Many people believe that a professional website means a genuine business.

That belief causes serious losses.

In recent years, several trading-related scams have followed the same pattern:

- A clean website

- Confident language about markets

- Telegram channels and Instagram profiles

- Promises of managed trading and profits

A user who interacted with Berij Financial Services experienced exactly this. The website looked genuine.

The communication sounded professional. But the result was a loss of ₹10,00,000 and complete silence afterward.

To understand why this happened, we need to look closely at what the company claims, what Indian regulations allow, and where the gaps appear.

Berij Financial Services Review

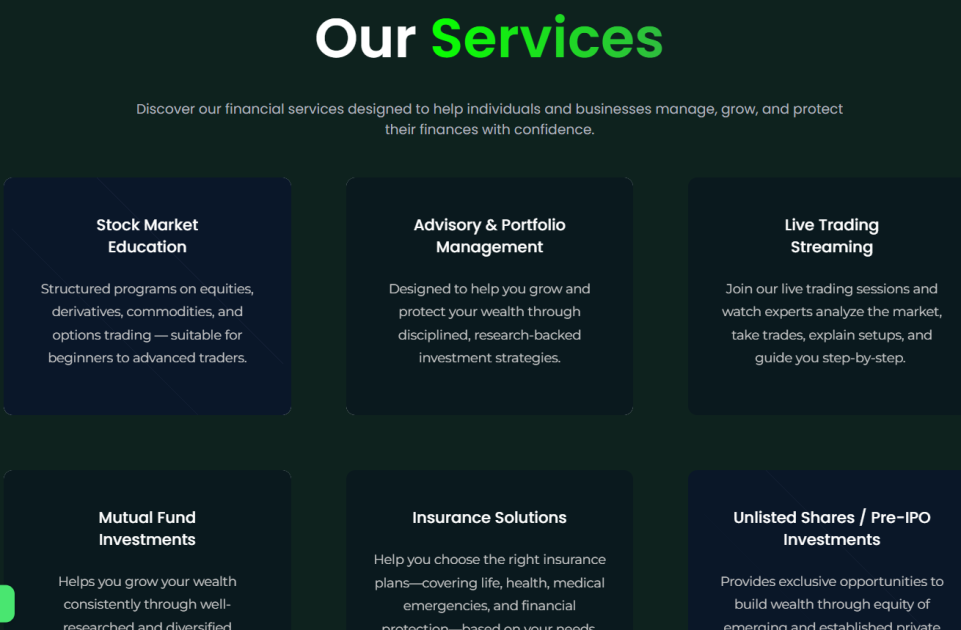

Berij Financial Services presents itself as a financial services and education company.

According to its website, it offers:

- Stock market courses and mentorship

- Advisory and portfolio-related services

- Live trading sessions

- Promotion of trading platforms

- Telegram and social media communities

Now offering stock market courses or mentorship is not an issue. The issue is providing advisory and portfolio management services without SEBI-regulation and authorization.

Berij Financial Red Flags

Companies like Berij Financials often attract people by claiming to offer investment advice or portfolio management services. But when losses happen, they do not take any responsibility.

In many cases, you cannot even complain to SEBI because these companies operate outside SEBI’s rules.

Simply put, if you trust such services blindly and lose money, the loss is entirely yours.

The good news is that there are ways to spot unauthorised investment advisory services and save yourself from financial loss and mental stress.

Let’s understand this in detail by considering Berij Financial:

- No SEBI Advisory License

Now, what confuses people is that when it comes to advisory or recommendations in the stock market, if the person is showing profits, he or she is genuine.

However, that is not true.

SEBI does not allow an unauthorised person, i.e., an individual withoutan SEBI RA or IA license, to:

- Give paid advice on buying or selling securities

- Guide portfolio decisions

- Recommend trades or strategies for real money

When a website mentions advisory or portfolio services but does not show SEBI registration details, that creates a serious compliance issue.

And this is what raises the major concern with Berij Financial services who does not hold any such license or certificate.

- Involved in “Live Trading”

Berij promotes live trading as a service.

This matters because:

- Live trading often influences users to place real trades

- Real-time trade guidance counts as investment advice

- Even SEBI-registered IAs cannot do live trading sessions.

- No unregistered entity can provide live trade instructions

If “live trading” means:

- Telling users when to enter or exit

- Guiding trades in real time

- Managing trades indirectly

Then the activity becomes illegal without SEBI registration.

