Your trading app freezes mid-trade. Orders fail. Prices stop updating. And within seconds, real money is at risk.

This is not just trader anxiety, it’s a technical glitch in stock market, and it has affected thousands of Indian investors.

In recent years, repeated system failures across major brokerage platforms have disrupted trades and caused financial losses.

Modern stock trading relies heavily on speed and system stability. But when technology fails, traders are left exposed.

So what exactly is a technical glitch in the stock market, and how can it impact you? Let’s break it down.

What is a Technical Glitch in Stock Market?

According to SEBI’s November 2022 framework, a technical glitch in the stock market refers to any malfunction in a stockbroker’s technological systems that disrupts normal trading operations.

This does not apply only to complete system shutdowns.

A technical glitch may involve issues in hardware, software, network connectivity, or internal processes used by the broker.

Even partial failures fall under this definition.

Importantly, SEBI considers it a technical glitch only when the disruption lasts for five minutes or more.

This includes situations where:

- Trading platforms stop responding

- Order execution slows down

- Price feeds lag or show incorrect data

- Login, fund transfer, or order modifications fail

Such disruptions can directly affect a trader’s ability to enter, modify, or exit positions on time, potentially leading to financial losses.

Because even brief delays can be critical during volatile market conditions, SEBI mandates that brokers report, document, and address such glitches promptly.

In short, if your trading activity is impacted by a system failure lasting 5 minutes or more, it is officially classified as a technical glitch, and regulatory safeguards may apply.

Impact of Technical Glitch in the Stock Market on Traders

On paper, a technical glitch may sound like a short system error. In reality, the impact is immediate and stressful.

Traders often face situations such as:

- Orders are getting stuck or delayed, with no confirmation of execution. In some cases, the order never goes through at all.

- Live market prices freeze for seconds or even minutes, forcing traders to make decisions without real-time data.

- Incorrect or missing bid–ask spreads make it difficult to judge actual market depth.

- Depth data disappearing or showing wrong quantities, rendering strategy-based trading ineffective.

- Duplicate order placements from a single click, leading to unintended overbuying or overselling.

- “Order Rejected by Exchange” errors without any meaningful explanation or system alert.

When milliseconds decide profits or losses, especially in F&O and intraday trading, even a minor technical glitch can spiral into significant financial damage.

This is why trading disruptions are not just technical inconveniences but real risk events for market participants.

Major Stock Market Technical Glitch Cases in India

Technical glitches in the stock market are not limited to broker platforms alone.

At times, even exchange-level system failures have disrupted trading across the country, affecting millions of traders simultaneously.

The following cases highlight major technical breakdowns in India’s stock market infrastructure and explain why such incidents triggered regulatory scrutiny and penalties.

1. NSE Technical Glitch

What began as a normal trading day turned chaotic when Nifty prices stopped updating around 10:06 AM.

Traders panicked. By 11:40 AM, confusion had turned into a crisis.

What Went Wrong?

Is your stock market app not working? Both telecom links between Mumbai and Chennai data centres failed simultaneously.

Their storage network (SAN) also crashed. NSE had no backup ready.

Trading remained frozen for nearly four hours. NSE resumed trading only at 3:45 PM, later extending the session to 5 PM.

But the damage was already done.

Then what is the exact impact on the traders?

Imagine being stuck in an intraday position. No way to exit. Your stop-loss won’t trigger. Your profit target is unreachable.

When trading finally resumes, the market has moved against you.

Auto-squared trades destroyed profits. Missed stop losses amplified losses. Traders were helpless spectators to their own financial ruin.

The Financial Consequences

NSE paid ₹49.77 crore, and NSE Clearing paid ₹22.88 crore, totalling ₹72.64 crore in settlement.

This came after SEBI’s investigation. The findings were shocking.

NSE had a faulty design in its critical trading infrastructure and then lower-than-required capacity to handle peak load.

Even more alarming? NSE and NCL were completely aware that allowing trades without risk management was disastrous, yet they never gave serious thought to moving to the disaster recovery site.

They knew the risks. They ignored them anyway. Traders paid the price.

2. BSE Technical Glitch

What began as a normal trading morning turned stressful for traders when the F&O segment of BSE suddenly went haywire.

