Have you ever wondered what happens when someone in the corporate world refuses to cooperate with a market regulator like SEBI?

Well, Ashish Pandey’s story offers a real example, and it has profound implications for transparency and accountability in corporate compliance.

In this blog, we’ll break down what SEBI found, what Ashish Pandey was accused of, and what it means for ordinary investors.

Who is Ashish Pandey?

Before we jump into the SEBI orders, let’s clarify who Ashish Pandey is. He wasn’t a “market influencer” type but a corporate officer tied to the Ricoh probe.

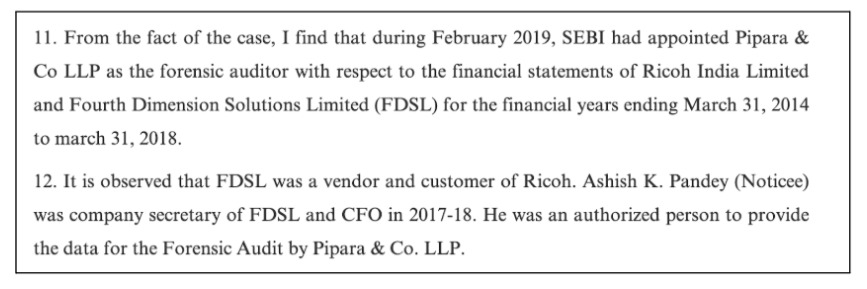

He served as the Company Secretary of Fourth Dimension Solutions Ltd. (FDSL), and also acted as CFO during FY 2017–18. That job title matters more than it sounds.

FDSL was both a vendor and a customer of Ricoh India. So when SEBI started digging into Ricoh’s books, FDSL naturally came under the microscope too.

SEBI’s forensic auditor (Pipara & Co. LLP) needed records.

And Pandey was treated as an authorised person to provide data and documents for that audit.

Also, Ashish Pandey is not presented in these orders as a SEBI-registered Investment Adviser or Research Analyst.

His role here is corporate compliance, not advisory.

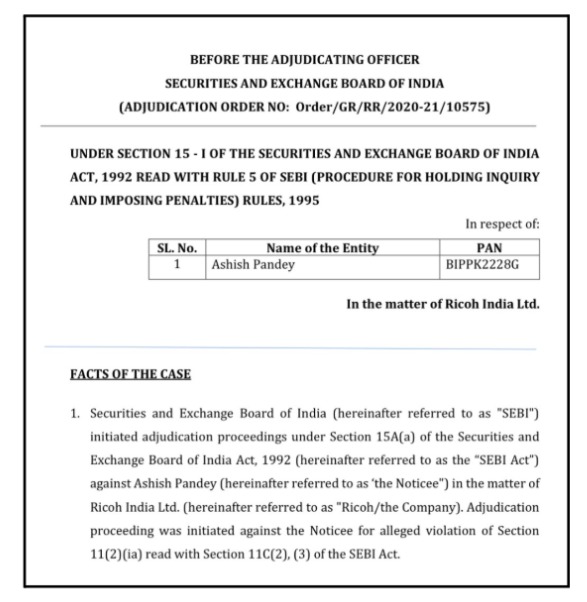

SEBI Orders Regarding Ashish Pandey

To understand the SEBI orders, you first need the context of the broader case, the investigation into Ricoh India Ltd.

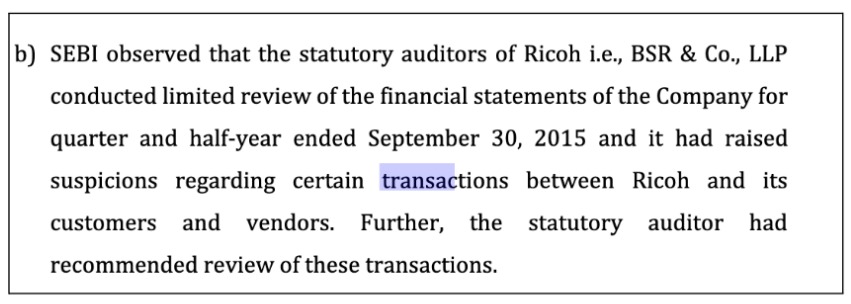

Ricoh India was undergoing a deep probe by SEBI into possible accounting problems and suspicious transactions between Ricoh and certain related parties.

SEBI’s investigation included examining transactions, invoices, sales entries, and even forensic audits spanning multiple years.

In this context, Ashish K. Pandey came into SEBI’s focus because:

- He was the Company Secretary of Fourth Dimension Solutions Ltd. (FDSL), a company that was both a vendor and a customer of Ricoh.

- He was also the CFO of FDSL during part of the period when SEBI investigated.

So Ashish Pandey was not some random outsider. He occupied a key corporate position in a company deeply tied to the Ricoh matter.

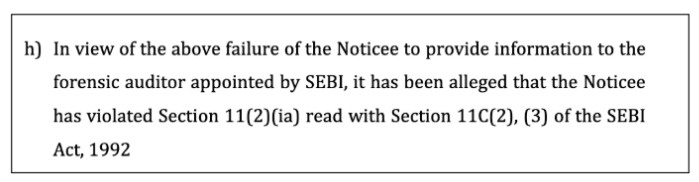

SEBI’s Allegation

SEBI appointed a forensic audit firm (Pipara & Co. LLP) to analyze the books of both Ricoh India Ltd. and FDSL for a multi‑year period, because earlier probes and auditor flags suggested suspicious accounting practices.

