Have you recently been added to a Telegram group offering block trading services and claiming huge returns and profits? Well, before you begin, take a minute to check whether Block trading is safe or not!

Let’s begin with the meaning of block trading!

Block trading refers to the buying or selling of a large quantity of securities, typically stocks or bonds, in a single transaction. Because these trades are so large, they can move market prices if handled on the open exchange.

But here’s the real question: How can a retail trader even think about bulk buying when block trades require massive capital?

And wait, are retail traders even allowed to participate in block trading?

Well, the truth is retail traders can’t place true block trades, but they can track them, and that’s where the real edge begins.

Still confused! Let’s get into the details.

Is Block Trading Safe in India?

As mentioned, block trading is dominated by big companies and institutional investors.

But again, the lack of understanding of how it works makes it easier for scammers to misguide retail traders, who are first randomly added to a Telegram or WhatsApp group and later are induced with fabricated profit screenshots.

Here is a news article published on Business Standards, creating awareness about such fraud groups running in the name of registered brokers, Axis Securities.

There isn’t just one type of scam; these fraudsters use the names of multiple well-known brokers to create fake groups.

They’ll even use the broker’s logo as the display picture and show a fake SEBI licence to appear legitimate.

Once the user gains trust, they convince them to download a clone trading app that looks almost identical to the real one. For a beginner, it’s nearly impossible to notice the difference at first glance.

But there are a few red flags that expose these fake apps:

- They ask users to deposit money for trading using third-party bank accounts or random UPI IDs.

- They insist on a “minimum deposit amount” before you can start trading.

Most new traders miss these signs simply because they don’t know the basics:

A genuine trading app never asks you to transfer money to a third-party account, and there is no mandatory minimum deposit required to open or use an account with a legitimate stockbroker.

Is Block Trading Legal?

Yes, block trading is legal in India when it is executed through a recognised stock exchange during the designated block deal window and under SEBI regulations.

It is typically conducted by institutional investors through registered brokers, with proper disclosure and compliance.

However, it becomes illegal when individuals or groups falsely claim to offer “private block deals,” guaranteed IPO allotments, or assured returns outside official exchange platforms.

Most Telegram or WhatsApp groups promoting such offers are linked to trading scams in India.

If money is collected through personal accounts, clone apps, or fake licences, it is not block trading; it is a scam.

In short, regulated exchange-based block deals are legal. Secret “guaranteed profit” block trading schemes are not.

Block Trading Scams

As mentioned, there are multiple cases where people lost their money in the block trading scam.

Below are a few case studies covering details and losses incurred by victims.

1. Mumbai Block Trading Scam: Last July, a 54-year-old lady was scammed in Mumbai.

- They lured the victim via WhatsApp messages.

- They promised “positive returns”, shares, and great block deals.

- Somehow convinced her to deposit money into third-party accounts, claiming that private block deals are happening.

- The police caught the owner of the account, Vinayak Promodkumar Baranwal, from Thane.

- Then, he was arrested for committing Cyber fraud and being involved in previous bank transfers of the same kind.

- The victim lost a lump sum of 27 Lakhs. Shocking, right?!

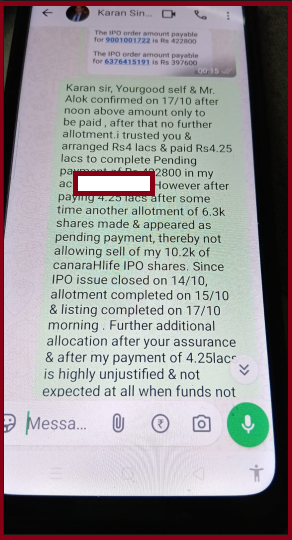

2. Conifer Investments

An 78-year-old Elderly Man Lost his Life’s savings in a Block Trading Scam on WhatsApp

- A 78-year-old senior citizen, Mr Amal Singh (name changed), was targeted through these groups and initially invested ₹50,000 after seeing fake profits and convincing messages.

- The scammers then pressured him to add more money by claiming he had received a large IPO allotment worth ₹3.2 lakh.

- He was told to deposit an additional ₹4,00,000 to “confirm” the allotment, and trusting their assurances, he transferred ₹4,25,000.

- The app showed fake balances and fabricated share holdings totalling 16,500 shares, all displayed after the IPO deadlines had closed, proving the allotment was fake.

- Whenever he tried to withdraw his money or sell the shares, the app showed errors and blocked the transactions.

- In total, he lost around ₹12,25,000, with the platform trapping every rupee and the scammers disappearing once he stopped adding funds.

3. Hyderabad Block Trading Scam: A retired engineering college principal got duped and lost 8 crores rupees.

- The victim got a call inviting him to join a WhatsApp group named SIG Trading.

- After joining this group, he was encouraged to join another one.

- E-26 RK Global Customer Care was its name. In this group, they gave Trading tips and IPO suggestions.

- Then, he was convinced to use the RK Global app to do trading.

- Initially, they let him withdraw a small amount to gain his trust.

- In the RK Global app, he was promised block trading with “institutional investors” and guaranteed IPO allotments.

- The victim consistently transferred funds to the app.

- Then, when he tried to withdraw his alleged profits, it did not reflect in his bank account.

- When speaking to the RK global customer care, they stated that he had to pay 2% of his total sum on the app to withdraw any money. The audacity, right? Unbelievable!

- It doesn’t stop there… The victim was forced to pay 75 Lakhs in numerous bank transfers.

- The victim pressed charges against the organisation, reporting fraud.

So, what can be interpreted from this?

Simple, that Block trading is not safe, and any group on Telegram or WhatsApp claiming to offer huge returns with block trading is simply a scam.

All you can do is to exit that group and block it.

How to Report Trading Scams Online?

If somehow you end up joining any such fake group and lose your money, do not panic.

You still have an opportunity for trading fraud recovery in India, especially if you report the matter immediately.

Just follow the steps below and:

- Lodge an FIR at the local police station.

- File a Cyber Crime complaint.

- Inform your bank immediately (raise a dispute, request a stop/recall where possible).

- Inform your broker/depository (NSDL/CDSL) so they can flag suspicious demat transfers.

Need Help?

Register with us, and we will guide you through the process to report such scams and help you recover your losses.

Remember, quick action increases chances of recovery.

Conclusion

If you want to start purchasing stocks through Block Trading, always choose a registered broker.

Work under the SEBI guidelines to do it in a window session.

This can help you avoid scams or fraud, especially those promoting fake block trading in Telegram groups.

It’s best to avoid unknown apps or do paper trades via WhatsApp, Facebook, or Telegram apps.