Around 10:53 AM, orders across multiple brokers, including Zerodha, started getting stuck in a pending state.

For traders, this meant no executions, no cancellations, and no way to manage positions. By 11:25 AM, connectivity was restored, but the chaos had already left its mark.

What Went Wrong?

A technical and connectivity glitch in BSE’s F&O systems caused orders to freeze.

Despite previous upgrades and past incidents, the exchange’s infrastructure failed to handle live trades efficiently during peak hours.

There were no effective fail-safes or disaster recovery measures in place for such a scenario, leaving traders vulnerable to market movements without control over their positions.

Impact on Traders

Imagine being mid-trade with leveraged positions or complex hedges. Your stop-losses don’t trigger.

You can’t exit losing trades, and your profit targets remain unreachable. When the system came back online, pending orders were executed at unfavourable prices.

Traders watched helplessly as profits evaporated and losses mounted. Anecdotal reports suggested losses reaching several lakhs of rupees in some cases.

Financial Consequences

Unlike some earlier cases at other exchanges, there was no publicly reported multi-crore penalty or formal compensation to traders for the disruption.

The direct financial burden fell on those affected, highlighting a major gap in accountability and risk management.

3. NSE – Bank Nifty Options Glitch

In June 2020, Bank Nifty option prices stopped updating properly during an active session.

Trading wasn’t halted completely. But the screens showed frozen prices. Stale data. Useless information.

Why This Mattered?

Options traders depend on real-time data. A delay of even 30 seconds can mean the difference between profit and loss.

Traders stared at frozen screens as stop-loss orders failed to activate.

Many ended up with losses. Not because of wrong predictions. But because they couldn’t see the actual market movement.

Impact on Traders

- Traders with open Bank Nifty positions, particularly in weekly F&O contracts, found themselves unable to execute new orders or exit existing positions properly. Some limit orders never got executed, while market orders went through at random/unjustified prices, reportedly deviating by as much as ₹100 or more from where the price should have been.

- Many ended up incurring losses, not because of wrong market calls, but because the system failed them: stale feeds, frozen screens, broken execution. What should have been controlled risk turned into avoidable losses.

4. CDSL Technical Glitch

On multiple occasions, CDSL, the primary depository where demat accounts for millions of investors are maintained, suffered technical glitches like CDSL not working or system failure, etc, that disrupted access and sell‑authorisations.

For example, on 4 June 2024, a system failure at CDSL prevented the “TPIN-authorisation” service from working, meaning investors couldn’t authorise the debit of securities from their demat accounts, effectively blocking sale orders.

Similarly, on 21 May 2024, many investors reported being unable to sell shares; the glitch affected the TPIN‑based verification process used by brokers to process sell orders.

Impact on Investors & Traders

- Investors holding stocks in their demat accounts found themselves unable to sell, even though the stock market and brokerage apps were working fine.

- Their orders could not be authorised because CDSL’s backend (TPIN verification) was down. This meant no control over exits, even if market conditions were unfavourable.

- For many, that translated into forced exposure; they were stuck with holdings they might have wanted to exit.

- In volatile markets, a few minutes can change prices significantly. Losses or missed opportunities thus became a real risk, not because of trading calls but due to infrastructure failure.

- For investors using sale triggers or attempting time‑sensitive transactions (e.g. urgent sell-offs, stop orders, margin‑related exits), the outage meant plans got thwarted.

Trading App Glitch

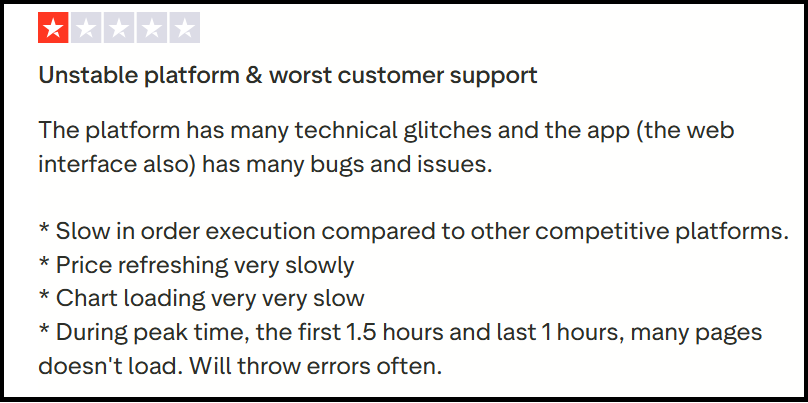

Exchange failures grab headlines. But the broker’s trading app not working, or platform glitches happen far more frequently.

