Every investor wants reliable guidance that can help them navigate India’s fast-changing financial markets.

Whether it’s portfolio management, wealth planning, or market research, the right expert opinion can make a world of difference.

In recent years, one of the names that often comes up in private wealth circles is Sanctum Wealth Private Limited.

But what is Sanctum Wealth Private Limited?

What does the company do?

And the most important!

What feedback clients have shared about the company.

Sanctum Wealth Review

Sanctum Wealth, as a platform, operates under the SEBI-registered Investment Advisor & Portfolio Manager, which ensures its analysts and advisors follow regulatory standards in research reporting and financial communication.

Shiv Gupta works as a research analyst at Sanctum Wealth Private Limited.

It is one of India’s well-established wealth management firms serving high-net-worth individuals and families.

His role primarily involves studying market trends, analyzing investment opportunities, and advising both clients and internal teams on financial strategies best suited to their goals.

Professionals like Shiv Gupta are responsible for conducting in-depth equity research, preparing market reports, and ensuring that client portfolios align with both risk appetite and performance expectations.

As part of Sanctum’s research team, he contributes to investment recommendations that shape client strategies across asset classes like equities, mutual funds, and alternative investments.

Sanctum Wealth Complaints

While Sanctum Wealth Private Limited has gained a solid reputation for advisory services, the financial services industry isn’t without occasional client dissatisfaction.

It is often linked to market volatility, miscommunication, or expectation mismatches rather than deliberate misconduct.

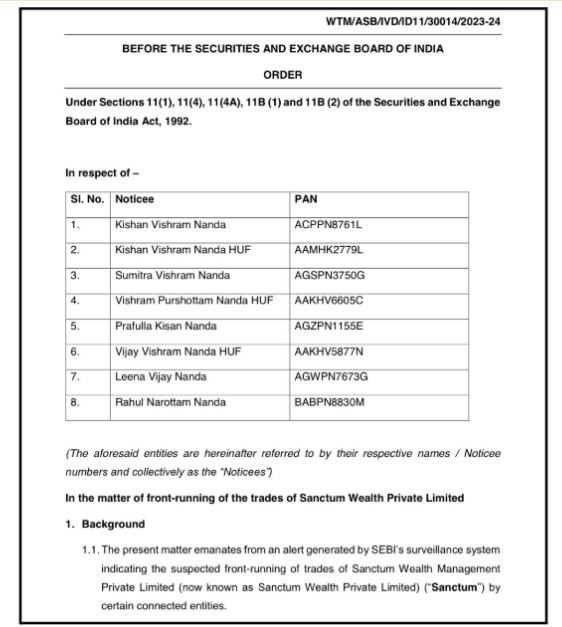

Sanctum Wealth SEBI Orders

In the SEBI front-running case, Sanctum Wealth Management came under scrutiny not because it directly executed fraudulent trades, but because serious violations occurred within its operational framework.

A dealer, Krishan Vishram Nanda, employed in Sanctum’s broking arm, had access to confidential, price-sensitive PMS order information and misused this information to front-run trades through his own and related family accounts.

The failure lay in inadequate internal controls, surveillance, and conflict-of-interest safeguards, which allowed sensitive client order information to be exploited over a prolonged period without detection.

This misconduct distorted fair price discovery and caused PMS trades to be executed at less favorable prices, ultimately harming investors whose portfolios bore the cost of manipulated market movements.

Such lapses undermine investor trust in portfolio managers and highlight how weak compliance oversight can translate directly into financial and reputational damage for investors, even when the firm itself does not place the illegal trades.

SEBI restrained Kishan Nanda (the main accused) from the securities market for 3 years and barred him from key roles in listed firms or SEBI intermediaries.

Family entities faced 1-year market bans, with some also restricted from directorships.

They must disgorge Rs 34.84 lakh (plus 12% interest from October 2020) to the Investor Protection Fund, and Kishan Nanda pays a Rs 5 lakh penalty under Section 15HA.

Kishan Nanda, an equity dealer at Sanctum’s broking arm, accessed non-public details of large “Big Client” (Sanctum PMS) orders.

He opened accounts in his HUF and family names (mother, father HUF, wife, brother HUF, sister-in-law, cousin) with Globalworth Securities, trading via his work computer (same MAC ID/IP).

Trades followed BBS (Buy-Buy-Sell) or SSB (Sell-Sell-Buy) patterns ahead of client orders on NSE/BSE, earning unlawful gains on 930+ common scrip days (79% of their volume).

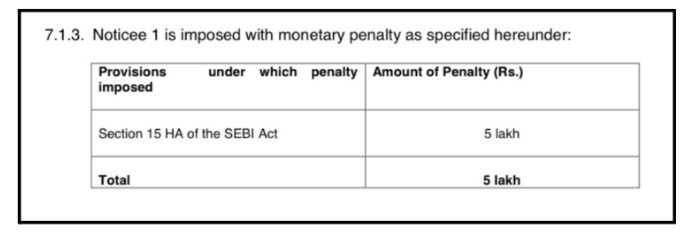

SEBI Verdict

Only Kishan Vishram Nanda has been fined.

