Most investors don’t begin their day expecting to file a SEBI complaint against an advisory company.

They open their trading app, follow the recommendations shared by their investment advisor, and trust that the guidance they’re receiving is fair, regulated, and in their best interest.

An advisory firm is chosen for expertise and risk management, not shortcuts or false reassurance.

The calls sound confident. The messages offer comfort. Phrases like “don’t worry” and “this is a safe trade” create a sense of trust.

Over time, however, the experience can start to change.

The advice no longer aligns with what was promised, losses continue to mount, and follow-up questions are ignored or delayed.

That’s when many investors realize the issue may go beyond market risk and begin to wonder whether the advisory firm crossed regulatory boundaries.

For many, this is the point where understanding how and when to file a SEBI complaint against an advisory company becomes essential.

When to File a SEBI Complaint Against an Advisory Company?

An advisory company helps people make better decisions, but they don’t take over or promise specific results.

Basically, advisory firms work as knowledge partners. They look at the market, understand data, and give structured advice so investors can choose what’s best for their goals, how much risk they’re comfortable with, and their financial situation.

Importantly, advisory companies are regulated by SEBI and are expected to operate within clearly defined boundaries.

They advise but do not control client accounts, do not force decisions, and do not assure profits.

In short, a real advisory company focuses on:

- Strategic planning

- Financial guidance

- Risk management

- Research and analysis

- Decision support

However, there are a few complaints by investors and traders that directly claim that some of the advisory firms misuse their SEBI registrations and mislead them, which led to huge losses.

Below are some of the violations committed by SEBI-registered advisors

- Account Handling

- Unauthorised Trading

- Guaranteed Returns, Sure-Shot Profits, and Refund Promises

- Misguidance and Unsuitable Advice

- Unregistered Advisory Activities

- Misleading or False Communications

- Non-Compliance with Reporting and Disclosures

Violations by SEBI Advisors: Real Cases

Below are real, publicly available cases where SEBI took regulatory action against registered advisors and research analysts for violations of applicable regulations.

These examples illustrate the types of non-compliance that can trigger enforcement action.

SEBI Order Against Options King Research Analyst for Giving Advice Without a Valid NISM Certificate

According to the SEBI adjudication order, regulatory action was taken because the person did not follow the certification rules set by the SEBI (Research Analysts) Regulations, 2014.

The main issue was that the research analyst continued to provide investment advice without holding a valid NISM certification for an extended period, despite being registered as an intermediary.

SEBI looked into the case through an inspection and legal process and then decided on a financial penalty based on the facts and information that was available.

SEBI’s final decision after considering all facts, submissions, and regulatory provisions.

It shows that SEBI imposed a monetary penalty of ₹1,00,000, concluding that the violation warranted regulatory action under the SEBI Act.

How to File SEBI Complaint Against Advisory Company?

When an advisory company goes beyond the rules, like giving bad advice, making false promises, or not keeping their promises, it’s normal to feel confused about what to do next.

Filing a complaint with the SEBI isn’t about being confrontational; it’s a proper way to officially report a problem and request an explanation.

Here’s how to do it step by step using the SCORES portal:

