Every investment has certain risks. How much risk you can bear depends only on you.

However, blindly trusting an entity with a history of multiple frauds is absurd!

If you think this time, Cross Market AI will give you the best return, you need to think again. Promising to pay you back later and earning the returns on your investment mean completely different things in the financial world.

Scratching your head will not get you the answer if investing in Cross Market AI is safe or not. Here, we have so many proofs to help you make the right choice.

What is Cross Market AI?

Cross Market AI is a trading company that uses algorithmic trading. The company offers AI-guided strategies to investors.

It sounds very interesting and easy to earn a high profit without failure. Even the recent hype has lured many people to invest a lump sum to make a gain.

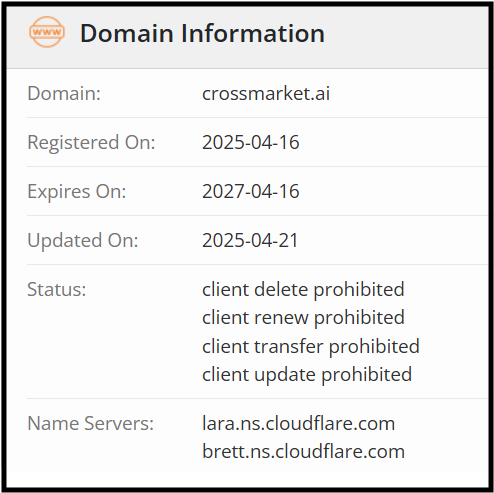

But there is a lot more you need to know to understand if Cross Market AI is safe or not. Moreover, the company was established in April 2025.

It is too young to be reported as a scam. But the chances are high for many reasons.

Sadly, the story does not end here. Because the owner of the company, Lavish Chowdhury, is the mastermind of multiple scams.

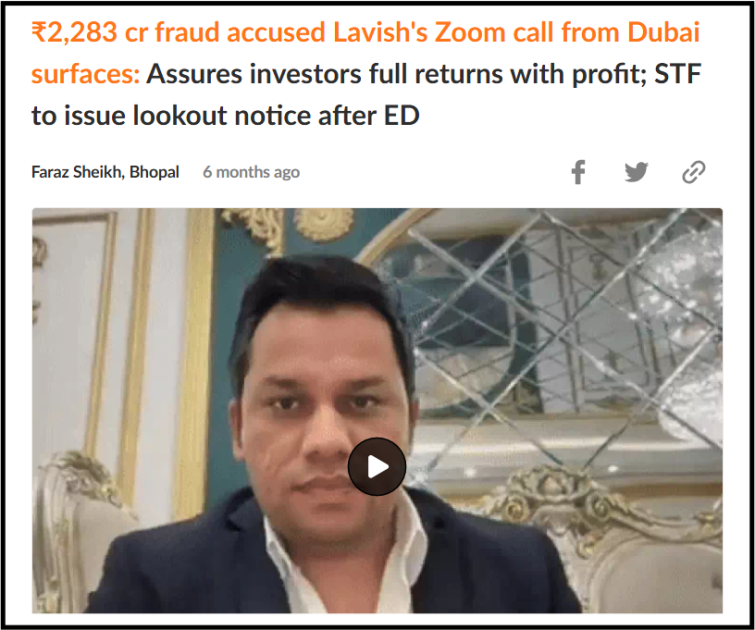

ED and the Bhopal Special Task Force are already on the lookout for him for the INR 2,283 crore fraud.

But he has fled to Dubai and is operating this new venture with new agendas.

Claiming that he will return money to investors can influence many to trust him again. But, if you prefer Cross Market AI despite learning about its crucial red flags, you are responsible for your own decision.

Is Cross Market AI Safe to Invest?

Investing in Cross Market AI is extremely risky and exhibits the classic hallmarks of a financial scam.

If you are wondering whether Cross Market AI is real or fake, or whether it is safe, the evidence points toward a sophisticated “shell game” designed to trap investor capital under the guise of high-tech arbitrage.

Here are the critical red flags that make this platform unsafe and fraudulent:

