Aurostar Investment Advisory Private Limited presents itself as a registered and ISO-certified entity operating under the proprietorship of Umesh Kumar Pandey, offering investment recommendations and trading tips in the Indian Capital and Commodity Markets.

While the firm positions itself as a professional guide for investors, this report takes a closer look at certain customer complaints and concerns that have surfaced in relation to its services.

Aurostar Investment Advisory Review

Aurostar positions itself as a comprehensive investment advisory service offering:

- Stock market trading tips and recommendations

- Commodity market advisory (MCX/NCDEX)

- Futures and Options (F&O) trading strategies

- Investment planning services

- Research-based calls for equity and commodity trading

The company typically reaches potential clients through digital marketing, phone calls, and online advertisements.

Despite its claims of providing professional investment guidance, the company has faced persistent investor grievances that have caught SEBI’s attention repeatedly.

Autostar Advisory Complaint

One detail that really stands out, and is important for investors to be aware of, is Aurostar’s repeated appearance in SEBI’s public notices for unresolved investor complaints.

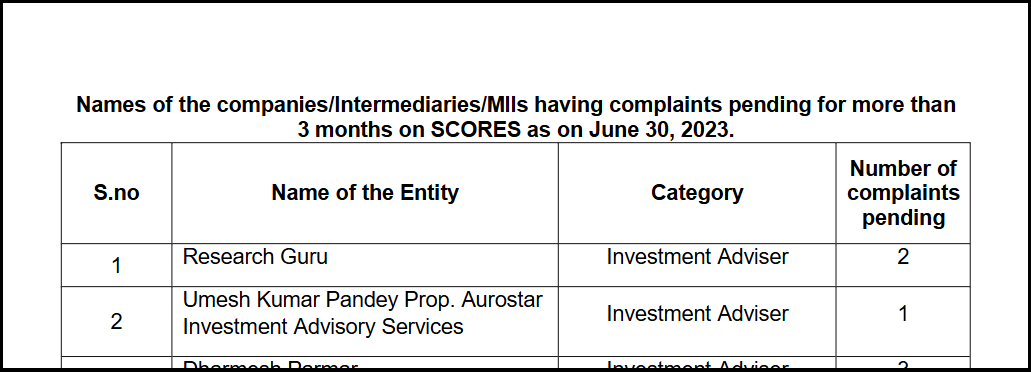

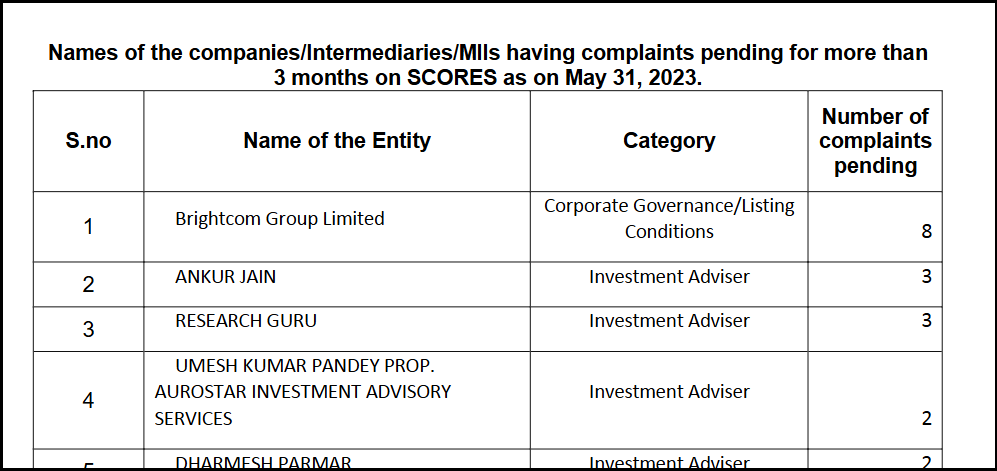

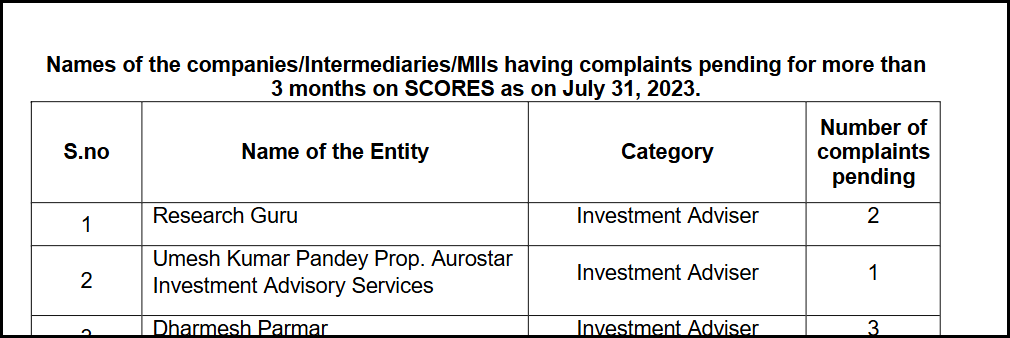

These aren’t one-off issues; the company was listed for four consecutive months in 2023 on SEBI’s SCORES platform, which tracks complaints that remain unresolved beyond the prescribed time frame.

Here’s how that timeline looks:

- April 2023: Aurostar appeared among 14 entities with complaints pending for more than three months.

- May 2023: It continued to feature, this time among 12 entities with unresolved complaints.

- June 2023: The company was still on the list, with eight entities flagged for delays beyond three months.

July 2023: Even by July, Aurostar remained listed for complaints that had not been resolved within the required period.

Why does this matter?

Because SEBI’s SCORES platform exists to protect investors when communication with an advisory firm breaks down.

