If someone tells you exactly which stock to buy, when to enter, when to exit, and how accurate the trade will be, there’s one legal requirement they cannot escape: SEBI registration.

However, in the case of Ruchir Gupta, that registration does not exist.

What this blog uncovers will shock many.

Who is Ruchir Gupta?

Ruchir Gupta positions himself as a stock market educator with over 17 years of experience.

His Ruchir Gupta Training Academy attracts thousands of beginners.

At first glance, this sounds legitimate, right?

However, an investigation by Fortune India tells a different story. The magazine grouped him with unregistered finfluencers.

As a result, these individuals sell paid recommendations without proper SEBI licensing. The concern? Potential securities law violations.

His main products include:

- GCD BSE Scanner: Priced at ₹99,999 for market predictions

- GCD Calculator Course: Costs around ₹40,000 after negotiation

- Stock Market Training Programs: Various pricing tiers available

- Live Classes and Webinars: Where specific stocks are discussed

- Telegram Groups: Paid stock recommendations to subscribers

- YouTube Content: Free videos with course promotions

His Telegram channels distribute investment advice. These recommendations go to paying members. The advice includes specific stocks. It mentions entry and exit prices.

However, here’s the critical issue. All these activities fall under SEBI regulations. Specific rules govern who can give such advice.

Therefore, proper licensing is mandatory. Without it, these activities become illegal.

Is Ruchir Gupta SEBI Registered?

SEBI requires registration for anyone giving paid stock advice.

Two licenses matter here:

- Investment Adviser (IA) – For portfolio recommendations

- Research Analyst (RA) – For stock-specific future predictions

According to investigative findings, Ruchir Gupta has none of these licenses.

Yet he provides specific stock targets. He discusses accuracy percentages. He gives entry and exit dates. All these activities require RA licensing.

And that makes his work illegal.

Ruchir Gupta ₹40,000 GCD Calculator Course

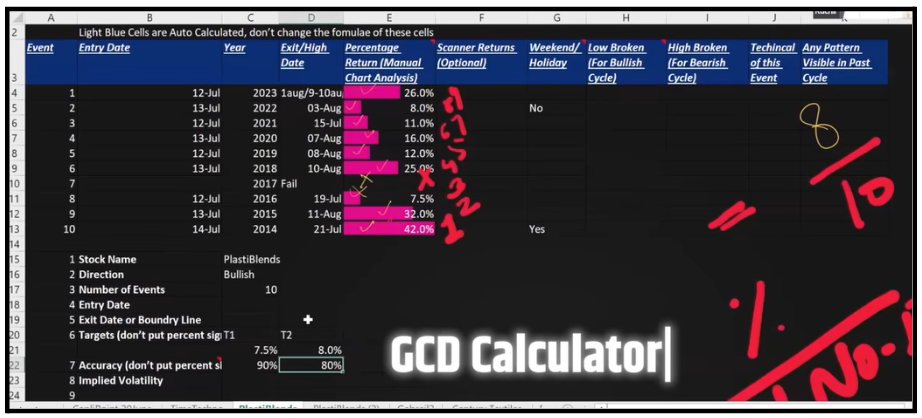

We purchased the course to verify violations. Here’s what we discovered.

Course Structure:

- Excel sheet download – Lists stocks with historical data

- Live classes – Specific stock recommendations given

- Targets provided – T1, T2, T3 for each stock

- Accuracy claims – 90%, 80%, 100% success rates mentioned

According to course recordings:

- Specific stocks were picked

- Entry dates were given.

- Exit dates were suggested.

- Future price targets were discussed.

Now, why does this matter?

