In the high-octane world of online trading, few things spread faster than the promise of “easy money” and “guaranteed profits.” And that’s exactly how countless investors find themselves stepping into a trap, one that looks polished on the surface but unravels fast once real money is involved. Lately, one name has been surfacing again and again for all the wrong reasons: TradeNow.

If you’re googling “TradeNow complaints”, wondering whether your funds are truly safe, or trying to make sense of unsettling experiences, you’re not alone.

This blog is written for you. We cut through the noise to uncover whether TradeNow is real or fake, where it stands from a regulatory perspective, and most importantly, what steps you can take if you’ve already been caught in its web.

Stay with us, because what you learn next could save you from a costly mistake.

TradeNow User Complaints

When we look at TradeNow Complaints, a consistent pattern of “The Trap” emerges. Here is a breakdown of what actual users are saying:

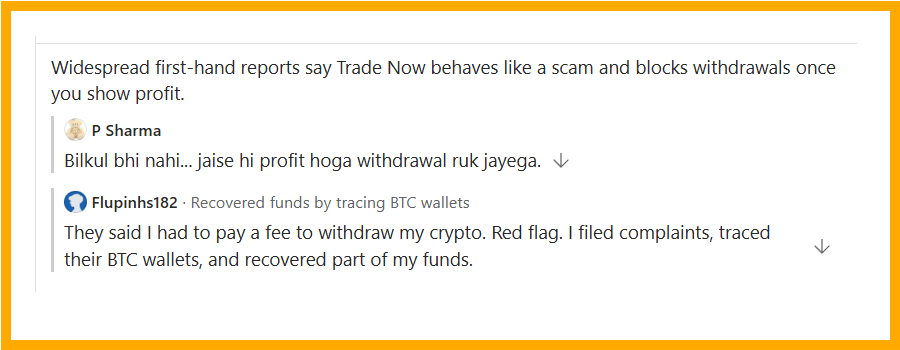

Complaint 1

One user recounts a classic scam tactic. After depositing funds (likely cryptocurrency), they were told they needed to pay an additional “fee” to withdraw their profits.

This is a common ruse employed by fraudulent platforms to extract more money from victims. Legitimate platforms incorporate withdrawal fees into their transparent fee structures, and they certainly don’t demand arbitrary, last-minute payments for withdrawals.

This complaint highlights a critical red flag. Unusual TradeNow withdrawal fees. Any platform demanding unexpected payments to release your funds is almost certainly a scam. The user’s proactive steps of filing complaints and tracing BTC wallets are commendable and show the possibility of recovering funds, though it’s often a challenging process.

Complaint 2

Another complaint vividly describes the core mechanics of the scam. The platform is designed to make deposits easy and losses acceptable, but as soon as a user makes a profit, the withdrawal process grinds to a halt.

This is a clear case of manipulated trading and coercive tactics. Legitimate platforms encourage responsible trading and process withdrawals promptly, regardless of profit or loss. Threatening to confiscate funds is a serious breach of trust and a strong indicator of fraud.

This complaint reveals the predatory nature of TradeNow. They create an environment where the house always wins. If you lose, they profit; if you win, they prevent you from accessing your gains and then threaten you into compliance.

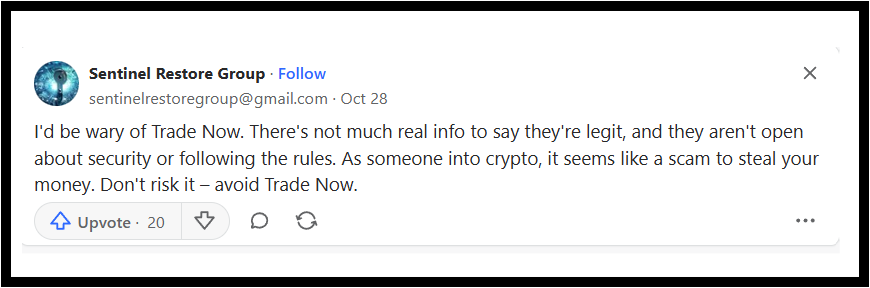

Complaint 3

In another case, the user expresses general caution and suspicion based on the lack of verifiable information and transparency. They highlight the absence of clarity regarding security measures and regulatory compliance. The user, with experience in crypto, identifies it as a potential scam.

Analysis: This complaint summarises many of the red flags we’ve already discussed: lack of legitimate information, absence of transparency, and questionable security practices. The user’s intuition, informed by experience in the crypto space, is a valuable warning.

