Declared dividend not showing in your bank account? Waiting weeks for money that should have arrived? You’re not alone.

Thousands of Indian shareholders face dividend payment issues every year.

The good news?

SEBI can help you recover your rightful money.

Let me show you exactly how.

SEBI Complaint for Non-Receipt of Dividend in India

In India, when a listed company declares a dividend, it must pay that dividend to all eligible shareholders within 30 days of the declaration date under the Companies Act, 2013.

However, if you don’t receive a dividend within defined timelines, then there could be one of the following reasons behind that:

- Incorrect Bank Details: Your bank account information in your Demat account is outdated or wrong. This is the most common issue.

- Address Mismatch: The company’s records show your old address. Dividend warrants sent by post never reach you.

- Mandate Issues: Electronic payment mandate not properly set up with your depository participant.

- KYC Not Updated: Your PAN, Aadhaar, or other KYC details aren’t linked correctly.

- Technical Errors: Sometimes the company’s registrar makes mistakes in processing payments.

Check your details first before filing any complaint.

In case things are correct & clear from your end, and still the dividend is not credited to your account, then you can raise a grievance in SEBI.

Although SEBI itself doesn’t directly pay dividends, it acts as the regulator and grievance redressal facilitator through its online portal SCORES (SEBI Complaints Redress System).

You file a complaint against the company, registrar, or intermediary, and SEBI pushes for redress.

Does SEBI Handle Dividend Complaints?

Yes, SEBI absolutely handles dividend complaints. But only for specific situations.

SEBI takes up complaints related to issues and transfers of securities and non-payment of dividends with listed companies.

This means if you’re a shareholder in a listed company and haven’t received your declared dividend, SEBI’s SCORES platform is your go-to solution.

However, there’s a critical timeline you need to know about.

When Should You File a SEBI Complaint for Non-Receipt of Dividend?

Timing matters here. Companies typically credit dividends within 30-45 days after the record date.

You can expect to receive dividends in your bank account linked to your Demat account within 15 business days after the record date.

Wait for this period first. If the money doesn’t arrive, it’s time to act.

But here’s something crucial. According to AMFI’s guidelines on complaint standards, “non-receipt of dividend to be treated as a complaint.

If the dividend is not dispatched within 30 days from the date of declaration.”

After 30 days from the declaration, you have a valid complaint.

The 7-Year Deadline You Must Know About

This is extremely important. Don’t ignore this.

If you don’t claim your dividend within 7 years, it’s gone to the government.

According to Section 124(5) of the Companies Act 2013, “any dividend amounts, which remain unpaid or unclaimed for a period of 7 years from the date they became due for payment, shall be finally transferred by the company to the IEPF,” which is the Investor Education and Protection Fund.

Once transferred to IEPF, you can still claim it. But the process becomes much longer and more complicated.

So act before those 7 years pass.

How to File SEBI Complaint for Dividend?

Let us walk you through the exact process of how to file a SEBI complaint.

Before Filing on SCORES

Don’t jump straight to SEBI.

Try these steps first:

- Contact the Company’s RTA: Every listed company has a Registrar and Transfer Agent. Find their contact details on the company’s website. Send them an email explaining your issue.

- Provide Required Information: Mention your Folio number (for physical shares) or DP ID and Client ID (for Demat shares). State which dividend you haven’t received.

- Wait 7-10 Days: Give them a reasonable time to investigate and respond.

- Check Your Bank Statement: Sometimes the dividend gets credited, but with an unclear description. Look carefully.

If this doesn’t resolve your issue, move to SCORES.

Filing on SCORES Portal

Now let’s file the actual complaint in SCORES:

- Visit SCORES Website: Go to the website from any device.

