Imagine scrolling through your phone, spotting an app promising quick bill payments and discounts that sound too good to pass up.

What if that simple download turns into a gateway for scammers eyeing your personal details?

In today’s digital jungle, apps like SD Pay pop up everywhere, raising the big question: is SD Pay safe for your money and privacy?

So, let’s dive deep into whether this payment app is a smart choice or a hidden trap waiting to snag unwary users like you.

SD Pay Review

SD Pay markets itself as a handy app for discovering local deals, recharges, bill payments, and even PAN card services, all wrapped in a user-friendly package.

It boasts features such as secure gateways and instant confirmations to lure in busy folks looking for convenience.

The app is going viral for its massive cashback offers. Some users say that it is like earning a second income while doing nothing.

Curious to know why? Let’s find out!

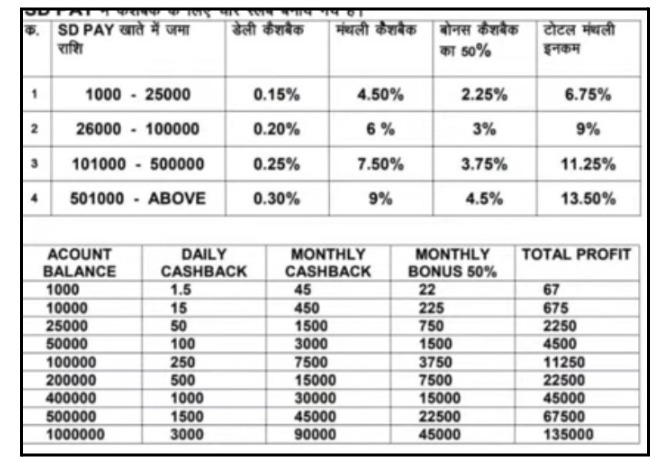

This is how you can earn money in this application:

- 0.15% to 0.30% daily, depending on your deposit balance

- A 50% monthly bonus on top

- Referral programs where you earn by inviting friends

- Promises of 1-2% cashback on purchases.

Sounds tempting, right?

Imagine depositing ₹10,00,000 and earning ₹3,000 every single day.

But hold on a second. You’re required to deposit money first before seeing any returns. At that point, it stops sounding like a simple cashback app and starts raising a serious question many users are now asking online: is SD Pay real or fake?

If it feels more like an investment scheme than a payment app, that’s because the structure closely resembles one.

Before falling into the trap, it’s crucial to ask the bigger question: is SD Pay safe to use or not?

Despite claims of registration and safety, a closer look at official RBI and SEBI databases shows no record of SD Pay as an authorized payment aggregator or regulated financial entity. There’s no banking license, no verified oversight, and no regulatory protection backing user funds.

Without proper regulation, using such platforms is like playing Russian roulette with your money. When legitimate apps proudly display their licenses and approvals, should you really trust one that doesn’t?

Is SD Pay Safe To Use?

Everyone wonders if SD Pay truly guards your hard-earned money and private life, or if it’s just another app dressed up to look trustworthy.

Picture handing over your location, photos, and personal details to something that might not deserve them. What could go wrong?

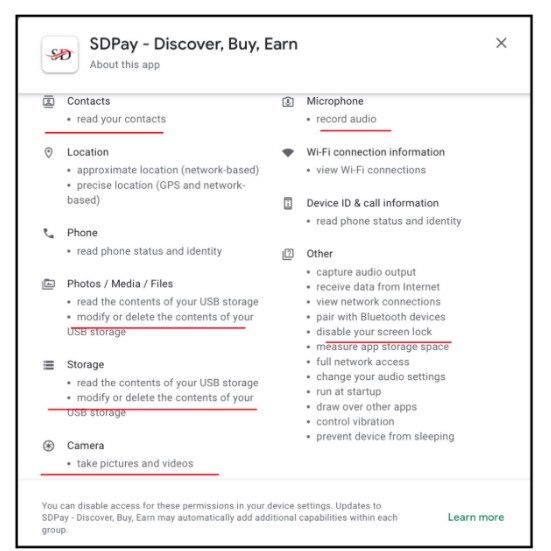

A peek at its Google Play data safety page shows it gathers:

- Location (both approximate and precise)

- Photos

- Contact

- Microphone access

- Storage

- Camera

- Storage

- Videos

- Personal info that goes way beyond what’s needed for basic bill pays or recharges.

