The PTM-QIB investment scheme has emerged as one of India’s most sophisticated financial frauds, with confirmed losses exceeding ₹4.74 crore in Goa

This elaborate operation impersonates Paytm Money while exploiting the Qualified Institutional Buyers (QIB) quota system to deceive investors through WhatsApp groups and fraudulent applications.

What looks like a harmless WhatsApp invite can quickly spiral into a five-stage financial trap and the PTM-QIB scam proves just how terrifyingly easy that journey can be.

PTM-QIB Investment Scam Details

Before getting into the details, let’s understand QIB, i.e. Qualified Institutional Buyer.

As per SEBI, Qualified Institutional Buyers are entities like mutual funds, pension funds, insurance companies, banks, and other financial institutions that meet specific eligibility requirements, including financial stability and experience in managing large investments.

However, in this case, the fraudsters deliberately misuse “Qualified Institutional Buyers” terminology to create an illusion of exclusivity and insider access.

So YES, PTM-QIB is a confirmed fraudulent operation with documented arrests and police cases.

Goa Cyber Crime Police arrested Avishkar Devidas Suradkar from Jalna, Maharashtra, in connection with a ₹4.74 crore fraud case registered under Crime No. 35/2025.

The investigation revealed that this scam operates across eight Indian states with a cumulative fraud totalling ₹13.10 crore.

Official Evidence:

- FIR Details: Registered under Sections 318(4), 319(2) read with 3(5) of BNS 2023 and Section 66-D of IT Act

- Primary Accused: Avishkar Devidas Suradkar received ₹80 lakh in his account and routed funds to multiple associate accounts

- Co-conspirator: Malathi B.N. from Bangalore received ₹30 lakh and transferred it through layered accounts

- Interstate Network: The same account has been linked to eight other cyber fraud cases across Maharashtra, Karnataka, Andhra Pradesh, Kerala, Gujarat, and Goa

Paytm Money itself has identified at least seven fake investment apps impersonating their platform, three on Apple App Store (PMIMS, PMLPRO, PML Pro) and two on Google Play (PML Pro, PM-S PMIMS) have been removed, while two remain active.

Modus Operandi of PTM-QIB Scam

The PTM-QIB scam operates through a calculated five-stage manipulation process:

Stage 1: Unsolicited WhatsApp Contact

On November 3, many individuals received suspicious SMS messages with WhatsApp group links from the handle “SMCSTL,” inviting recipients to join groups purportedly run by Paytm Money.

The accused posed as representatives of “PTM-QIB,” a fake entity mimicking Paytm Money, and lured victims via WhatsApp and YouTube channels.

Stage 2: Building False Trust

Once users joined the group, they were met with a flood of messages and fake testimonials showcasing “abnormal profits,” with screenshots creating an illusion of authenticity.

The admin claims they’re writing a trading book, sharing stock tips with charts, and using simple indicators like Bollinger Bands to seem legitimate.

