A SEBI Registered Research Analyst (RA) is authorized to provide and publish stock tips and recommendations. However, unlike Investment Advisors, an RA cannot offer customized or personalized advice to individual clients.

In simple terms, the key skill of an RA is research—whether it’s fundamental or technical. This research is published and made available to clients who pay for the service.

Seems straightforward, right?

Unfortunately, many beginners are unaware of these distinctions and get trapped by misleading schemes or advice from RAs.

This is exactly what happened to Arif (name changed), a beginner stock market learner. One day, he received a call from a Research Analyst and was trapped in a profit-sharing scheme, resulting in a loss of nearly ₹1,00,000.

Here’s the complete story of how it all unfolded and how our team helped Arif recover 50% of the lost amount from the Research Analyst.

How Arif Got Trapped in the Wrong Advisory Services

Arif had developed an interest in learning about the stock market and had registered for a webinar after seeing an ad on Instagram. Soon after, he received a call from Mumbai.

The call was from the office of a SEBI-registered Research Analyst. The caller, Irshad (name changed), offered Arif their services, assuring him that he wouldn’t need to pay any fees upfront. Instead, they would share any profits made from stock tips on a 60:40 basis.

But any registered or unregistered advisory working on profit profit-sharing model is itself a big red flag. But again Arif was not aware of the same.

Initially, Arif wasn’t interested, as he wanted to focus on learning and only had a limited capital of ₹40,000.

But Irshad convinced him by calling him regularly and asking him to start small. He promised that, after making some profits, Arif could invest more and assured him that losses would be recovered in future trades.

To lure him further, Irshad shared the PnLs of other clients.

Impressed by the profit value and the promises, Arif eventually agreed to take the service.

In the beginning, Arif made some profits and, as agreed, shared 40% of them with the RA. But soon after he increased his capital, things took a turn.

One day, he faced a loss of ₹7,000, and the next, ₹20,000. Even when Arif wanted to square off his positions, Irshad convinced him to hold them without any stop-loss.

In total, Arif ended up losing ₹90,000 in capital and an additional ₹15,000 in profit-sharing payments. When he called Irshad for help, he was advised to add more capital to recover the losses.

By then, Arif had lost all his savings and no longer trusted the RA’s tips.

How We Helped Arif Recover ₹50,000

Arif reached out to our team for assistance in recovering his lost money.

We examined his case and verified the details of the SEBI-registered RA from the bank account information and SEBI registration number Arif had received. The RA was based in Kolkata, but all calls to Arif had come from Mumbai.

Our team drafted a detailed account of the incident and attached the available proof, although Arif had no call recordings since most conversations took place over WhatsApp. However, some chat messages between Arif and Irshad proved useful.

When we emailed the RA, they initially agreed to settle the matter by repaying ₹30,000. But Arif insisted on recovering a larger portion of his lost savings.

Soon after, the RA denied all allegations and sent an email stating that neither he nor his team had promised guaranteed returns or engaged in a trading account handling with profit sharing.

This led us to escalate the case to SEBI. We guided him to register and file a SEBI SCORES complaint. After a few days, SEBI requested additional evidence. Fortunately, Arif had some of the necessary documents, and we were able to strengthen our case.

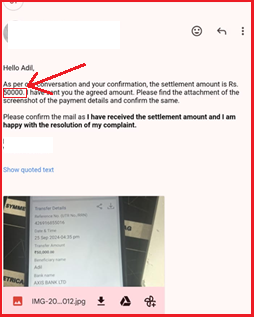

Upon submitting the missing proofs to SEBI, the RA called back and offered to settle for 50% of the amount lost. Finally, Arif agreed on this amount.

After a long, 1.5-month process, Arif finally recovered his losses.

What Arif Learned From This?

Although Arif didn’t recover his entire loss, the experience taught him a valuable lesson: never blindly trust any registered entity, no matter how official they seem.

Instead, focus on learning and gaining knowledge before entering the stock market.