Using the word “education” does not change the nature of the activity.

- Promotion of Trading Platforms

Berij’s website promotes external trading platforms and redirects users to sign up.

This raises concerns because:

- Investment advisers cannot promote platforms for commissions

- Referral relationships require disclosures

- Many promoted platforms operate outside Indian exchanges

SEBI does not allow unregistered entities to:

- Act as trading facilitators

- Push users toward specific platforms

- Earn referral income without disclosure

Berij does not explain:

- Its relationship with these platforms

- Whether it earns money from referrals

- Whether the platforms operate under Indian regulation

That lack of transparency creates risk for users.

- Selling Premium Telegram Channel Subscription

Most trading scams do not execute on the website itself. They execute on Telegram and Instagram.

In this case, the user interacted with:

- A Telegram channel offering managed trading

- Instagram accounts claiming to represent the service

- A website used to establish trust

The website worked as a credibility layer. The persuasion happened on messaging platforms.

Berij Financial Services Complaints

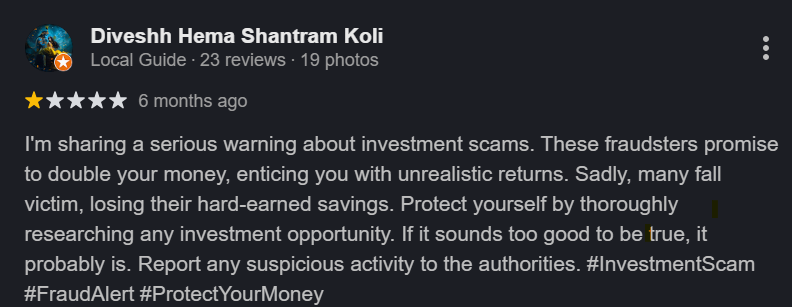

One user raised a complaint to warn people about investment scams run by Berij Financials.

He mentioned the promise to double your money.

₹10 Lakh Lost in a Scam Using the Name of Berij Financial

A user reported the following experience:

“I came across a Telegram page offering online trading services. They assured me they would manage trading on my behalf and guarantee profits.”

The operators:

- Promised guaranteed returns

- Claimed they would handle trading

- Directed the victim to the Berij Financial Services website.

Based on repeated assurances and PnL screenshots, the user transferred ₹10,00,000.

After payment:

- No real trading updates appeared

- No returns came

- Telegram and Instagram communication stopped

This pattern matches a common online trading fraud structure:

- Website for trust

- Telegram for persuasion

- Social media for personal interaction

- Silence after money transfer

How to Identify Such Unauthorised Advisory Frauds?

This case shows multiple violations:

- Guaranteed returns are illegal under SEBI rules

- Managing trades on behalf of users requires registration

- Investment advice without SEBI IA registration is prohibited

- Live trading influence crosses into regulated activity

- Platform promotion without disclosure violates fair practice norms

Education is allowed. Advice, influence, and fund handling are not permitted unless registered.

How to Report Investment Scams?

In case you are one of the victims of any such unauthorised advisory, account handling, etc, then taken an immediate action by following the process below:

1. Preserve All Evidence

Save:

- Telegram chats

- Website screenshots

- Payment proofs

- Social media profiles

2. File a Cyber Crime Complaint

Report the case at cyber crime under online financial fraud.

Mention:

- Telegram channel names

- Website link

- Instagram accounts

- Payment details

3. File a Complaint in SEBI

In such cases, you cannot lodge a complaint with SCORES; however, you can report it to SEBI by sending an email with all the proofs related to:

- Unregistered advisory activity

- Guaranteed return claims

- Misuse of financial services branding

SEBI tracks patterns even if recovery takes time.

Need Help?

Cases like this confuse people because everything looks professional on the surface.

Register with us today.

We provide clear, step-by-step guidance on:

- Identifying unregistered investment advisers

- Mapping website claims to SEBI violations

- Structuring cybercrime and SEBI complaints correctly

- Avoiding recovery scams that target victims again

The focus stays on facts, evidence, and the correct process.

Conclusion

Berij Financial Services may sell courses.

That alone raises no issue.

But when a company:

- Implies advisory services without SEBI registration

- Promotes live trading

- Links to Telegram channels promising managed trading

- Gets linked to real user losses

The issue moves from education to regulatory violation and potential fraud.

In trading, registration and compliance matter more than appearance.

Always verify before you trust.