Repeated inclusion over several months suggests ongoing issues in addressing client grievances, and that’s something potential investors should carefully factor in before making decisions.

Aurostar Investment Advisory Complaint Types

Based on SEBI disclosures and available information, complaints against Aurostar typically fall into these categories:

Common Complaint Types:

- Wrong Investment Advice: Clients report receiving inaccurate trading calls resulting in significant financial losses

- Non-Performance of Promised Services: Failure to deliver the advisory services as committed at the time of payment

- Refund Issues: Difficulty obtaining refunds when services are unsatisfactory or when advisers fail to meet obligations

- Misleading Claims: False promises about guaranteed returns or profit-sharing arrangements

- Aggressive Marketing Tactics: Persistent calling, pressure tactics, and unauthorised contact even after clients decline services

- Lack of Transparency: Inadequate disclosure of fees, risks, or conflicts of interest

- Poor Customer Service: Unresponsive to complaints, inadequate follow-up on client concerns

Based on customer reviews on public platforms, multiple users have expressed that they have lost a considerable amount of money because of wrong recommendations and bad guidance.

A few of them, in particular, have talked about fake promises and money requests for extra charges after they have already made their payments.

Aurostar Investment Advisory Arbitration

Other than complaints, there are arbitration records that offer another lens through which an investment advisory firm’s conduct and dispute-resolution practices can be understood.

Arbitration proceedings typically arise when grievances escalate beyond routine resolution and require formal adjudication.

The following section outlines arbitration-related documents and details associated with Aurostar Investment Advisory, providing readers with context on the nature of disputes and how they have progressed through formal channels.

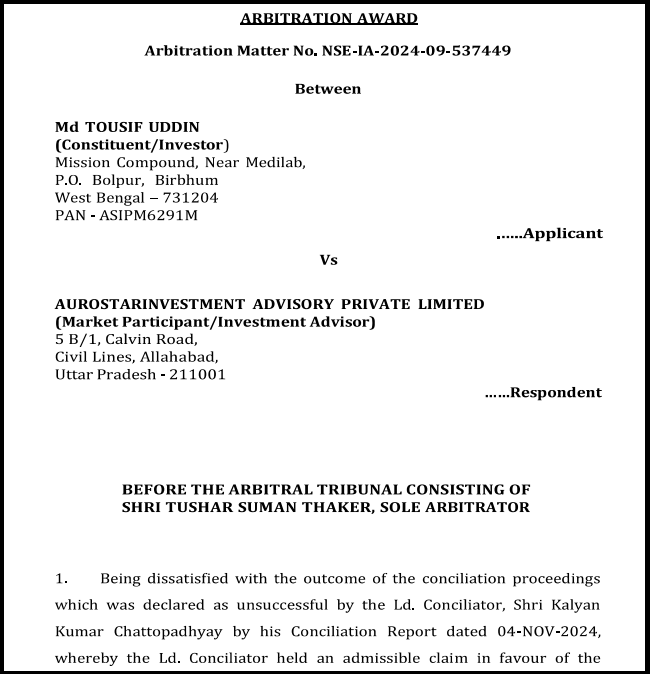

This case represents a significant outcome for an individual investor in proceedings against a SEBI-registered investment advisory firm.

