Not every trading loss happens because markets move against you. Some losses happen because someone else controls your account.

This blog examines a real Nirmal Bang complaints, a SEBI-registered stock broker, where a client alleges that a broker representative handled the trading account, promised profits, caused losses, and later stopped responding.

The issue here is not whether Nirmal Bang is registered. The issue is how the account was handled and whether that handling followed SEBI and exchange rules.

Nirmal Bang Review

According to its official website, Nirmal Bang operates as a full-service stockbroker. It offers:

- Equity, derivatives, commodities, and currency trading

- Mutual funds, IPOs, insurance, and NPS

- Depository services

- Research and market insights

- SEBI-registered Portfolio Management Services (PMS)

The company clearly states its SEBI registrations for broker segments and PMS. From a regulatory standpoint, Nirmal Bang has the legal authority to execute trades for clients on Indian exchanges.

However, execution authority does not mean account control.

Nirmal Bang Complaints

Now, as per SEBI and exchange rules:

- A broker can execute trades only on client instructions

- A dealer or relationship manager cannot decide trades independently

- A broker representative cannot promise assured or guaranteed profits

- Client funds and decisions must remain under client control, unless a valid PMS agreement exists

However, in the case of Nirmal Bang, the story was quite different, where one of the broker’s executives:

- Handled the account on the client’s behalf

- Took trading decisions without explicit consent

- Promised profits to induce deposits

Account Handling by Nirmal Bang- Real Case

A client recently filed a formal complaint against Nirmal Bang, alleging serious misconduct in the handling of his trading account.

The client had opened a Demat and trading account through a representative named Mr. Ranjeet (name changed), explicitly relying on his assurances to generate profits.

The client was upfront about lacking both the time and expertise to trade independently. Trusting these promises, he deposited ₹1,50,000, placing his faith entirely in the representative rather than self-directed trading.

According to the complaint, Mr. Ranjeet persuaded the client to allow him to manage the account personally, allegedly guaranteeing profits along the way.

However, instead of gains, the client suffered a complete loss of the deposited funds. He did not make any independent trading decisions, raising serious questions about unauthorized or improper account handling.

After the losses, the client was told his money would be returned.

Only ₹10,000 was refunded, and subsequent calls and messages went unanswered. With no explanation or resolution forthcoming, what began as a trading loss escalated into a matter of accountability and professional conduct.

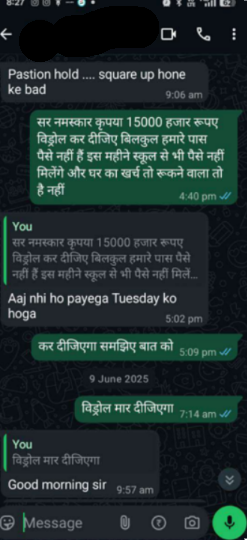

Chat screenshots reveal a troubling pattern.

Messages from Mr. Ranjeet were emotional and dismissive, suggesting positions had already been closed while repeatedly delaying withdrawal requests; promises of “today not possible, Tuesday” became a recurring refrain.

Despite repeated pleas to withdraw ₹15,000, the client received no clear explanation of trades, losses, or account status.

Meanwhile, trading platform screenshots confirmed that the account had been fully depleted, leaving a balance of just ₹0.90 and no open positions. The withdrawal option existed but was unusable, confirming the client had no practical control over his funds.

This case highlights multiple regulatory red flags.

- A broker or dealer cannot manage a client’s account without explicit, verifiable instructions for each trade or a valid Portfolio Management Services (PMS) agreement. None of which existed here.

- SEBI strictly prohibits assured or guaranteed profits, as well as profit-linked inducements, and even registered entities cannot offer such promises.

- Trades executed at the dealer’s discretion without client authorization shift the burden of proof to the broker.

- Repeated withdrawal delays and a complete communication breakdown further demonstrate a failure to uphold client rights.

If Mr. Ranjeet acted as an employee, dealer, or authorized representative of Nirmal Bang, the firm may be held fully vicariously responsible under SEBI and exchange regulations. This complaint thus paints a disturbing picture of mismanagement, lack of transparency, and potential regulatory violations, underscoring the need for stricter oversight and accountability in client fund handling.

The client filed a written complaint alleging serious misconduct. The key points from the mail are clear and specific.

Where to Complaint Against Stock Broker?

Now, such cases are disappointing and have raised trust issues with SEBI-registered stock brokers. However, it takes time to gain trust in such entities, but you can recover losses if you take timely and proper actions.

Below are the steps that you can follow to file a complaint against stock broker:

Step 1: Collect All Evidence

Save:

- Chat messages

- Call logs

- Platform screenshots

- Deposit and withdrawal proofs

- Emails and complaint records

Step 2: Escalate Internally to the Broker

Send a written complaint to:

- The broker’s compliance team

- The grievance redressal email is listed on the website

Step 3: Lodge a Complaint in SCORES

File a complaint through the Securities and Exchange Board of India SCORES for:

- Improper account handling

- Unauthorized trading

- Guaranteed return inducement

Step 4: File a Complaint in Stock Exchange

If the broker does not resolve the issue:

- File a complaint with the exchange NSE/BSE

- Use the Investor Grievance Redressal Process (IGRP)

Need Help?

Account handling disputes often fail because clients:

- Do not document instructions

- Trust verbal assurances

- Delay escalation

Register with us today. We help by:

- Structuring complaints correctly

- Identifying regulatory violations clearly

- Preparing cases that stand up in exchange and arbitration forums

- Guiding clients through the proper escalation path

The focus stays on facts, evidence, and process, not noise.

Conclusion

Nirmal Bang operates as a SEBI-registered broker. That status allows execution of trades; not unchecked control over client accounts.

When a broker representative:

- Promises profits

- Handles trading decisions

- Causes losses

- Avoids communication afterward

The issue moves beyond market risk into regulatory accountability.

In trading, how the account is handled matters as much as who the broker is.