Online loan platforms promising instant approvals and quick cash have increased rapidly. Yes Finance is one such name that often reaches users through calls, messages, or social media promotions.

While it may appear convenient at first glance, many users have raised serious concerns about how the platform operates.

This blog explains how the Yes Finance loan process works, why it is considered risky, and what steps you should take if you have already interacted with them.

Yes Finance Review

The loan application process promoted by Yes Finance usually looks simple on the surface, but this simplicity itself is part of the risk.

Typically, users are asked to:

- Share personal details over WhatsApp, phone calls, or online forms

- Provide PAN card, Aadhaar details, bank information, or screenshots

- Pay certain “mandatory” charges before loan approval

Why is this process risky and unsafe?

- There is no secure or transparent application system, as regulated lenders use

- Users are asked to share sensitive information even before loan terms are disclosed

- Payments are demanded upfront, often repeatedly, for different reasons

- No official loan agreement or written documentation is provided

In many cases, once money is paid, either the loan never arrives, or more fees are demanded, trapping users in a cycle of losses.

Is Yes Finance Real or Fake Platform?

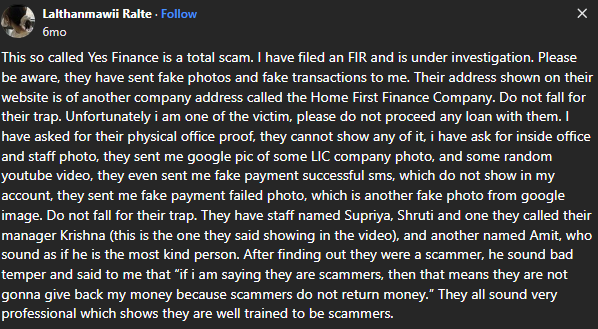

Yes Finance user complaints reveal a pattern of red flags that go beyond isolated service issues and point toward deeper credibility concerns.

1. Fake Transaction Proofs

Several users say they were sent screenshots or confirmation messages claiming that loan amounts had been credited.

However, no funds ever appeared in their bank accounts, suggesting these “confirmations” were used only to create false trust.

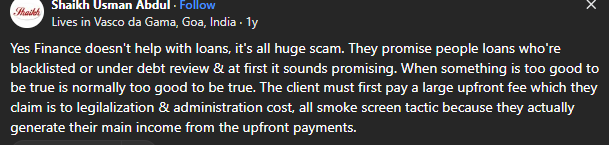

2. Repeated Upfront Fee Demands

A common red flag is the request for multiple advance payments, often disguised as processing fees, insurance, verification, or clearance charges, before a single cent is released.

If you find yourself asking, “Is Yes Finance legit?” because they are demanding money before giving money, you have your answer.

Legitimate lenders typically deduct administrative costs from the sanctioned loan amount rather than requiring repeated upfront transfers from the borrower.

3. Misleading Approval Promises

Be wary of high-pressure tactics that sound too good to be true. Scammers often use “guaranteed” outcomes to lure victims into a false sense of security.

No legitimate, regulated lender can bypass credit assessments or legal checks. In the financial world, “guaranteed” is a red flag.

Legitimate institutions are legally required to perform due diligence.

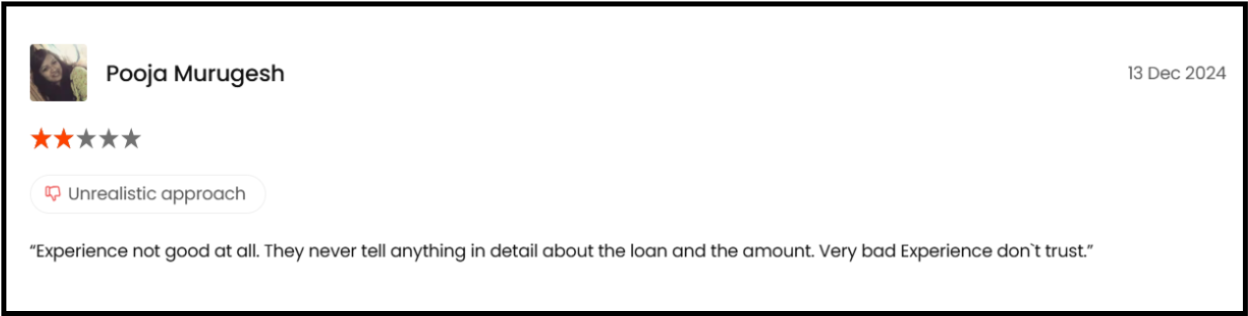

4. Lack of Loan Transparency

Many borrowers state they were never given clear loan terms. There is no written agreement, no defined interest rate, no repayment schedule, and no explanation of the total amount payable.

This absence of disclosure makes it extremely risky, as users cannot understand their true financial liability.

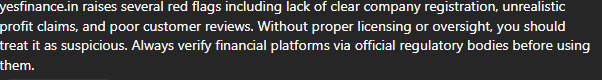

Taken together, these complaints strongly suggest that Yes Finance operates with limited transparency and uses tactics commonly associated with fraudulent or deceptive financial platforms.

5. No Verified Physical Office or Company Details

There is no publicly verifiable office location or official business address. Genuine finance companies always disclose their registered office.

Users are unable to find any RBI or NBFC registration or company records.

How to Report Loan Scams in India?

If you have interacted with Yes Finance or suffered financial loss, act immediately:

- Stop making any further payments

- Do not share additional personal, banking, or OTP details

Report the issue through official channels:

- Report at the National Cyber Crime Reporting Portal: File a complaint with screenshots, call logs, and payment proofs

- Cyber Crime Helpline: Dial toll-free helpline number

- Consumer Grievance Platforms: Report misleading or fraudulent financial practices

- Contact Your Bank: Notify your bank’s fraud department to freeze your cards or accounts and flag unauthorised transactions.

Always preserve evidence such as messages, emails, UPI IDs, phone numbers, and payment receipts.

Need Help?

If you are confused, pressured to pay more money, or unsure whether Yes Finance is genuine, reach out to us.

We help affected users understand what’s really happening, assess whether the platform shows scam indicators, and decide the safest next steps.

Our team assists with collecting and preserving evidence, drafting clear complaints, and guiding you on where and how to report the issue to the appropriate authorities.

We also help you understand follow-up options so your complaint doesn’t stop at submission.

Conclusion

Based on operational patterns, consistent user grievances, and a total lack of transparency regarding licensing, Yes Finance is a high-risk platform that fails to meet safety standards for financial services.

There is no evidence of verifiable registration or licensing with financial authorities (like the RBI).

Reports indicate a pattern of demanding “upfront fees” under various labels (GST, processing fees, security deposits) with no actual loan disbursal.

Hence, this can be considered as a loan fraud in India.

Online loan platforms should clearly disclose their identity, terms, and repayment conditions before asking for any commitment.

When these basics are missing, the chances of misuse and loss increase significantly.

To protect yourself, always choose RBI-registered lenders, avoid paying any fees in advance, and never share sensitive personal or banking details without proper written documentation.

In the digital lending space, a “quick fix” can lead to long-term financial ruin.

When a platform lacks transparency and demands advance payments, the risk of loss is nearly certain. Prioritise your security over speed.