Ever stumbled across a financial advisory service boldly promising “guaranteed returns” and felt that tug of temptation? You’re not alone. In India’s fast-moving and opportunity-rich securities market, such claims often sound too good to ignore. But what happens when those shiny promises fade, and investors are left staring at unexpected losses?

That’s exactly where this story begins.

In a recent and compelling case resolved through SEBI’s cutting-edge Online Dispute Resolution (ODR) platform, an investor we represented didn’t just seek justice, he found it, swiftly and decisively. What followed was a digital-first battle that ended in accountability and recovery.

In this blog, we take you behind the scenes of a real-world case study, where technology met regulation and fairness won, Yogesh Gupta vs. Insight Research. From misleading assurances to resolution at the click of a button, this is a story every investor should read before believing the next “guaranteed returns” pitch.

What Action Was Taken Against Insight Research?

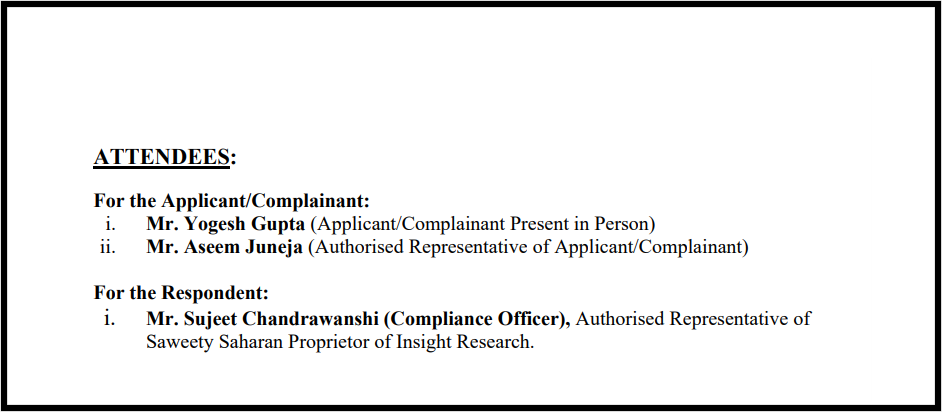

The story unfolds in early 2024, when Yogesh Gupta, an individual investor, locked horns with Saweety Saharan, the proprietor of Insight Research, a SEBI-registered Research Analyst. What began as a routine investor–analyst relationship soon spiralled into a formal dispute, setting the stage for a regulatory showdown.

We standing firmly for the applicant and Mr. Aseem Juneja stepped in as the Authorised Representative and steered the case through every stage of the proceedings.

Adding a modern twist to the process, the matter wasn’t fought in a traditional courtroom. Instead, it was handled via Webnyay, an independent Online Dispute Resolution (ODR) platform empanelled by the National Securities Depositories Limited (NSDL), in line with SEBI’s Master Circular on ODR. This digital forum became the battleground where arguments were heard, documents were examined, and justice began to take shape—online, efficient, and regulator-backed.

In short, this was not just a dispute between two individuals, but a real-world example of how India’s securities ecosystem is embracing technology to resolve conflicts faster and smarter.

Violations Done by Insight Research

Mr. Gupta’s complaint wasn’t just about losing money; it was about how the money was lost. He raised several serious allegations against the Respondent:

- Misleading Practices: Representatives initially offered demo trades that generated minor profits (around Rs. 5,000) to build trust.

- Lack of Diligence: After paying a service fee of ₹56,000, Mr. Gupta incurred a substantial loss of ₹2,30,000. He attributed this to a lack of proper stop-loss or target guidance.

- Regulatory Breaches: The investor alleged violations of SEBI regulations, including misleading performance reports and conducting business primarily over WhatsApp, which lacks the transparency required for official investor dealings.

Insight Research, however, pushed back strongly. They pointed to their Research Recommendation Agreement, arguing that it clearly spells out that they cannot be held responsible for any losses suffered by clients. According to them, the allegations of “assured profits” simply don’t hold water.

The firm insisted that they never promise guaranteed returns, never make performance assurances, and never sell certainty in an inherently uncertain market. In short, their defence was clear: they provide research, not guarantees, and the final investment decision always rests with the client.

Conciliation Details

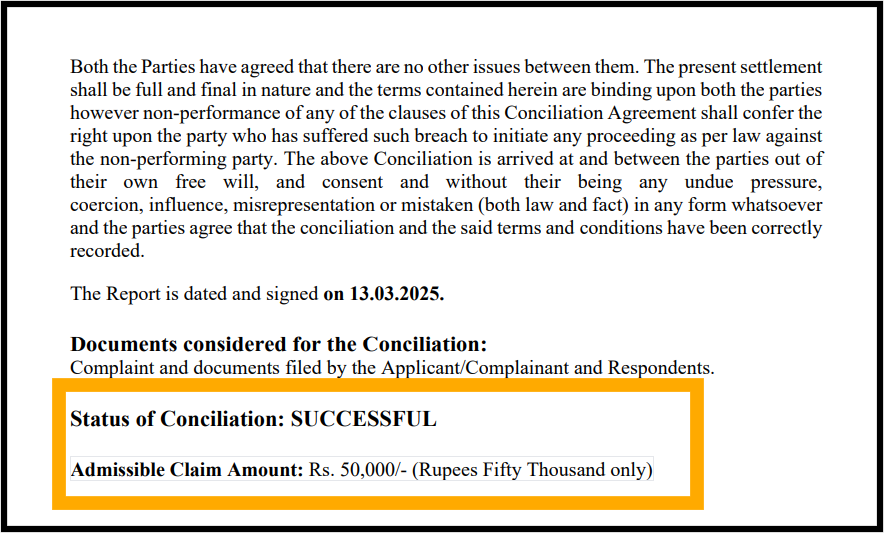

In many traditional legal battles, these two sides would have remained locked in a stalemate for years. However, this case reached a SUCCESSFUL status on March 13, 2025.

A key reason this case reached a successful outcome was the strong and strategic representation of the Applicant, and that’s where our role truly made the difference.

As the Authorised Representative, we stepped in to cut through the complexity of the allegations and ensure the investor’s voice was heard loud and clear. Instead of allowing the issues to be brushed aside as routine “market risk,” we meticulously laid out the evidence, point by point. From unauthorised demo trades to clear violations of SEBI’s transparency requirements, every lapse was documented and presented with precision.

Moreover, we helped Mr. Gupta move beyond the emotional distress of financial loss to focus on the unauthorized trading practices and violations of SEBI regulations.