Imagine the global economy as a fast-moving current, sometimes smooth, sometimes unpredictable, but never standing still. The real question isn’t whether it moves, but how investors choose to move with it.

That’s where platforms like Alexa Global Finance start to catch people’s attention.

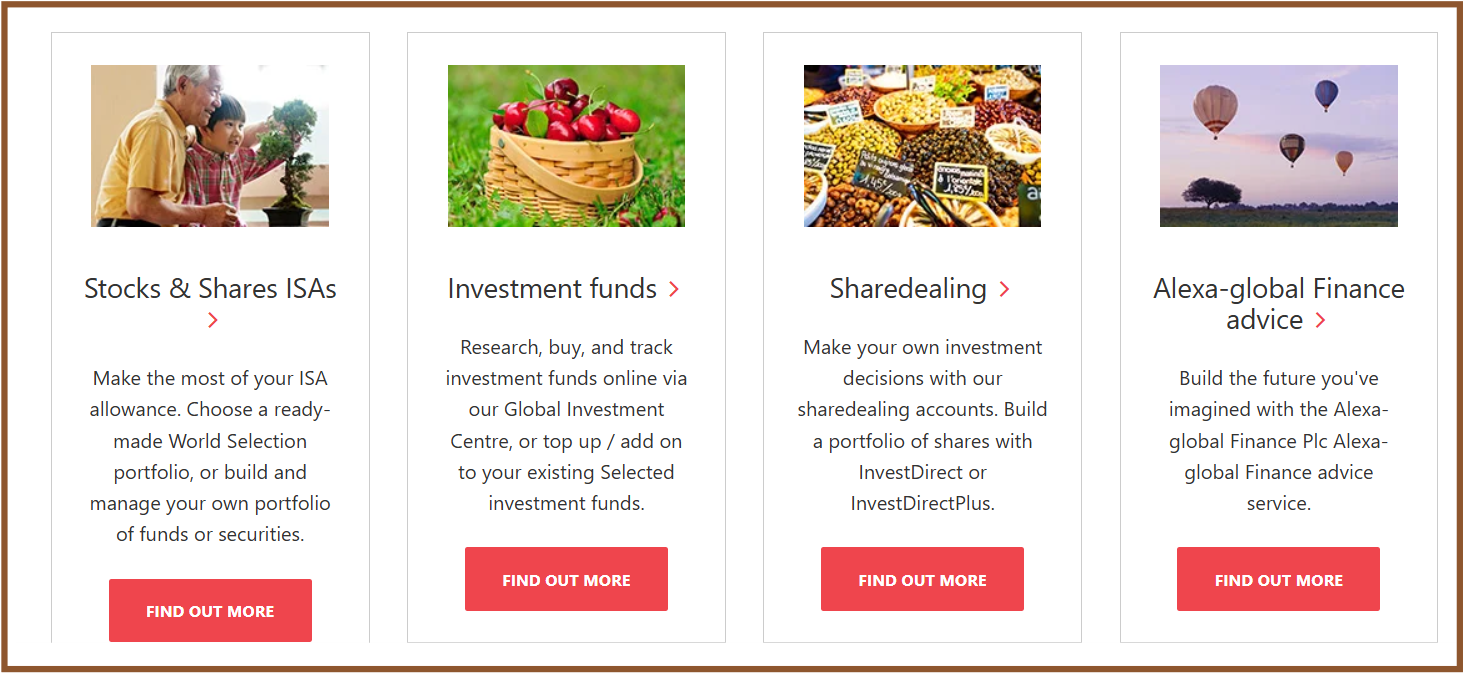

What does a “World Selection” portfolio actually look like in practice? How does global share dealing differ from what most investors are used to?

And more importantly, who is this platform really designed for: seasoned traders, first-time investors, or someone in between?

We’ll unpack the ecosystem piece by piece, connect features to real investing scenarios, and leave room for you to decide what resonates with your own financial goals.

Curious? Let’s take a closer look.

What is Alexa Global?

Alexa Global Finance, often branded as Alexa-Global Finance Plc, likes to think of itself as more than just another financial institution.

It presents itself as a one-stop destination where both individuals and businesses can manage, grow, and protect their wealth under one roof.

Yes, it offers familiar banking staples like credit cards and mortgages, but that’s only the surface of the story.

At the heart of Alexa’s approach is a promise of global accessibility. The idea is simple but powerful: why should sophisticated, institutional-grade investment tools be reserved for a select few?

By combining automated, ready-made portfolios for hands-off investors with self-directed share-dealing accounts for those who like to stay in control.

