A SEBI-registered investment adviser collected ₹11.39 crores in just 3.5 months but not a single employee had the required qualifications.

The registered proprietor rarely visited the office. Unregistered “franchise owners” ran the entire operation. When SEBI inspectors arrived, critical evidence mysteriously disappeared.

This isn’t a hypothetical warning story. This is Research Guru, and SEBI just imposed a ₹12 lakh penalty for systematic fraud.

Research Guru Review

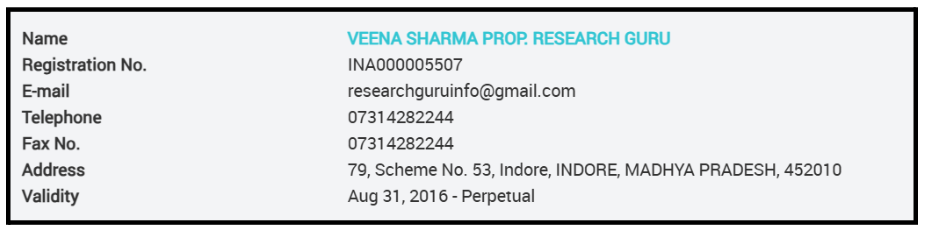

Research Guru is a SEBI-registered investment advisory firm with registration number INA000005507.

The registered proprietor is Mrs. Veena Sharma.

According to SEBI’s January 2026 adjudication order, Mrs. Veena Sharma’s firm was registered in her name; however, she had little to no involvement in its actual operations.

Is this what retail traders expect when they rely on the credibility of a SEBI-registered investment adviser?

Well, let’s get into the detail to uncover SEBI findings.