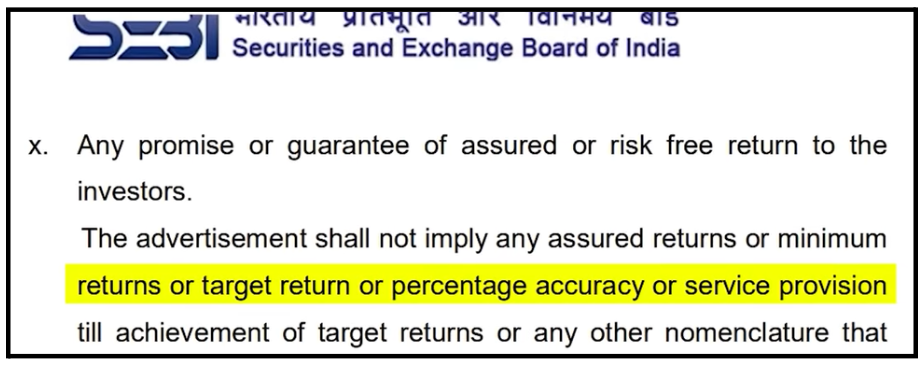

SEBI’s RA Master Circular – Section 8(C)(10) explicitly prohibits accuracy claims.

According to SEBI regulations, you cannot:

- Give stock-specific future predictions without an RA license

- Discuss accuracy percentages

- Provide entry/exit dates for stocks

Ruchir Gupta does all three. Without proper registration.

Ruchir Gupta Telegram Channel

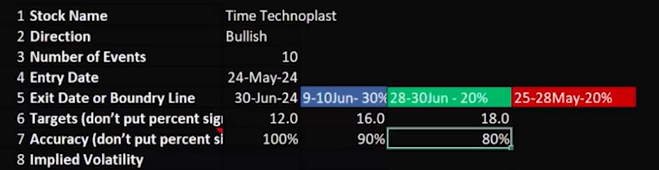

His Telegram groups contain paid recommendations. Subscribers pay for “premium” stock tips.

- Specific buy/sell calls are shared

- Target prices are discussed

All these activities require SEBI RA registration. Which remains unverified.

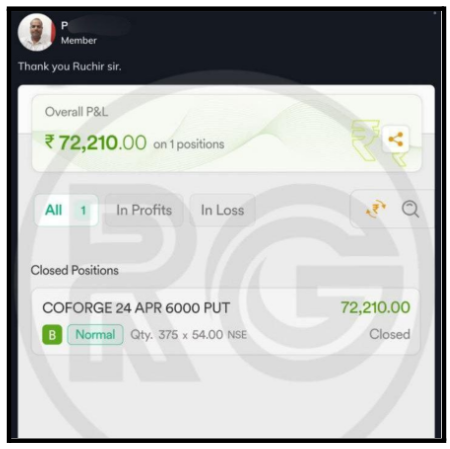

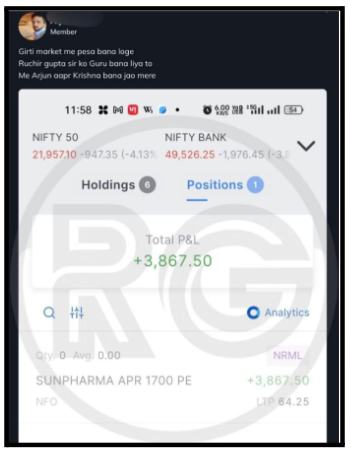

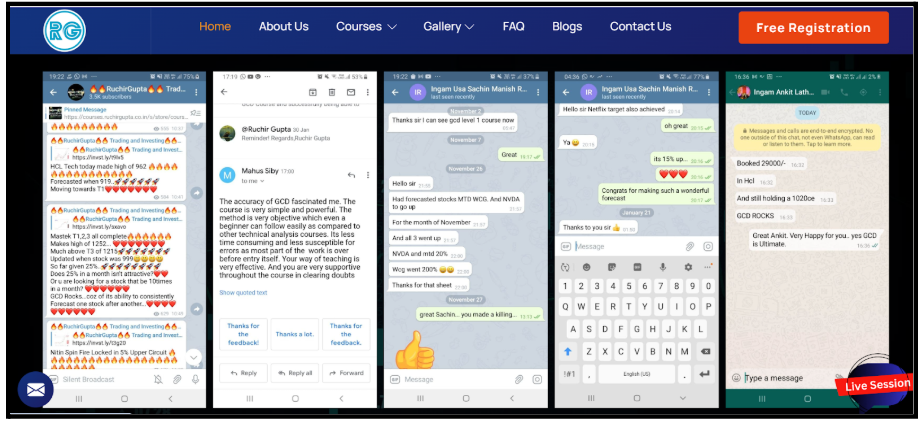

And not just this, even the past profitable performances of his students are cherry-picked to be openly shown on the channel.

