Seeking quick cash can be stressful, and ensuring a loan app is legitimate is crucial for your financial safety.

The TrustRoot Loan app advertises a partnership with an RBI-registered NBFC, making it seem safe.

However, a closer look at recent user experiences and regulatory guidelines reveals significant red flags.

So, is TrustRoot the helping hand you need, or a potential financial nightmare? Let’s uncover the truth.

TrustRoot Loan App

There is an engagement of multiple entities around this app. This raises questions.

According to Aptoide, the developer is listed as SHIVAPARK FINANCE PRIVATE LIMITED. Meanwhile, the app claims a partnership with Charumati Finance.

This confusion about ownership is a red flag. Legitimate apps maintain clear company information.

According to the RBI’s NBFC list, Charumati Finance Private Limited appears in the registry of registered companies.

Yet, the app’s practices tell a different story.

When you see conflicting company names, especially from entities that are supposed to be responsible for your sensitive financial data, it instantly raises a massive question mark about their legitimacy and accountability.

Is TrustRoot Loan App Legit?

The TrustRoot Loan App, on its app store page, often states that it connects users with a registered NBFC (Non-Banking Financial Company), which is sometimes named as Charumati Finance Private Limited, and that this NBFC is registered with the RBI.

It is worth noting that the app is not directly registered with the RBI. Rather, only the lending entity, the bank or NBFC that it is associated with, is the one that holds the RBI registration.

So, the question that arises here is whether the mentioned partner is real and whether the app is really following the rules set by the RBI.

Well, Legitimate NBFC partnerships must ensure safe and ethical lending.

However, the overwhelming number of serious complaints about predatory behaviour (like short tenures and harassment) directly violates the ethical lending practices prescribed by the Reserve Bank of India (RBI).

A simple claim of being connected to an RBI-registered NBFC does not guarantee the app itself is operating safely or legally.

The user experiences strongly suggest non-compliance and fraudulent activity.

Here is the quick glace on the risk associated with the app:

1. Automatic Loan Disbursement:

“The app may automatically disburse loans.”

Some financial apps or digital lending platforms have features where money can be lent to users without a formal, explicit request for each loan.

This could happen if the app pre-approves users based on their profile, credit history, or activity within the app.

Users might receive loans they didn’t actively apply for, creating a sense of “involuntary borrowing.”

2. Forced Debtors:

“Users become forced debtors without application.”

This is the key risk: receiving money automatically makes the recipient a borrower legally responsible for repayment, even if they never intended to take the loan.

In essence, people are trapped in debt without consent.

Users could suddenly owe money, with legal obligations or interest accruing, even if they didn’t ask for it.

3. Payment Failures:

“Many borrowers face payment failures.”

Once loans are disbursed, some users may be unable to repay on time due to financial strain or lack of awareness about the automatic loan.

This can trigger penalties, fees, or negative credit reporting.

These apps create a high-risk environment where users can easily default on loans, leading to financial stress.

4. The Real Trap:

“Then comes the real trap.”

The “trap” refers to a vicious cycle of debt:

- Automatic loans, Users are obligated to pay, missed payments & Penalties, high interest, or aggressive collection practices.

- In some cases, this can escalate to legal threats or long-term credit damage.

This clearly warns about predatory lending practices in some fintech apps.

These apps might lend money automatically, making users unsuspecting borrowers.

When users cannot repay, the consequences, penalties, compounding interest, and debt collection create a financial trap.

It’s a caution against apps that can push people into debt without their informed consent.

