Imagine an investment opportunity that promises steady 2% monthly returns, only to watch your hard-earned money vanish without a trace.

This is the unsettling reality one investor faced with Thanawala Wealth Management, raising questions about the safety of wealth services in today’s fast-paced financial world.

But is it the real company offering such claims or a scammer using its name to trap people?

In this blog, we dive into the details of the Thanawala Wealth Management investment scam and share a real victim’s story to help you stay informed and protected.

Understanding Thanawala Wealth Management

Thanawala Wealth Management appears as a small firm based in Mumbai’s Borivali West.

It has been registered under the name of Dipen Rashmikant Thanawala since 2017.

It holds GST registration and LEI certification. This means that they are registered to participate in financial-market transactions requiring identification.

Thus, Thanawala Wealth Management is a small independent financial services operator rather than a regulated wealth-management firm.

However, if you notice, there is another platform named Thanawala Investments with the same address and the same proprietorship.

It is involved in financial planning, insurance, and investment services.

It is important to note that if a platform is providing investment services, it must be registered with SEBI.

But Thanawala Investments is not registered as an investment advisor or portfolio manager with SEBI.

But, if we look at it from a broader perspective, there is a possibility that scammers are impersonating the name of Thanawala Investments or Thanawala Wealth Management to trap people.

To protect yourself, it is vital to identify Ponzi scheme tactics early on before any capital is committed.

So, before you think of investing in any of these two platforms. Make sure to do detailed research and check some user reviews.

Let’s turn to one investor’s journey that highlights why caution is key.

A Victim’s Real Experience with Thanawala Wealth Management

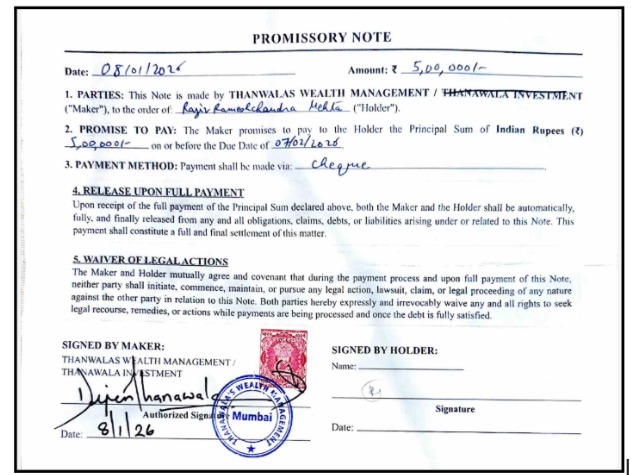

Recently, a concerned investor reached out to us with a detailed account of his ordeal.

He was introduced to Thanawalas Wealth Management/ Thanawala Investment through a family relative who spoke highly of their returns.

Curious and ready to grow his savings, he explored their offerings:

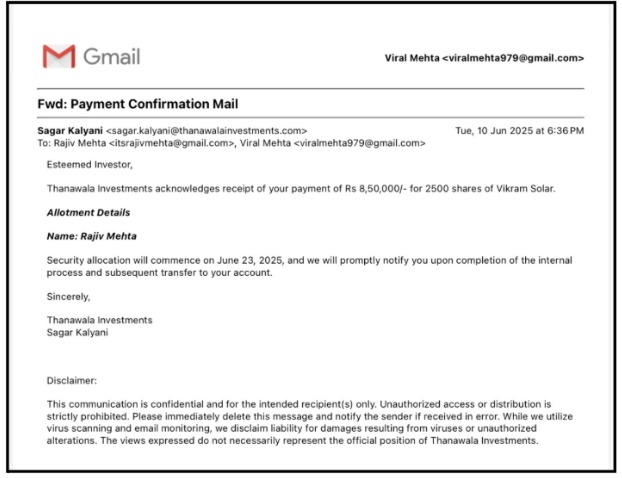

- A “prop desk algo” plan where funds were pooled for algorithmic trading with a promised 2% monthly return.

- An IPO investment in Vikram Solar shares with guaranteed profits.

For the first two or three months, everything seemed perfect as he received those assured 2% payouts, building his confidence to invest more.

But then, the payments abruptly stopped, and his Vikram Solar investment turned sour, with neither the principal returned nor shares delivered.

It closely mimics those scams where that 2% returns for a few months were just a trap to gain trust and incur more investment.

This is how a Ponzi scheme works: early returns lure more investors, but support vanishes when demands increase, leaving innocent investors with no clear explanations.

The victim lost a staggering Rs 30,00,000 in total.

He also shared that in his network alone (people who invested through Thanawala Wealth Management) reportedly lost a collective Rs 150 crores.

He described it as resembling a Ponzi scheme, where early returns lure more investors, but support vanishes when demands increase, leaving innocent investors with no clear explanations.

It’s crucial to note here that we cannot guarantee that this was directly from Thanawala Wealth Management; it could be impersonators using their name to build false trust.

What if someone is pretending to represent them just to scam you?

Stories like this remind us that high-return promises, especially without verifiable credentials, deserve a pause.

If approached by anyone claiming ties to Thanawala Wealth Management, always verify the platform’s authenticity through official channels first.

Is Thanawala Wealth Management Running A Ponzi Scam?

Ponzi scam is a fraudulent investment scheme where returns are paid to existing investors using money from new investors, rather than from actual profit earned by the organization.

The victim’s experience echoes classic Ponzi red flags, like those initial 2% returns that stopped cold after a few months.

Key warning signs from his story include:

- Providing investment services without being registered as an official entity. Thanawala Investments’ Facebook page mentions forex trading, an activity requiring specific SEBI approval that this entity lacks.

- Lack of website or social media presence for both platforms.

- Pooled “prop desk algo” setups promising fixed gains often mask unauthorized trading, as seen in recent Indian prop scams totaling crores.

- Sudden silence on withdrawals and unfulfilled share deliveries, as with the Vikram Solar IPO.

- Lack of customer support when issues arise.

Looking at all these red flags and the real victim story, it is clear that there is a scam that is either operated by Thanawala Wealth Management/Thanawala Investments or is its name being misused by a scammer to trap people.

In either case, the decision to invest in such a platform can be risky.

So, choose wisely and invest carefully.

How to Report Investment Scams in India?

Facing a suspicious investment situation?

Reporting promptly can protect others and aid recovery efforts.

Follow these simple steps to get started in reporting Ponzi scams:

- Report a complaint in Cyber Crime.

- File a detailed complaint, including transaction proofs, chats, and contact details of the entity.

- Lodge an FIR at your local police station under sections for cheating and cyber fraud.

- File a SEBI complaint on the SCORES portal for investment-related grievances.

- Preserve all evidence, like screenshots and bank statements, without deleting anything.

Need Help?

We understand that it gets extremely frustrating to see all your savings vanish in one go to a platform you truly trusted.

But you can beat the scammers in their own game by taking the right steps.

If you need any guidance and support, you can register your complaint with us.

We will make sure that you get satisfactory results.

Conclusion

This real investor’s story with Thanawala Wealth Management underscores how family referrals and early payouts can blind us to risks.

The market is full of scams that often impersonate real platforms so that they can play with people’s trust.

Always prioritize SEBI-registered firms and question unrealistic returns to safeguard your future.

Stay vigilant, verify independently, and share this awareness, because one informed decision today could save you tomorrow.