The world of online sports betting and casino gaming shines bright on the surface. Flashy banners promise instant withdrawals, risk-free bets, and life-changing wins.

It all sounds tempting, almost too good to ignore. But if you’re an Indian player who has clicked the 12Bet Login and go thorugh the process, that glitter may quickly fade into frustration, confusion, and in some cases, outright panic.

Many users also report being lured through 12Bet Telegram channels, where exaggerated bonuses and “instant win” claims create false excitement and push them to deposit more.

If you’re searching for “12Bet withdrawal problems”, chances are you’re already stuck, watching your winnings sit frozen in your account, endlessly refreshing the page, or being asked to “wait 24 more hours”.

We’ll walk you through the reality behind the promises, explore the grey legal zones this platform operates in, and share the uncomfortable stories of users who learned the hard way that winning is easy, but getting paid is not. And if you’re already caught in this mess, don’t worry.

We’ll also explain the practical steps you can take right now if you believe you’ve been scammed.

12BetExchange Withdrawal Issues

To understand what really happens when users try to withdraw money from 12Bet Exchange, you don’t need insider access or technical analysis. Just a few minutes on Trustpilot will do.

The platform’s 1-star reviews read less like isolated complaints and more like a repeating script, and that’s where the alarm bells start ringing.

For many Indian users, these experiences also trigger a bigger question in the background: is 12Bet legal in India, and what happens when something goes wrong?

Since 12Bet operates as an offshore platform, it is not licensed or regulated under Indian gambling laws. This means users have limited legal protection if disputes arise.

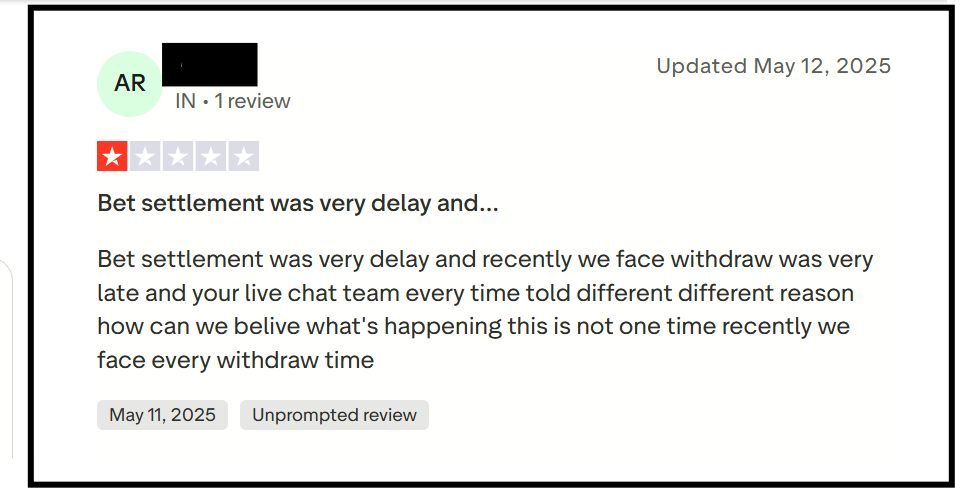

One user describes how withdrawals that once seemed routine suddenly turned into a waiting game with no end. Bet settlements were delayed, withdrawals stretched endlessly, and every time they contacted live chat, a new explanation appeared.

One day it was a “technical issue,” the next day it was a “bank delay.” Same problem, different excuse. After facing this again and again, you can sum it up bluntly. How can anyone trust a platform where the story keeps changing every single time?

