If you’ve been exploring online trading, you might have come across TradGrip on platforms like WhatsApp or Telegram.

It is a trading platform that allows users to engage in forex and stock trading, offering features like account management and market access.

The platform is designed to make trading accessible, with tools and resources aimed at helping investors navigate online markets.

In this TradGrip review, we’ll take a closer look at what the platform offers and how it works.

TradGrip Review

TradGrip Trading platform, an initiative of Zenith Markets PLC, describes itself as a lively CFD (Contract for Difference) trading platform to meet the needs of traders at any skill level.

In fact, it provides the traders with more than 250 instruments to trade, such as forex, stocks like Apple and Tesla, indices, commodities, metals, and cryptocurrencies.

The company provides a proprietary WebTrader along with mobile apps for both iOS and Android, allowing users to access their accounts through the TradGrip login anytime and from anywhere.

One of the reasons for this great convenience is that the users can enjoy fast execution, real-time charts powered by TradingView technology, and no hidden fees.

Everything may appear straightforward, but questions remain. With offshore licensing, weak regulation, and multiple user complaints, many are asking: Is TradGrip legit?

While the platform offers trading features, the lack of regulation and reported issues suggest caution is needed.

Several users in India have shared experiences that point to scams commonly referred to as ‘Pig Butchering’ or ‘Fake Trading Fraud.’

Is TradGrip Safe?

When it comes to online trading, a healthy dose of scepticism is your best friend.

Many people who come across the platform are asking the same question: is it actually safe to invest through this platform?

Well, it cannot be considered safe for Indian users.

Reason?

It is operated by Zenith Markets PLC and regulated under the MWALI International Services Authority (MISA).

That means if anything goes wrong, say, Tradgrip withdrawal issues or a platform shutdown, recovering your money could be almost impossible.

In short, as an Indian trader, one must rely on and trust the platform regulated and approved by SEBI & RBI, respectively.

Any platform outside this regulation itself raises a question.

To summarise, TradGrip sits in a grey area, not outright proven as a scam, but certainly not risk-free.

If a broker operates under weak or offshore oversight, it’s a strong signal to think twice before depositing any funds.

Is Tradgrip Real Or Fake?

TradGrip is an unregulated trading platform that has gained attention on social media channels like Instagram and Telegram.

Many users come across Telegram groups sharing screenshots and “success stories,” which can make the platform look appealing.

However, TradGrip app has not been officially verified on trusted sources like Google Play, and its APK is not available through verified app stores.

Checking the app’s developer details, reviews, and download numbers can help gauge authenticity, and unverified downloads may carry risks to both funds and personal information.

Based on available information and user experiences, the platform should be approached with caution.

Reading trusted TradGrip reviews and doing proper research before installing or investing is the best way to make an informed decision.

TradGrip Scam: Real Cases

Case 1: Investor Unable to Withdraw Funds from TradGrip App

In one of the reported cases, the victim mentioned that she came across the platform on Telegram.

