Discovering missing securities in your CDSL Demat account or struggling to get responses from your DP can be frustrating.

These issues affect thousands of investors across India, yet many are unaware that structured grievance-redressal mechanisms are already in place.

Here are some of the common CDSL complaints and the process to report them online.

Is CDSL Safe?

CDSL (Central Depository Services Limited) is one of India’s leading securities depositories. Established in 1999, it currently manages over 9.57 crore Demat accounts and processes crores of transactions every day.

Think of CDSL as a digital locker for your investments, your shares, bonds, and mutual funds are held electronically, eliminating the need for physical certificates.

Key Statistics (as of November 2025)

- Active Demat accounts: 9.57 crore+

- Depository Participants (DPs): 600+

- Average daily transactions: Several lakhs

As per information available on CDSL’s official website, it operates the second-largest depository infrastructure in India.

The entity was promoted by the Bombay Stock Exchange (BSE) to introduce competition alongside NSDL.

CDSL functions under strict SEBI regulations, with regular audits and robust compliance frameworks in place to safeguard investor securities.

Additionally, CDSL is a publicly listed company, ensuring financial transparency; its quarterly financial results are available for anyone to review.

All things considered, CDSL stands out as a well-regulated, transparent, and credible institution in India’s capital market ecosystem.

Common CDSL Complaints

According to CDSL’s complaint handling framework, issues fall into these categories:

1. Account Operations

- Account opening delays beyond 15 days

- Closure request not processed

- Duplicate account issues

- Conversion problems (minor to major)

2. Transaction Related

- Settlement failures post T+2

- Securities wrongly debited/credited

- Off-market transfer stuck

- Pledge/unpledge errors

3. Service Quality

- Poor DP customer support

- Delayed response to queries

- Incorrect information provided

- Hidden charges levied

4. Corporate Actions

- Dividend not received

- Bonus shares not credited

- Rights/buyback issues

- Stock split problems

5. Technical Glitches

- Portal login failures

- OTP not received

- Statement download errors

- Mobile app crashes

Each category has different resolution procedures. Knowing your complaint type helps navigate the system better.

How to File a CDSL Complaint Online?

Ready to file your complaint? Follow this precise process.

Step 1: Try Resolving with Your DP First

This step is mandatory. CDSL requires proof that you approached DP first.

Contact your DP:

- Explain the issue clearly

- Provide all relevant details

- Attach supporting documents

- Request resolution timeline

According to CDSL guidelines, give DP at least 7-15 days to respond before escalating.

Why does this matter? Because CDSL will ask: “Did you contact DP first?” Without proof, a complaint may get returned.

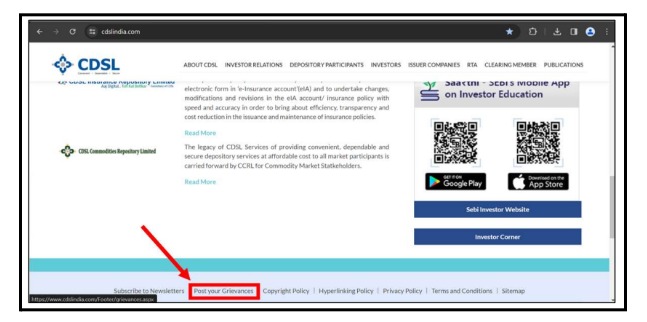

Step 2: Visit CDSL’s Official Complaint Portal

If DP doesn’t resolve your issue, escalate to CDSL.

Navigate to the “Investor Services” section. Look for the “Investor Grievance” or “Complaint Registration” option.

According to CDSL’s website structure, the complaint mechanism is accessible from the main menu. Usually under the “For Investors” dropdown.

Step 3: Register on CDSL Portal (If New User)

First-time registration process:

- Click “New User Registration”

- Enter your BO ID (16-digit number)

- Provide a registered mobile number

- Enter registered email address

For existing users:

- Simply log in with your credentials

- Use the forgot password option if needed

Portal maintains your profile. Future complaints become easier to file.

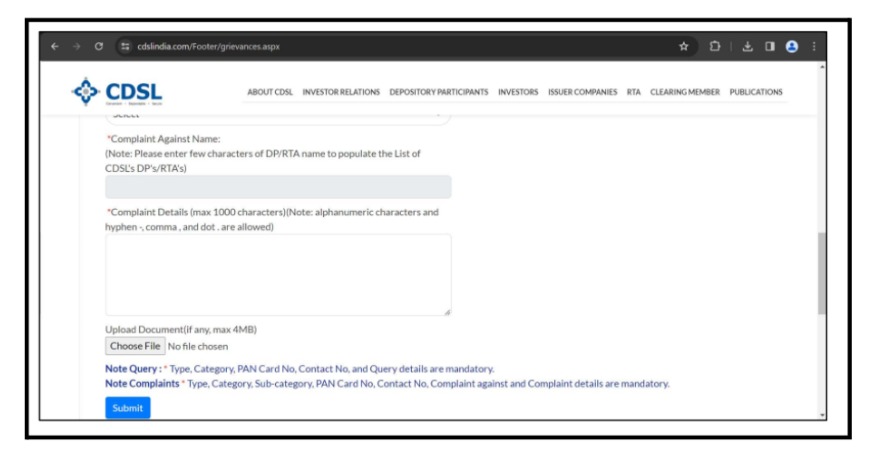

Step 4: Fill the Complaint Form Accurately

Now the critical part. Fill with complete accuracy.

