Imagine this: You just sent ₹50,000 to your “trusted” investment adviser. Your phone rings. You pick up, excited about the stock tips that’ll double your money.

But the voice on the other end isn’t your adviser. It’s a dial tone. You’ve been blocked.

This is the Winway Research story. Where certified might not mean safe.

Winway Research Review

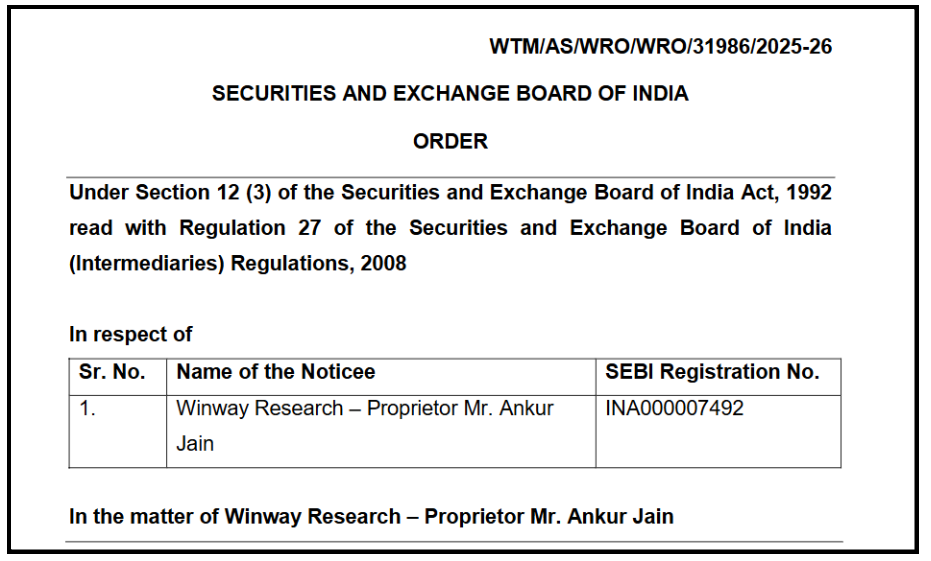

Ankur Jain runs Winway Research, a SEBI-registered investment advisory firm (Registration No. INA000007492) based in Indore, Madhya Pradesh.

In reality? SEBI just slapped him with a ₹7 lakh penalty and a formal censure for systematically cheating his own clients.

How Winway Research Operates?

Jain’s business model is simple:

- Attract clients with promises of premium stock tips and derivative strategies

- Charge hefty fees for “exclusive” packages (Cash Tips, Future Tips, Options Premium)

- Provide advice through calls and messages

- Collect more money by upselling additional packages

- Block clients who complain or ask for refunds

What makes it worse? He does this under the protection of SEBI registration, which is supposed to guarantee investor protection.

Winway Research User Experiences

Here is a summary of real investor complaints and experiences based on the SEBI orders against Winway Research:

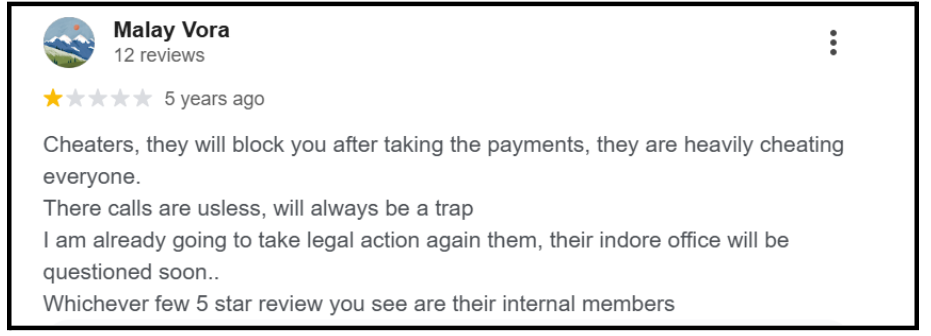

1. “They Block You After Taking Your Money”

Clients paid for services but got nothing in return. When they tried to contact Winway Research, they were simply blocked.

Malay warned others years ago. But the scam continued. SEBI only acted in 2024 after multiple complaints piled up on SCORES.

