In today’s fast-moving digital lending space, apps like U Money (along with its many clones) sell a seductive dream: quick cash, instant approval, zero hassle.

Sounds like a lifeline, right? But as 2026 unfolds, a far more disturbing reality is coming into sharp focus.

Behind what seems like a harmless “U Money login” lies a chilling pattern reported by countless users. What begins as a small loan to manage a temporary cash crunch can rapidly descend into a nightmare.

One marked by aggressive threats, morphed photos, privacy invasion, and nonstop harassment. For many, the emotional damage has proven far worse than the financial loss.

If you’re thinking of installing this app, pause right here. And if you’re already caught in its grip, know this: you’re not alone, and you’re not powerless.

Is U Money Login Safe?

The legitimate U-Money app is a digital wallet for bill payments and transfers. However, there is a fake version circulating on third-party websites and social media that advertises “Instant Loans without Documentation.”

The “fake” versions are unauthorised lending platforms. They often use the U Money name or similar branding to appear trustworthy. These apps are not linked to registered Banks or NBFCs (Non-Banking Financial Companies).

Instead of providing financial help, they function as extortion tools.

Think a U Money login is just about typing a password and moving on? Think again. The moment you tap “Allow” and step inside most high-interest apps, you may be opening the door to far more than a loan offer or instant transaction.

When users start questioning whether U Money is real or fake before login, they often find themselves at a dangerous crossroads.

Here’s what really happens during that innocent-looking login.

As soon as permissions are granted, the app can quietly start digging through your phone. Your contact list, every saved name and number, can be pulled in.

Your photo gallery, filled with personal moments you never intended to share, may become accessible. Your location can be tracked in real time, and your SMS inbox can be scanned to read OTPs and monitor financial transactions.

And here’s the uncomfortable truth: if the app isn’t clearly verified or regulated by the RBI in India, that login is not safe at all.

You’re not just signing in, you’re potentially handing over the keys to your private life to unknown players who may use this data for harassment, pressure tactics, or outright fraud.

So before you hit “Allow,” pause for a second. Because with these apps, logging in isn’t a small step. It can be a lifelong access pass.

U Money User Complaints

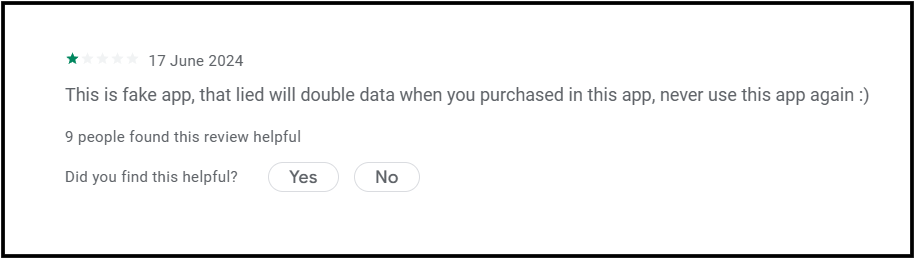

Dig a little into user complaints about the U Money app and you’ll quickly realise the issue goes far beyond a disappointing star rating. What starts as mild frustration soon turns into serious questions about trust and even login security.

One user flat-out calls the app a scam, claiming it lured them in with promises of doubling their data after purchase—promises that allegedly vanished the moment money changed hands. According to them, the experience was enough to swear off the app for good.

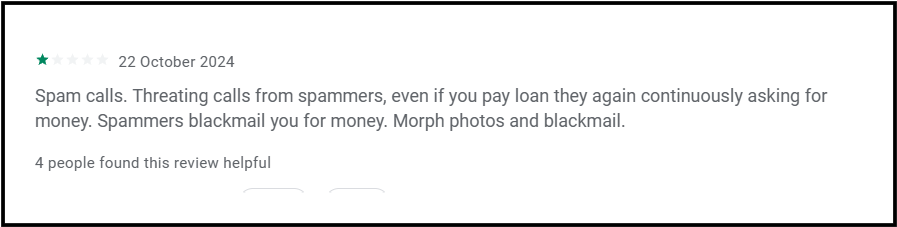

Another review paints an even darker picture. After taking a loan, the user says the trouble didn’t stop at repayment. Instead, they were bombarded with spam and threatening calls, repeatedly pressured for more money even after paying what they owed.

The most alarming allegation? Blackmail tactics, including photo morphing, were used to intimidate users into sending more cash.

How To Report Fake apps?

If you are being blackmailed, do not pay more money. It will not stop the cycle. Instead, follow these professional steps immediately:

- Take screenshots of the threatening messages, the morphed photos (as evidence), the call logs, and your payment receipts. Do not delete the app until you have captured the “Developer Info” from the Play Store.

- File a Cybercrime Complaint.

- Go to your local Cyber Cell. Present your evidence and demand an FIR against the app’s developers.

- Go to the app’s page on the Play Store, click the three dots in the top right, and select “Flag as inappropriate.” Choose “Harmful to device or data” or “Hateful or abusive content.”

Need Help?

If you are feeling overwhelmed and don’t know where to start, we can help guide you through the official reporting process. Register with us.

Conclusion

The convenience of an “instant” digital loan is never worth the price of your privacy and mental peace. The U Money login screen can be a gateway to a sophisticated extortion racket.

If you have been targeted, remember that you are the victim of a crime, not a “bad borrower.”

By coming forward and reporting these fraudsters, you help break the cycle and protect the next person from falling into the same trap.

Stay safe, stay informed, and never grant your gallery permissions to a stranger.