When you search a name in the stock market space today, the first thing you usually see is not a regulatory document — it’s social media.

In the case of Yash Dahiya, the search brings up a mix of things. There appears to be an SEBI registration in his name. Also, an Instagram account operating under his name.

A Telegram link is provided through these platforms, but at the time of checking, the Telegram username shows “not found.”

For an investor, this combination naturally raises questions.

Is the registration active? What does that registration actually allow?

Are the social media channels linked to the same registered entity?

And what should investors verify before relying on online market content?

This article does not assume anything. It simply examines what is publicly visible and explains what investors should understand before making financial decisions.

Yash Dahiya Review

Based on publicly available information, Yash Dahiya appears to be associated with stock market–related content and trading discussions online.

There is an Instagram account operating under his name where market-related posts, charts, and trading commentary are shared. In addition to this, another Instagram handle named Smart Bull Traders is also linked to his presence.

Both handles appear to focus on trading and market activity.

A Telegram link is also provided through these social media platforms. However, at the time of reviewing, the Telegram link shows “username not found.”

This could mean the channel has been removed, renamed, made private, or is temporarily inactive. Without further clarification, it is not possible to determine the exact reason.

It is not uncommon for market participants to use multiple social media channels for branding or community building.

However, when financial content is shared publicly, especially if it relates to trading ideas or strategies, investors should always verify the regulatory status and scope of registration of the individual involved.

This brings us to the next important question:

Is Yash Dahiya officially registered with SEBI, and what does that registration actually mean?

Is Yash Dahiya SEBI Registered?

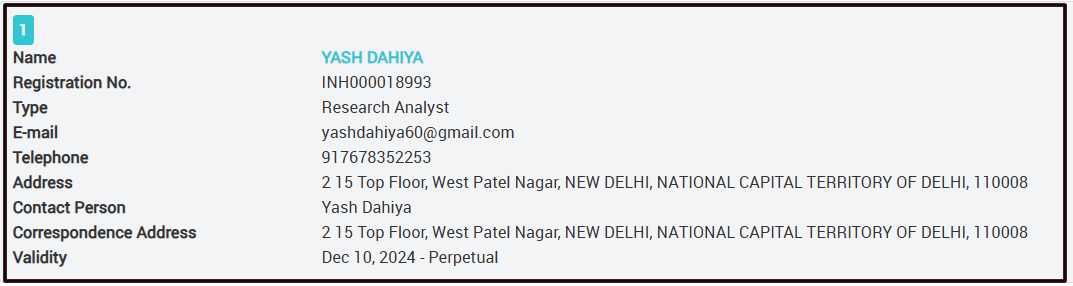

A search on SEBI’s official Research Analyst register shows that Yash Dahiya is registered as a SEBI Research Analyst.

Below is the official registration entry as reflected in SEBI’s public database.

This confirms that Yash Dahiya holds a SEBI Research Analyst (RA) registration as per the regulator’s records.

However, it is equally important to understand what a Research Analyst registration allows.

A Research Analyst is permitted to:

- Publish research reports

- Share market analysis

- Provide research-based views on securities

At the same time, this registration does not automatically allow:

- Managing investor funds

- Offering guaranteed or fixed returns

- Running pooled investment schemes

- Acting as a portfolio manager

SEBI-registered RA’s are required to follow SEBI guidelines for Research Analysts. This consist of disclosure norms, compliance requirements, and conflict-of-interest guidelines.

For investors, the key takeaway is simple:

Registration confirms regulatory recognition. But investors must still ensure that the services being offered align with the scope of that registration.

The next logical question then becomes: Has SEBI ever taken any action against Yash Dahiya?

Has SEBI Issued Any Orders Against Yash Dahiya?

A review of SEBI’s public enforcement database, as of the date of writing this article, does not show any enforcement orders, penalties, suspension notices, or bans issued against Yash Dahiya.

SEBI publishes its enforcement actions openly on its website. At the time of checking, no such orders appear in connection with his name in the publicly accessible records.

For investors, this is an important distinction.

The absence of enforcement orders means there are no publicly recorded regulatory actions against him at this point in time.

However, investors should still perform independent due diligence before relying on any financial content, especially when social media platforms and messaging apps are involved.

The Telegram channel is no longer functioning, which raises suspicion about why an official Telegram channel would be discontinued.

Which brings us to a broader investor-focused question; When should you consider reporting a Research Analyst?

When Should You Report a Research Analyst?

You may consider reporting a Research Analyst to SEBI if you notice:

- Guaranteed or fixed return promises being made in advertisements, social media posts, or private communication.

- Services going beyond the scope of registration, such as handling client funds directly, operating pooled investment schemes, or acting like a portfolio manager without proper authorization.

- Misuse or misrepresentation of SEBI registration details, including incorrect use of a registration number or allowing unregistered entities to operate under the registered name.

- Lack of mandatory disclosures, such as absence of risk disclaimers or conflict-of-interest statements in research communication.

- No proper grievance redressal mechanism, or refusal to acknowledge and address investor complaints.

It is important to distinguish between market losses and regulatory violations.

Losses can occur in normal market conditions. However, misleading claims, non-compliance, or misrepresentation fall under regulatory concerns.

How to File a Complaint Against RIA?

If you believe a Research Analyst has violated SEBI regulations, the complaint process is structured and transparent.

Here is how you can proceed:

- File a complaint on the SEBI SCORES portal

SEBI’s SCORES (SEBI Complaints Redress System) platform allows investors to submit complaints online against registered intermediaries. - Preserve all communication records

Keep screenshots of Instagram posts, Telegram links, emails, chat conversations, and any promotional material. - Maintain proof of payments

Bank transfer details, UPI receipts, invoices, or subscription confirmations should be saved. - Attach supporting documents clearly

When filing the complaint, explain the issue in simple language and attach relevant evidence. - Track the SEBI complaint status online

SCORES allows investors to monitor progress and responses from the concerned entity.

SEBI requires registered entities to respond to complaints within prescribed timelines. Filing a complaint through official channels ensures the matter is documented and reviewed under regulatory supervision.

Need Help?

Dealing with financial service providers can feel overwhelming, especially when regulatory processes are involved.

Many investors are unsure about:

- Whether their concern qualifies as a regulatory issue

- What documents are required

- How to draft a clear complaint

- What steps to take next

We assist investors in organising their documents, understanding the scope of SEBI regulations, and preparing structured complaints where necessary.

If you are unsure about the next step, Register with us.

Conclusion

Yash Dahiya appears to hold a SEBI Research Analyst registration and maintains a social media presence through Instagram channels.

As of the date of writing, no public SEBI enforcement orders have been found against him.

SEBI registration is an important regulatory marker.

However, investors should independently verify credentials, understand what a Research Analyst registration permits, and avoid relying solely on social media content when making financial decisions.

In financial markets, informed decisions are always better than rushed ones.