Have you ever heard someone whisper, “Bhai, original market se zyada leveraget yahan milta hai”? Or someone promising “no tax, no SEBI issues, instant trading”?

That world is Dabba Trading. And the more you read real cases, the clearer it becomes: this is not a shortcut. It’s a trap.

Before you lose money, trust, or peace of mind, let’s understand why investors must stay far away from it.

Let’s find out: why should investors avoid dabba trading through this blog?

How Dabba Trading Works?

The word “Dabba” literally means box in Hindi, but in the trading world, it hides something far more dangerous.

Imagine this: you think you’re placing trades in the stock market, buying shares of Reliance or Tata.

You see prices moving, charts updating, profits and losses flashing on your screen. Everything looks real. But behind the scenes, your trades never leave a private “box.”

That box could be a handwritten diary or a software system controlled entirely by a Dabba operator. Nothing you do reaches the NSE or BSE. No shares are bought.

No orders are placed. You’re not investing at all; you’re simply betting against the operator on whether the price will go up or down.

And here’s where the trap gets even more tempting.

In a regulated market, buying ₹1,00,000 worth of shares usually requires a healthy margin and strict rules. But in Dabba trading, the operator dangles a thrilling offer: 500x leverage.

Sounds powerful, right?

With just ₹200, you’re told you can “control” ₹1,00,000 worth of stock. It feels like a shortcut to big profits. But the math tells a brutal story.

A price movement of just 0.2% in the wrong direction is enough to wipe you out completely. That’s it, your entire capital is gone in seconds. No warning. No recovery. No exchange protection.

What feels like smart trading is actually high-risk gambling, dressed up as investing. And the house, the Dabba operator, always has the advantage.

If it sounds too easy, too fast, or too good to be true, it probably belongs in a box you should never open.

Why Dabba Trading is Risky?

Dabba trading looks like normal stock trading from the outside. But none of it touches NSE or BSE.

Everything happens inside a private network, controlled by an operator sitting in a room, often with a laptop, a terminal, and a long list of victims.

Dabba operators run parallel markets. They mimic real prices, but the outcome is fixed because they control the books. It’s a bet, not a trade.

And the worst part? You have no legal protection because dabba trading lives in the shadows.

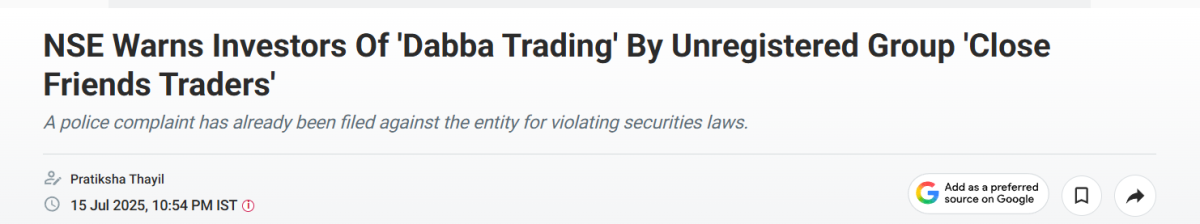

- SEBI publicly stated that dabba trading is illegal, carries high financial risk, and has no investor protection at all. Even ads promoting dabba trading were flagged as “dangerous”.

- NSE issued its own warning, saying unregistered groups operating dabba rings pose a severe fraud risk and often target “close friends and traders who trust each other”.

Dabba Trading Scams

Let’s talk about what’s happening across India because the complaints are becoming louder and scarier.

Scams are spreading through:

- Telegram/WhatsApp groups

- Fake trading apps

- Private UPI networks

- Personal references

- “Guaranteed profit” schemes

People are losing savings, salaries, and years of financial stability. Below are real cases that show how deep this runs.

Case 1: Mumbai Flat Busted – 3 Arrested

Police busted a full-fledged dabba trading setup operating from a Mumbai flat.

Inside, they found multiple computer terminals, fake trading software, cash records, and logs of hundreds of victims

Operators were running “private trades” and collecting money from unsuspecting retail traders who believed they were investing in the real market.

The lack of regulation means you are at the mercy of the operator. When the police knock, or the operator vanishes, your capital is gone. Always stick to SEBI-registered brokers to ensure your hard-earned money stays safe.

Case 2: Noida Man Loses ₹64 Lakh in Illegal Stock Scheme

A man from Noida was lured into what appeared to be a professional trading service. They promised daily profits, fast payouts, and expert-run trades.

He deposited money in multiple transactions. When he asked for withdrawal, they stopped responding. His total loss: ₹64 lakh.

In this case, the police confirmed the accused had no licenses. Moreover, they were operating entirely outside the law. This indicates a total lack of safety for your money.

The Noida dabba trading scam is a tragic example of financial fraud. It shows that even “verified-looking” apps can be total fakes. The biggest lesson here is to always check SEBI registrations.

How to Report Dabba Trading?

If you have lost money or suspect that you were involved in a dabba trading setup, it’s important not to stay silent.

Prompt reporting increases the chances of action and helps prevent others from being affected.

Here are the steps you can take:

- File a complaint in cyber crime:

- File a complaint on the National Cyber Crime Reporting Portal.

- Select “Financial Fraud” and upload all supporting evidence, including screenshots, chat records, UPI or bank transaction proofs, app details, and website links.

- After submission, note down the complaint number for follow-up.

- Approach the Nearest Cyber Police Station:

- Visit your nearest cyber police station and file an FIR.

- FIRs help authorities trace operators, shell accounts, payment routes, and digital infrastructure used in dabba trading operations.

- File a Complaint with SEBI:

- If the platform or individual claimed to provide trading access, investment advice, or brokerage-like services, file a complaint on SEBI’s SCORES portal.

- This helps SEBI take regulatory action against unregistered and illegal market participants.

- Report to the MCX (Multi-Commodity Exchange):

- If the activity involves commodities trading or MCX-linked contracts, submit a complaint through the MCX Investor Grievance / Reporting Portal.

- MCX collects information on illegal and off-market trading activities and forwards credible cases to regulators and enforcement agencies.

Need Help?

If you’re confused, overwhelmed, or scared after losing money, you’re not alone. But dabba operators thrive on that silence.

Register with us, and we can help you:

- Draft the complaint properly

- Organise your evidence

- Understand which authority to report to

- Track your case step-by-step

Support matters. And you don’t have to fight this alone.

Conclusion

Dabba trading is illegal, unregulated, and dangerous. If someone offers you a “better version” of the stock market, walk away.

If an app promises zero tax, zero SEBI issues, instant returns, run.

Real trading happens on NSE, BSE, through SEBI-registered brokers. Everything else is a gamble where the house always wins, and you always lose.