Supreme Investrade and Research Services offers stock market advisory services for Indian retail traders and investors, focusing on equity and options trading.

Like many advisory firms, it claims to help people make sense of market movements through research-backed guidance and trading alerts.

That said, not everyone’s experience has been smooth.

This blog looks at complaints, user feedback, and concerns shared by clients of Supreme Investrade, so readers can get a clearer picture of what working with the firm may actually look like.

Supreme Investrade Review

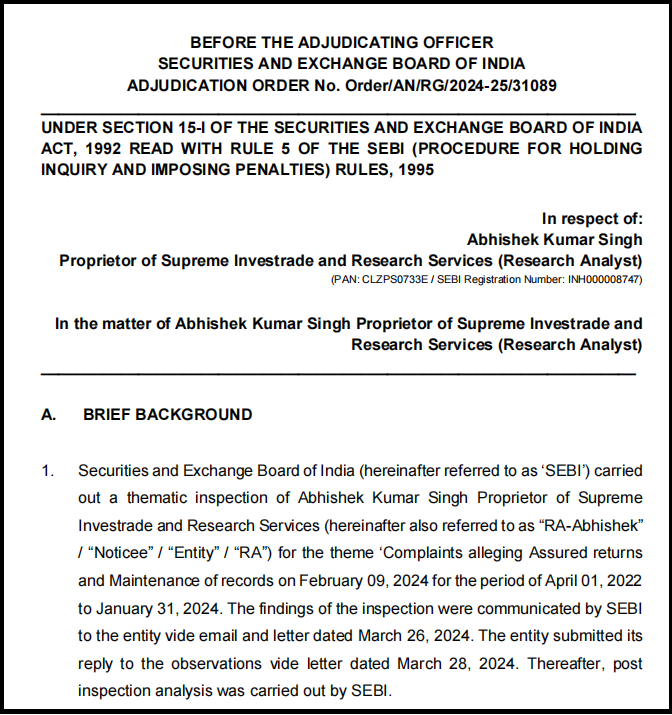

Supreme Investrade and Research Services, operating under proprietor Abhishek Singh, is a SEBI-registered research analyst firm with registration number INH000008747.

This means the firm is authorised to provide research and advisory services in the securities market under the regulatory framework established by the Securities and Exchange Board of India.

The firm is not registered with NSE (National Stock Exchange) as a member or trading participant.

Research analysts are registered with SEBI, not with individual stock exchanges. However, the firm may use NSE data for analysis purposes.

Supreme Investrade functions as a research analyst firm that delivers trading recommendations to its clients.

Key Services Offered:

- Intraday trading tips for Nifty and Bank Nifty

- Options segment research alerts

- Equity segment research recommendations

- Research alerts with target and stop-loss levels

Supreme Investrade Complaints

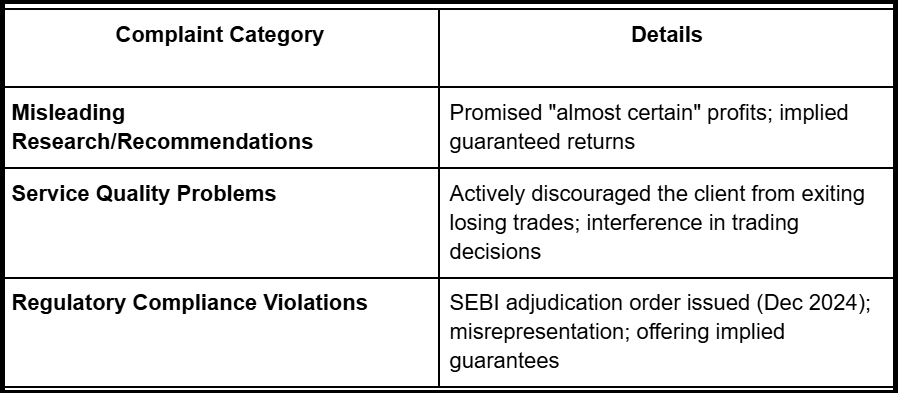

For Supreme Investrade, complaints would fall under SEBI’s Research Analyst complaint framework, which would include:

