Hyderabad is a city of ambitions and tech dreams. But Ponzi scams have quietly shattered countless lives, luring people with promises too good to be true.

A Ponzi scam in Hyderabad isn’t just about headlines; it’s about families losing all their life savings overnight.

Have you ever wondered if that investment tip from a friend could be your downfall?

These schemes prey on the hopes of people, using new investors’ money to pay old ones, until the whole house of cards collapses.

Let’s dive into real stories that will make you think twice before clicking “invest.”

Ponzi Scam in Hyderabad: Real Cases

A Ponzi scam is a fraudulent investment scheme where returns to earlier investors come from fresh money invested by newcomers.

Understanding how a Ponzi scam works can help you recognise the warning signs early and avoid falling into the trap.

Initially, you may receive some profits, but these are not real. This is just an illusion of success to gain trust. As soon as people stop investing, it implodes, leaving people shattered.

In Hyderabad, these traps have exploded in recent years, hitting people hard amid the city’s booming economy.

According to the reports, 6,316 people were duped by scamsters posing as investment agents in Hyderabad. Their victims collectively lost a staggering Rs 611 crore

What starts as a small deposit often spirals into massive losses, leaving victims desperate.

Let’s uncover some real cases that have left the country in a shocking state:

1. Rs 5 Crore Vanishes: Brothers’ AI Stock Mirage!

B Gowri Shankar, a 45-year-old from Hyderabad, heard about an unbeatable AI tool predicting stock market wins at conferences in Hyderabad, Vijayawada, and Visakhapatnam.

The scammers acted as directors of IIT Capital Technologies and AV Solutions and promised 7% monthly returns with zero risk.

Trusting their words, Shankar poured in Rs 20 lakh between May 2023 and July 2025, watching fake trading reports show profits.

But reality hit hard when he demanded his money back. The scammers shut down websites, deleted chats, and even threatened him while splurging on properties and gold.

The Economic Offences Wing of Cyberabad Police registered a case after investors lost over Rs 5 crore across states.

The lesson here?

If it sounds too good to be true, it probably is; always verify SEBI registration before investing and never ignore red flags like pressure to stay silent.

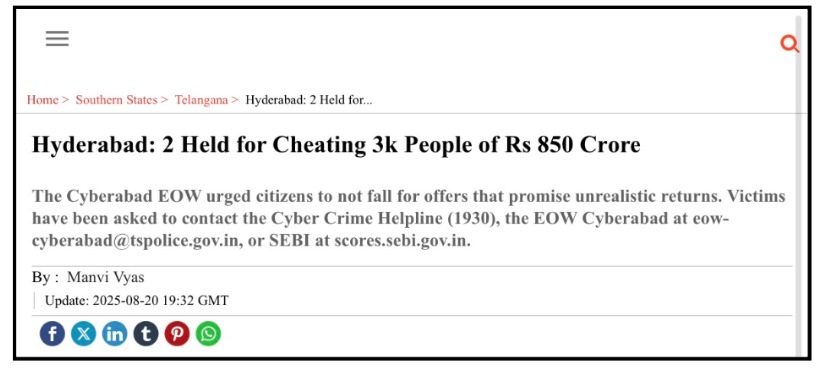

2. Rs 850 Crore Heist: 3,000 Lives Ruined Overnight!

In a shocking bust, Hyderabad police arrested two men from Capital Protection Force Private Limited for running Falcon Invoice Discounting.

It was a Ponzi scheme that duped over 3,000 people nationwide of Rs 850 crore.

They promised 11-22% returns on short-term deposits from 45 to 180 days. All of this was done through flashy ad promotions and they had been collecting funds since 2021.

Victims, including many from Hyderabad, saw initial payouts that were only given to build trust, but new investors’ money soon dried up, leaving everyone bankrupt.

What happened next was chaos, with families losing homes and dreams.

The key takeaway: High returns always come with high risks. Report suspicious schemes immediately to stop the fraudsters from doing any further damage.