SEBI Order Against Research Guru

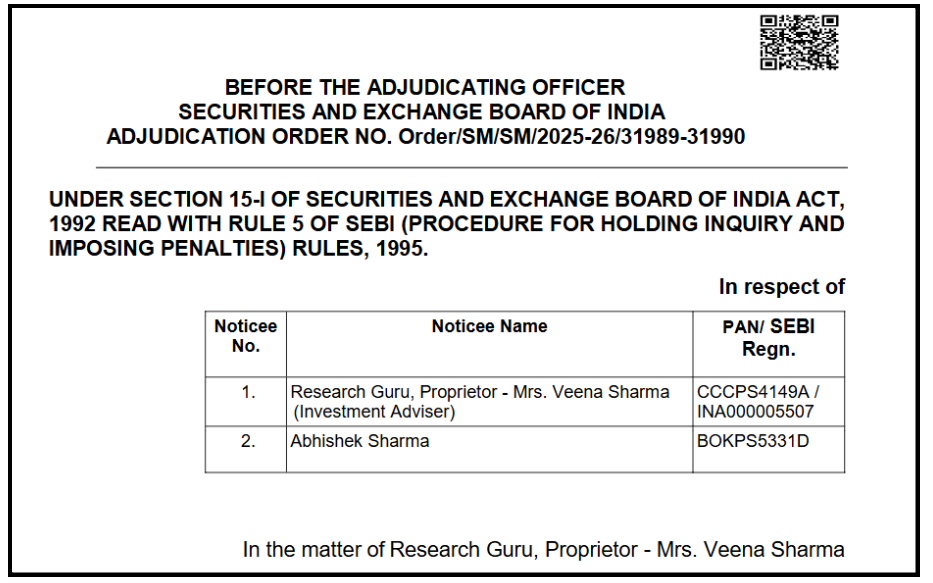

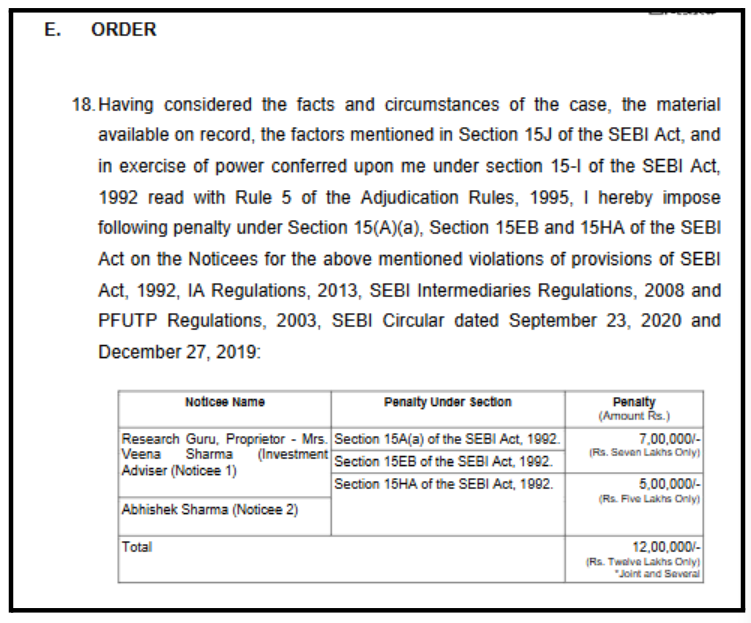

The Securities and Exchange Board of India (SEBI) has imposed a penalty of ₹12 lakhs on Research Guru (Proprietor: Mrs. Veena Sharma) and Mr. Abhishek Sharma for multiple violations of investment advisory regulations.

The case originated from a complaint and a surprise inspection that revealed widespread misconduct, including fraudulent practices, misrepresentation, and non-compliance with SEBI’s Investment Advisers (IA) Regulations.

Research Guru Identified Violations

SEBI’s inspection and subsequent adjudication revealed multiple serious violations:

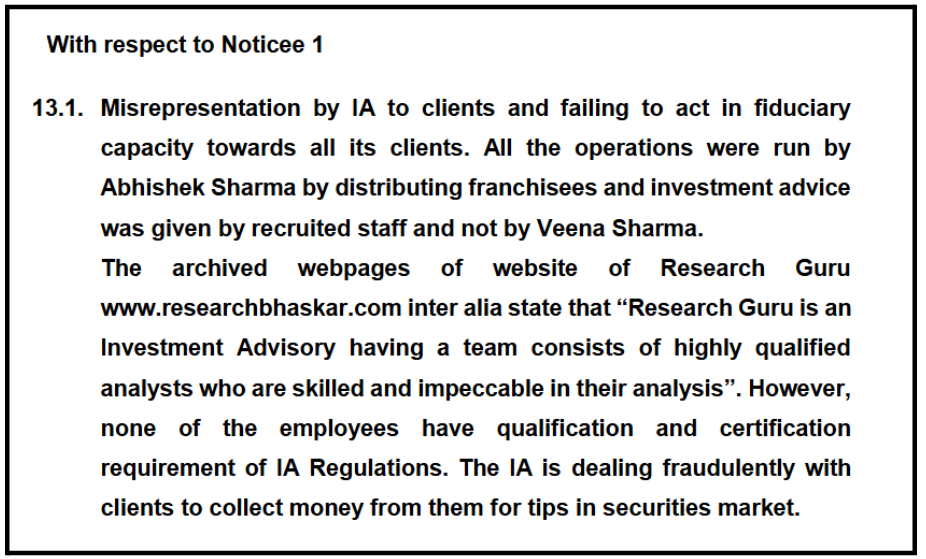

1. Misrepresentation to Clients

What the Website Claimed: The archived pages of Research Guru’s website boldly declared:

“Research Guru is an Investment Advisory firm that has a team consisting of highly qualified analysts who are skilled and impeccable in their analysis.”

The Harsh Reality:

- None of the 100 employees had NISM certification (mandatory for investment advisory)

- The “highly qualified analysts” were nothing more than sales staff making cold calls

Impact on Investors: Thousands of retail investors believed they were receiving advice from qualified professionals.

Instead, they were being guided by unqualified individuals whose only goal was to meet sales targets and collect fees.

2. The Shadow Controller: Abhishek Sharma

Regulation 2(1)(r) of IA Regulations defines this as: “Any member, partner, officer, director or employee…occupying a similar status or performing a similar function irrespective of the nature of association…who is engaged in providing investment advisory services.”

Mrs. Veena Sharma made shocking admissions during the inspection:

Her Own Statements:

- “The entire operations of Research Guru, including recruitment of employees, HR policies as well as all activities under SEBI (Investment Advisor) Regulations, 2013, are controlled by Mr. Abhishek Sharm.a”

- She “seldom attends the office.”

- She had “delegated all the tasks to be looked after by Mr. Abhishek Sharma.”

When obtaining SEBI registration, she had declared that all operations would be carried out by herself – a promise she never intended to keep.

