₹40,000 is a lot of money. Especially when you’re a beginner. You’re thinking about joining Ruchir Gupta’s stock market course.

But wait. Have you checked if he’s even allowed to teach what he’s teaching?

Therefore, we did a complete investigation. We bought his course and tracked his recommendations. Here’s everything you need to know before spending your hard-earned money.

Ruchir Gupta Course Review

Ruchir Gupta runs a stock market training academy. His name is quite popular on YouTube. Videos show him as an experienced trader. He claims 17+ years in the market.

His social media has pictures with ministers. He shows off multiple certificates. At first glance, everything looks quite professional.

His business includes several products. He also runs paid Telegram channels. Students get “stock tips” in these groups.

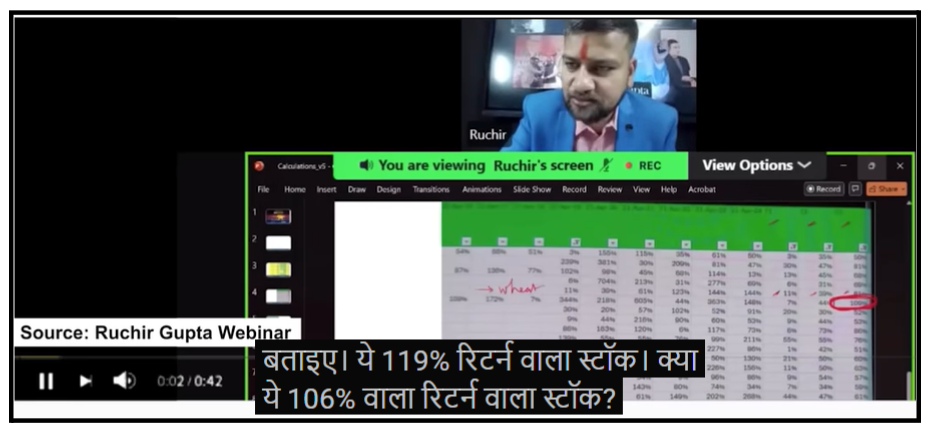

And before selling courses, webinars happen. These run for 2-3 hours.

The webinar starts with questions. “Can beginners make big money?” “Do you want 100% returns?” People type “yes” enthusiastically. Social proof builds.

Then come the examples. Screenshots show stocks that gave 317% returns. Another gave 119%. One more showed 106% gains. All carefully selected past winners.

Emotional claims appear too. According to transcripts, statements like “God gives me market knowledge” are made.

By the webinar’s end, people are convinced. They believe the stock market is easy. They trust the instructor completely. They’re ready to pay ₹40,000. The psychology worked perfectly.

His webinars attract many beginners. People trust him because of his awards. They believe his experience. But should they?

Now, let’s see what ₹40,000 buys you. We joined to find out.

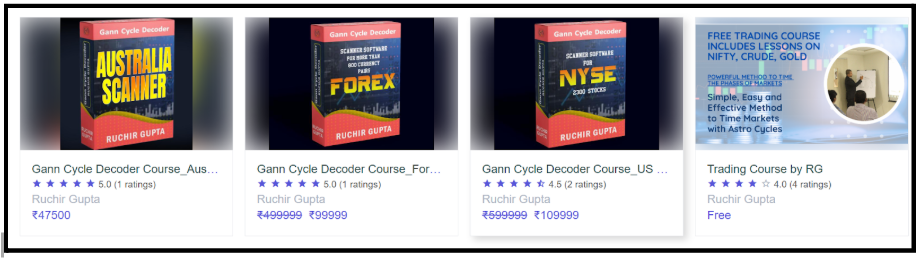

What Courses Does Ruchir Gupta Offer?

According to course listings, Ruchir Gupta sells multiple products at different price points:

| The Premium Scanner Products | The Training Programs |

| GCD BSE Scanner | Investment Time Cycle Method with ITCM Scanner |

| Gann Cycle Decoder for Indian Stocks | Investment Time Cycle Method |

| Gann Cycle Decoder for US Stocks (NYSE) | Trading Course by RG – Free |

| Gann Cycle Decoder for Forex | Hindi Webinar on Stock Market Timing |

What Actually Happens Inside These Courses?