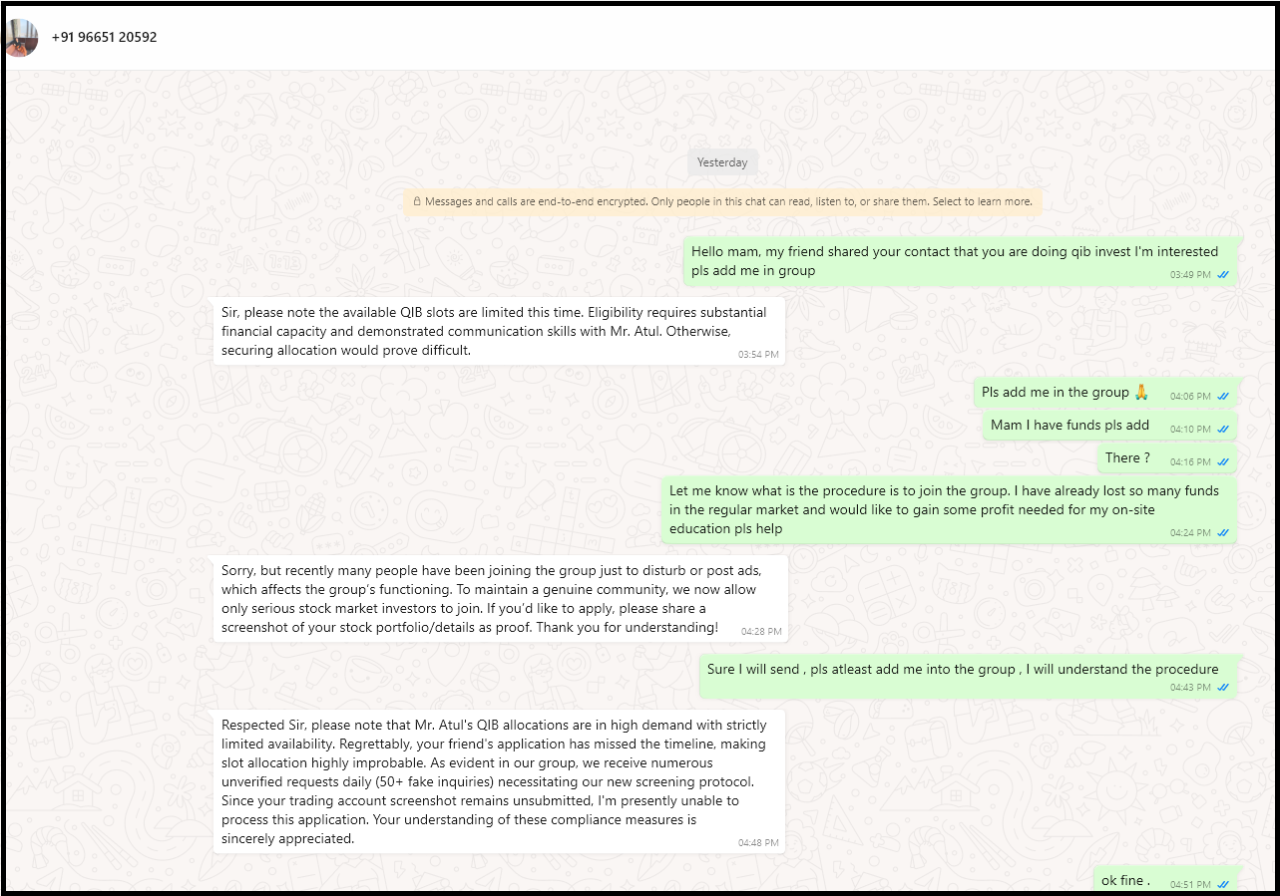

Stage 3: Private Manipulation

Scammers posing as Paytm Money representatives reached out to participants from the WhatsApp group in one-on-one chats, offering exclusive investment deals with polished pitches, professional tones, and irresistible promises.

Stage 4: Fake App Downloads

Customer representatives insist victims download fake impersonated apps, and even when these apps were removed from app stores, scammers redirected victims to counterfeit websites designed to look like official app stores.

These fraudulent applications display inflated profit dashboards and fake IPO allotments worth crores.

Stage 5: The QIB Trap

The accused induced the complainant to invest in the IPO by impersonating as a qualified institutional buyer (QIB) linked to an online payment app, where a large number of shares were reportedly allotted.

Fraudsters showed fake profits on sham dashboards, claimed that shares were allotted via a Qualified Institutional Placement (QIP) quota, and even pressured victims with fake ‘loans’ and threats to freeze their funds.

PTM-QIB Scam Complaints

Reports surrounding the PTM-QIB scam have been steadily increasing, with users claiming they were lured through fake investment promises, quick-profit schemes, and fraudulent “QIB” (Qualified Institutional Buyer) tags misused to appear credible.

Many victims say the scammers used professional-looking websites, WhatsApp groups, and paid ads to appear legitimate before disappearing with investors’ money.

Below are some of the key complaints that highlight how the scam operates.

Case 1: Panaji Senior Citizen- ₹4.74 Crore Loss

A senior citizen from Panaji was cheated of ₹4.74 crore through a fake IPO scheme impersonating Paytm Money, with the victim believing substantial IPO shares had been allotted and transferring the entire amount.

This represents Goa’s largest recorded cybercrime fraud to date.

Case 2: Hyderabad Professional – ₹43 Lakh Loss

A 63-year-old Hyderabad resident received a WhatsApp message posing as a Bank employee, offering exclusive IPO allotments and trading deals, transferring money in four payments between July 12 and early August 2025.

Case 3: Hyderabad Software Engineer – ₹1.21 Crore Loss

A 52-year-old software engineer from Gachibowli was lured into a WhatsApp group sharing stock market tips.

He was made to participate in discussions on stock suggestions, chart patterns, QIB trading during pre-market hours, and IPO investments through what was falsely presented as an AEGIS-CAP trading account.

The victim lost ₹1.21 crore between August and September 2025.

How To Report Investment Scams?

If you’re a victim of PTM-QIB scam or any other similar types of investment scams:

Immediate Actions:

- File a Cyber Crime Complaint

- Gather all evidence: WhatsApp screenshots, bank receipts, app screenshots, group member details

- Contact your bank immediately to halt further transactions

- Report to Indian Cyber Crime Coordination Centre (I4C)

Need Help?

Facing a similar scam? Don’t stay silent or confused.

Register with us, and our team will help you understand the next steps, gather the right evidence, and guide you on how to report the fraud through the proper legal and cybercrime channels.

Whether you’re dealing with lost money, blocked withdrawals, fake investment platforms, or misleading ads, we’ll point you in the right direction so you can take action quickly and confidently.

Conclusion

The PTM-QIB investment scam represents a dangerous evolution in financial fraud, combining sophisticated social engineering through WhatsApp with technologically advanced fake trading platforms.

The confirmed arrest of Avishkar Devidas Suradkar and identification of co-conspirator Mrs. Malathi B.N, along with links to eight cybercrime cases totalling ₹13.10 crore, proves this is an organised cr iminal network operating across multiple states.

The fundamental protection remains clear: legitimate QIB investments are exclusively institutional and never marketed through social media to retail investors.

Any “exclusive QIB quota” offer targeting individuals is fraudulent by definition.

Always verify investment opportunities through official SEBI channels, never download unverified trading apps, and report suspicious activities immediately to protect yourself and others from becoming the next victim of this expanding threat.