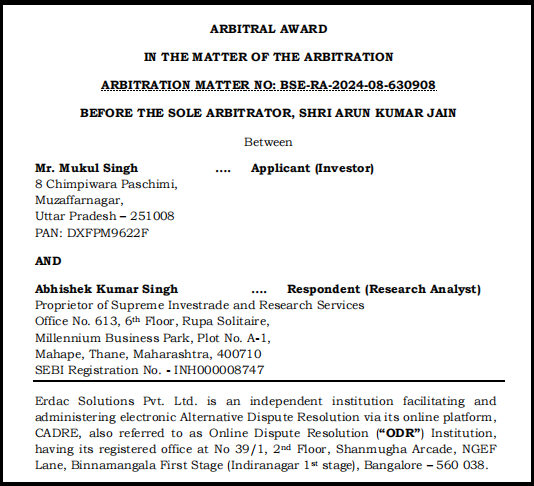

Supreme Investrade BSE Arbitration Case Summary: Investor vs. Advisory Firm

In a recent BSE arbitration case, an investor challenged a registered advisory firm over alleged false promises, pressure-based advice, and financial losses.

The dispute reveals how disclaimers, communication gaps, and advisory influence can significantly impact retail traders.

Let’s take a look at the case applied by Mr. Mukul Singh against the Supreme Investrade and Research Services.

Case Background

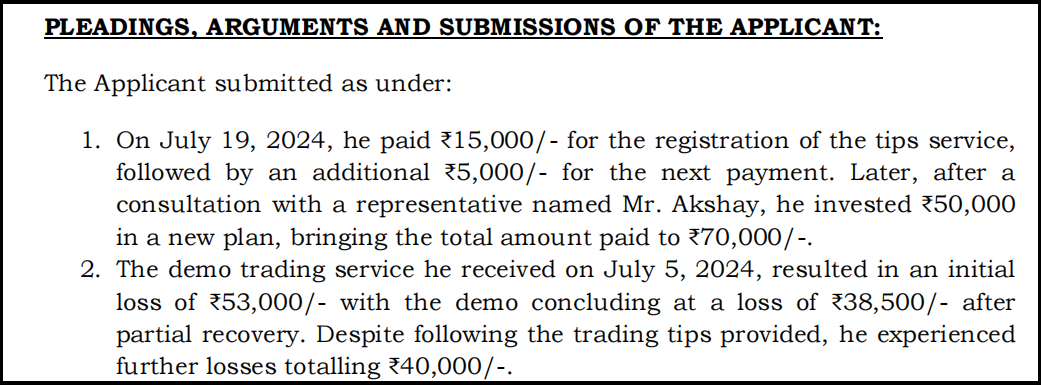

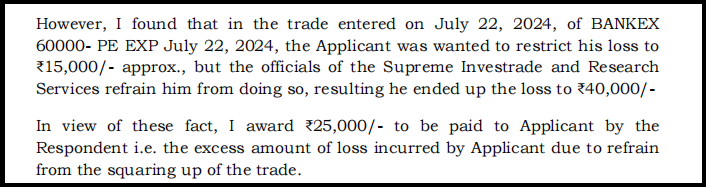

Mr. Mukul Singh paid Supreme Investrade and Research Services a total of ₹70,000 for trading tips.

The firm, he claimed, promised profits and pressured him to stay in a losing trade, which ultimately cost him an extra ₹25,000 on top of his initial acceptable loss.

The firm denied everything, pointing to a standard disclaimer that stated all fees were non-refundable and all market risks were the client’s responsibility.

Investor’s Complaints (Mukul’s Side)

- Paid ₹70,000 in three payments for research and tip services.

- The firm promised profits and showed past performance records to gain trust.

- Wanted to exit the trade at a loss of ₹15,000 to limit damage.

- The firm’s representative told him to wait, promising a recovery.

- The loss increased to ₹40,000 because he did not exit when he wanted to.

- The firm pressured him to arrange more capital.

- Received a link to the trading app late, after trades were already placed on his behalf.

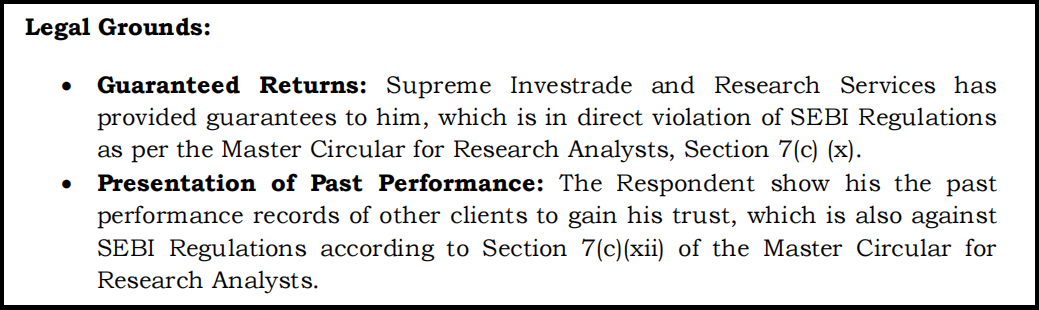

- Alleged violations of SEBI rules on guaranteed returns and conflict of interest.