This created a dangerous situation where:

- An unregistered person (Abhishek Sharma) controlled all investment advisory operations

- No qualified oversight existed for client portfolios

- SEBI’s regulatory framework was completely circumvented

3. Non-Compliance with IA Regulations

- No Risk Profiling or Suitability Assessment: No KYC, risk profiling, or suitability checks were conducted for clients.

- Failure to Maintain Records: No client records, call recordings, invoices, or advisory documents were maintained.

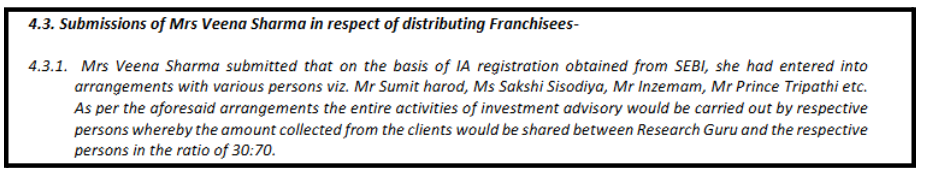

- The IA operated through unauthorized franchise arrangements with third parties (e.g., Sumit Harod, Sakshi Sisodiya, etc.), sharing revenue 70:30, without disclosing this to clients.

Investors were deprived of basic regulatory protections, exposing them to unsuitable advice and financial harm without recourse.

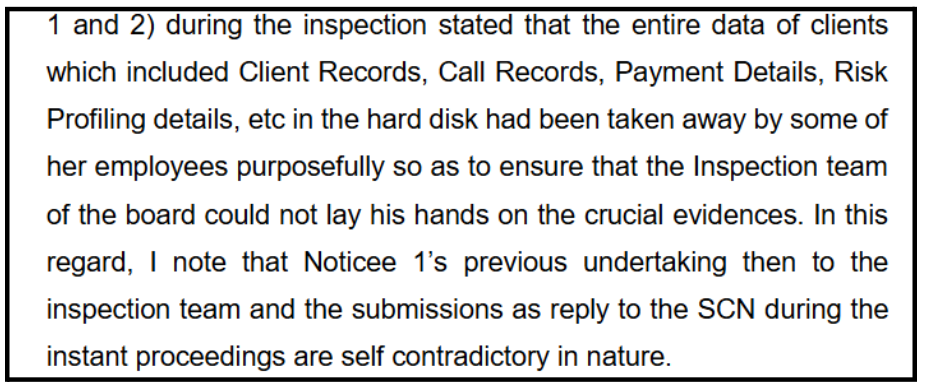

4. Obstruction of Inspection

- Data Destruction: During SEBI’s surprise inspection, hard disks containing client data were removed to prevent scrutiny.

- False Information to EPFO: PF contributions were filed for only 13 employees despite having over 100 staff.

Investors’ chances of recovering funds or proving misconduct were sabotaged by the deliberate destruction of evidence and false reporting.

5. Violation of SEBI Circulars

- Circular dated Dec 27, 2019: Fees were accepted in cash and unauthorized accounts, not through formal banking channels.

- Circular dated Sep 23, 2020: Failed to maintain and preserve client communication records for 5 years.

Investors’ payments were diverted into untraceable channels and their advisory history erased, leaving them financially vulnerable and without proof of service.

Impact of the Violations On Investors

- Financial Loss & Misled Trust: Clients paid for “expert advice” from unqualified individuals, risking poor investment decisions and losses.

- No Risk Assessment: Investors were not evaluated for risk tolerance, potentially leading to unsuitable high-risk recommendations.

- Lack of Transparency: Clients were unaware their funds were being managed by unregistered franchisees, violating their right to informed consent.

Penalty Against Research Guru

The Adjudicating Officer imposed the penalty of ₹12 Lakh under the SEBI Act, 1992:

Research Guru User Complaints

Apart from just the order. Let’s get on the ground and check real user complaints.

The user reviews paint a disturbing picture that aligns perfectly with SEBI’s findings.

