Imagine scrolling through your phone and spotting an ad promising quick cashback and easy earnings. All this just by using an app like your everyday UPI wallet.

What could go wrong with something that sounds so simple and rewarding?

You’ve probably wondered if this is the next big thing in digital payments or just another shiny trap waiting to snag your trust and money.

In a world where financial apps pop up daily, the temptation of SD Pay login pulls in thousands, but here’s the hook: what if logging in opens the door to risks you never saw coming?

This blog dives deep into why that SD Pay login might be the last thing you want to attempt.

SD Pay App Login

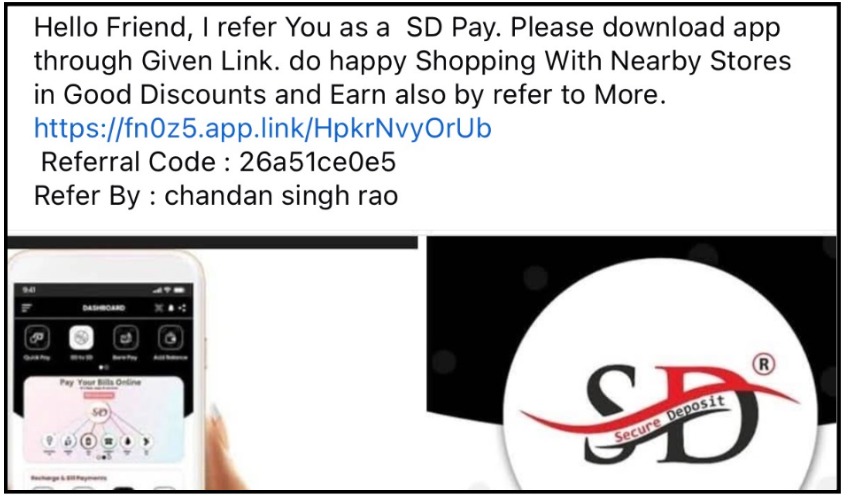

SD Pay presents itself as a digital wallet app, much like PhonePe or Paytm, where users can supposedly recharge mobiles, pay bills, and shop online. Users can also earn through a multi-level referral system promising up to 15 levels of income.

But as exciting as that sounds, many users quickly realize it’s built on a fragile foundation of unverified promises.

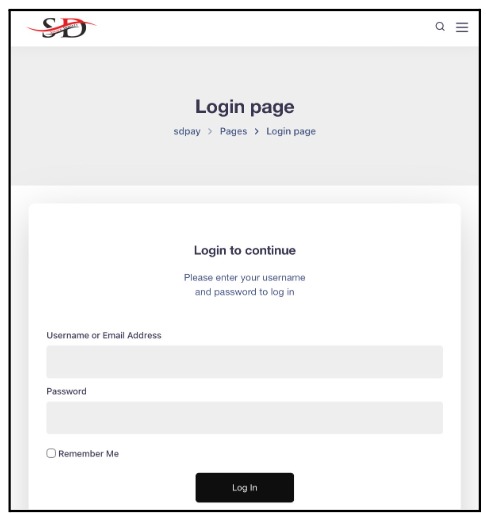

Logging into the SD Pay app seems straightforward at first glance. No fancy biometrics or OTPs required beyond the initial signup, where you also provide your name, email, and a reference ID for referrals.

The process takes seconds: open the app, punch in your phone number tied to the account, add your password, and hit submit.

Login feels simple and user-friendly, almost too easy for a financial app handling real money. And that’s exactly why many users pause and ask the uncomfortable but necessary question: is SD Pay real or fake?

Because when red flags are already waving everywhere, the real decision isn’t just about logging in, it’s about whether you should trust the platform at all.

Think twice before you hit that button.

Is SD Pay Login Safe?

Before you enter your details, consider these critical factors that raise serious doubts about the app’s safety and reliability.