Our team represented the investor throughout the arbitration, guiding the matter through formal dispute-resolution mechanisms.

Case Overview

Parties Involved:

- Investor / Applicant: Md Tousif Uddin

- Advisory Firm / Respondent: Aurostar Investment Advisory Private Limited

- Arbitrator: Shri Tushar Suman Thaker

Core Dispute:

The investor suffered a financial loss of approximately ₹14.1 lakh, allegedly arising from reckless, non-compliant, and unethical investment advice provided by Aurostar.

Final Outcome:

After reviewing the submissions and evidence, the arbitrator ruled entirely in favour of the investor, directing Aurostar to pay full compensation along with refunds and applicable interest.

What the Advisory Firm Did Wrong?

The arbitrator identified multiple serious violations of SEBI regulations:

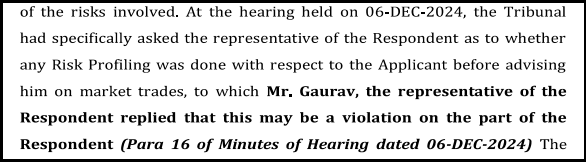

1. Failure to Conduct Mandatory Risk Profiling

- SEBI requires investment advisors to assess a client’s financial situation before giving advice.

- Aurostar skipped this essential step entirely.

- Their own representative admitted during the hearing that this was a violation.

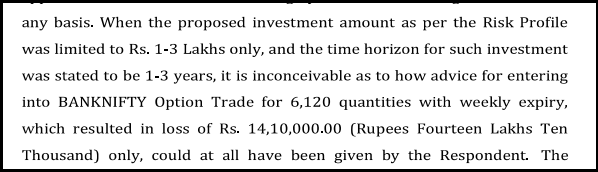

2. Providing Reckless and Unsuitable Advice

- Evidence suggested the investor’s risk capacity was only ₹1–3 lakhs.

- Despite this, Aurostar recommended a high-risk weekly options trade.

- This trade resulted in a loss of ₹14.1 lakhs.

- The arbitrator called the advice “highly reckless and dangerous.”

3. Promising Guaranteed Returns

3. Promising Guaranteed Returns

- Aurostar executives assured the investor of high profits.

- SEBI rules strictly prohibit advisors from promising assured returns.

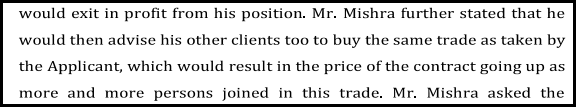

4. Attempting Market Manipulation

- An executive claimed they could influence the market by recommending the same trade to multiple clients.

- This is a serious violation of securities laws.

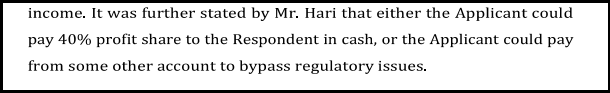

5. Demanding Illegal Extra Payments

- The contract capped the annual fee at ₹1,47,500.

- After collecting this, Aurostar demanded an additional ₹5 lakhs in cash.

- They instructed the investor to pay from his wife’s account to avoid detection.

6. Using Coercive Tactics

- When trades lost money, advisors urged the investor to “average down,” increasing his exposure.

- They then used these mounting losses to pressure him into paying more for “loss recovery” services.

- Even after the investor complained to SEBI, the firm contacted him to withdraw the complaint.