TrustRoot Loan App User Reviews

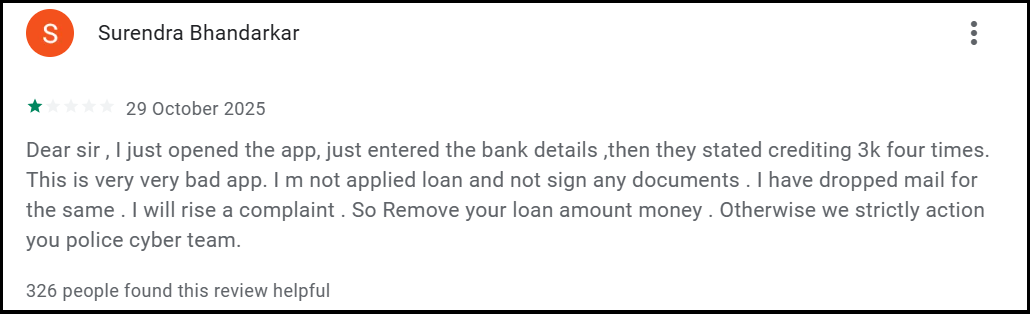

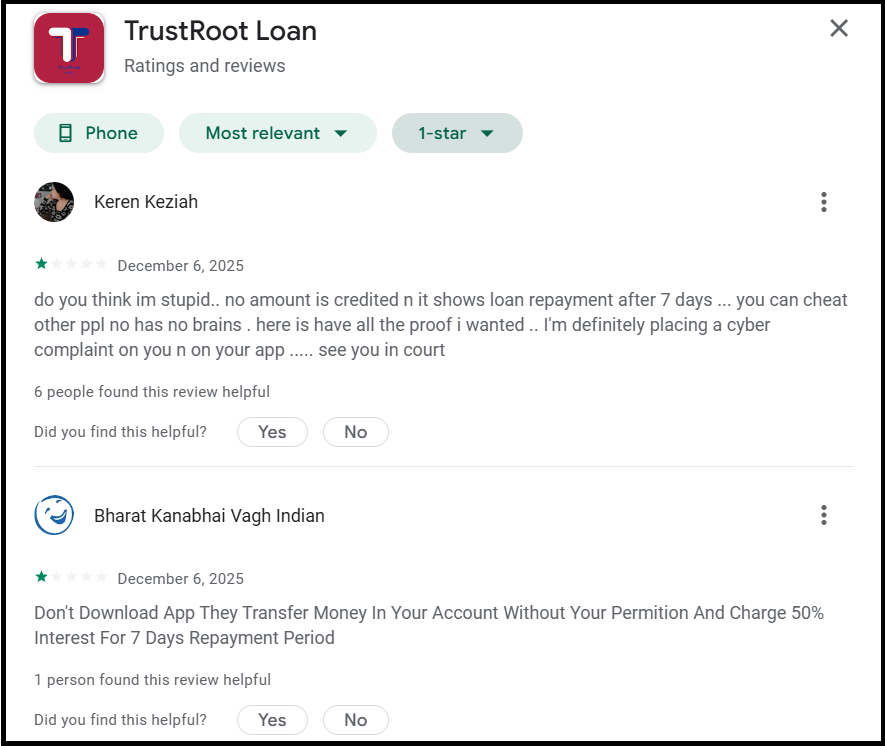

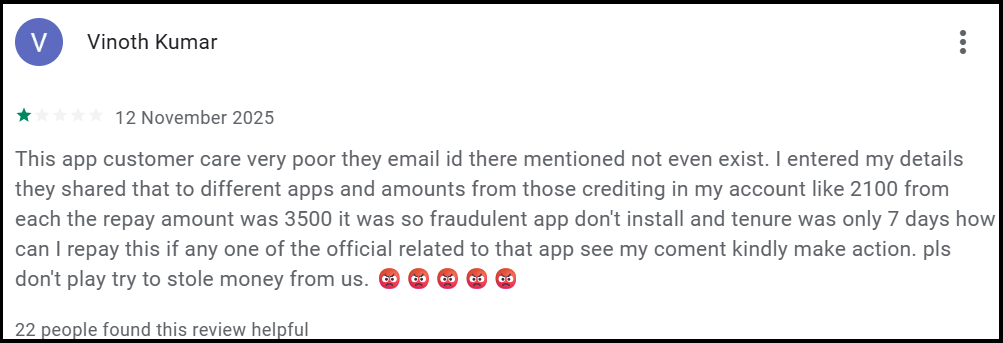

Reports and user complaints across various platforms suggest a disturbing pattern associated with the Trustroot Loan App.

1. As per several reviews, the app started crediting amounts in the bank account without notifying the users. In many cases, the users did not even apply for loans.

2. Another victim faced similar issues. According to the same review compilation, user Aaron reported that immediately after entering bank details, ₹4,000 was credited three times without consent or signed documents.

3. Users report emails going unanswered completely. Support numbers lead to unresponsive agents. Some face harassment even before taking loans.

How to Report TrustRoot Loan App?

Facing issues? Take immediate action now.

National Cyber Crime Reporting Portal

- Register and file a cyber crime complaint at the cybercrime portal

- Include screenshots and transaction proof

RBI Sachet Portal

- File complaints to the RBI against unauthorised apps

- Provide app details and NBFC name

Need Help?

Facing issues with TrustRoot Loan or similar apps?

Register with us if you’re experiencing issues like unauthorised loan disbursals and fraudulent charges.

Don’t suffer alone. Register now for immediate support for such loan app scams.

Conclusion

TrustRoot Loan app operates in murky territory. While technically connected to an RBI-registered NBFC, user experiences paint a troubling picture.

Consistent reports of unauthorised transactions and harassment suggest the app is “more scam-adjacent than safe”.

The pattern is clear: unauthorised disbursals, impossible repayments, and potential data harvesting. Heavy charges on short-term loans trap vulnerable borrowers.

Your financial security matters more than quick cash. Choose wisely.