Choosing a financial advisory firm can be confusing because promises often sound tempting, but what really matters now is clarity, accountability, and trust.

In a market full of advice, technology, and marketing stories, people are starting to wonder who is really looking out for their best interests online.

This curiosity often leads people to look into firms like 1 Finance Private Limited, which focus on structured financial planning services.

Before forming any opinions, it’s helpful to look at what they offer, their online presence, customer reviews, and how they share information to get a clearer picture of what to expect.

1 Finance Private Limited Review

1 Finance Private Limited is an Indian financial advisory company that provides personalized and fair financial planning services to individuals across the country.

The company helps people with managing their investments, insurance, loans, taxes, and retirement through structured advice, rather than pushing products.

Jeet Marwadi and Keval Bhanushali started 1 Finance Private Limited with support from the Marwadi Chandarana Group in the Indian business environment.

The firm is registered as an investment advisor with SEBI under the registration number INA000017523, and offers advisory services that are regulated for retail investors.

As an Investment advisor, 1 Finance platform and app gather information about users’ personal goals, income, debts, and spending habits through a guided setup process.

Once users complete this setup, they get a customized financial plan that covers areas like investments, insurance, loans, taxes, and retirement planning for the long term.

The platform lets users assess financial products using its own scoring system, rather than just following sales pitches.

Users can also keep in touch with SEBI-registered financial advisors via the app for ongoing advice, adjustments, and help throughout different stages of their lives.

MoneySign is a tool that helps understand how people feel about money and make financial choices over time.

1 Finance Private Limited keeps an active presence on social media to teach people and build trust through regular financial content.

1 Finance Private Limited Complaints

Even when platforms seem reliable and known, people still need to stay watchful, informed, and careful with their money and personal information.

Some users expressed worries about their privacy after seeing terms that allowed the sharing of their data with partners, which was not what they had expected in terms of keeping things private.

A few reviews also talked about delays in the KYC process and unclear answers from the compliance teams, which made things confusing during the setup and verification steps.

These experiences show why it’s important to read through everything carefully, ask questions right away, and make sure you’re looking out for your own interests.

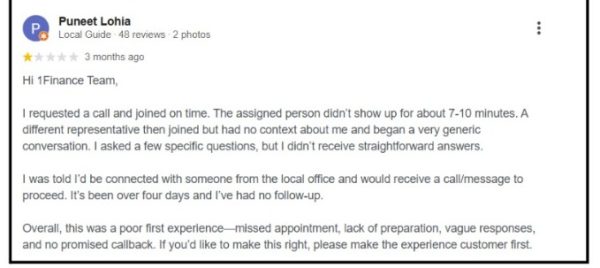

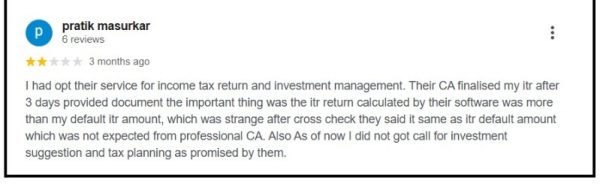

Here are a few user reviews to get a clear understanding:

User 1: The review concerns missed appointments, delayed follow-ups, and generic conversations that affected the overall first interaction experience.

This reminds readers that service quality can vary, making it important to track responsiveness and clarity during early advisory interactions.

User 2 – This review reflects concerns around calculation clarity, unmet service expectations, and delays in promised follow-ups after initial service engagement.

Such experiences underline why users should verify deliverables, timelines, and scope clearly before relying fully on advisory commitments.

When to File a Complaint Against RIA?

A common issue seen in both user reviews and the detailed case study is when responses are delayed, and concerns aren’t resolved even after repeated follow-ups.

These patterns show a failure in service and a lack of accountability, which means you should consider escalating the issue if direct attempts to resolve it don’t work.

Red flags to see before filing complaints:

- You should file a complaint if an advisor ignores your questions, delays promised services, or refuses to provide clear written confirmations after reasonable follow-ups.

- You should escalate if the firm gives misleading explanations, unclear agreements, or contradicts previous assurances about data or services.

- You should take action if promised advisory support, documents, or planning deliverables don’t arrive even after completing the onboarding and compliance steps.

- You should reach out to platforms like SEBI SCORES if communication stops or if responses remain unsatisfactory after trying to resolve the issue directly.

How To File a Complaint Against RIA?

Acting early is important because waiting too long can let problems get worse, documents expire, and responsibility can fade away completely and forever.

Keeping an eye out helps protect your money, information, and rights, especially when some unclear communications or promises remain unfulfilled for weeks without proper answers.

Steps to Report:

- You should start by writing a formal complaint directly to the advisor and giving them enough time to resolve the issue in writing before taking further action.

- If your concerns aren’t resolved, you can file a complaint through SEBI SCORES.

- Always keep records like emails, agreements, call logs, and a timeline ready to back up your complaint with clear facts during any official review process.

- In case the complaint is not resolved in SCORES, you can file arbitration in stock market.

Need Help?

Facing problems with financial advice can be extremely stressful, especially when communication becomes unclear, responses are delayed, or the support you expected simply isn’t there.

We take the time to carefully understand your situation by reviewing documents, timelines, and past communications, and then explain your options clearly and honestly, without pressure or judgment.

You can register with us, and our team will help you draft complaints, identify the right authorities to approach, and track responses so you’re never left confused or unsure about what comes next.

From the moment you raise a concern until the matter is resolved, we stay by your side with steady guidance, timely follow-ups, and calm support throughout the entire process.

Conclusion