With the rise of online trading apps in India, investors are always looking for platforms that promise easy access, high returns, and low costs.

One such app gaining attention is TradeKaro, which claims 500x leverage and zero brokerage fees.

But before trusting any platform with your hard-earned money, the most important question is: Is Trade Karo SEBI registered?

SEBI registration is crucial because it ensures legal safety, transparency, and protection for investors. Without it, trading on any app becomes risky, no matter how attractive it looks.

The clear answer is: No, TradeKaro is not SEBI registered.

Even though the app markets itself as modern and professional, offering:

- High leverage options – up to 500x

- Zero brokerage – no fees on trades

- User-friendly interface – sleek and easy to navigate

It does not meet SEBI’s regulatory standards. SEBI registration ensures that a trading platform operates legally, follows government regulations, and protects investor funds. Without it, there’s no regulatory oversight, no guarantee of safety, and no legal accountability.

Why TradeKaro is Likely a Dabba Trading Platform?

Given the types of offerings — extremely high leverage, zero brokerage, and promise of easy profits — TradeKaro shows characteristics of a dabba trading platform.

Dabba trading refers to illegal or unregulated trading where:

- Trades are conducted off-exchange, without proper recording on recognized stock exchanges.

- Investors’ money is handled internally by the company, rather than executed in real market conditions.

- Profits and losses are manipulated by the operator, rather than reflecting actual market movements.

In simple terms, even though it looks like a legit trading app, your trades may not actually be happening on a real exchange, putting your funds at extreme risk.

Risks Of Using TradeKaro Without SEBI Registration

Trading on a platform that is not SEBI-registered comes with significant risks. Many users often wonder Trade Karo app real or fake, which highlights the need to be cautious before investing.

1. High Financial Risk

There’s no protection for your funds. If the platform mismanages your deposits or shows fake profits, there is no safety net.

2. Lack of Accountability

Unregistered platforms are not legally bound to follow rules, resolve complaints, or provide timely customer support.

3. Lack of Transparency

TradeKaro does not clearly disclose its owners or management. This makes it difficult to verify credibility or hold anyone responsible in case of problems.

4. Unrealistic Promises

Claims like 500x leverage and zero brokerage are extremely risky and uncommon among SEBI-registered brokers. These features often target inexperienced traders, increasing the chance of financial loss.

5. Withdrawal Challenges

Many users report delays or difficulties in withdrawing funds, making it hard to access even legitimate profits.

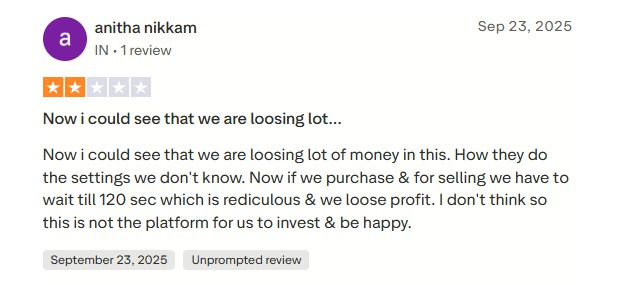

Trade Karo App Complaints

As already mentioned that Trade Karo is not SEBI registered and thus risky for trading.

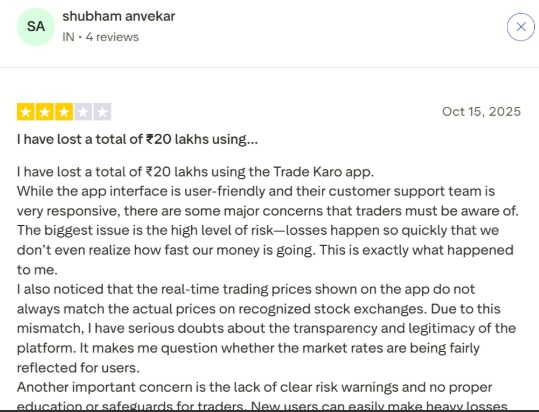

Even after that, if you are willing to trade to reap the benefit of huge leverage, then first check out what users are saying, because the complaints are hard to ignore.

- Several users report unexplained delays during buying and selling, with some saying they’re forced to wait up to 120 seconds before a trade goes through. In trading, that kind of delay isn’t just annoying; it directly causes losses.

- One user even shared that he lost ₹20 lakhs, claiming the app’s prices don’t always match real market rates. That mismatch alone raises serious questions about how transparent and reliable the platform truly is.

Across reviews, the message is the same: confusing settings, fast unexpected losses, no clear risk warnings, and zero guidance for beginners.

In short, many users feel Trade Karo creates more stress than profit, and their experiences are a reminder to approach the platform very cautiously.

How to Report Trade Karo App?

If you (or someone you know) has lost money to an app like Trade Karo, don’t just stay silent. You can file dabba trading complaints, and while it may not always guarantee refunds, it builds a stronger case against such platforms.

Here’s where to go:

1. File a Complaint in SEBI

- Since it is an unregulated platform, you cannot file a complaint in SCORES. However, still report it by sending an email to SEBI.

- Attach screenshots, chat records, bank statements, anything that proves your case.

2. File a Complaint in the Stock Exchange

- Both NSE and BSE have investor grievance cells.

- Even if the app isn’t registered with them, reporting helps build a paper trail.

3. File a Cyber Crime Complaint

- Many of these scams operate through shady apps and WhatsApp numbers.

- Report online fraud at the National Cyber Crime Reporting Portal.

- You can also file a local FIR with the police cyber cell.

Need Help?

Register with us, and we will guide you through the process to report the complaint against such unregulated and fake trading platforms online.

Conclusion

TradeKaro is not SEBI-registered, making it a high-risk platform. Its claims of high leverage and zero brokerage may seem tempting, but without regulation, investors’ funds are not protected, and the app could operate like a dabba trading setup.

Traders should stick to SEBI-registered platforms to ensure safety, transparency, and legal protection. Always verify a platform before investing, and report suspicious apps to SEBI or consumer authorities to protect yourself and others.