Alexa speaks to everyone, from cautious beginners to confident, market-savvy participants.

Despite the professional UI and the use of banking terminology, Alexa Global lacks the foundational requirement for any financial entity operating in India.

Alexa Global Complaints

There are several complaints regarding Alexa Global for its services.

Let’s find out the details of a user complaint.

Alexa Global Case Study– The ₹1,10,000 Deception

Let’s break down the tragic experience of an investor who was associated with an online trading group from August 2023 to December 2023.

The Alexa Global case reads like a textbook online trading scam—slick, convincing, and devastatingly effective.

How did it start?

It usually begins on social media, where fraudsters introduce themselves as seasoned market experts from a firm called “Alexa Global.”

Their profiles look professional, their language sounds confident, and their feeds are filled with flashy success stories.

They offer “free” trading tips that promise unusually high profits, all designed to make one thing happen: trust.

Once curiosity turns into interest, the victim is quietly added to an “Online Trading Group,” typically on WhatsApp or Telegram.

Inside these groups, the real manipulation begins. So-called “mentors” and “analysts” dominate the conversation, posting screenshots of massive profits and congratulating members for their wins.

Almost every profile in the group is fake, but to an outsider, it looks like a thriving community of successful traders. For the first couple of months, the victim is guided with free trading signals.

What happened next

Once the victim is emotionally invested and convinced they’ve found a golden opportunity, the pressure escalates.

The fraudsters introduce the idea of upgrading to an “Institutional” or “VIP” account.

According to them, real money can only be made at this level, where elite investors supposedly enjoy higher margins and exclusive opportunities.

Wanting to level up, the victim transfers ₹1,10,000 via UPI and online transactions.

This is where the scam becomes painfully clear in hindsight.

No genuine global financial institution collects investment money through personal UPI IDs or scattered individual bank accounts.

These are mule accounts, temporary channels used to move and vanish money before anyone can trace it.

The Final Act

The final act is the most brutal. When the victim tries to withdraw funds or starts asking uncomfortable questions, the tone suddenly changes.

Sometimes scammers demand more money in the name of “taxes,” “unlock fees,” or “clearance charges.” Other times, as in this case, they simply disappear.

Messages go unanswered. Calls don’t connect.

The once hyperactive trading group falls silent. This complete ghosting isn’t accidental; it’s the final confirmation that the fraud was planned from the very beginning.

This case isn’t just about money lost; it’s about how easily trust can be engineered online. And that’s exactly what makes this kind of scam so dangerous.

Key Violations of SEBI Rules and Regulations

The operations of Alexa Global in India constitute several severe violations of the Securities and Exchange Board of India (SEBI) framework. Any entity offering investment services to Indian residents must be registered with SEBI.

- Under Regulation 3(1), no person or entity shall act as an investment adviser unless they have obtained a certificate of registration from SEBI.

- The FUTP regulations prohibit the making of any statement that is false or misleading, to induce any person to deal in securities.

- Any platform facilitating trades must be a registered Stock Broker or a Sub-broker. By acting as an intermediary and soliciting funds for “trading,” they functioned as an illegal, unauthorised broker.

What Can You Do in Such Cases?

If you have been a victim of any investor or broker, you can register with us. Our legal team will help you with the following steps:

1. Documentation Assistance

We help you gather, organise, and structure all the necessary documents, trade statements, ledger reports, contract notes, call logs, screenshots, and emails, so your case is backed with solid evidence.

2. File a Complaint in SEBI

Since Alexa Global is not SEBI registered, you cannot file a complaint on SCORES. However, you can report it to the regulatory authorities by sending an email with all the proof.

3. File a Complaint in Cyber Crime

If there is a financial loss, then you can report it to the Cyber Crime Register and draft your complaint along with all evidence.

3. Escalation Guidance

If your complaint needs to be escalated beyond SEBI or cyber, we show you the right path, whether it’s going to the exchange or preparing for the next stage.

Conclusion

The case of Alexa Global is a textbook case of cyber-financial fraud. The platform is an unauthorised “Clone Firm” that uses the name of a fictional or offshore PLC to bypass Indian regulatory scrutiny.

The ₹1,10,000 loss was not a result of market volatility but a premeditated theft executed through social engineering and digital impersonation.

The use of UPI for transfers and the eventual “ghosting” of the victim are definitive indicators of a criminal syndicate rather than a failing business.

The individuals involved used the “Alexa Global” brand as a smokescreen to appear professional while operating outside the legal framework of the Indian financial system.