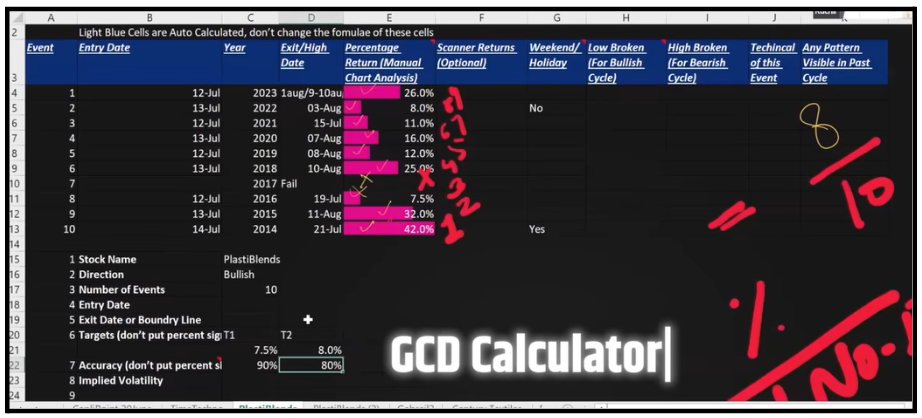

1. The GCD Calculator: Just an Excel File?

The main product is called GCD Calculator. It’s an Excel spreadsheet. Students download this file after payment.

So, what does this Excel do?

It lists many stocks. It shows their past prices. You can see returns from previous months. Historical data for 1 year, 2 years, and 3 years. That’s basically it.

According to our analysis, anyone can create this. Yahoo Finance gives historical prices for free. Google Finance does too. A basic Excel user can compile data.

There’s no complex algorithm. No artificial intelligence. Just old price data in rows and columns.

But here’s where problems start. The course teaches a method.

Students are told to pick stocks from this data. Create positions based on patterns. Set entry points. Wait for targets.

The entire strategy relies on one assumption: history repeats.

In reality, does it?

Not reliably. Markets change. Past performance never guarantees future results. Yet the course ignores it completely.

2. Live Classes: Where Real Problems Begin

The course includes live Zoom sessions. This is where Ruchir Gupta discusses markets. On the surface, this sounds educational, right? But watch what actually happens.

Students are told when to buy. They’re told when to sell. Stop loss levels get discussed.

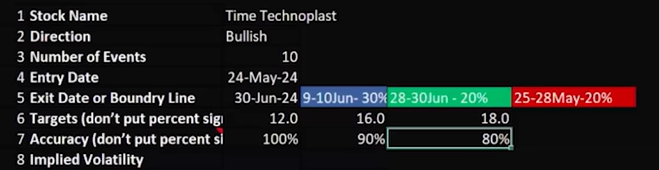

Three targets appear: T1 at 12%, T2 at 18%, T3 at 25%.

Complete trade setups are provided.

Classes also make bold claims. According to recordings, statements include:

“Our method has 90% accuracy.”

“Last quarter, we achieved 100% success.”

“This stock will definitely give 50% returns.”

At this point, a simple but critical question comes up: is Ruchir Gupta SEBI Registered?

The answer matters because he does not hold a SEBI license. Giving specific stock advice without registration is illegal, and making guaranteed accuracy or return claims is also prohibited under SEBI regulations.

This means that every such class session potentially violates multiple regulatory rules, something investors should not ignore.

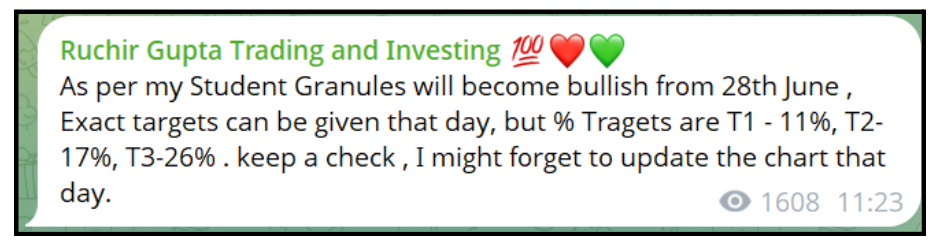

3. The Telegram Groups: Tip Sheets in Disguise

Paid members get Telegram group access. These groups contain regular recommendations. We verified this claim.