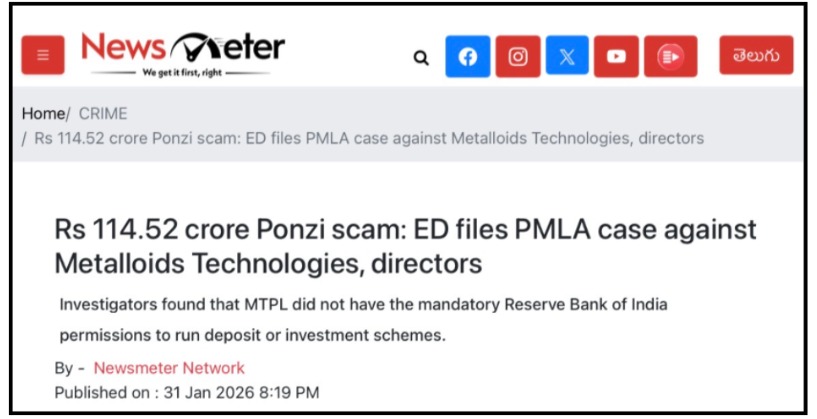

3. Rs 114 Crore Tech Fraud: Directors in the Dock!

In a recent report, the Enforcement Directorate filed a PMLA case against Metalloids Technologies directors for a massive Rs 114.52 crore Ponzi scam centred in Hyderabad.

They lured investors with promises of astronomical returns on tech investments.

When the scheme unravelled, hundreds were left penniless, sparking outrage and legal action.

This case highlights how even “tech-savvy” firms can be fronts for fraud.

Ever ask yourself why these scams keep succeeding?

This is because greed blinds us, but checking company credentials on MCA portals can save you.

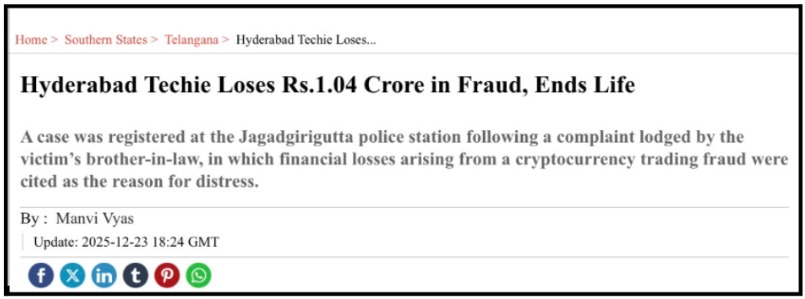

4. Rs 1.04 Crore Loss: A Techie’s Tragic End!

A Hyderabad techie invested Rs 1.04 crore in a fraudulent scheme, chasing the high returns shown on a fake platform.

When the victim tried to withdraw his money, he was asked to pay taxes and fees. So he borrowed the money only to discover new excuses every time.

Overwhelmed by debt and betrayal, he tragically ended his life, leaving his family devastated.

Police are investigating, but the damage is irreversible.

This tragedy screams a vital message: Your mental health matters more than any investment. So, seek help early and never invest what you can’t afford to lose.

How To Report A Ponzi Scam?

Reporting a Ponzi scam empowers you to fight back and protect others.

Here’s how in simple steps:

- Collect Evidence: Evidence is your shield against fraud. Collect all the necessary data, like payment receipts, promises made, chats, etc.

- File a complaint in Cyber Crime: Report at the National Cyber Crime Portal. Provide transaction proofs like bank statements.

- File an FIR: Go to your nearest police station and file an FIR there. Also, submit all the evidence so that the case becomes stronger.

- File a SEBI complaint: Register at the official portal with investment docs and accused info. SEBI investigates unregistered schemes

Need Help?

Fallen victim to a Ponzi scam in Hyderabad or elsewhere?

Don’t struggle alone; register your complaint with us today.

We’ll guide you in organising evidence, collecting solid proofs like transaction records and chats, and filing at the right platforms swiftly.

Reach out now, and let’s reclaim what’s yours together.

Conclusion

In Hyderabad, Ponzi scams have stolen not just money but trust and futures.

Ponzi scams thrive on silence and greed, but awareness is your shield in a city where dreams run high.

Learning how to identify a Ponzi scam can help you protect your hard-earned money.

Remember: Awareness is your strongest weapon.

Next time a “sure-win” investment pops up, pause and verify with SEBI or the police.

Real wealth builds slowly, not overnight. Stay safe, stay smart.