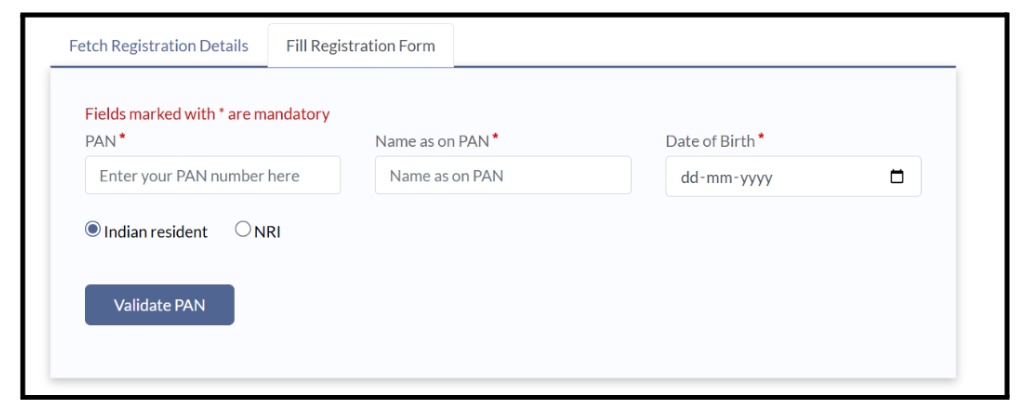

- Register or Login: Use your PAN and date of birth to register. It takes about 5 minutes for first-time users.

- Click “Lodge Complaint”: After logging in, you’ll see this option clearly on the dashboard.

- Select Category: Choose “Listed Company” as the category. Then select “Dividend” as the nature of the complaint.

- Enter Company Name: Type the company’s name. The system will show you the registered company details.

- Describe Your Issue: Write clearly

- Which financial year’s dividend

- Declaration date

- Amount you’re entitled to receive

Keep it factual. No emotional language.

- Upload Documents: This is critical. Attach:

- Demat account statement showing shareholding

- Dividend declaration announcement (from company website or stock exchange)

- Emails sent to RTA/company

All files should be PDF or JPEG under 2 MB.

- Submit and Note Your Number: After submission, you’ll get a complaint reference number. Save this carefully.

According to SEBI’s FAQ document, “Entities shall resolve the Complaint and upload the ATR on SCORES within 21 calendar days of receipt of the Complaint.”

The company must respond within 21 days.

What Happens Next?

Once you file, here’s the journey:

- Company Gets Notified: Your complaint automatically reaches the company’s compliance officer.

- They Must Investigate: The company checks their records, RTA systems, and payment logs.

- Action Taken Report (ATR): Within 21 days, they submit their response explaining what happened and how they’ll fix it.

- You Review Response: SEBI sends you their response. Read it carefully.

- Accept or Reject: If satisfactory and money is credited, accept and close. If not, you can request a First Level Review within 15 days.

- Further Escalation: Still unsatisfied? Request Second Level Review. SEBI will then examine the case more closely.

Most cases resolve faster than the 21-day deadline.

Need Help?

Waiting for dividend money that never arrives? Watching months pass by with no response from the company? That frustration is real.

It’s your money. You earned it by investing wisely. The company declared it.

You shouldn’t have to fight this battle alone. Register with us now.

Here’s how we stand by you throughout your dividend recovery journey:

- Evidence Collection Assistance: We help you gather Demat statements, dividend announcements, bank records, shareholding certificates, and email trails with the RTA. Proper evidence makes your complaint undeniable.

- Complaint Writing Support: We help you draft a complaint that’s professional and precise, stating facts like dividend period, amounts, record dates, and your attempts to resolve this. No filler, just strong credibility.

- SCORES Filing Guidance: We walk you through creating your account, selecting the correct categories, uploading documents properly, and submitting everything so your complaint doesn’t face technical rejections.

- End-to-End Follow-up: We help you track progress, interpret company responses, prepare counter-arguments if needed, and guide you through review levels until your dividend reaches your account.

Don’t let your unclaimed dividends slip away. Connect with us today, and let’s recover what belongs to you.

Conclusion

SEBI does handle dividend complaints effectively through SCORES for listed companies. The system works when you follow the proper process with complete documentation.

Remember these key points: Wait 30 days from declaration before complaining. Always contact the company’s RTA first. File on SCORES only if they don’t respond. Keep all your documents ready. Don’t let dividends remain unclaimed beyond 7 years, or they’ll transfer to IEPF.

Most dividend issues happen because of outdated KYC or bank details. Update your information regularly. Use Demat accounts instead of physical shares. Monitor your holdings every quarter.

SCORES typically resolves dividend complaints within 21 days. The company must respond, and SEBI monitors the entire process. If unsatisfied, you can escalate through two review levels.

Filing a SEBI complaint for non-receipt of dividend through SCORES ensures the issue is formally escalated to the company and monitored by the regulator.

Your dividend is your right as a shareholder. Companies have a legal obligation to pay you. Don’t hesitate to use SCORES if they fail to fulfill this obligation. The system exists to protect your interests.

Act promptly, document thoroughly, and follow up regularly. Your money will reach you.