The format is standard.

A message appears:

“Stock: XYZ Ltd (NSE: XYZ).” “Entry: ₹240-245.” “Stop Loss: ₹230.”

“Targets: T1-₹265, T2-₹280, T3-₹310.” “Expected time: 2-3 months.”

This is exactly what tip sheets do. These are direct trading calls. Members are expected to execute these. Many beginners follow blindly.

But providing such calls needs a Research Analyst license. Without it, each message violates securities regulations.

Should You Join Ruchir Gupta’s Course?

To be clear, educating people about the stock market is not illegal when done ethically and responsibly.

Anyone genuinely interested in learning the share market should choose a course based on the mentor’s knowledge and credibility, not through inducements or misleading promises.

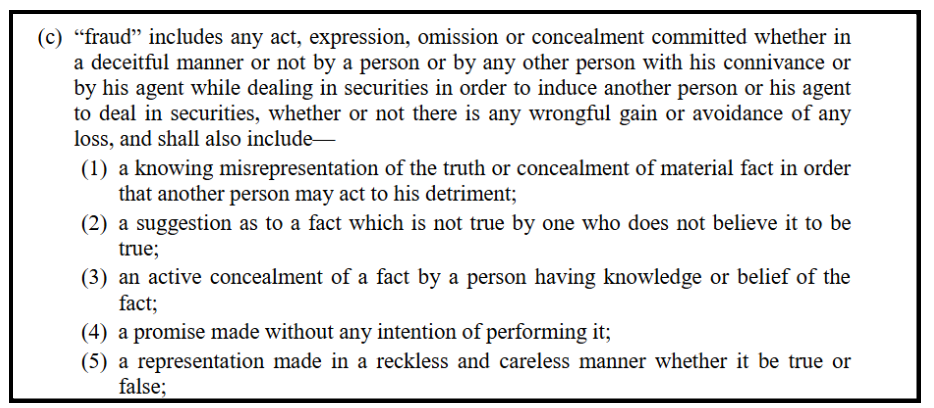

Unfortunately, this does not appear to be the case with Ruchir Gupta’s courses, where participants are reportedly lured through live sessions and exaggerated or fake profit claims.

What is even more concerning is that trading tips are allegedly being shared without the necessary legal authorization or a valid SEBI registration.

Here are some of the major reasons why you should not enroll in Ruchir Gupta’s course:

- Operating Without Investment Adviser License

SEBI’s Investment Advisers Regulations 2013 are clear. Anyone giving investment advice for money needs registration. “Investment advice” means recommendations on securities.

What does Ruchir Gupta do?

He recommends specific stocks and suggests buying or selling. He guides portfolio decisions. All for ₹40,000 fees. This fits the definition perfectly.

- Research Analyst Activities Without a License

Providing research reports requires RA registration.

What qualifies as research?

Stock-specific predictions. Price targets. Entry-exit recommendations.

Look at what his courses provide. Specific stock names with codes. Future price targets. Entry and exit dates. Expected timeframes.

The RA license is missing. Therefore, every stock analysis violates RA regulations.

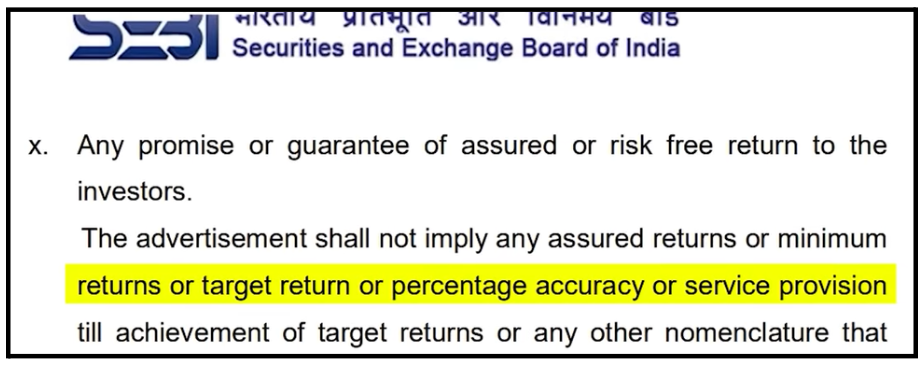

- Accuracy Claims Prohibited by Section 8(C)(10)

