present for this USER ID/PRAN”.

This indicates backend processing issues. Moreover, users can’t access accounts for weeks.

3. CAS Statement Problems

Consolidated Account Statement downloads frequently fail.

According to user feedback on Consumer Complaints India, the portal shows “Unable to process request” errors. Even after multiple attempts.

4. Payment Gateway Failures

UPI transactions are completed successfully.

However, applications don’t get submitted.

According to multiple complaints, users pay ₹107-₹210 for PAN services. Money gets deducted. But status remains unchanged.

This reveals poor payment reconciliation systems. Sounds concerning, right?

NSDL Real User Issues

Let’s look at actual problems reported by real investors. Not generic textbook stuff.

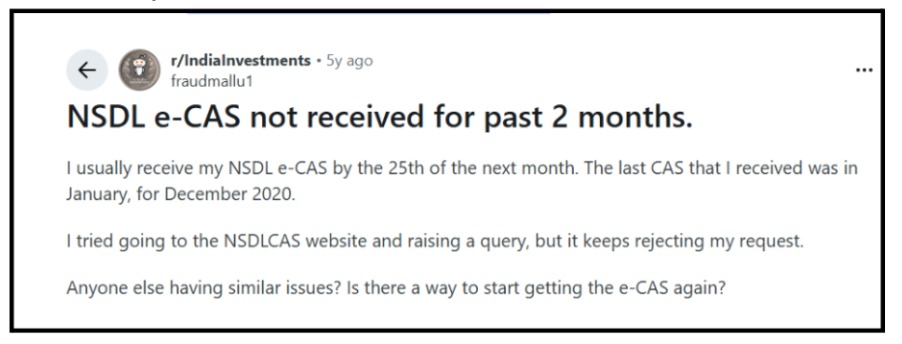

Problem 1: e-CAS Statement Not Received

Many investors report not receiving their Consolidated Account Statement (e-CAS) for months.

Real user complaint from Reddit r/IndiaInvestments:

This indicates systematic email delivery failures. CAS statements contain crucial investment details. Missing them creates tracking problems for investors.

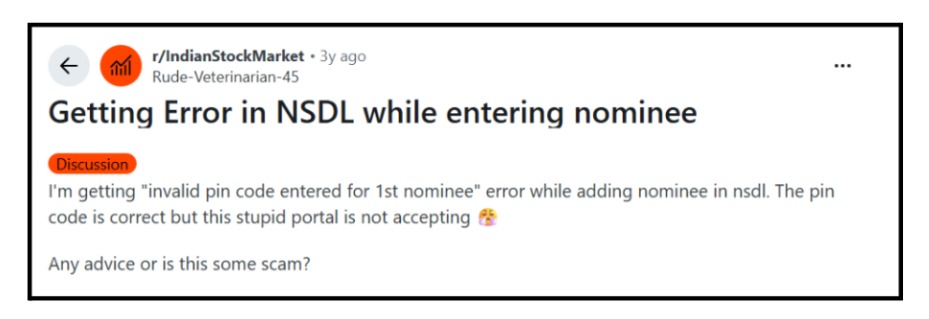

Problem 2: Nominee Addition Errors

Investors face technical glitches while adding nominees to their Demat accounts.

Real user complaint from Reddit r/IndianStockMarket:

This reveals backend validation issues in NSDL’s portal. Correct information gets rejected due to system errors.

Frustrating for investors trying to secure their accounts.

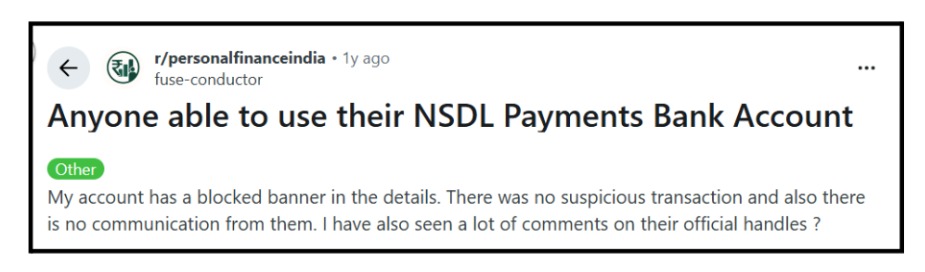

Problem 3: NSDL Payments Bank UPI Failures

Several complaints exist about NSDL Payments Bank facing transaction failures.

Real user complaint from YouTube:

“NSDL payment bank is facing high payment failure on all UPI apps. NSDL bank sends money problem.”

This indicates infrastructure issues with NSDL’s banking services. UPI transaction failures disrupt daily payment activities. Affects trust in digital payment systems.

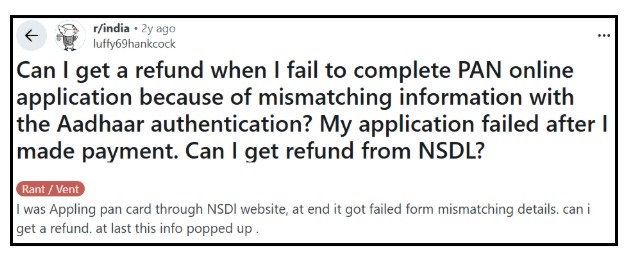

Problem 4: PAN Application Refund Issues

Applicants face difficulties getting refunds for failed PAN card applications.