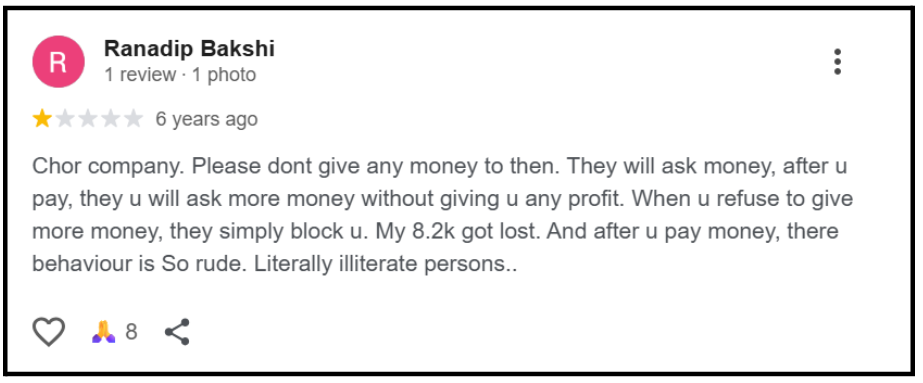

2. “They Keep Asking for More Money Without Giving Any Profit”

This is the classic trap. First payment gets you in.

Then they demand more for “premium packages” or “upgrades” to recover your losses. But profits never come.

SEBI discovered that Jain charged clients for overlapping services and routed payments to employee personal accounts.

Ranadip’s ₹8,200 likely went into one of those untracked accounts.

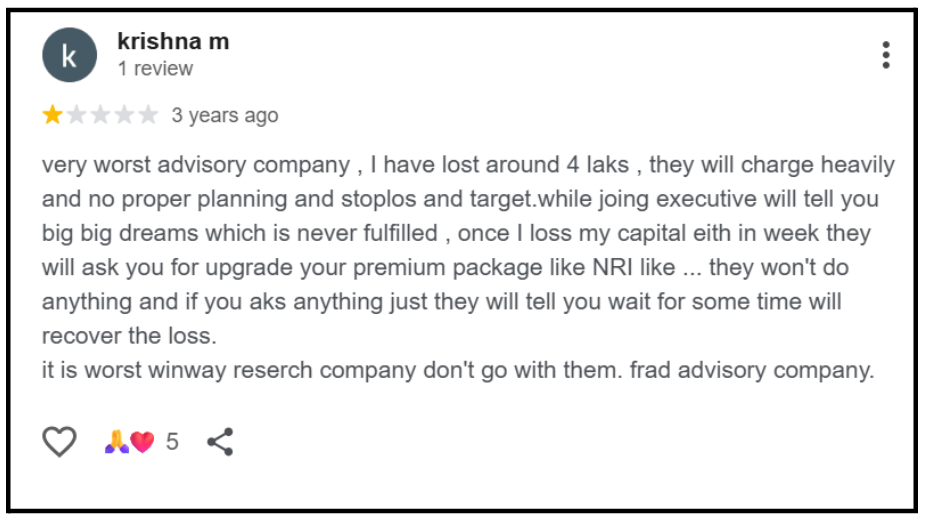

3. “Fraudsters Who Will Make You Lose Everything”

Instead of making profits, clients lost their entire capital. Poor advice led to massive trading losses. Then came the upselling pressure.

Krishna lost ₹4 lakhs following Winway’s advice. SEBI found that Jain’s calls were useless because he failed to maintain mandatory call records.

There’s no accountability. No proof of what was promised. Just empty pockets for investors.

SEBI Order on Winway Research

The Securities and Exchange Board of India (SEBI) has issued a regulatory censure against Winway Research – Proprietor, Mr Ankur Jain, for multiple violations of SEBI regulations.

The order, dated January 21, 2026, follows an enquiry into complaints received through the SEBI SCORES portal and subsequent investigation by a Designated Authority.

Key Violations Found Against Winway Research

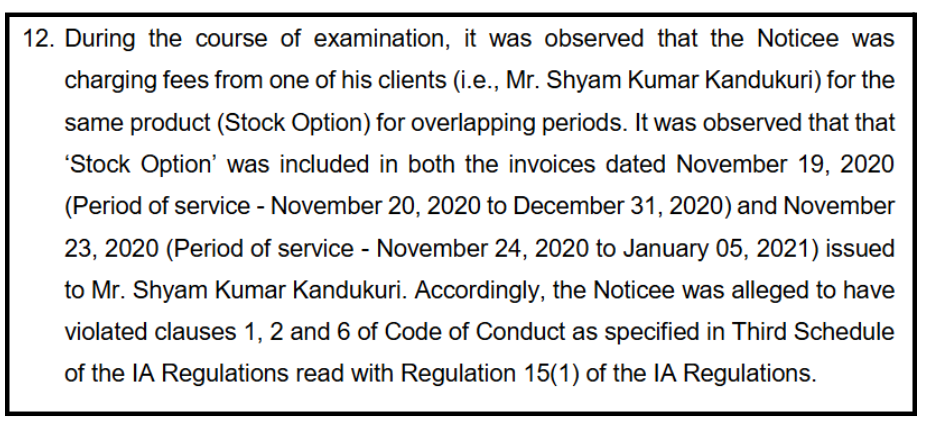

- Charging Fees for Overlapping Periods

The Noticee charged a client, Mr Shyam Kumar Kandukuri, for the same service (“Stock Option”) during overlapping periods.