SEBI has imposed a money penalty of Rs 5,00,000 (5 lakh) on him under Section 15HA of the SEBI Act. The total monetary penalty mentioned in that table is Rs 5 lakh.

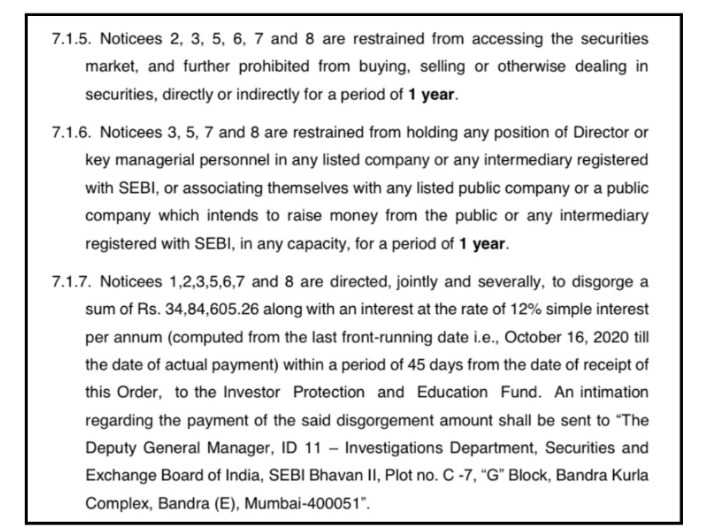

Notices 2, 3, 5, 6, 7, and 8 are banned from accessing the securities market and from buying, selling, or dealing in securities (directly or indirectly) for 1 year.

Notices 3, 5, 7, and 8 are also banned for 1 year from being Director or key managerial personnel in any listed company or SEBI‑registered intermediary, or associating with any such company in any capacity.

Notices 1, 2, 3, 5, 6, 7, and 8 together must return Rs 34,84,605.26, plus 12% simple interest per year from 16 October 2020 till the actual payment date.

This amount has to be paid within 45 days to SEBI’s Investor Protection and Education Fund.

The show‑cause notice against Notice 4 is closed without any directions, so no penalty is imposed on Notice 4.

Key Learnings

- Dealers cannot trade on client order info, even in family accounts. Devices, funds, and patterns expose links.

- Front-running needs no client match or big profits; using non-public info ahead of trades suffices.

- Family “mule” accounts offer no shield if operated by the insider with awareness.

How to Complaint Against Research Analysts?

If you have encountered problems with Shiv Gupta or any other research analyst, you can follow the steps below:

Step 1: Register Your Complaint With Us

Contact us immediately and share all the details of your issue with Shiv Gupta, Research Analyst. Explain what happened, when it happened, how much money is involved, and attach screenshots, reports, contract notes, and any chats or emails you have.

Step 2: Consult Our Case Manager

We arrange a dedicated call with an experienced case manager. They carefully review your facts, check how strong your complaint is, explain your rights as an investor, and outline the full action plan from start to finish.

Step 3: Draft a Strong Complaint

Our team helps you prepare a clear, well-organised complaint letter against Shiv Gupta. We make sure every important incident, date, transaction, promise, and supporting document is covered so that your case looks professional and credible before any authority.

Step 4: Engage the Research Analyst

With our support, you first reach out to **Shiv Gupta Research Analyst** or his team directly. This opens the door for clarification, refund, or settlement, and shows regulators that you tried to resolve the matter amicably before escalating.

Step 5: Submit a Complaint on SEBI SCORES

If the issue is not resolved, we guide you step by step to file a complaint on SEBI’s SCORES portal. We help with registration, filling out the online form, selecting the correct intermediary (research analyst), uploading documents, and tracking the status until you get a response.

Step 6: Use SMART ODR if SCORES Fails

If SCORES does not give a satisfactory outcome, we help you move the case to SMART ODR (Online Dispute Resolution). This includes creating your ODR account, uploading all papers, preparing you for conciliation sessions, and presenting your side firmly yet professionally.

Step 7: Navigate Arbitration, If Required

If the dispute still remains, we support you in going for arbitration as per the rules of the concerned exchange or platform. We help draft the arbitration application, structure your evidence and claims, and guide you through each hearing and communication until the case is finally closed.

Conclusion

In India’s wealth management space, professionals like Shiv Gupta play a crucial role in shaping the financial decisions of investors who trust institutional advice.

Though no official complaints or controversies stand out in his record, investors should always cross-verify credentials, understand advisory risks, and maintain realistic expectations about research-backed recommendations.

The best approach is to stay informed, seek transparency, and choose advisory relationships that prioritize ethical practices and long-term wealth creation.

Whether it’s Shiv Gupta or any other analyst, trust in research should always be balanced with personal financial awareness.