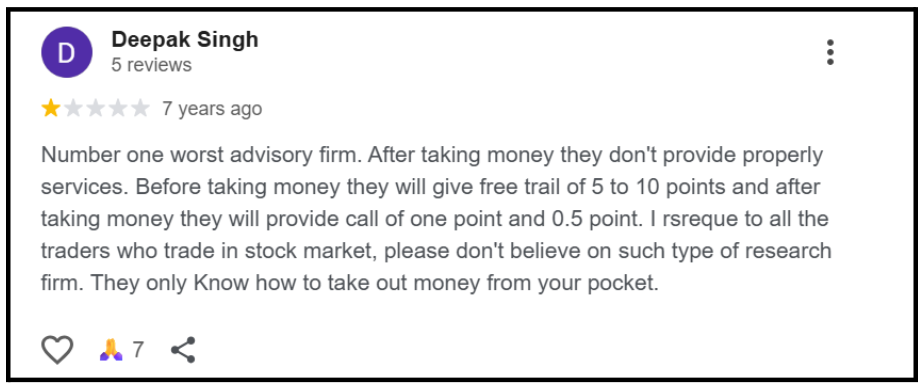

- False Promises and Service Quality Deterioration

Research Guru lured clients with impressive “free trial” results, then provided worthless advice once fees were paid.

This is the classic bait-and-switch scam. During the “free trial,” clients received 5-10 profitable stock tips.

Once they paid registration fees, the quality plummeted to barely usable “0.5 point” recommendations.

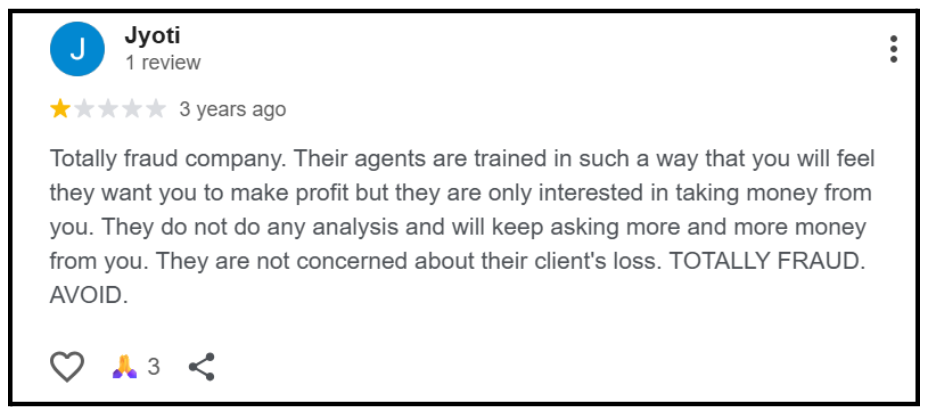

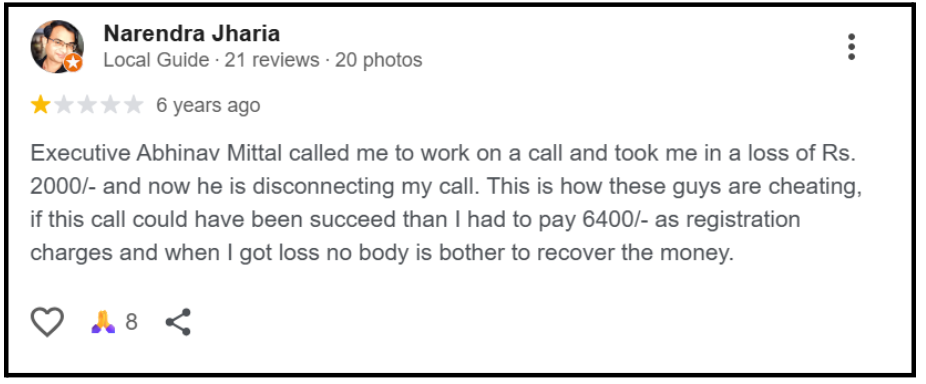

- No Accountability or Support for Client Losses

When clients lost money, Research Guru staff disappeared and stopped taking calls, leaving investors with no recourse.

The “executive” (likely one of the unqualified sales staff) convinced the client to take a trade, promising that successful results would lead to paid registration.

When the trade resulted in ₹2,000 loss, all communication stopped. The client was expected to pay ₹6,400 if the trade succeeded, but got abandoned when it failed, showing Research Guru had zero fiduciary responsibility toward clients.