Firm’s Defense (Supreme Investrade’s Side)

- The investor signed a detailed User Consent Form before receiving services.

- The form clearly stated:

- Fees are non-refundable under any condition.

- No guaranteed profits or fixed returns are offered.

- All market risks are borne by the client.

- Offered ₹15,000 as a goodwill gesture to settle the dispute, without accepting fault.

- Denied all allegations of pressure, guarantees, or delayed service.

Key Evidence Considered

- User Consent Form signed by the investor with a clear no-refund and risk disclaimer.

- Payment receipts for ₹70,000.

- Audio clips and WhatsApp chats submitted by the investor.

- The arbitrator noted the audio contained phrases like “ho sakta hai” (it may happen), which do not legally constitute a guarantee.

- Proof that the investor wanted to exit at ₹15,000 loss but was advised to wait.

The Final Award Decision

- Refund of Fees (₹70,000): Not Granted.

Reason: The investor signed a binding agreement accepting that fees are non-refundable. - Compensation for Trading Loss (₹40,000): Partially Granted.

Reason: The firm’s specific advice to not exit the trade caused an extra loss of ₹25,000, which is compensatable. - Total Award: ₹25,000 to be paid by the firm to the investor within 15 days.

Why This Case Matters to Retail Traders?

- Read Before You Sign: Disclaimers about “no refunds” and “no guarantees” are legally binding if clearly presented and agreed to.

- Your Exit Decision is Key: An advisor should not prevent you from exiting a trade to cut losses. You have the final say.

- Document Everything: Keep clear records of all promises, advice, and communications.

Supreme Investrade SEBI Orders

SEBI’s adjudication against Supreme Investrade exposes how misleading promises, capital inducements, and unauthorised trading guidance can violate investor protection norms.

This case highlights the growing regulatory scrutiny on research analysts and the consequences of non-compliant advisory practices.

Key Allegations by SEBI

The Noticee (Supreme Investrade) was accused of:

1. Misleading Clients with Assured Profits

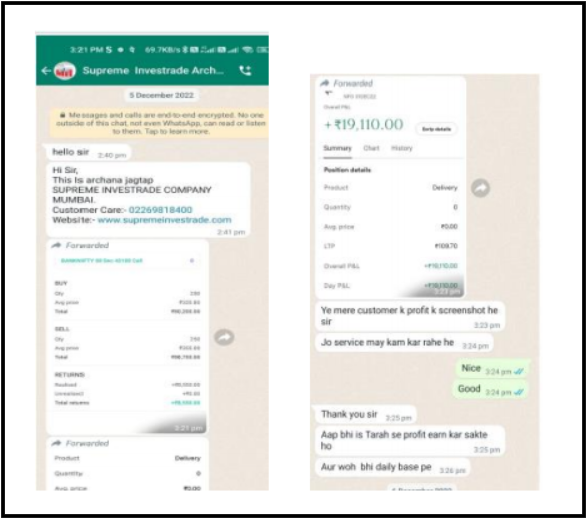

- Sharing screenshots of profits earned by previous clients to show assured returns.

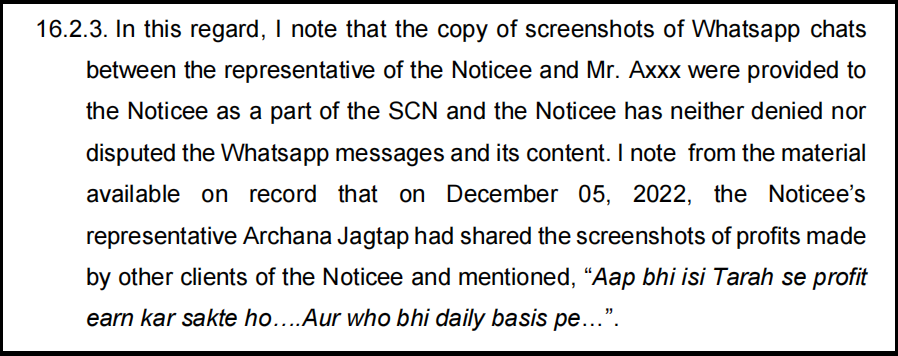

- Example: In the case of “Axxx,” a representative said, “Aap bhi isi Tarah se profit earn kar sakte ho… Aur who bhi daily basis pe…” (You can also earn profit like this… and that too on a daily basis).

