Over the past few years, India has seen a huge rise in digital lending. With money just a few taps away, it’s natural for people to turn to quick-loan apps when they need urgent cash.

But alongside genuine platforms, a worrying number of fake or unregulated loan apps have entered the scene.

These apps promise instant help but often end up creating bigger problems for borrowers.

One name that keeps resurfacing in 2025 is the Rupee Bus Loan App.

If you have come across it or are thinking of using it, it’s important to understand what you’re dealing with.

Rupee Bus Loan App

On the surface, Rupee Bus appears to be a simple app offering fast personal loans without much paperwork.

It markets itself as a solution for people who need quick money and can’t wait for traditional banks.

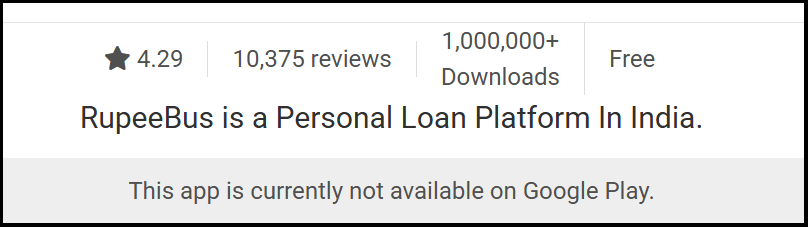

But here’s the first red flag: there is no legitimate version of the Rupee Bus app available on any trusted app store.

Now, in such cases, such loan apps become riskier.

Scammers use this name and target people through WhatsApp or Instagram.

They lure needy people by showing low interest rates or instant approval and make them download an APK file.

Reputable lenders never operate this way, because APK files can easily hide malware or tools designed to steal personal information.

The second concern is that Rupee Bus is not associated with any RBI-registered NBFC or bank. In simple terms, it’s not allowed to lend money legally in India.

Is Rupee Bus Loan App Safe?

Given everything about how the app is promoted, how it operates, and what users say about it, Rupee Bus is far from safe.

When a financial app only exists as an APK file, you lose all the safeguards that come with verified app stores, security checks, transparency, and accountability.

Apps like Rupee Bus typically ask for sensitive information such as Aadhaar, PAN, and selfies. They may also demand access to your contacts, photos, and phone storage.

Once you share these details, you have no control over how they are used. Many people end up sharing more than they intended, without ever receiving the loan they were promised.

Overall, there is nothing to suggest that Rupee Bus is a legitimate or safe lending platform.

Rupee Bus Loan App Complaints

People who interacted with Rupee Bus or downloaded its APK have reported similar experiences again and again. For example:

Fake Loan App Harassment Complaints:

- They were contacted through WhatsApp or social media with offers of instant loans.

- The so-called app asked for documents and permissions way beyond what is normal.

- Many were asked to pay “processing” or “verification” charges upfront, but the loan never arrived.

- In cases where money was credited, it was far smaller than promised, and the repayment deadline was extremely short.

- When users hesitated or questioned the process, they received threatening or abusive messages.

- Contact lists and personal photos were misused to pressure people into paying money they did not owe.

These are classic signs of fake loan app networks running loan app scams, troubling thousands of people across the country.

How to Identify Fake Loan Apps?

Thankfully, it’s not too hard to spot a suspicious loan app once you know what to look for. Here are some warning signs to check fake loans that should make you step back immediately:

- The app is not available on Google Play or other official stores and is shared only as an APK.

- There is no clear name of an RBI-registered bank or NBFC behind it.

- The loan is “guaranteed” with almost no credit checks or proper KYC.

- The app hides interest rates, repayment periods, and other key details.

- It demands unnecessary permissions like access to contacts, gallery, and call logs.

- You receive the app link through WhatsApp, Instagram, Telegram, SMS, or from strangers online.

- The app asks for money before disbursing the loan.

- Users complain about harassment, data misuse, or fake recovery agents.

If even one of these points feels familiar, it’s safer to avoid the app entirely.

How to Report Loan Frauds in India?

If you think you’ve been targeted by a fake loan app, don’t panic—but do act fast. Here’s what you should do:

- Stop responding to the numbers or people contacting you.

- Save screenshots, messages, payment proofs, and call logs as evidence.

- File a complaint in Cyber Crime

- Visit your nearest Cyber Crime Police Station and lodge an FIR.

- If needed, alert your bank to secure your accounts.

Reporting early can prevent scammers from misusing your data.

Need Help

If you’re unsure whether a loan app is genuine, the safest option is to check whether the lender is listed with the RBI or you can register with us.

You can also ask a trusted financial advisor or contact consumer protection services for guidance.

Above all, avoid downloading APK files or responding to random loan offers sent through WhatsApp or social media.

Genuine lenders do not operate this way, and your personal safety should always come first.

Conclusion

Rupee Bus is a good example of how fake lending apps operate in India today.

A link sent through WhatsApp, an APK file to install, no verified lender behind it, these are all signs of a setup designed to misuse personal information rather than provide real financial help.

In a digital world full of shortcuts and quick options, taking a few minutes to verify an app can save you from months of stress and harassment.

Stick to regulated lenders, rely on trusted sources, and stay alert to warning signs. Being informed is the strongest protection you have against online loan scams.