SEBI’s Research Analyst Master Circular has Section 8(C)(10). This section explicitly bans accuracy claims.

You cannot say “my calls have 90% success.” You cannot claim specific hit rates.

Why this rule? Because accuracy claims mislead investors. They create false confidence.

- Inducement Under PFUTP Regulations

SEBI’s Prohibition of Fraudulent and Unfair Trade Practices (PFUTP) prohibits inducement.

What’s inducement?

Promising guaranteed returns. Claiming sure-shot profits. Saying wealth creation is easy.

- Misleading Advertisements

SEBI’s Advertisement Code applies to all market participants. Ads must be fair. They cannot mislead. Claims must be substantiated. Risk disclosure is mandatory.

Look at his YouTube thumbnails. “How to get 150% returns?” “Best way to make crores.” “This stock will double.” These are clear promises. Where’s the data backing them? Where’s the risk warning?

- Real Performance Doesn’t Match Claims

We tracked recommendations for months. According to our records, most stocks underperformed. Some showed tiny gains. Many went nowhere. A few caused losses.

One stock was recommended at ₹240.75. Target was ₹280+. Reality? It fell to ₹231. Where’s the 90% accuracy?

If real results contradict marketing, that’s a major red flag. The product delivered differs from the product sold.

Ruchir Gupta Complaints

Issues categorised based on recurring problems reported by users.

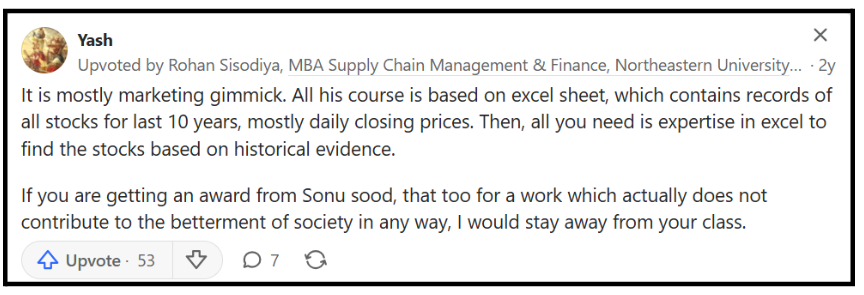

1. Excel-Based Strategy Disguised as a Premium System

Users report that the course relies heavily on basic Excel sheets using historical price data, despite being marketed as an advanced proprietary system.

Yash stated that the entire course is based on Excel records of past stock prices and that basic Excel expertise is enough to replicate the method.

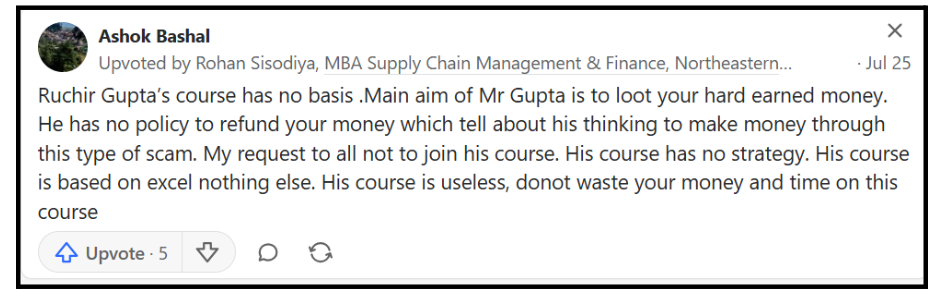

2. No Clear Strategy or Practical Trading Edge

Multiple users claim the course lacks a clear, actionable trading strategy and does not provide a real edge in live market conditions.