Why does a simple discovery tool need precise whereabouts or access to your camera roll, making you question if it’s building a profile on you instead of just processing a payment?

Even worse, the listing warns that data isn’t always encrypted and can’t easily be deleted, clashing with claims elsewhere about secure transit.

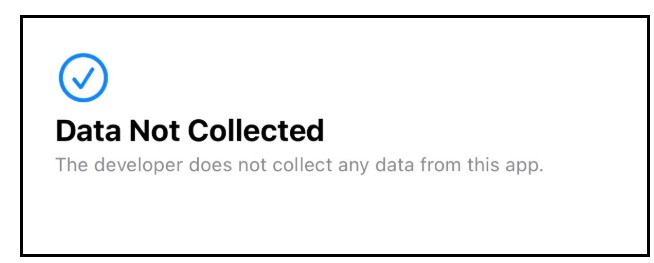

On the Apple App Store side, things get murkier with reports of it declaring “no data collected,” a stark mismatch that screams inconsistency and erodes trust right away.

Legitimate apps stay transparent across platforms, but this flip-flop hints at sloppy or sneaky practices.

Have you ever thought about an app potentially eavesdropping or snapping pics without a clear reason?

India’s Digital Personal Data Protection Act of 2023 demands strict data minimization: only grab what’s essential, get explicit consent, and explain the purpose clearly to shield users from abuse.

Yet SD Pay’s broad grabs violate that spirit, collecting extras like USB storage tweaks or audio recording permissions in similar apps, which no honest payment tool requires.

For anyone valuing privacy, this overreach turns SD Pay into a no-go zone packed with red flags.

SD Pay Complaints

There are various types of complaints regarding this application. Users seem frustrated with the SD pay app. Although you will see various positive reviews as well, sidelining negative reviews can be a big mistake!

Here’s what users are complaining about:

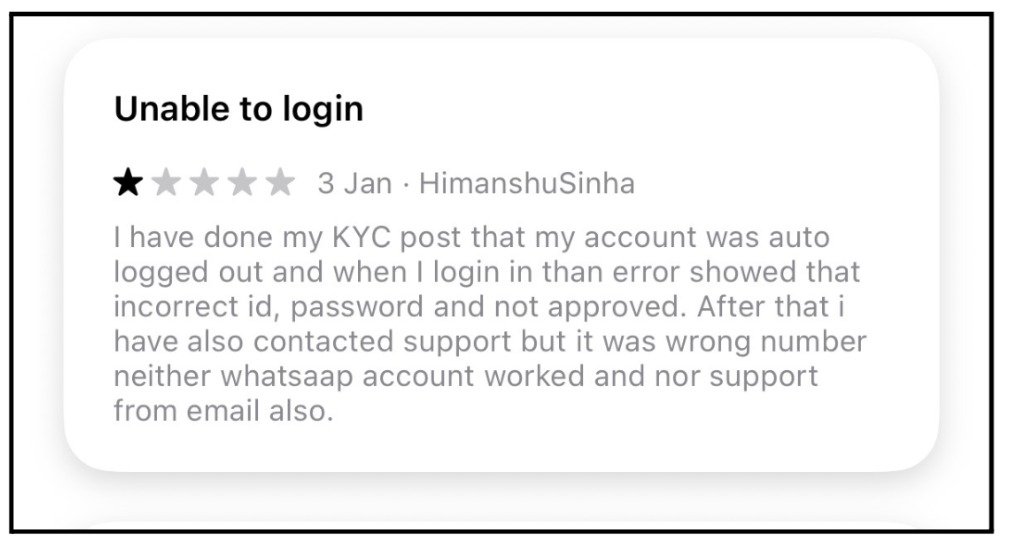

1. Login Issues

Most of the users are facing SD Pay login issues after they have created an account successfully and deposited the money.

Imagine depositing huge amounts into the app, and then the app logs you out without your consent.

Worst?

Even if you try to login with your right credentials, the app doesn’t let you do that as well.