Real user complaint from Reddit r/india:

Money gets deducted, but applications fail due to Aadhaar mismatches. Refund process unclear. Users were left confused about the next steps.

These complaints reveal recurring technical problems. Portal errors, validation glitches, and payment failures all point to systemic issues requiring attention.

NSDL Complaint Resolution Timeline

According to NSDL’s official grievance policy, complaints lodged directly with the Depository shall be resolved within 21 calendar days.

However, real user experiences differ drastically. Many report waiting 30-60 days without resolution.

Official Timeline:

- Initial complaint acknowledgement: Within 24 hours

- Resolution timeline: 21 days

- GRC escalation: If unresolved after 30 days

- SEBI SCORES: If still unresolved

How to File NSDL Complaint Online?

If you have faced loss due to NSDL glitches or other issues, then take immediate action online by following the steps below:

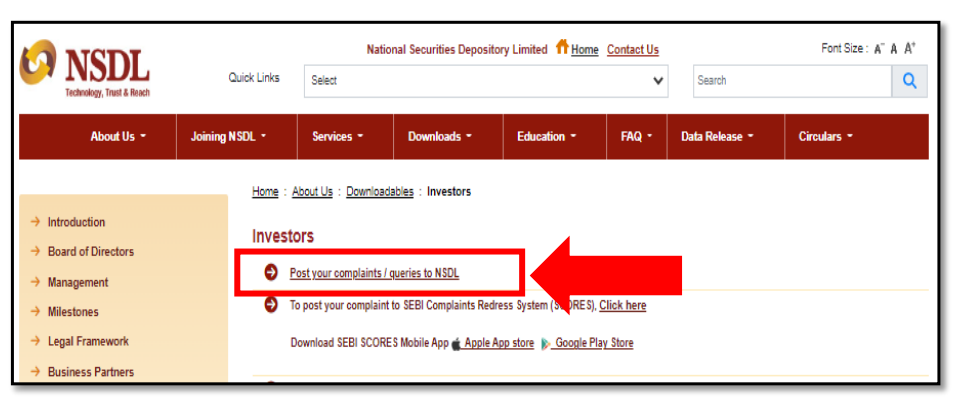

Step 1: Register on the NSDL Grievance Portal

Visit NSDL’s official website. Navigate to the “Post your complaints/queries to NSDL” section.

Click on “Register” if you’re a new user. Provide your first name, last name, and registered mobile number. You’ll receive an OTP for verification.

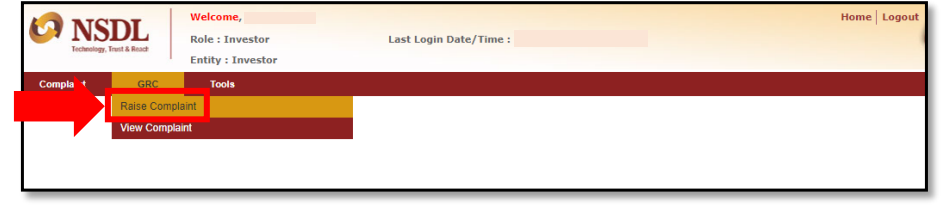

Step 2: Log in and Raise a Complaint

According to NSDL’s guidebook for investors, enter your registered email ID and password, then click “Generate OTP”, which will be sent to your registered mobile number.

Select the “Raise Complaint” option from the dashboard. Choose the appropriate complaint category (PAN, Demat, CAS, etc.).

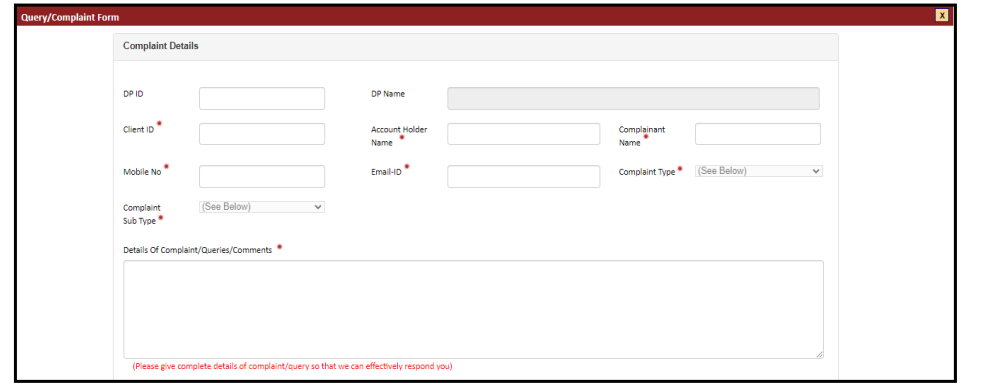

Step 3: Fill in Complete Details

Provide comprehensive information, including:

- Acknowledgement number (if applicable)

- Transaction details

- Issue description

- Supporting documents in PDF format

A reference number will be generated, and you will receive an email confirmation at your registered email address. Save this reference number carefully.