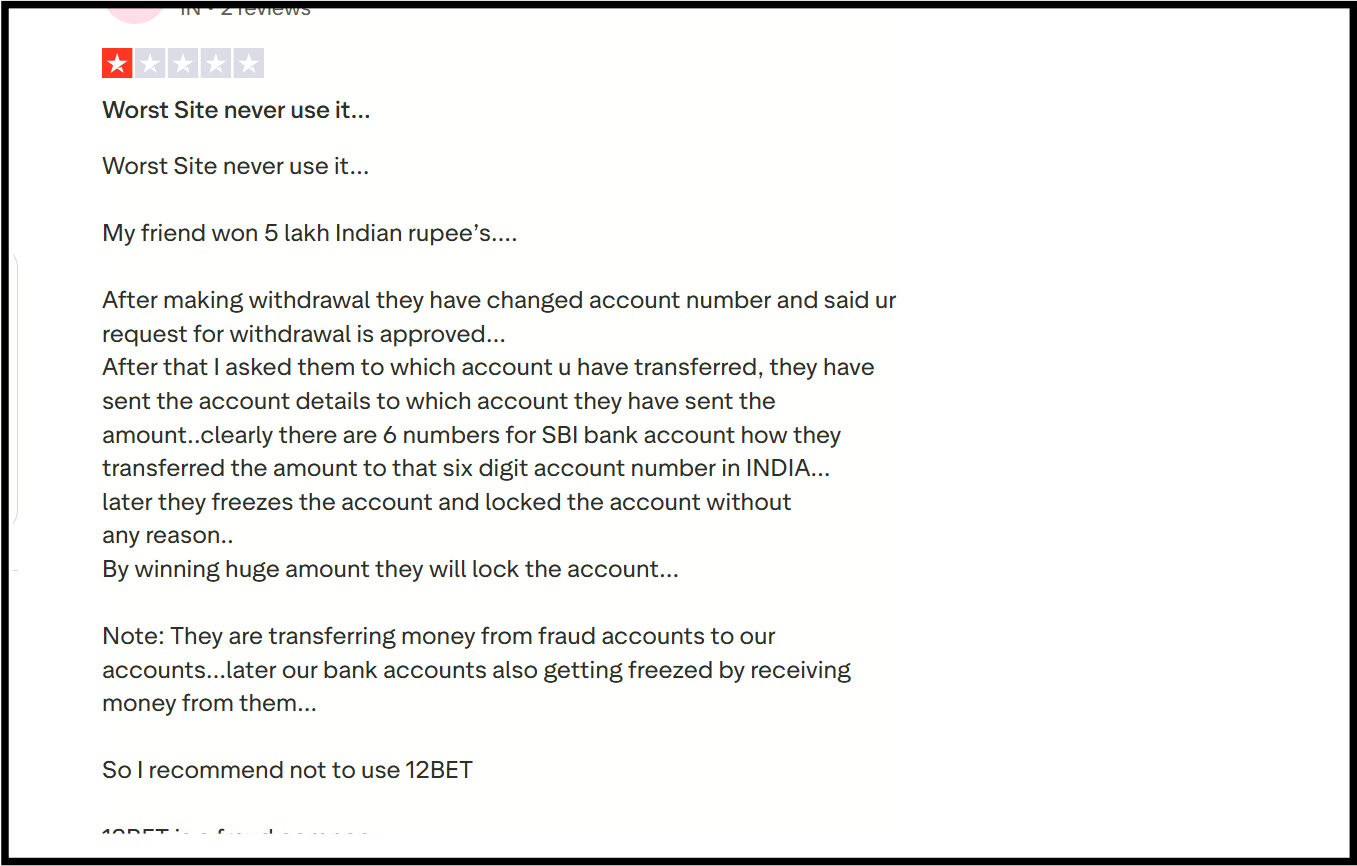

Another reviewer shares an even more disturbing experience. After placing a withdrawal request, the user was told the transaction was approved. But then came a shock. The platform claimed the money had been transferred to a bank account number that didn’t even look real.

In India, SBI account numbers are typically 10 or 11 digits long, yet the so-called “proof” showed just six digits. Naturally, the user asked a simple question: to which account was the money actually sent? Instead of getting clarity, the account was frozen without any explanation.