Let’s be real: life doesn’t always wait for your next paycheck. Whether it’s a sudden car repair, a dream wedding, or a medical emergency, sometimes you need a financial boost, and you need it now.

Online finance platforms promising instant loans or quick financial help are everywhere. Many people turn to such services during emergencies, hoping for fast approvals and minimal paperwork.

Yes Finance is one such name that has caught attention online. But beneath the promises, several warning signs raise serious concerns.

It is a platform that promises a “paperless,” “instant,” and “easy” experience. But in a world full of fine print and hidden fees, does it actually live up to the hype?

This blog explains what Yes Finance claims to be, the risks involved, and how to protect yourself if you encounter similar platforms.

Yes Finance Review

Yes Finance presents itself as a financial service provider offering loans or monetary assistance through online channels. It claims to simplify borrowing with fast processing, easy approvals, and minimal formalities.

However, users searching for clarity often find very little transparent information about how Yes Finance actually operates, who runs it, or under what legal framework it provides financial services.

Is Yes Finance Safe?

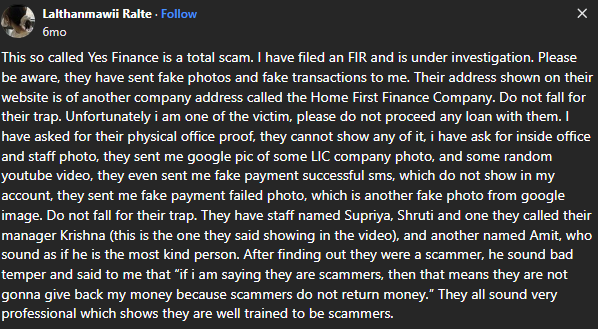

Based on multiple red flags reported by users, Yes Finance does not appear to be a safe platform. Below are some Yes Finance complaints that are concerning and can raise red flags:

1. Fake Transactions

Several users report seeing transaction screenshots or payment confirmations that do not reflect real bank entries. These fake or misleading transaction proofs are often used to gain trust or push users to pay more money.

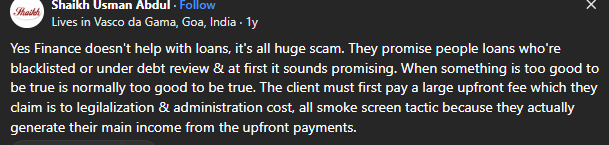

2. Large Upfront Fees

A major red flag is the demand for advance payments in the name of:

- Processing fees

- Account activation charges

- Insurance or verification costs

- Administration costs

Many users, desperate for financial help, often ask: Is Yes Finance legit? The answer lies in how they handle your money.

Legitimate financial institutions do not demand large upfront fees before loan disbursement.

They typically deduct any necessary costs from the loan amount itself rather than asking you to pay out of pocket before you see a single cent.

3. Unrealistic Profit or Approval Claims

Promises such as “guaranteed loan approval,” “instant credit without checks,” or “money credited in minutes” are classic warning signs. Real financial services always involve eligibility checks and documented terms.

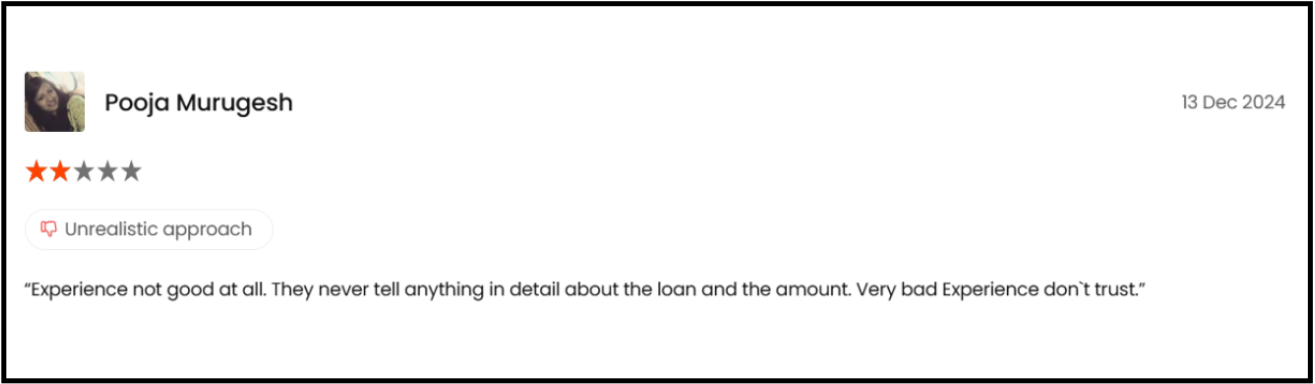

4. No Disclosure of Loan Details

Users report that:

- Interest rates are not explained clearly

- Repayment tenure is not disclosed

- EMI structure is missing

- Written loan agreements are not provided

Any platform that avoids sharing loan terms upfront should not be trusted.

Is Yes Finance Real or Fake?

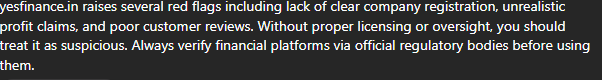

When basic verification checks are applied, Yes Finance fails to meet standard credibility benchmarks.

Unverified Physical Office Address

There is no verifiable office location shared publicly. Genuine finance companies always disclose a registered or branch office address.

No Company Registration Details

Users are unable to find:

- ROC registration details

- RBI registration or NBFC license

- CIN number or legal entity information

Operating without legal registration strongly indicates a fake or unregulated setup.

How to Report Loan Frauds in India?

If you have interacted with Yes Finance or faced financial loss due to loan app scams, take action immediately:

- Stop making any further payments

- Do not share additional personal or banking information

Report the issue through official channels:

- Report to National Cyber Crime Reporting Portal: File a complaint with screenshots, call logs, and payment proofs

- Cyber Crime Helpline: Dial Toll-Free number

- Consumer Grievance Platforms: Report misleading financial practices

- Your Bank: Inform them immediately if transactions have occurred

Always preserve evidence such as messages, emails, UPI IDs, phone numbers, and payment receipts.

Need Help?

If you believe you’ve been targeted by Yes Finance or a similar online financial platform, you’re not alone, and help is available. Many victims hesitate or delay action due to confusion or fear, which can lead to further losses.

We help affected users by:

-

Reviewing suspicious platforms and explaining whether they show scam or fraud indicators

-

Guiding victims on what steps to take next, including where and how to report the incident

-

Helping organize evidence such as payment proofs, messages, phone numbers, and UPI IDs

-

Raising awareness so others do not fall into the same trap

If you are being pressured to pay fees, share personal details, or continue transactions, stop immediately and seek guidance. Register with us.