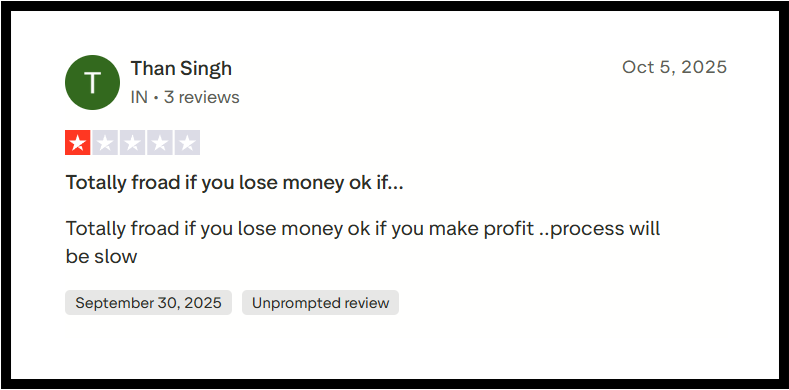

Complaint 4

This short but impactful complaint reiterates the common theme. If you lose money, it’s fine, but if you make a profit, the withdrawal process becomes intentionally slow or blocked. The word “Totally fraud” emphasises the user’s strong conviction that the platform is illegitimate.

This user’s frustration is palpable. They experienced firsthand how the system is rigged against profitable traders.

Complaint 5

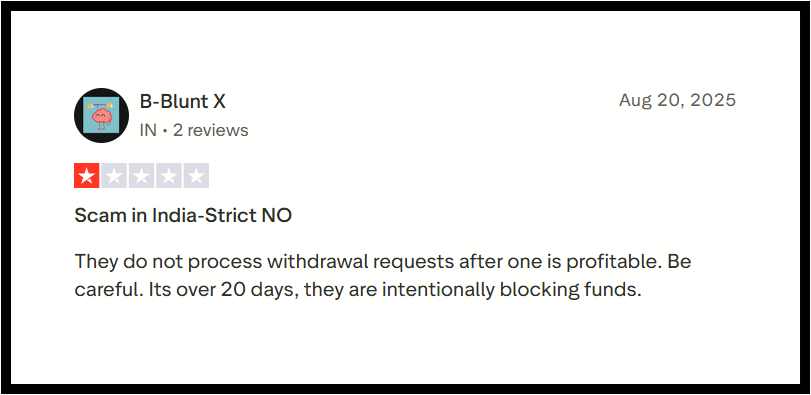

Even in another complaint, the user explicitly calls out TradeNow as a “Scam in India” and provides a concrete example of blocked funds. The user’s withdrawal request has been pending for over 20 days after they became profitable, indicating an intentional withholding of funds.

This directly confirms the intentional blocking of funds for profitable traders. A delay of over 20 days for a withdrawal request, especially after making a profit, is completely unacceptable for any legitimate platform.

A stark warning is served by this complaint. Fraudulent operations often involve the intentional blocking of funds, and it is a clear indication of theft.

How To File a Complaint Against TradeNow?

If you have already invested with TradeNow and are facing issues, here’s what you can do:

Although TradeNow is not a SEBI-registered entity, you can still send an email to file a complaint with SEBI. Other than this-

- File a complaint in Cyber Crime.

- Lodge an FIR at the local police station.

- If you made deposits via bank transfer or credit card, contact your bank immediately to see if they can initiate a chargeback or stop payments.

Need Help?

Dealing with financial fraud can be overwhelming, stressful, and deeply frustrating—especially when it involves trading platforms like TradeNow or similar schemes. Victims are often left feeling uncertain about what steps to take next and whether recovery is possible. You don’t have to navigate this process alone.

By registering with us, you receive structured guidance and hands-on support throughout your recovery journey. Our team works closely with you to ensure every stage of the process is handled clearly, accurately, and efficiently.

How Our Team Helps:

-

Documentation of Proof: We assist you in gathering, organising, and reviewing all relevant evidence, including transaction records, communication logs, platform activity, and timelines. Proper documentation is critical to building a strong and credible case.

-

Drafting of Complaint: Our team helps draft professional and compliant reports, complaints, and formal statements tailored for regulators, financial institutions, and legal entities, ensuring your case is presented clearly and effectively.

-

Filing a Complaint: We guide you through the correct filing process with the appropriate authorities, such as financial regulators, banks, payment providers, and law enforcement agencies, minimising errors and delays.

-

Escalation of Complaint: When initial reports do not receive adequate response, we support strategic escalation by identifying the right channels, follow-up procedures, and additional bodies that may strengthen your case.

While outcomes vary depending on individual circumstances, taking informed and timely action significantly improves your position. Our goal is to reduce confusion, restore confidence, and help you pursue every viable avenue toward resolution and potential recovery.

Register with us today to take the first step toward clarity, structure, and professional support.

Conclusion

The evidence is overwhelmingly clear. TradeNow exhibits all the hallmarks of a fraudulent scheme. The absence of a legitimate online presence, the lack of regulatory oversight, and the consistent pattern of user complaints regarding withdrawal issues and coercive tactics paint a grim picture.

However, investing in a platform like TradeNow is akin to throwing your money into a black hole. You risk not only losing your initial investment but also falling prey to further demands for “fees” or being subjected to threats.

Our strongest advice is to avoid TradeNow entirely. If you encounter any platform exhibiting similar red flags, exercise extreme caution and conduct thorough due diligence before investing any money.