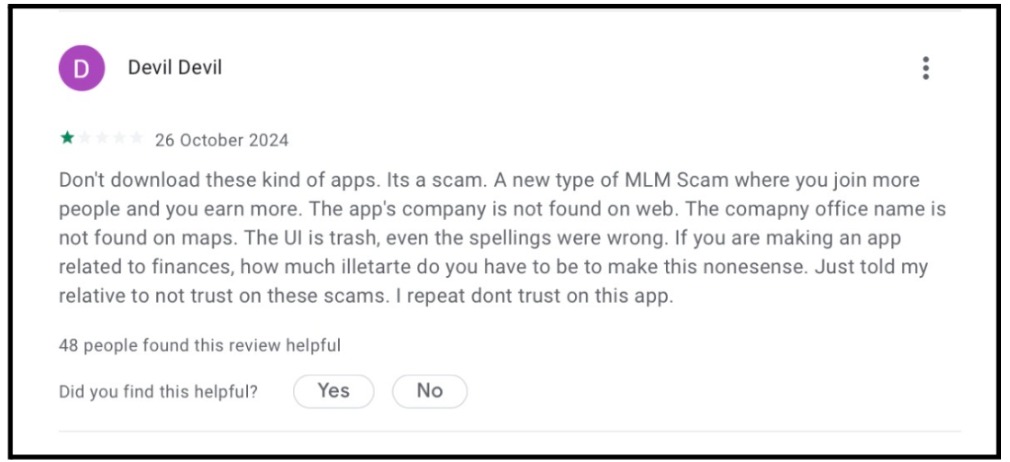

2. MLM Scam

A similar complaint revolves around it being an MLM scam. And yes, seeing its referral program, it does mimic MLM.

The SD pay app lets you earn money if you join more and more people. It won’t even take a second for the app to vanish with your money.

The app has no website or address as well. And the user also complains that there are grammatical mistakes in the app.

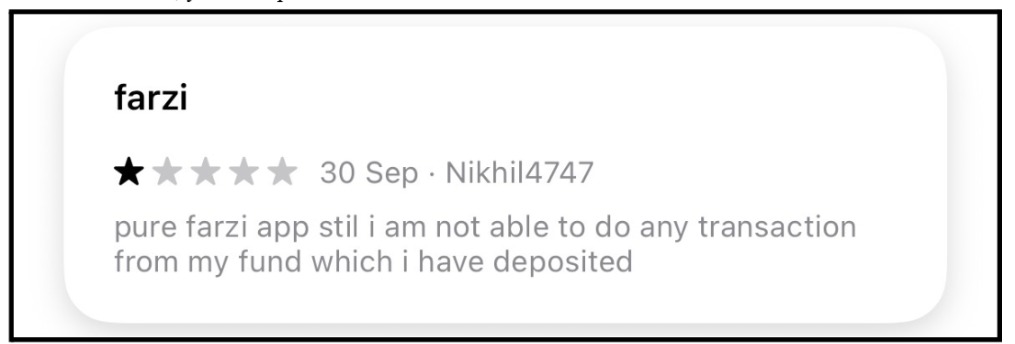

3. Unable to do Transactions

Imagine downloading an app that serves the purpose of transferring money to pay for your everyday needs. But instead, you end up with blocked transactions.

This is a similar issue faced by many users. Users say that they deposit the money, and after that, they are unable to do any transactions with it.

What is the use of this application if they don’t serve the main purpose?

What to do if Online Fraud Happens?

Spotting shady apps early keeps the community safer, so if SD Pay sets off alarms, acting fast matters. What steps can you take to flag it properly and protect others?

Here’s a straightforward path:

- Start by collecting solid evidence like screenshots of permissions, data claims, and any odd transactions.

- File a complaint on Google Play via the app’s page by tapping “Flag as inappropriate” and detailing privacy issues.

- Report a Cyber Crime complaint through their online portal or call them. Attach your evidence for quick investigation.

- You can file an FIR at your nearest police station and take all your evidence for proof

- Aware of other people on various community platforms, so that they can also become aware of this scam.

Need Help?

We understand that losing your money can be challenging and difficult, but if you take the right steps, you can recover your money. All you need to do is register with us.

We have a team of dedicated specialists who will help you in every step of recovering your money.

Conclusion

SD Pay’s flashy promises crumble under scrutiny, from absent regulations to creepy data habits that defy India’s privacy laws.

Why gamble your info when safer, verified options like PhonePe or Paytm deliver without the drama?

Next time an app whispers “easy money,” pause and check its credentials.

In a world full of wolves in sheep’s clothing, knowledge is your strongest armor.