Select complaint category:

- Choose from the provided dropdown

- Pick the most relevant option

- Sub-categories appear automatically

Enter DP information:

- DP ID mandatory

- DP name auto-populates

- Can’t proceed without the correct DP ID

According to CDSL’s processing guidelines, detailed complaints get priority attention. Vague ones create back-and-forth delays.

Step 5: Submit and Save Reference Number

After filling everything:

- Review all details once

- Click the “Submit” button

- The system generates a complaint reference number

- Format usually: CDSL/COMP/2024/123456

This reference number is your complaint identity. Without it, tracking becomes impossible.

Step 6: Track Complaint Status Regularly

Don’t just file and forget. Track actively.

Login to the CDSL portal anytime:

- Go to the “Track Complaint” section

- Enter your reference number

- Current status displays

Status indicators typically show:

- Registered: Complaint received by CDSL

- Forwarded to DP: Sent to your DP for action

- Under Review: DP is investigating the issue

- DP Responded: DP has submitted their reply

- Resolved: Issue fixed, complaint closed

- Reopened: If the resolution is unsatisfactory

According to CDSL’s tracking system, its status updates every 48-72 hours. Check weekly for progress.

CDSL Complaint Resolution Timeline

How long before you get a resolution?

Let’s see realistic timelines.

Official Timeline Framework

According to CDSL’s investor charter and SEBI guidelines:

Day 1-3: Complaint registered and acknowledged

Day 4-7: Forwarded to the concerned DP for response

Day 8-21: DP investigates and submits reply

Day 22-30: CDSL reviews DP’s response

Day 30: Resolution communicated to investor

Total standard timeline: 30 days maximum

This is what CDSL commits officially. Reality varies based on complexity.

What to Do When CDSL Doesn’t Resolve a Complaint?

30 days passed. Still no proper resolution. What next?

Escalation mechanisms exist. Use them strategically.

Level 1: Escalate to CDSL’s Grievance Officer

If the initial complaint doesn’t yield results, escalate within CDSL.

Contact CDSL’s Grievance Redressal Officer:

Email: [email protected]

According to CDSL’s escalation policy, the Grievance Officer reviews within 15 days.

Has the authority to direct DPs to take specific actions.

Level 2: Approach Investor Grievance Redressal Committee (IGRC)

Still unresolved? Move to IGRC.

What is IGRC?

According to SEBI regulations, every depository must have an Investor Grievance Redressal Committee. It includes:

- Independent external members

- CDSL representative

- Investor representative

- Legal/subject experts

IGRC Powers:

- Can summon DP for explanation

- Review all transaction records

- Order specific corrective actions

- Award compensation to investors

- Impose penalties on erring DPs

Timeline: IGRC typically decides within 45 days of receipt.

Level 3: File on SEBI SCORES Platform

IGRC didn’t help? Time for regulatory intervention.

SEBI SCORES (SEBI Complaints Redress System) – Most powerful investor tool.

Steps to file complaint in SCORES:

- Register on the SCORES portal (one-time)

- Login with credentials

- Click “Lodge Complaint”

- Select entity type: “Depositories”

- Choose entity name: “CDSL”

- Select complaint category

- Fill comprehensive complaint form

- Upload all documents:

- CDSL complaint history

- DP correspondence

- Transaction proofs

- Loss calculation

- Submit and note the SCORES complaint number

Moreover, SCORES complaints create permanent records. Affects the entity’s regulatory rating.

Level 4: Arbitration Mechanism

If the dispute involves a monetary claim and remains unresolved through earlier channels, arbitration in stock market can be pursued as the final formal remedy.

How to initiate arbitration:

According to CDSL’s arbitration framework:

- File an arbitration application with CDSL

- Pay prescribed arbitration fees

- CDSL appoints arbitrator(s)

- Both parties present evidence

- Arbitrator passes binding award

Arbitration timeline: 6-12 months typically

Arbitration costs: ₹10,000-50,000 depending on claim amount

Suitable for significant disputes. Not for small service issues.

Need Help?

Still struggling after trying everything? Complaint going nowhere? Does the system seem too complicated?

You’re not alone. Professional help exists.

Your situation involves:

- Financial loss exceeding ₹1 lakh

- Complex legal or technical issues

- Multiple failed resolution attempts

- Suspected fraud or unauthorised trading

- Time-sensitive urgent matters

- Conflicting responses from multiple parties

We’ll help you with:

- Expert complaint drafting using legal terminology

- Strategic escalation path planning

- Representation before IGRC/arbitration

- SEBI SCORES filing assistance

- Consumer court case preparation

- Evidence compilation and documentation

Register with us today. Get your CDSL complaint resolved systematically. Expert guidance. Strategic approach. Maximum results.

Start your resolution journey today.

Conclusion

CDSL is a legitimate, SEBI-regulated depository. Your securities are legally protected under Indian law. Infrastructure is robust. Systems are generally reliable.

However, operational issues do occur. DP-level problems are common. Technical glitches happen. Service deficiencies exist.

Start with DP, then CDSL portal, then IGRC, and finally SEBI SCORES if necessary. Sequential escalation works.

Use complaint reference numbers. Check status weekly. Document everything. Maintain complete records.

The standard resolution timeline is 30 days as per SEBI guidelines. Most genuine complaints with proper documentation get resolved within this period. Escalation mechanisms work for complex cases.

Remember: Silence changes nothing. Proper complaints with correct documentation get results. Your securities, your money, your rights, action is your responsibility.

Don’t let unresolved issues linger indefinitely. File correctly today. Escalate strategically. Protect your investments actively.