Two invoices were issued in November 2020 for overlapping dates, both including the same service.

Violation

- Breach of Code of Conduct under the IA Regulations (Clauses 1, 2, 6).

- Failure to act with honesty and fairness towards clients.

This practice misleads clients into paying twice for the same service, eroding trust and violating the fiduciary duty of an investment adviser.

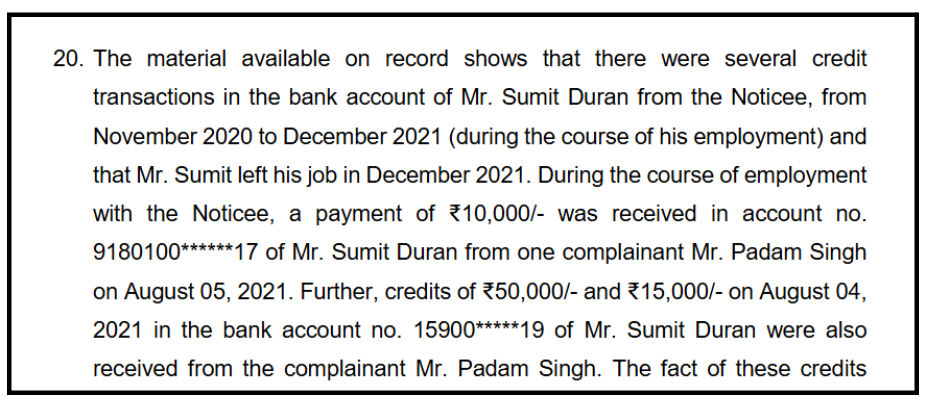

- Receiving Client Money in Personal Bank Accounts

The Noticee’s employee, Mr Sumit Singh Duran, received client payments in his personal bank account during his employment.

Transactions were traced from the complainant, Mr Padam Singh, to the employee’s account in 2021.

Violation

- Breach of IA Regulations (15(1), 15(2), and 15(9)).

- Failure to prevent unauthorised financial dealings by employees.

This creates a serious risk of fraud and misappropriation of funds. Clients’ money is not protected, and there is no audit trail, making it difficult to recover funds in case of disputes. It also reflects poor internal controls and negligence in supervision.

- Failure to Maintain Call Records

The Noticee failed to maintain and submit call recordings of client interactions as required.

- Excuse Given: Technical failure during data shifting.

Violation

- Breach of SEBI Circular 2020 and IA Regulations.

- Failure to maintain mandatory records of client communications.

Without call records, there is no proof of advice given, making it impossible to verify whether recommendations were appropriate or fraudulent.

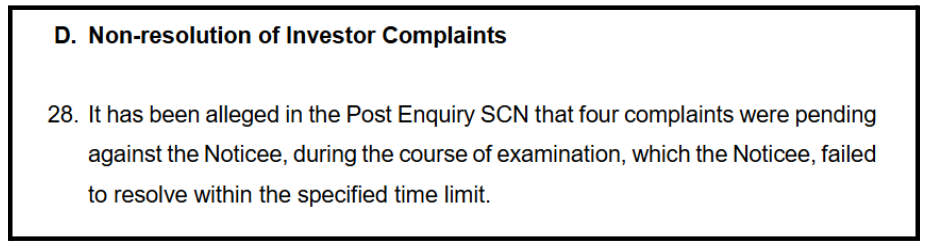

- Non-Resolution of Investor Complaints

Four investor complaints remained unresolved within the stipulated time.

Violation

- Breach of SEBI Circular 2022 and IA Regulation 21(1).

Investor grievances are not addressed in a timely manner, leading to loss of investor confidence in the grievance redressal system.

Delayed resolution can cause financial and emotional distress to clients, especially if funds are stuck or services are undelivered.

SEBI’s Final Decision on Winway Research

Regulatory Censure Issued: A formal reprimand has been issued to Winway Research – Proprietor, Mr Ankur Jain.