Ashok Bashal reported that the course has no real strategy and is limited to Excel-based analysis without practical usefulness.

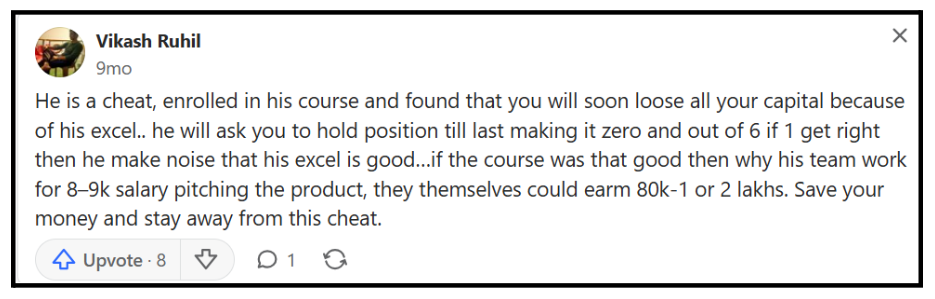

3. Capital Losses Due to Rigid Holding Approach

Users allege that they were encouraged to hold losing positions for too long, leading to significant capital erosion.

The user Vikash Ruhil shared that after enrolling, he experienced losses as positions were held until they nearly reached zero based on Excel signals.

4. No Refund Policy & Sales-Driven Model

Reviewers mention the absence of a refund policy, raising concerns about customer protection and post-sale accountability.

The user Ashok Bashal highlighted that there is no refund mechanism, which he believes reflects a money-focused sales approach.

How to File A Complaint Against Ruchir Gupta?

Lost money? Feeling cheated?

You have options. Multiple authorities can help.

File your complaint with complete details. Mention the course name. State the amount paid.

Describe promises made versus reality. Attach supporting documents: payment receipts, course materials, Telegram screenshots, and loss statements.

Since everything happens online, cybercrime laws apply. File a complaint. Describe online fraud or misrepresentation clearly.

Attach evidence of misleading ads. Include false promise screenshots. Cyber cells increasingly act on financial fraud.

Need Help?

Did you pay for Ruchir Gupta’s GCD Calculator? Joined his paid Telegram channels? Following his stock recommendations? Facing losses now? Feeling deceived by false promises?

Register your complaint with us. We’ll guide you through the entire process. Here’s our support:

- Filing SEBI Complaints Correctly:

SEBI complaints need a specific structure. Certain information is mandatory. We ensure nothing gets missed. We help articulate violations clearly.

- Evidence Collection Support:

This often becomes the weak point. Students lose money but lack proof. We help with proper documentation. Screenshots must capture everything.

- Refund Claim Strategies:

Getting money back is tough but possible. We guide through refund processes. How to escalate when ignored. Legal options when refused.

Don’t stay silent. Your trust was exploited. Your losses matter.

Take action. Register with us. Let’s hold unregistered advisors accountable together.

Conclusion

Should you join Ruchir Gupta’s courses?

The evidence speaks clearly.

He has awards and recognition. Photos with politicians create impressions. His marketing looks professional. Thousands follow him. On the surface level, everything seems credible.

But dig deeper. SEBI registration is absent. Both Investment Adviser and Research Analyst licenses are missing.

Yet he provides specific stock recommendations. He gives price targets. He makes accuracy claims. Every single activity violates securities law.

He operates in the unregistered influencer space. Their investigation raised serious regulatory concerns. The magazine grouped him with others giving unlicensed advice.

His courses involve systematic problems. Webinars use emotional manipulation. Divine guidance claims exploit faith.

Inducement replaces genuine education. False promises create unrealistic expectations.

Your ₹40,000 is hard-earned money. Your financial future deserves better protection. Make informed decisions. Choose registered advisors. Verify qualifications. Don’t fall for emotional marketing.

The stock market isn’t easy. No course guarantees success. No method has 90% accuracy. Anyone claiming otherwise is either lying or breaking laws. Probably both.