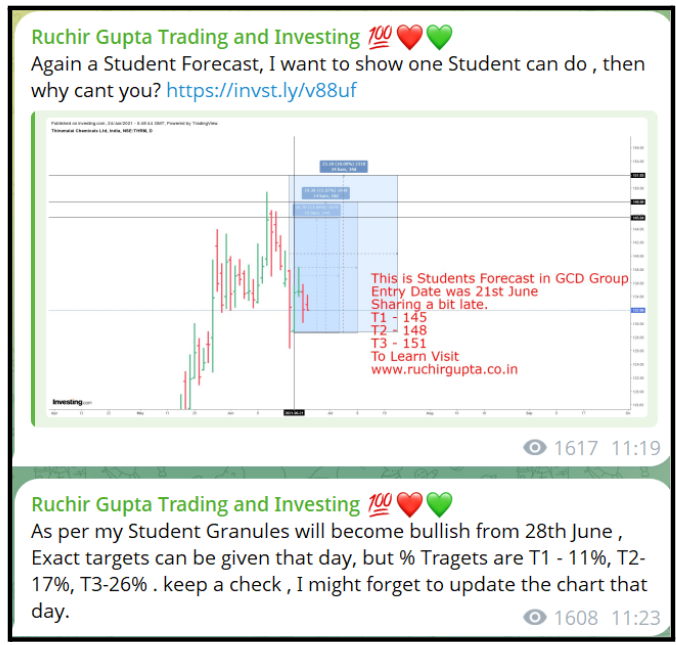

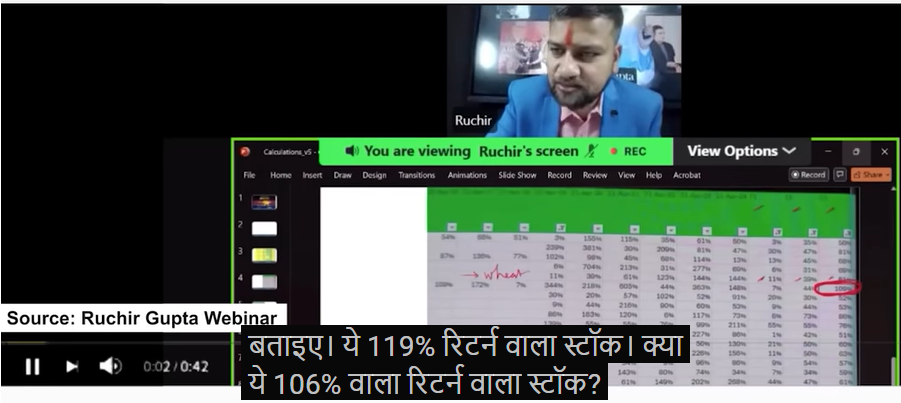

Ruchir Gupta Webinar Review

We enrolled in his webinar to investigate. The session lasted 2-3 hours. What happened inside reveals everything.

According to our investigation notes, participants were repeatedly asked:

“If you are a beginner, can you earn big money?”

Then came the promises:

- Target 1, Target 2, Target 3 would be provided

- “Thick-cream returns” guaranteed

- Quality family time after easy profits

Moreover, emotional claims were made. According to transcripts, Ruchir stated:

“God puts ideas into my mind, and I distribute them to you.”

In short, this is a classic inducement under SEBI’s PFUTP Regulations. Sounds manipulative, doesn’t it?

And as per SEBI’s Prohibition of Fraudulent and Unfair Trade Practices (PFUTP), it defines inducement as:

- Guaranteed accuracy claims

- Profit assurances

- Statements like “making money is very easy.”

According to regulatory guidelines, these claims are illegal. They mislead investors. They create false expectations. Selling courses isn’t wrong.

But selling them through false promises violates SEBI rules.

Ruchir Gupta’s YouTube

Moreover, his YouTube content shows concerning patterns. We analyzed multiple videos. The tactics repeat consistently.