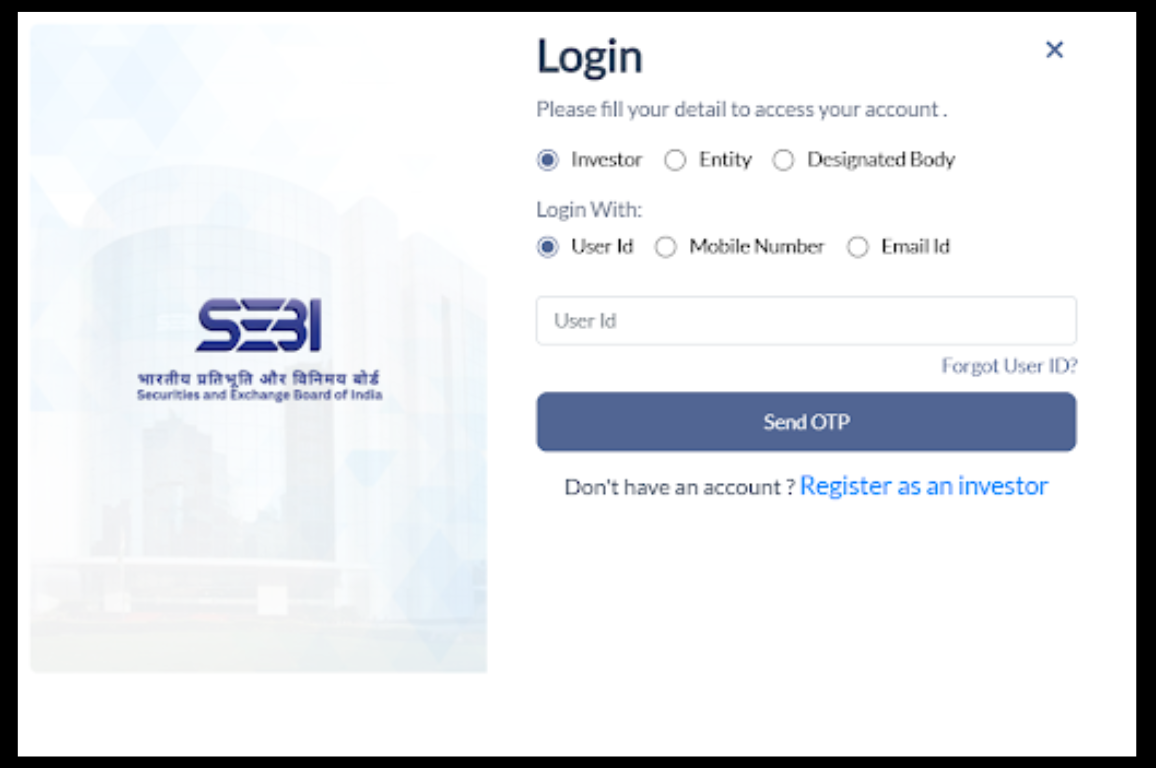

First, register or log in – Go to the SCORES portal and create an account using your PAN, or log in if you already have one. This makes an official record of your complaint.

Next, choose the advisory company and the issue. Pick the right category and select the advisory firm or person involved.

Describe the problem clearly and simply, like wrong advice, actions without permission, or not providing the services promised.

Then, upload supporting documents – Add proof like emails, WhatsApp messages, invoices, payment records, or any other communication related to the issue.

Finally, submit and track your complaint – After you send it, you can check its status online.

you aren’t happy with the response from the advisory firm, you can ask for a review within the time given.

Register With Us to Report a Complaint Against the Advisory Company in SEBI

When an advisory company goes past the line, the effects go beyond just losing money.

It makes you doubt your choices, and the silence or unclear answers that come after can feel even worse than the financial loss.

If you’re already confused or stressed, dealing with a SEBI complaint on your own can feel really tough, but you don’t have to do it alone.

Here’s we help you on how to lodge complaint in SCORES, step by step:

- Documentation Support: We assist you in finding and organizing all the important documents needed for a strong complaint, like payment receipts, bank statements, advisory messages, emails, chat screenshots, and contracts. Having the right documents makes your complaint clear, complete, and more likely to be taken seriously.

- Complaint Drafting Assistance: We help you write your complaint clearly and factually.

Explain what happened, when it happened, and how it affected you without using emotional words or mistakes that might harm your case.

- SCORES Portal Filing Support: If the SCORES portal is hard to understand, we walk you through every step from signing up to submitting your complaint.

This helps prevent errors, missing information, or delays in getting your complaint processed.

- End-to-End Case Support: Our help doesn’t stop once the complaint is filed.

Register with us, and we will assist you in checking the status, answering questions, and staying updated until the issue is resolved.

Conclusion

Filing a complaint with SEBI against an advisory company isn’t about fighting against the system; it’s about using the system to protect yourself.

When advice goes beyond what’s ethical or allowed, SEBI offers a clear and fair way to address these issues.

Some investors don’t speak up because they think their opinion doesn’t matter, but each complaint helps hold people accountable and makes investor protection stronger.

If you’ve suffered losses because of bad advice, know that you’re not alone and you don’t have to face this alone.

There’s a regulator watching over the market, and there are clear steps to voice your concerns, get answers, and find a solution.

Taking action is often the first step in rebuilding your confidence, not just in the market, but in yourself.