Before committing their hard-earned money, every investor wants absolute clarity about what they are signing up for. In India’s fast-evolving investment advisory landscape, trust and transparency have become more important than ever.

This is why Param Nivesh often comes up when individuals begin searching for dependable investment guidance.

Today’s investors are surrounded by countless financial products and advisory services. To navigate these choices confidently, they look for straightforward, honest information that helps them compare options without confusion.

Param Nivesh naturally becomes part of this decision-making journey, as investors seek to understand how the firm operates and what value it truly delivers.

By clearly knowing what Param Nivesh offers, investors are better equipped to evaluate whether the service fits their financial needs and long-term goals, leading to more informed and confident investment decisions.

Param Nivesh Review

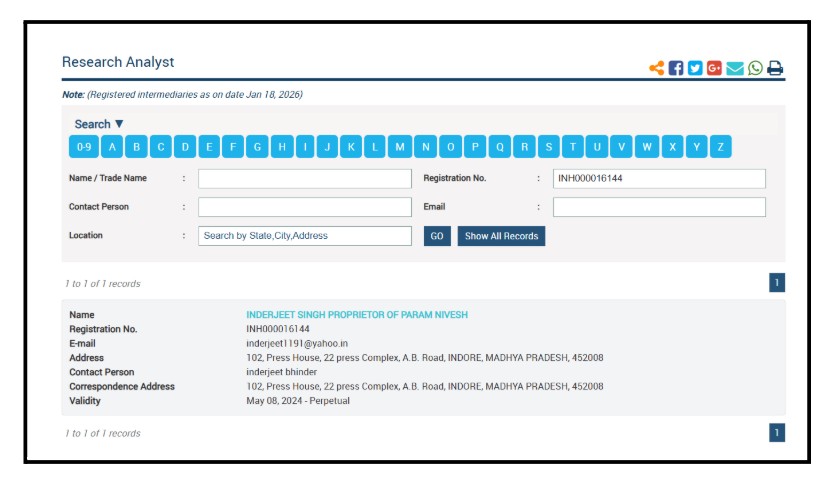

Param Nivesh is an India-based financial research and market insights platform operated by Inderjeet Singh, who is registered with the Securities and Exchange Board of India (SEBI) as a Research Analyst (Registration No. INH000016144).

As a SEBI-registered Research Analyst, the platform states that it operates in accordance with the regulatory framework applicable to research professionals in India.

The registration indicates that the analyst is authorized to provide research-based insights under SEBI guidelines.

Param Nivesh offers research and analysis across different segments of the financial markets, including equities, futures, and options.

The platform presents structured market insights, trading perspectives, and analytical observations related to price movements and derivatives strategies.

The firm maintains an active presence on Facebook, where it shares market updates, research summaries, educational posts, and information about its services and discussion channels.

Param Nivesh also operates a Telegram channel connected to its services. Currently, the platform does not maintain official accounts on other major social media platforms such as Twitter or Instagram.

Since the platform operates under SEBI registration, its activities are governed by a defined regulatory framework that specifies what a Research Analyst is permitted to do and what activities fall outside the scope of the regulations.

What SEBI Permits a Research Analyst to Do?

Research Analysts (RAs) in India operate under the SEBI (Research Analysts) Regulations, 2014.

These rules clearly define what services an RA can legally provide and how they must conduct themselves.

When an analyst follows SEBI’s framework properly, investors can rely on their research with greater confidence.

1. Issuing Research Reports

A registered Research Analyst is allowed to prepare and publish detailed research reports covering listed securities, industries, or market segments.

Such reports may contain:

- Fundamental or technical analysis

- Sector or industry insights

- Interpretation of financial statements

- Valuation explanations

- Clearly defined assumptions and risk factors

Importantly, these reports must be objective, data-driven, and free from bias.

Analysts are also required to disclose any conflicts of interest, personal holdings, or business relationships that may influence their views.

Transparency is not optional; it is mandatory.

2. Providing Research-Based Recommendations

An RA may issue “buy,” “sell,” or “hold” recommendations, but only when they are backed by proper research.

Every recommendation must:

- Be supported by documented analysis

- Include adequate risk disclosures

- Avoid any language that suggests guaranteed outcomes

- Clearly state that markets are uncertain

Recommendations must reflect professional judgment derived from research, not sales tactics or promotional intent.

3. Offering Analytical Opinions

Research Analysts are permitted to share informed opinions and analytical perspectives on:

- Individual stocks

- Broader market movements

- Specific sectors or investment themes

- Macroeconomic trends

- Derivative strategies (from a research standpoint)

These insights are meant to assist investors in making informed decisions.

However, RAs cannot execute trades on behalf of clients or directly manage their investment capital unless separately registered under other applicable regulations.

The focus must always remain on analysis, not fund handling.

4. Charging Fees Within Regulatory Limits

An RA can charge fees for research and advisory services, but only within SEBI’s prescribed framework.