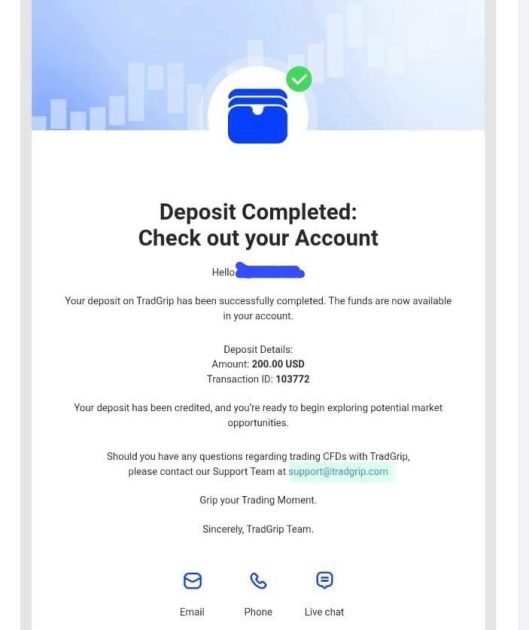

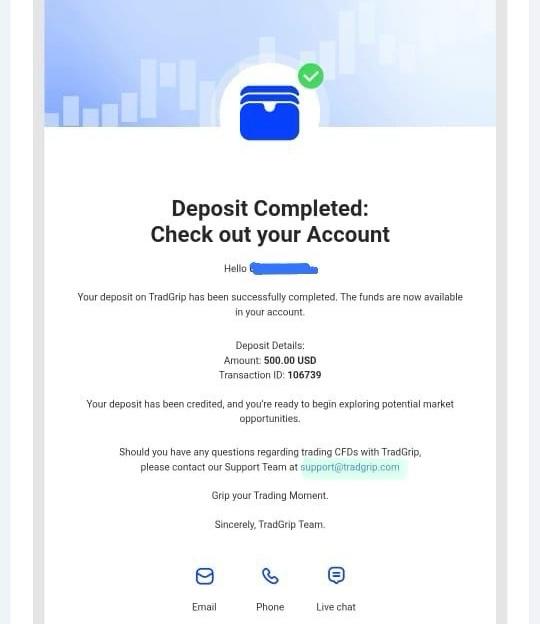

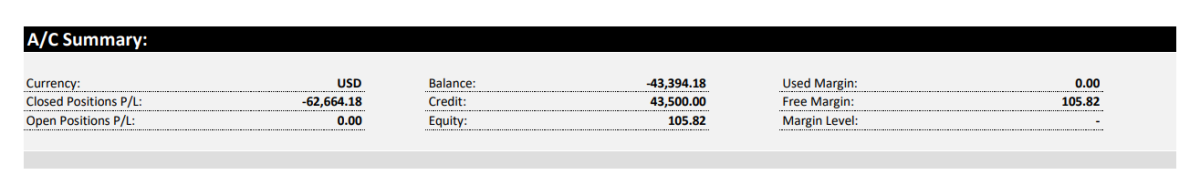

Seeing easy money and opportunity to make money, she downloaded the app and started funding multiple times.

But is unable to withdraw the amount from the Tradgrip app.

Whenever she got the details, it showed that the P/L has been closed and the balance is negative.

We are adding some evidence for your referral-

Case 2: A 69-year-old senior citizen from Thiruvananthapuram, Kerala, was defrauded of ₹1.59 crore in a TradGrip Investment Scam, which has been brought to light through public attention.

The fraudsters first reached the victim through WhatsApp and offered a “free trading course” in order to gain his trust.

After that, they added him to a Telegram group called “Tradgrip Account Manager” and convinced him to invest in the website www.tradgrip.com, which turned out to be a fraudulent site.

The victim had made an initial investment of ₹10,000 and had received a return of ₹27,000, thereby making the scam look real.

When the victim tried to withdraw the money that was accumulated, the fraudsters told him about “technical issues” and forced him to invest even more money.

How to Report Forex Trading Complaints in India?

If you have been victimised by the Tradgrip trading scam or any similar online investment fraud, taking immediate action is very important.

Fast action greatly increases the probability of getting your money back again.

- File a Cyber Crime Complaint: First, you need to report the financial transfer as fraud and then give all the details concerning UPI/bank transfers. The helpdesk works with banks to stop the stolen money from being transferred further in real-time.

- Contact Your Bank: Tell your bank’s fraud department about the illegal transaction and, if possible, request a reversal or stop payment.

- File a Complaint in SEBI (Securities and Exchange Board of India): As this is a fake trading platform, you can inform the authorities by sending an email, attaching all the relevant evidence.

Need Help?

Register with us, and we will guide you through the process to file a complaint.

We have helped multiple victims in getting forex trading scam recovery by guiding them to report a complaint using the right protocol.

Conclusion

Online trading is full of amazing opportunities, but it is also full of very clever scams. Make sure that you always put regulation, security, and transparency first.

If a trading opportunity appears to be overly good, such as a platform that promises you huge profits with a questionable regulatory record, then it is almost definitely a lie. You have to ensure that your money is safe.

Watch out and keep your money safe!