In 2026, digital lending feels like a blessing and a trap rolled into one. With just a few taps, loan apps promise instant cash when you need it the most. But what happens when that “quick help” quietly turns into a nightmare you never signed up for?

That’s exactly what’s unfolding right now.

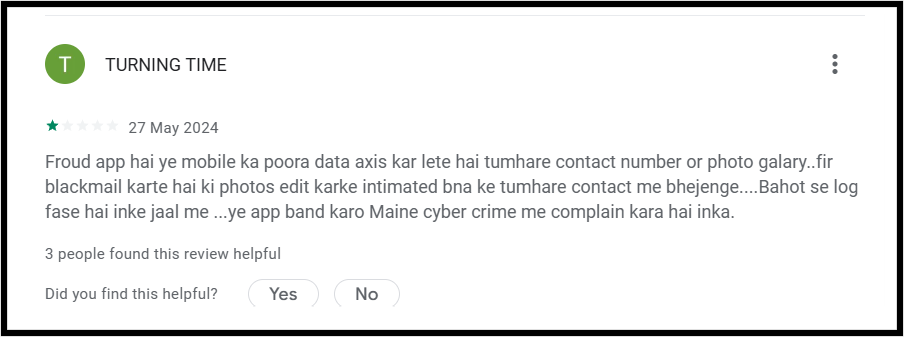

A flood of alarming reviews on the Google Play Store has dragged U Money into the spotlight, and not for reasons any borrower would want to see.

Stories of stress, confusion, and regret are piling up, leaving many users asking the same uneasy question: Is U Money real, or is it fake?

If you’re considering downloading the app, or worse, if you’ve already been pulled into its web, pause right here. This blog isn’t just another warning. It’s your survival guide. Let’s break down what’s really happening behind the screen, so you can protect your money, before it’s too late.

Is U Money App Real or Fake in India?

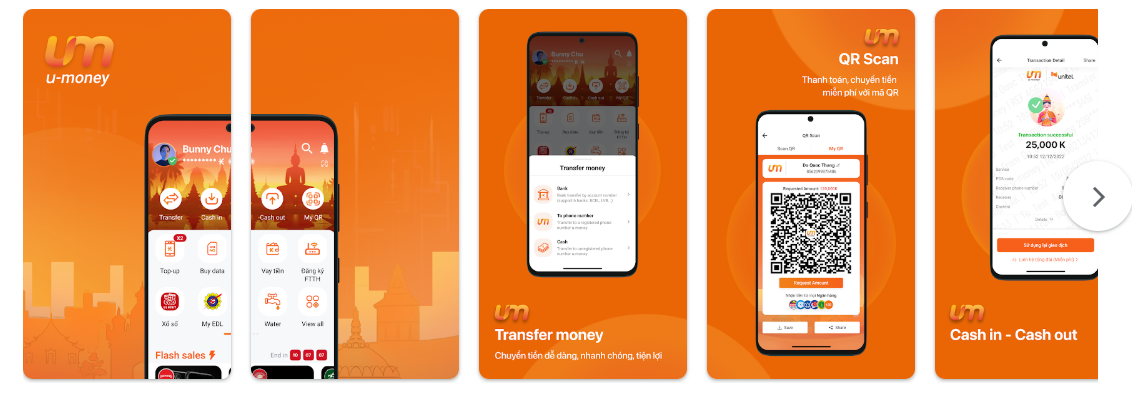

The name “U Money” is used by several different services globally, which is exactly how fraudsters hide. While there are legitimate digital wallets, there are dozens of “cloned” or “fake” loan apps using this name to target users in India and other regions.

It enables users to perform cash-in and cash-out transactions, transfer money, pay Unitel’s mobile and internet bills (often with a discount), and access general utility payment options.

The other U Money loan app is questionable. At first glance, U Money markets itself as an “instant personal loan” provider.

It promises low-interest rates, minimal documentation, and approval within minutes. However, according to user reports, the app doesn’t function as a lender. Instead, it acts as malware.

The “loan” you receive is often just a fraction of what you asked for, with a tenure as short as 7 days, and that is where the nightmare begins.

People keep asking whether the U Money app is real or fake, so let’s clear the confusion.

The truth is, it’s not “fake” in the way people usually think. It actually exists. You can find it, download it, and in many cases, it even gives you a loan. And honestly, that’s what makes it dangerous.

Most scam loan apps don’t show up waving red flags. They slip into the Play Store pretending to be something harmless — a money manager, a finance tool, sometimes even something totally unrelated.

Once you install it, they suddenly offer a quick loan. No paperwork, no questions. Sounds convenient, especially if you’re in a tight spot.

Then comes the catch.

To process the loan, the app asks for permissions, contacts, photos, media, and sometimes call logs. A lot of people allow it without thinking twice because it feels normal.

But the moment you do that, you’ve basically handed over your personal life.

From there, things can go downhill fast.

If you miss a payment or even delay it by a day, the tone changes completely. Calls start coming in. Messages get aggressive. In some cases, they start contacting people from your phonebook.