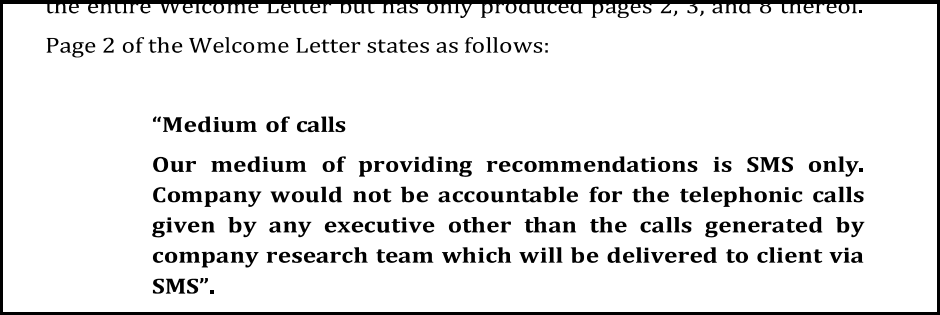

7. Misleading Communication Practices

- The firm’s welcome letter stated that advice would only be given via SMS.

- In reality, all communication and advice were delivered through phone calls and WhatsApp.

- The arbitrator held the firm fully responsible for the actions of its employees.

The Final Ruling: What the Firm Must Pay?

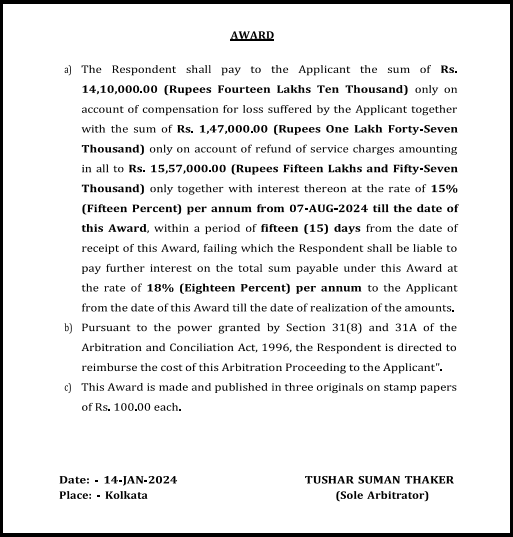

The arbitrator issued a strong and detailed award in the investor’s favour:

Aurostar is ordered to pay the investor a total of ₹15,57,000.

This includes:

- ₹14,10,000 as compensation for the trading loss.

- ₹1,47,000 as a full refund of all advisory fees paid.

Additional Financial Penalties:

- Interest of 15% per annum from August 7, 2024, until the award date.

- If payment is not made within 15 days, the interest rate rises to 18% per annum until full payment.

- Aurostar must also reimburse the investor for the cost of the arbitration proceedings.

What does This Mean for Retail Investors and Traders?

- Trust erosion. Cases like Aurostar damage confidence in legitimate advisory services.

- Increased scrutiny. Persistent complaints invite stricter regulatory action and industry-wide repercussions.

- Investor awareness grows. More people now check SEBI public notices before engaging advisers.

- Market integrity suffers. Unresolved grievances discourage retail participation in capital markets.

How to File a Complaint Against RIA?

If you’re facing issues with Aurostar Investment Advisory Services or any other investment advisory firm, we’re here to help you.

Register with us today.

We Can Assist You with:

1. Direct Engagement & Escalation:

- Filing a SEBI SCORES Complaint: We provide step-by-step assistance to file your SEBI complaint through the SCORES portal. Our team also helps you monitor your SEBI complaint status and respond effectively to any queries from SEBI.

- Using the Smart ODR Platform: For disputes eligible under SEBI’s Smart ODR system, we can guide you through this faster, online method for resolving conflicts with market intermediaries.

2. Assistance in Drafting Effective Complaints: Our experienced team helps you craft clear, comprehensive complaint letters.

3. Document Compilation and Organisation: We assist in gathering, organising, and presenting supporting documents such as payment receipts, communication records, etc.

4. Throughout the Process: From initial filing to follow-up and escalation, we guide you through every stage of the complaint resolution process.

Whether you need help understanding your rights, filing a complaint, or recovering your investments, we’re committed to supporting you every step of the way.

Conclusion

The investment advisory industry in India serves an important function in helping retail investors navigate complex financial markets. However, the sector also attracts entities that may not always operate in investors’ best interests.

The securities market offers genuine opportunities for wealth creation, but only when investors work with ethical, transparent, and properly regulated advisers.

If an advisory service has a documented history of unresolved complaints and regulatory concerns, it’s prudent to look elsewhere for investment guidance.

Stay informed, stay protected, and always verify before you trust your hard-earned money with any investment adviser.