1. Running Multiple Shell Companies

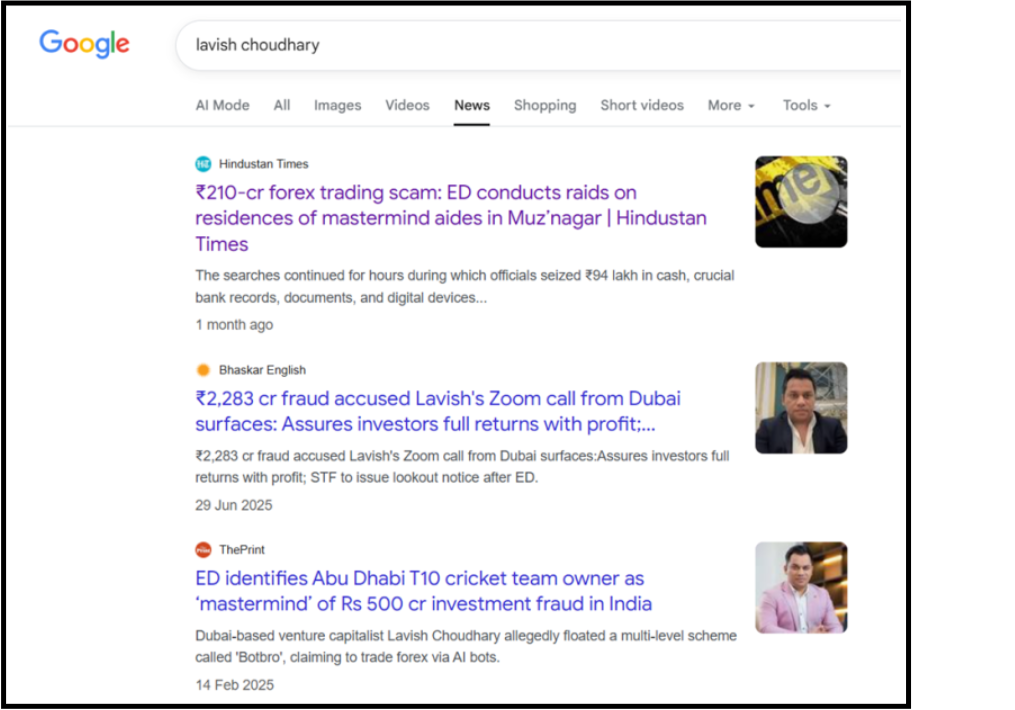

The owner of the Cross Market AI, Lavish Chowdhuri, is also the owner of Botbro, QFX Trade, and Yorker FX (YFX). These companies scammed around INR 500 crore in investment.

Is there any guarantee that they will not scam the Cross Market AI investors?

After all, you do not know which products you are buying or where your money is invested. Arbitrage trading can become risky and highly loss-making without the right strategy.

More than that, due to SEBI’s restriction, the trading is not completed within one day. Noncompliant Cross Market AI does not follow this rule. It also practices trading without routing through the security exchanges.

Thus, it is another big flaw in the system, which is completely illegal in India.

2. Lack of Transparency

The platform is not SEBI registered. It is mandatory to operate cross-market arbitrage trading in India. Thus, it acts as another red flag.

Moreover, if the company suddenly stops its operations, how will you trace it back?

Do they have a registered office in India? No.

Does the company have any license to claim its legitimacy in India? At least, you do not have any such information.

Then, why will you trust the company? Just to earn a high return? And that is also without any confirmation from a legitimate source!

Moreover, due to various legal and safety issues, the app is not available in the Google Play Store or the Apple App Store.

You have to download the APK files. Why? Simply to avoid negative reviews from users. If it is also acceptable to many. How can you put your system vulnerable to hackers by downloading the APK files?

Doing this, you might lose money, personal information, critical data, and your system.

3. False Income Claims In a Short Period

Promising a 0.5% to 1% daily return is a big red flag for novice investors.

The cross-market arbitrage trading is profitable only when the invested amount is very high. Earning money through a small difference in price is risky and loss-making.

There is no certainty that you will make the right choice, even if the platform takes a genuine approach, which it is not doing.

So, how much are you willing to put at stake? And Why? When there is very little chance to win, any expert will take a step back and think again.

Can Cross Market AI Stop Working?

Yes! It can. Since it did the same with Botbro, QFX Trade, and YFX, it can do the same with Cross Market AI. It is more likely that the owner will not return any money after closing the company.

There are many reports against Lavish Choudhury, who is operating from Dubai.

Popular newspapers such as The Print and Hindustan Times recently reported a scam of INR 500 crore and INR 210 crore, respectively. In both of these scams, he was the key player.

If you still doubt whether investing in Cross Market AI is safe or not, you have to do a little research. Remember, a hype is necessary to lure you. But it is not necessary for you to trust a fraudster.

How to Report Cross-Market AI?

If you made a big loss on the platform or became a victim anyway, you have to follow this guideline.

- Collect proofs: Save all the information related to transactions, messages and other communications.

- Contact Bank: Call your bank to freeze your account to avoid any automatic debit.

- Register a complaint at Cyber Crime: File an FIR in the nearest cybercrime police station.

- Lodge a complaint at SCROES: Report to SEBI for immediate action.

- Report to RBI: File a complaint at RBI Sachet portal as well.

- Consult Experts: Take help from scam recovery service providers to take legal actions, get justice, and recover lost money.

Need Help?

Register with us with your issues about the platform.

We will help you to file a complaint and recover money in case you suspect a scam. From documentation to getting justice, we supported 15,000+ at every stage in the fight against odds.

Conclusion

Therefore, when you are aware of all the pros and cons, why take the risk? It’s your hard-earned money after all!

Cross Market AI shows multiple warning signs that investors should not ignore. When transparency, regulation, and accountability are missing, the risk of financial loss increases significantly.

Protecting your hard-earned money starts with caution, verification, and refusing to trust unrealistic promises.