Friends. Family. Colleagues. There have even been reports of photos being misused just to scare people into paying.

And the worst part? The amount they demand often has nothing to do with what you actually borrowed. Hidden fees, insane interest, and penalties that were never clearly explained add up quickly.

People assume that if an app is on the Play Store, it must be safe. Unfortunately, that’s not always true. These apps keep changing names, companies, and listings just enough to stay under the radar.

So no, U Money isn’t “fake.” It’s real, and that’s exactly why you need to be careful.

Any app offering instant loans while asking for access to your contacts and personal data should immediately make you pause. Quick money isn’t worth the stress, fear, and loss of privacy that can follow.

Is the U Money App Safe?

When you attempt a U Money login, you aren’t just entering a portal for a loan; you are often granting an unverified app full access to your contacts, gallery, and location. This isn’t a standard credit check. It’s the setup for a digital shakedown.

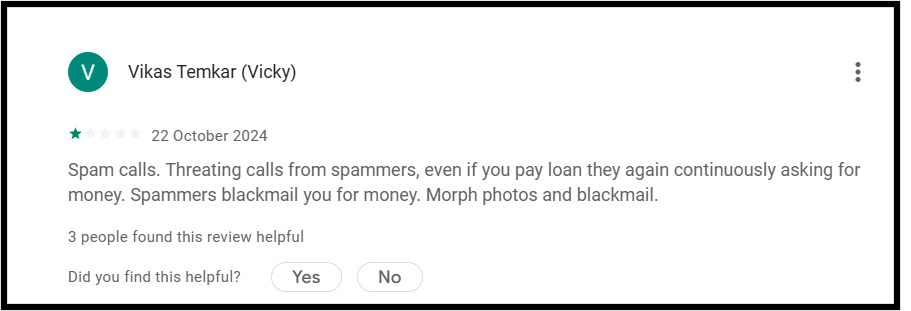

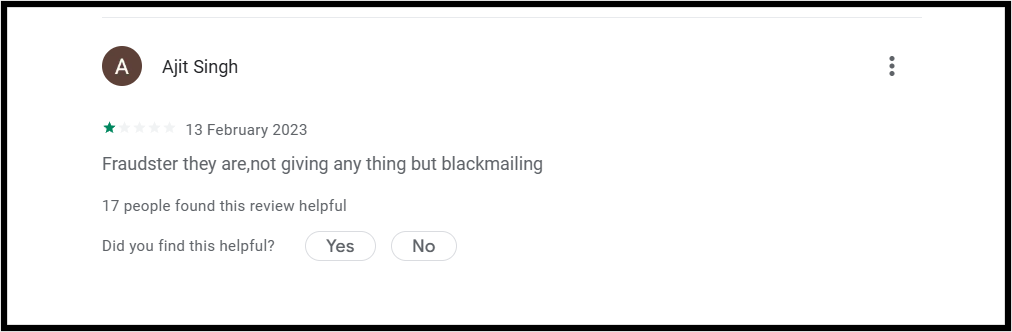

Based on recent user experiences and clear warnings on the Play Store, multiple versions of the U Money app are being flagged as scam-heavy and abusive.

The danger starts the moment you install it. Almost immediately, the app demands access to your Contact List and Photo Gallery.

Sounds harmless? It’s not. This access isn’t about improving your experience. It’s about collecting ammunition.

Your friends’ phone numbers and your private photos quietly get pulled into their system, ready to be used against you later.

The real nightmare begins if you miss a payment by even a single day, and in some cases, victims report harassment starting even before the due date.

Your phone lights up with nonstop calls. These aren’t polite reminders or professional bank agents. They are aggressive, abusive, and threatening. Callers shout, insult, and intimidate, often dragging your family into the conversation to increase pressure and fear.

But the most disturbing red flag reported by victims goes far beyond spam calls. This is where things turn truly sinister. Using the photos stolen from your gallery, scammers allegedly morph them into obscene or nude images.

These fake images are then sent directly to people you know. Your father, your boss, your relatives, or close friends, purely to humiliate and blackmail you into paying more money.

How To Report Fake U Money App?

If you are a victim, do not suffer in silence. The law is on your side.

- File a complaint at the National Cybercrime Portal. Provide screenshots of the threats and the app’s Play Store link.

- Use the RBI Sachet portal to report illegal lending apps. This helps the regulator track and ban these entities.

- Go to the app’s page on the Play Store, click the three dots in the top-right corner, and select “Flag as inappropriate.” Choose “Harmful to device or data” or “Hate speech/Harassment.”

- If they are circulating your photos, go to your nearest Police Station and file an FIR. This is essential for your legal protection.

Need Help?

If you have been a victim of such app scams, you can register with us. Our team of experts will assist you in filing your complaint online effectively and safely.

Conclusion

The U Money App (and its many clones) is a dangerous tool used by cyber-criminals to exploit financial vulnerability. By using high-pressure tactics, illegal data access, and social shaming, they aim to trap you in a cycle of debt and fear.

Your safety is more important than a 7-day loan. If an app asks for your gallery access and promises “instant cash” with no documents, run the other way.