And they’re equally damaging.

Between 2021 and 2023, Zerodha faced as many as 15 technical glitches during trading, leading to customer complaints.

Real User Complaints from Indian Traders

Amit (November 2023 – Consumer Review Platform):

“position show ni kr rha.. mai apna profit book ni kr paya.. aur ab wo minus me hai.. phir bhi mai position show ni hone k kaarn usko cut ni kr paa rha hu.. zerodha ek froud app hai”

The main issue was that positions weren’t showing, and the users couldn’t book profit. Due to this, the users was in a loss.

This reveals a terrifying reality. Your position exists. It’s losing money. But you can’t see it. You can’t close it.

Another Verified User raised concern about recurring technical glitches in the trading app.

These are not isolated incidents. Across multiple glitches, traders find themselves unable to view or manage positions, even as markets move against them.

Losses happen in real time, while the platform leaves them powerless.

Recurring technical failures, coupled with inadequate customer support, turn what should be a trading tool into a source of stress and financial risk.

For investors, it’s a stark reminder: reliability and responsiveness of broker platforms are just as critical as exchange infrastructure.

What to Do When a Technical Glitch Occurs?

Your screen freezes. Panic sets in. But acting smart can minimise damage.

Step 1: Verify the Problem

Check if the problem is widespread by searching “NSE down today” or “NSE technical glitch” on Twitter or Google.

Step 2: Document Everything

Immediately capture:

- Screenshot showing the frozen screen

- Exact timestamp of when it started

- Your pending orders and positions

- Any error messages displayed

This evidence is crucial for filing complaints later. Without proof, your complaint means nothing.

Step 3: Contact Your Broker

Don’t wait. Contact your broker immediately to confirm pending order status.

Step 4: Avoid Further Trading

Avoid placing new orders until the platform is fully operational.

How to Report a Technical Glitch?

Lost money due to platform failure? Don’t suffer silently.

Here’s exactly how to fight back.

1. Report to Your Stock Broker

If the issue is related to the trading app, then first reach out to your stockbroker through email.

- Draft your complaint

- Upload a screenshot with the order details

2. File a Complaint in SEBI

- Go to SEBI’s SCORES portal.

- Register with your email and mobile.

- Choose the relevant category,

- Include all important details like trading ID, time, date, and screenshots.

3. File a Complaint in SMART ODR

Visit the Investor Grievance portal, log in, register a complaint describing the issue clearly, and upload screenshots as proof.

What to Include:

- Your trading account number

- Date and exact time of the glitch

- Description of what happened

- How does it affect your trades

- Financial loss amount

The quicker you file, the better your chances. Most traders wait too long. They lose their right to complain.

Need Help?

Facing a Technical Glitch?

- App or platform malfunction?

- Unexecuted orders or incorrect trades?

- Suffered losses due to exchange/broker system failure?

We Can Guide You With:

Document Everything

- Take screenshots.

- Save order IDs & contract notes.

- Keep broker communication.

File & Escalate Your Complaint

- Filing on NSE’s portal or lodge complaint in SCORES can be complex.

- We simplify the process with step-by-step guidance.

Seek Compensation

- Recovery for technical losses is possible with strong evidence.

- We’ve helped users recover over ₹4 crore from broker & exchange glitches.

If you’re unable to report your complaint effectively, register with us. We’ll help you build your case and navigate the process.

Conclusion

Technical glitches in India’s stock market aren’t rare anomalies. They’re recurring problems affecting thousands of traders daily.

These system failures have caused immense financial damage.

SEBI’s new framework brings hope. Stricter reporting. Mandatory disaster recovery. Public transparency. Financial penalties. These might finally force platforms to prioritise stability. But the responsibility also lies with traders.

The NSE February 2021 case proved accountability is possible. Exchanges and brokers can be held responsible. But waiting for compensation after a loss is painful. And uncertain.

Stay alert. Stay prepared.

Because in trading, the platform failure you don’t prepare for is the one that hurts most.