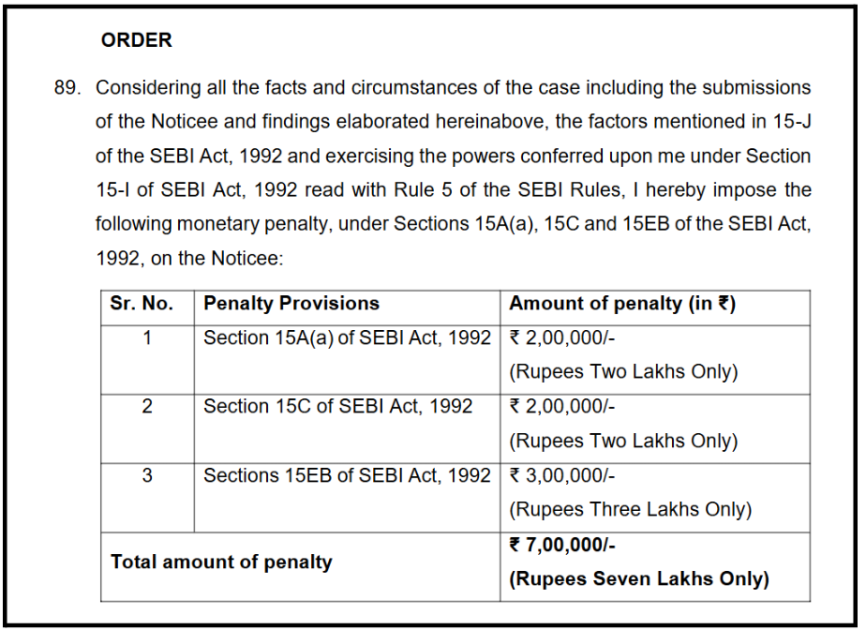

November 2024: ₹7 Lakh Fine

First adjudication order imposed a monetary penalty for investor grievance failures and record-keeping lapses.

January 2026: Regulatory Censure

Formal public reprimand issued, warning Jain to “be diligent and careful” in future dealings.

While milder than license suspension or heavier fines, censure:

- Becomes part of the permanent regulatory record

- Damages professional reputation

- Can affect future business partnerships

- May lead to stricter monitoring by SEBI

The Red Flags You Must Never Ignore

- Payment to Personal Accounts

Never transfer money to GPay, personal bank accounts, or employee accounts. Legitimate firms use company accounts only.

- Pressure to Pay More

If they promise you’ll “recover losses” by upgrading packages, run. This is the oldest scam in the book.

- Blocking Complaints

When someone blocks you after taking your money, it’s not a misunderstanding. It’s theft.

- No Call Records

If an adviser can’t provide records of advice given, they’re hiding something.

- Fake Reviews

As Malay warned: “Whichever few 5-star reviews you see are their internal members.”

How to File Complaint Against SEBI Registered Investment Advisor?

If you were a client of Winway Research, Mr Ankur Jain, or lost money to similar fraudulent investment advisory schemes, you are not alone.

SEBI’s order confirms that what you experienced was systematic fraud.

Our dedicated team specialises in helping investors like you get justice.

1. Initial Consultation & Case Assessment

We arrange a confidential discussion with a dedicated Case Manager who will:

- Listen carefully to your full experience with Winway Research

- Review your transaction records and communication history

- Assess the strength of your case

- Explain your legal options clearly

No judgment. Just solutions.

2. Professional Case Documentation & Drafting

We help you prepare a structured, persuasive, and legally sound complaint that outlines:

Specific SEBI violations, including:

- Charging fees for overlapping services (double-billing)

- Receiving payments in employee personal accounts

- Non-resolution of investor complaints

- Fraudulent misrepresentation and unfair trade practices

3. Direct Engagement & Escalation

Step 1 – Formal Communication: We guide you in formally notifying Winway Research/Mr. Ankur Jain (required before SEBI escalation)

Step 2 – SEBI SCORES Filing: We assist you in:

- File a SEBI complaint on the SEBI SCORES portal

- Tracking SEBI complaint status in real-time

- Responding to SEBI queries professionally

Step 3 – SEBI Smart ODR: If eligible, we guide you through the Online Dispute Resolution platform for faster resolution

We handle the bureaucracy. You focus on recovery.

4. Advisory & Strategic Counselling

Our experts provide:

- Realistic assessment of recovery prospects

- Timeline expectations based on similar fraud cases

- Alternative remedies, including consumer forums and police complaints

- Legal precedent analysis using SEBI’s Winway Research order

- Guidance on claiming refunds for unrendered services

Transparency from day one.

5. Arbitration & Legal Representation

If initial SEBI actions are unsatisfactory, we help you:

- File arbitration in stock market disputes

- Pursue civil recovery suits

- File criminal complaints under IPC Section 420 (cheating)

- Represent your case professionally

- Pursue all available remedies until resolution

We don’t stop until you get justice.

Register with us today.

Let our experienced team guide you toward a fair resolution.

Your losses deserve accountability. Your voice deserves to be heard.

Conclusion

This case exposes a terrifying truth: SEBI registration doesn’t guarantee safety.

Ankur Jain operated for YEARS despite complaints. Reviews from 2019 warned people. But SEBI only acted in 2024.

How many investors lost money in those 5 years?

Winway Research isn’t an isolated case. It’s a symptom of a broken system where:

- Fraudsters hide behind official registration

- Victims are ignored until complaints pile up

- Penalties are pocket change for criminals

- Real investors lose life savings

Your money. Your responsibility.

Don’t trust names. Don’t trust promises.

Do your research. Demand transparency. Keep records. And the moment something feels wrong, get out.