2. Inducing Clients to Add More Capital

- Persuading clients to infuse more capital even after they incurred losses.

- Promising to recover losses through subsequent tips.

- Example: In the case of “Axxxxxxx Pxxxxx Sxxxx Jxxxxx,” the firm asked the client to arrange more capital for trading.

3. Handholding and Unauthorised Advice

- Providing exact timing for entry and exit beyond the research alerts.

- Example: In the case of “Jxxxxxxx Sxxxx Rxxxx,” messages like “jaldi buy karo… maximum quantity buy karo” (buy quickly… buy maximum quantity) were sent.

The WhatsApp screenshots show the firm’s representative sharing profit images of other clients and telling the investor that they, too, can earn similar profits on a daily basis.

This exchange was viewed by SEBI as an assurance of guaranteed returns, making the firm’s defence unacceptable.

SEBI’s Findings and Conclusions

The Adjudicating Officer rejected the firm’s arguments and found the following:

1. Evidence of Misleading Conduct

- WhatsApp chats clearly showed representatives promising profits and recovery of losses.

2. Inducing Additional Capital

- The firm admitted to asking clients to add capital so they could trade.

- This was seen as an inducement, especially when clients were already at a loss.

3. Unauthorised Handholding

- Messages directing clients on when and how much to trade went beyond research alerts.

- This constituted mis-selling and unfair trade practices.

4. Violations Upheld

- The Noticee violated:

- PFUTP Regulations (fraudulent/unfair practices)

- SEBI Act (manipulative/deceptive devices)

- Research Analyst Code of Conduct (honesty, diligence, compliance, senior management responsibility)

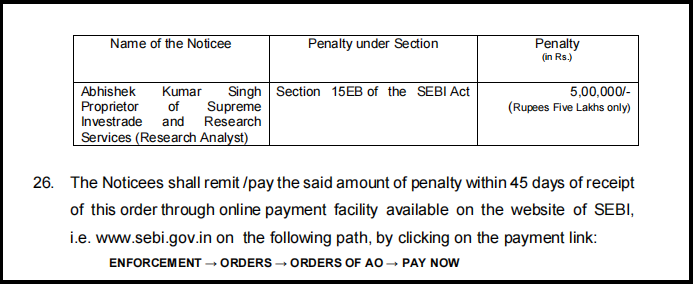

Penalty Imposed

- Penalty Amount: ₹5,00,000 (Five Lakh Rupees)

Reason: Failure to comply with SEBI regulations and directions - Consequence of Non-Payment: Recovery proceedings, including attachment of properties

Why This Case Matters to Retail Traders?

- Be Wary of Profit Screenshots: Past performance sharing can be a red flag for misleading promises.

- Read All Documents: Signing disclaimers may limit refunds, but fraudulent advice is still punishable.

- Report Suspicious Behaviour: SEBI takes action on complaints, even if some are resolved informally.

How to File a Complaint Against Supreme Investrade?

If you’re facing issues with Supreme Investrade or any other research analyst/investment advisory firm, we’re here to assist you.

Our team specialises in helping investors navigate complaint procedures and recover their investments.

How We Can Assist You?

- Expert guidance to file a SEBI SCORES complaint

- Assistance in drafting effective complaint letters

- Help in compiling and organising supporting documents

- Representation throughout the complaint resolution process

Contact us for Support. Don’t navigate this complex process alone. Our experienced team understands SEBI regulations, complaint procedures, and investor rights.

We work to ensure your complaint is properly documented, filed, and pursued until resolution.

Conclusion

Supreme Investrade and Research Services is a SEBI-registered research analyst firm that provides trading recommendations in the equity and options segments of the Indian stock market.

While the firm is properly registered, investors must know that a recent SEBI adjudication order was issued against them in December 2024.

So, what does this mean for you, the potential investor?

A SEBI registration is the bare minimum, not an endorsement of performance or a shield from regulatory issues. Investors should carefully evaluate their needs, understand the risks involved, and verify all credentials before engaging with any research advisory service.

Remember that investment decisions should be based on personal financial goals, risk appetite, and thorough research rather than solely on third-party recommendations.

Stay informed, stay vigilant, and invest wisely!