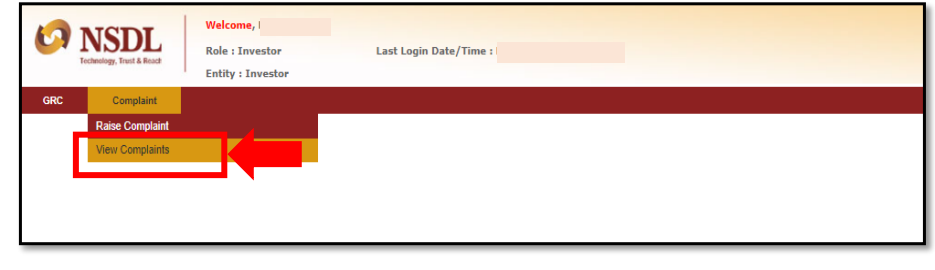

Step 4: Track Your Complaint Status

Log in to the grievance portal anytime. Use your reference number to check status updates. The system maintains a complete audit trail.

What To Do When NSDL Doesn’t Resolve Your Complaint?

30 days passed. No resolution.

Now what?

Don’t panic.

Escalation options exist. Let me explain each level.

Level 1: Escalate to NSDL’s Nodal Officer

If your complaint remains unresolved after 30 days, escalate within NSDL first.

Email: [email protected]

According to NSDL’s escalation policy, the nodal officer reviews within 15 days. They have the authority to override DP decisions.

Level 2: Approach Grievance Redressal Committee (GRC)

Still not resolved? Time for GRC.

What is GRC?

According to NSDL’s investor protection guidelines, GRC is an independent committee. It includes external members. Not NSDL employees.

According to NSDL’s GRC guidelines, there’s no fee for filing.

The committee meets monthly. Hearings are conducted if needed.

GRC timeline: Decision within 45 days of receipt.

GRC powers:

- Can order DP to take specific action

- Can award compensation

- Can impose penalties on erring DPs

- Decisions are binding

Level 3: File on SEBI SCORES Platform

SEBI SCORES (SEBI Complaints Redress System) is your next step.

Why SCORES works:

According to SEBI’s official data, 99% of SCORES complaints get responses. SEBI monitors closely. Companies must respond within 30 days.

- Register on the SCORES portal

- Select “Depositories” as entity type

- Choose “NSDL” from the dropdown

- Fill complete complaint form

- Upload all previous correspondence

- Mention the GRC complaint details

- Submit and get SCORES complaint number

SCORES timeline:

- Entity must respond: 30 days

- SEBI review: 15 days

- Final disposal: 60 days maximum

Moreover, SEBI can penalise non-compliant entities. This pressure works.

Level 4: Approach Securities Appellate Tribunal (SAT)

Extremely rare. For unresolved cases involving significant amounts.

SAT is a quasi-judicial body. Hears appeals against SEBI orders.

When to approach SAT:

- SEBI order unsatisfactory

- Substantial financial loss is involved

- Complex legal interpretation needed

However, SAT requires legal representation. You’ll need a lawyer. Costs involved.

According to Securities Appellate Tribunal rules, appeals must be filed within 45 days of the SEBI order.

Level 5: Consumer Court

Parallel option to the SEBI route. For service deficiency cases.

According to the Consumer Protection Act 2019, you can file against both NSDL and DP. Service deficiency includes delayed resolution.

Consumer court cases take 6-12 months, typically. But compensation awarded includes costs and mental agony.

Need Help?

Still struggling with unresolved issues? Does the system seem too complex? Are multiple rejections frustrating you?

You’re not alone in this fight.

Register with us if you’re facing:

- Confusing error messages

- Contradictory responses from DP

- Repeated document rejections

- No response after 45+ days

- Legal terminology you don’t understand

What We Offer?

- Complaint Assessment: Review your entire case. Identify weak points. Strengthen documentation.

- Professional Drafting: Prepare legally sound complaints. Cite relevant regulations. Use proper format.

- Strategic Escalation: Plan optimal escalation path. Time each step correctly. Maximise pressure efficiently.

- Follow-up Management: Handle all correspondence. Track deadlines. Send reminders systematically.

- Multi-platform Filing: File on NSDL, SCORES, and consumer forums simultaneously. Create maximum visibility.

- Representation: Represent before GRC if needed. Assist with SEBI interactions. Support in the consumer court.

Conclusion

NSDL is a legitimate, SEBI-regulated depository. Your securities are legally protected.

However, when NSDL is not working as expected, operational issues can and do occur.

Most complaints involve DPs, not NSDL directly. But NSDL’s complaint redressal system handles both. The standard resolution timeline is 30 days maximum.

When direct complaints fail, escalation works. GRC and SEBI SCORES are powerful tools. Use them strategically.

Remember: Silence accomplishes nothing. Proper complaints get results. Your money, your rights, your actions are needed.

Don’t let unresolved complaints drain your investments. Act now. File correctly. Escalate smartly. Win your case.