As part of that process, SEBI officially asked Ashish Pandey, in his capacity as an FDSL officer, to provide:

- Invoices and financial details.

- Delivery challans and purchase orders.

- Purchase and sales documentation.

- Digital accounting data (like files from Tally).

- Bank account details of directors and key persons.

- Shareholding and company documents relevant to the audit.

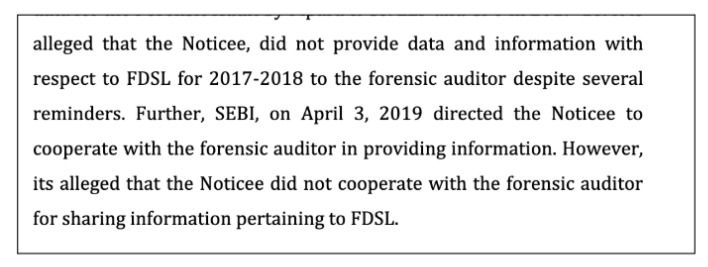

SEBI even issued multiple reminders and formally directed him to cooperate with the forensic audit.

But the allegation was that he failed to hand over the materials, despite those reminders and statutory obligations. SEBI said this refusal hampered the investigation.

That’s a big deal. Under the SEBI Act, officers and insiders must preserve and produce relevant books and records when asked by a regulator. Failure to do so is a violation of Sections 11(2)(ia), 11C(2), and 11C(3) of the SEBI Act.

What SEBI Did?

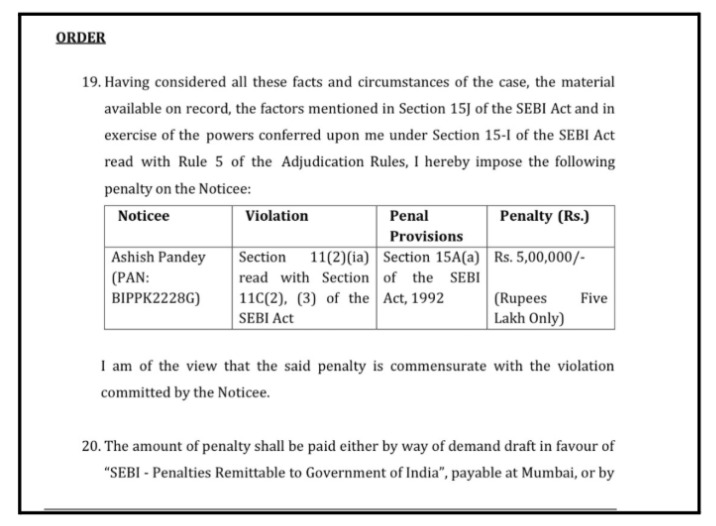

Based on this, a monetary penalty was imposed under Section 15A(a) of the SEBI Act. Ashish was advised to pay a penalty amount of Rs. 5 lakhs within 45 days; otherwise, recovery proceedings were ordered.

So they made an example of him, both to ensure compliance and to signal that withholding information in an investigation won’t be tolerated.

What We Can Learn from This Case?

Here’s the honest, real takeaway:

- Corporate investigations are serious: Investigators don’t just look at stock prices; they look at real accounting, real transactions, and real supporting evidence.

- Regulators need cooperation: If an insider refuses to share records, it creates a gap in the investigation that could hide material misrepresentation.

- Investors should value transparency. When a company’s books or its officers resist scrutiny, it raises red flags about governance.

Ashish Pandey’s case is a reminder that markets thrive on trust backed by facts. When facts are withheld, investors are the ones left in the dark.

How to Report if You’ve Dealt with Such Cases?

If you’ve paid for stock tips from an unregistered Research Analyst or joined questionable WhatsApp/Telegram groups, you don’t have to handle it alone.

Here’s how we can help:

- Document Collection: We assist you in gathering all necessary documents, contract notes, screenshots, and emails for solid proof.

- Complaint Drafting: Our team prepares clear and well-structured complaints for submission to platforms like NSE, BSE, SEBI SCORES, and SMART ODR.

- Submission Support: We guide you through the filing process to ensure everything is filled out correctly, preventing delays.

- Escalation: If your case needs to be escalated, we show you the right steps to take.

- Case Management: We keep track of your case, provide reminders, and help with any follow-up questions.

- Support in Arbitration: If your case reaches arbitration in stock market, we help prepare your documents and statements to ensure your position is clearly presented.

By registering with us, you’ll avoid the stress of complicated paperwork and procedures. We make it easier, faster, and more accurate so that you can focus on recovery.

Conclusion

Ashish Pandey was penalised by SEBI not because he made a trading mistake or failed to disclose a shareholding. He was punished for refusing to cooperate with a forensic audit conducted by SEBI into Ricoh India Ltd.

That lack of cooperation, especially in an investigation full of suspicious transactions, hit right at the heart of market integrity.

If anything, this story should make you more aware, not just of what investments you make, but how well the companies you invest in respond to scrutiny when regulators ask tough questions.