This generally means:

- Fees must be clearly disclosed in advance

- The fee structure must be agreed upon before services begin

- Compensation cannot be linked to trading profits

- Profit-sharing arrangements are strictly prohibited

- The structure must not create conflicts of interest

The intent behind these rules is simple: the analyst’s income should not depend on market performance.

This helps preserve independence and objectivity in research.

What an SEBI-Registered Research Analyst is Not Allowed to Do?

Understanding restrictions is just as important as understanding permitted services. SEBI’s regulations are designed to protect investors from misleading practices and conflicts of interest.

Here are some key prohibitions:

1. Promising Guaranteed Profits

A registered Research Analyst cannot promise fixed returns, assured income, or guaranteed profits.

Financial markets are unpredictable by nature. Any claim suggesting certainty, such as daily fixed earnings or assured returns, is misleading.

Even if profits are achieved occasionally, presenting them as guaranteed outcomes is considered misrepresentation.

SEBI treats such claims as a serious regulatory violation.

2. Assuring Loss Recovery

No Research Analyst is allowed to guarantee that client losses will be recovered.

This includes:

- Predicting market movements with certainty

- Claiming losses can be reversed through “sure-shot” trades

- Suggesting that experience eliminates market risk

Loss recovery promises often encourage investors to take additional risks under false expectations.

SEBI views such conduct as unethical and misleading.

3. Linking Fees to Profits

SEBI requires a clear separation between advisory fees and trading outcomes.

An RA cannot:

- Operate on a profit-sharing model

- Charge fees based on client profits

- Structure compensation as a percentage of gains

- Deduct fees directly from trading returns

When compensation depends on profits, it creates a conflict of interest and may encourage excessive or risky trading behavior. That is precisely what the regulations aim to prevent.

4. Using High-Pressure Sales Tactics

Investors must be allowed to make decisions independently.

Practices such as:

- Repeated unsolicited calls

- Creating artificial urgency

- Downplaying risks

- Pressuring clients for immediate payments

can violate SEBI’s fair conduct principles.

Even a registered entity can face regulatory scrutiny if its sales practices undermine investor autonomy.

5. Failing to Provide Proper Documentation

Transparency in documentation is a core requirement.

Before offering services, an RA must provide:

- A clear explanation of services

- Comprehensive risk disclosures

- Transparent fee details

- Written agreements outlining responsibilities

Failure to provide proper documentation weakens investor protection and may amount to non-compliance with regulatory norms.

What to Do If You Experience Issues With a Research Analyst?

If you feel that a Research Analyst has provided misleading information, failed to follow regulatory standards, or acted in a way that raises concerns, it is important to handle the situation carefully and systematically.

There are established investor protection channels available to address such matters.

Taking the right steps and raising your concern through appropriate platforms can help ensure that your complaint is reviewed and resolved in a structured manner.

- Lodge a Complaint in SEBI SCORES – You can file your complaint on this platform run by SEBI. Sign up with your email, choose the category ‘Research Analyst,’ and provide all the necessary information clearly.

- Make sure to include all the details of your transaction – Write down the analyst’s name, their SEBI registration number, and what service they provided. Also, mention the dates, amount paid, and the problem you faced, but be honest and not make things bigger than they are.

- Attach any proof that supports your claim – This could be payment receipts, chat messages, emails, or marketing materials. Having clear documents makes it easier for SEBI to look into your case.

- Check SEBI complaint status regularly – You can do this using the reference number you get from SCORES. If SEBI asks for more information or documents, respond quickly.

- If your complaint isn’t resolved, you can ask for it to be escalated within the SCORES system. SEBI will then review it again and take any necessary steps.

Need Help?

Register with us, we know that false promises and unrealistic hopes can trick investors who want their money to grow steadily.

Many platforms use exciting promises to make people feel confident, even when the real results in the market aren’t clear. These situations often leave people confused and worried about their money.

That’s why it’s so important to get clear and honest information at this time. We’re here to help you from the very beginning with clear and organized advice.

If you’re feeling lost, we’ll guide you step by step with easy-to-understand explanations and real-life actions. Our main goal is to help you learn, understand, and make smart choices.

This way, investors can move ahead with more confidence and control over their money.

Conclusion

Param Nivesh is a SEBI-registered Research Analyst platform, which means it operates under the regulatory framework set for research professionals in India.

Registration with SEBI reflects that the entity is authorized to provide research-based insights and must follow certain compliance standards.

However, registration alone does not define the complete experience of investors. It is important to understand how the platform actually communicates, delivers services, and handles client interactions in real situations.

Before choosing any research or advisory service, investors should verify the registration details, review the scope of services carefully, and clearly understand the fee structure and terms.

Maintaining proper records of payments, agreements, and communications can also help in case any clarification or issue arises later.

Ultimately, informed decision-making and careful evaluation of available information allow investors to better protect their interests and make choices aligned with their financial goals.