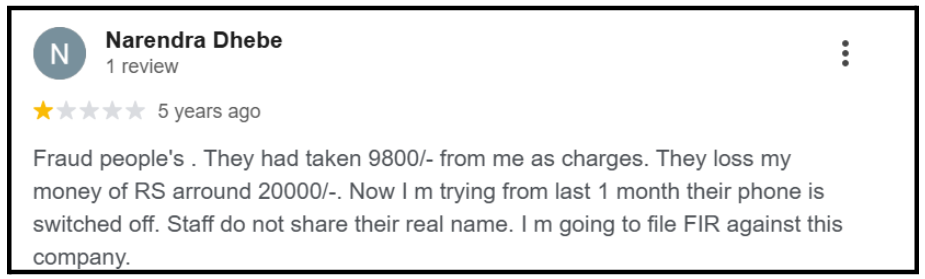

- Money Collection Fraud and Disappearance

Research Guru collected large fees upfront, caused client losses, then became completely unreachable with staff hiding their identities.

This matches SEBI’s findings that fees were collected in multiple third-party accounts, employees weren’t given formal appointment letters, and the operation was designed to avoid accountability.

Lessons for Investors: Red Flags to Watch

This case provides a masterclass in identifying fraudulent investment advisers.

Watch for these warning signs:

1. Registration Display vs. Reality

- SEBI registration number prominently displayed on website

- Operations handled entirely by “managers” or “senior staff”

2. High-Pressure Sales Environment

- Multiple “relationship managers” calling repeatedly

- Pressure to invest quickly

3. No Proper Documentation Process

- No detailed KYC process

- No risk profiling questionnaire

4. Payment Red Flags

- Asked to pay in cash

- Directed to deposit in personal accounts

5. Communication Through Personal Channels

- Advisers use personal WhatsApp numbers

- Personal email IDs (Gmail, Yahoo, etc.)

- Personal mobile numbers

6. Qualification Claims Without Proof

- Website claims “highly qualified” staff

- No NISM certification mentioned

How to File Complaint Against SEBI Registered Investment Advisor?

If you were a client of Research Guru, Mrs. Veena Sharma, or lost money to similar fraudulent investment advisory schemes, you are not alone.

SEBI’s order confirms what you experienced was systematic fraud.

Our dedicated team specializes in helping investors like you get justice.

1. Initial Consultation & Case Assessment

We arrange a confidential discussion with a dedicated Case Manager who will:

- Listen carefully to your full experience with Research Guru

- Review your transaction records and communication history

- Assess the strength of your case

- Explain your legal options clearly

No judgment. Just solutions.

2. Professional Case Documentation & Drafting

We help you prepare a structured, persuasive, and legally sound complaint that outlines.

Specific SEBI violations including:

- Operating through unregistered persons

- No risk profiling or suitability assessment

- Fraudulent misrepresentation

3. Direct Engagement & Escalation

Step 1 – Formal Communication: We guide you in formally notifying Research Guru/Mrs. Veena Sharma (required before SEBI escalation)

Step 2 – SEBI SCORES Filing: We assist you in:

- Filing complaints with SEBI on the SEBI SCORES portal.

- Tracking SEBI complaint status in real-time.

- Responding to SEBI queries professionally.

Step 3 – SEBI Smart ODR: If eligible, we guide you through the Online Dispute Resolution platform for faster resolution

We handle the bureaucracy. You focus on recovery.

4. Advisory & Strategic Counselling

Our experts provide:

- Realistic assessment of recovery prospects

- Timeline expectations based on similar fraud cases

- Alternative remedies including consumer forums and police complaints

- Legal precedent analysis using SEBI’s Research Guru order

Transparency from day one.

5. Arbitration & Legal Representation

If initial SEBI actions are unsatisfactory, we help you:

- File arbitration in stock market disputes

- Represent your case professionally

- Pursue all available remedies until resolution

We don’t stop until you get justice.

Register with us today.

Let our experienced team guide you toward fair resolution.

Your losses deserve accountability. Your voice deserves to be heard.

Conclusion

This SEBI order against Research Guru and Abhishek Sharma highlights the critical importance of regulatory compliance, transparency, and ethical conduct in the investment advisory space.

It serves as a strong warning to unregistered or fraudulent operators and reassures investors of SEBI’s commitment to protecting their interests and maintaining market integrity.

If you lost money to Research Guru, the SEBI order provides official validation of fraud. You may consider filing complaints with local police or consumer forums, citing this adjudication order as evidence.

Let this be a lesson in due diligence. SEBI registration is just the starting point, verify operations, qualifications, and compliance before trusting anyone with your money.

Investors: Stay vigilant. Advisers: Stay compliant.