Each one points to why proceeding with an SD Pay login could expose you to unnecessary risk, and why so many users keep asking the same question online: SD Pay is safe or not?

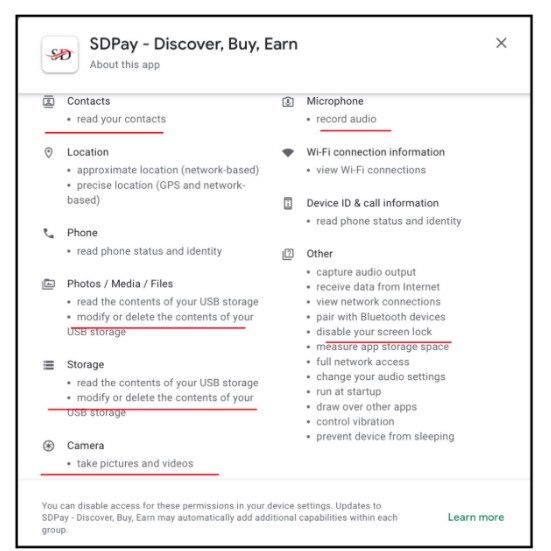

- Excessive Data Collection Raising Safety Issues

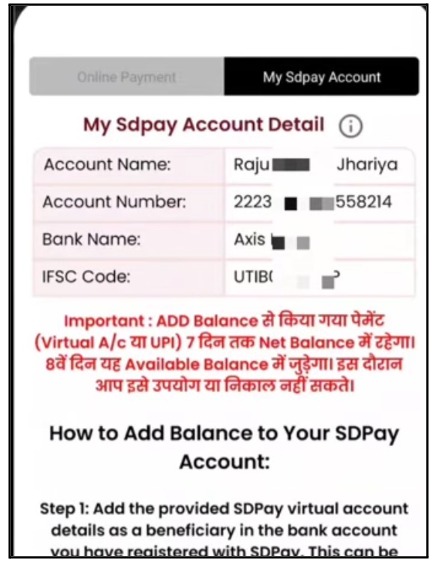

The app requests personal details such as your full name, mobile number, USB storage access, location, email, and even Aadhaar-linked information during KYC, but lacks clear privacy policies on how this data is stored or shared, leaving users vulnerable to breaches or misuse.

- Not Regulated by Financial Authorities

Unlike legit UPI apps overseen by RBI or NPCI, SD Pay operates without any visible certification or regulatory approval, making it a wild west for transactions.

- Various User Complaints Piling Up

Reports flood YouTube and app stores about frozen accounts, delayed payouts, and sudden logouts post-KYC, with users unable to access their balances.

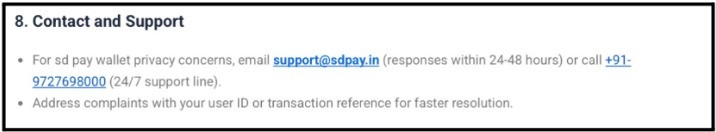

- Unresponsive Customer Care

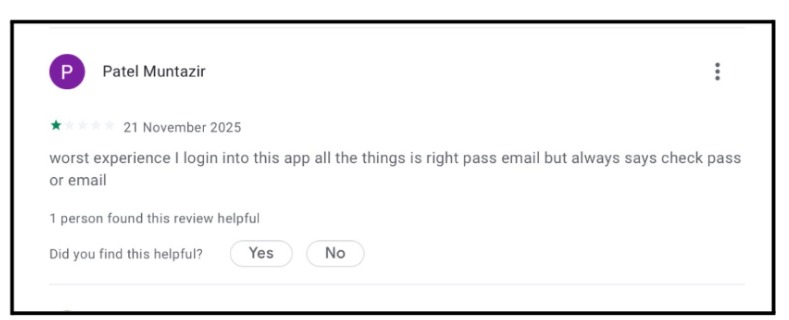

Support channels like WhatsApp numbers and emails go unanswered, as seen in reviews where users beg for help with login errors but get silence. Also, if you try to dial their customer care number at generally goes off.