- Misleading Thumbnails

Video titles promise things like “How to get 150% returns?” Another reads “Best way to make crores in the stock market.” Yet another claims, “This stock will double soon.”

These aren’t educational titles. They’re inducement-based marketing.

- The Shocking Video Claims

According to video evidence, he even advised viewers to take extreme steps:

“Sell your holdings. Liquidate your positions. Buy my course instead. Knowledge is above everything.”

In contrast, think about this advice. He’s telling investors to exit investments. To raise cash. So they can pay him ₹40,000 or ₹99,999.

Is this sound financial advice? Or is it sales pressure?

One video claimed 317% returns were possible. The claim wasn’t hypothetical. It was presented as achievable.

Another showed 119% return stocks as if they were easy to find. Then came the question that crosses every line:

“Who wants to be part of such a method?”

The answer is obvious. Everyone does. But the method doesn’t exist. Not with certainty. Not with guaranteed results. Making such claims violates SEBI law.

Ruchir Gupta SEBI Violations

According to compiled evidence, the following violations are apparent:

Violation 1: Inducement Under PFUTP Regulations

According to SEBI’s Prohibition of Fraudulent and Unfair Trade Practices, inducement includes making guaranteed return claims.

Ruchir Gupta’s videos claim 150% gains are possible. These statements qualify as inducement.

They’re made knowing they cannot be guaranteed. Yet they’re presented as likely outcomes.

Violation 2: Emotional Manipulation Tactics

Beyond simple inducement, there’s emotional manipulation.

Statements like “God puts ideas in my mind” exploit religious faith.

According to SEBI principles, such manipulation constitutes unfair trade practice.

Violation 3: Unregistered Investment Advisory

According to our investigation, specific stock recommendations are given to paying subscribers. The Telegram groups contain buy and sell calls.

SEBI requires Investment Adviser registration for paid recommendations. The registration is absent. Therefore, each paid recommendation violates IA regulations.

Anyone providing stock-specific future predictions needs an RA license. Ruchir Gupta’s courses give specific stock names. They provide entry and exit dates.

Therefore, every specific stock tip violates RA regulations.

Violation 4: Cherry-Picked Performance Reporting

According to investigation findings, only successful trades are highlighted. Losing positions are minimized or ignored. Past performance is selectively reported.

This selective disclosure violates SEBI’s transparency requirements. It creates a false impression of success.

Some are even shared openly on his official website.

Has SEBI Taken Action Yet?

At present, according to our research, no public SEBI penalty orders exist. Major outlets like Economic Times, Business Standard, and Times of India haven’t reported enforcement actions.

However, according to the investigation notes, evidence has been submitted to SEBI via email.

The regulatory body now has documented proof.

Will action follow?

That remains to be seen.

How to Report Against Ruchir Gupta?

Facing issues with unregistered financial advisers?

Lost money following paid stock tips?

You can report to:

- File complaints against unregistered advisers

- Track your complaint status online

2. File a Cyber Crime Complaint

- Report online financial fraud

- File complaints about misleading advertisements

Need Help?

Have you purchased Ruchir Gupta’s courses? Are you facing losses after following his recommendations?

Have your Ruchir Gupta complaints been ignored?

Register with us. We can guide you through:

- SEBI complaint filing process

- Consumer forum representation

- Evidence documentation

- Refund claim procedures

Don’t suffer in silence. Your money matters.

Conclusion

Ruchir Gupta presents himself as an award-winning educator. He operates without clear SEBI registration. According to our detailed investigation, his methods involve inducement.

Ruchir Gupta courses contain specific stock recommendations. His accuracy claims violate SEBI regulations.

No proven legal penalties exist yet. However, the evidence is substantial.

According to SEBI’s own rules:

- Inducement is prohibited

- Unregistered advice is illegal

- Accuracy claims are not allowed

Before paying ₹40,000 for Excel calculators, ask yourself: If someone truly had a “gold mine” stock method, would they sell it publicly for ₹40,000?

According to basic logic, probably not. Check SEBI’s registered adviser list first. Verify credentials independently. Your hard-earned money deserves that caution.

Remember: Teaching stock market concepts isn’t wrong. But emotional manipulation, guaranteed claims, and unregistered advice? That’s where the line gets crossed.