- Ponzi Scam Mimicking Through Referrals

The heavy emphasis on 15-level referrals and team-building income screams classic Ponzi traits, where early users profit from recruiting others until the scheme collapses.

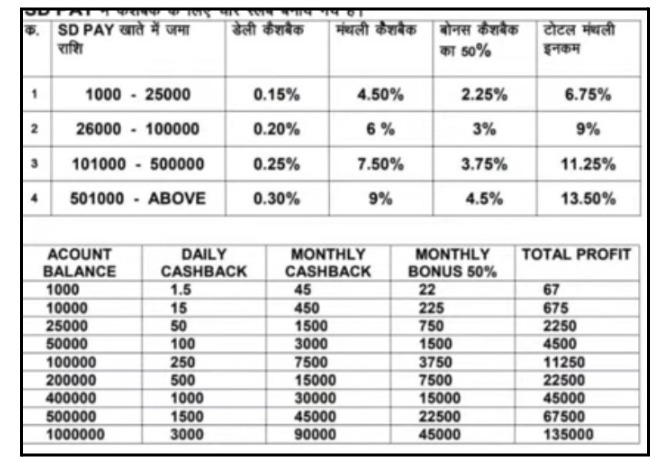

- Unrealistic High Cashbacks

Promises of massive daily cashbacks on routine payments sound irresistible, but they often serve as bait to lure deposits that vanish later.

- Cannot Use Available Balance

Many complain that after adding money or earning “rewards,” withdrawals fail or balances get locked, trapping funds indefinitely.

These issues aren’t just minor glitches; they form a pattern suggesting SD Pay login might lead straight to frustration or loss.

Wouldn’t you rather play it safe?

SD Pay Login Complaints

On various platforms like YouTube, App Store, and Google Play reviews, one common thread stands out loud and clear: login issues plague SD Pay users relentlessly.

People report “incorrect ID/password” errors even with valid credentials, accounts getting auto-logged out after KYC approval, and “not approved ID” messages blocking access entirely.

Imagine creating an account and giving all the unnecessary access only to face login issues. Is this all done just to take your data and then vanish?

Even if you have put your correct details, you still won’t be able to login into the application.

What starts as an exciting signup turns into a nightmare, with users stuck in loops of failed attempts and ignored pleas for help.

If login itself is this unreliable, imagine trusting it with your money. These shared experiences scream caution before you even try.

What To Do If You Are Being Scammed?

Reporting suspicious apps like SD Pay protects you and others, alerting authorities to shut down potential fraud early.

In India, where digital scams surge daily, taking action is straightforward and empowers you against threats like SD Pay.

Follow these step-by-step instructions to report effectively and contribute to a safer online space:

- Collect all the evidence that is necessary. Take a screenshot of added deposits, money, spent, and other important details.

- File an FIR at your nearest police station, and take all the evidence with you as proof.

- You can file a complaint in Cyber Crime through their online portal.

- Contact your bank and ask them to block all the suspicious transactions.

- Report this app on the App Store and Google Play Store so that it can be removed.

- Share these things on social media platforms, so that other people can also become aware of these scams.

By reporting promptly, you not only seek recourse but also warn others eyeing that tempting SD Pay login.

Need Help?

We understand that losing your hard-earned money can be difficult, but if you act right, you can recover all your money. All you need to do is register with us.

We are a team of experts that specialise in recovering money lost to scams or frauds

Conclusion

Stepping back, the allure of SD Pay login fades fast when you uncover the layers of complaints, regulatory voids, and Ponzi vibes lurking beneath its cashback promises.

Why risk your personal data and savings on an app riddled with login headaches and payout blocks when safer, regulated options abound?

Instead of chasing unreliable rewards, you protect your finances and sleep easily knowing you’ve dodged a potential bullet.

Stay vigilant, stay safe, and let’s keep digital India scam-free together.