Lost money in the stock market? Broker refusing to return your funds?

You’re not alone in this struggle.

Thousands of Indian investors face similar issues every day.

The big question is: can SEBI actually solve your problem?

Let’s find out everything you need to know.

Understanding SEBI’s Role in Complaint Handling

SEBI stands for Securities and Exchange Board of India.

Think of it as the police of the stock market.

But here’s the thing. SEBI doesn’t work like regular customer service. They have specific rules about what they can and cannot handle.

According to SEBI’s official documentation, they operate through a platform called SCORES (SEBI Complaints Redress System).

This system was launched to make complaint filing easier for common investors.

The platform is free to use. Anyone can register and file complaints online.

However, there’s a catch you must understand first.

Does SEBI Actually Handle All Types of Complaints?

In short, the answer is no.

SEBI only deals with complaints related to registered market entities. This is extremely important to understand.

What does “registered” mean?

It means the company or person must have a valid license from SEBI. Without registration, SEBI’s hands are tied.

For example, imagine you lost ₹5 lakh to a Telegram trading tips group. You file a complaint with SEBI.

But if that group isn’t SEBI-registered, your complaint won’t progress through SCORES.

Types of Complaints SEBI Handles

SEBI’s jurisdiction covers specific market-related grievances.

Let us break them down for you:

1. Stock Broker Complaints

Your broker is your gateway to the stock market. When they mess up, it hurts.

SEBI handles these broker complaints:

- Funds are not credited to your account after withdrawal

- Trading was done without your permission

- Contract notes not received or incorrect

- Excessive brokerage charges

- Account statements not provided

- Losses due to a technical glitch in the trading app

2. Mutual Fund Grievances

Mutual funds involve your long-term savings. Issues here can be serious.

SEBI addresses:

- Units not credited after investment

- Redemption amount delayed

- Wrong NAV applied to your purchase

- Switching between schemes was not executed

- Dividend not received

For instance, delayed mutual fund redemptions are quite common.

3. Complaints Against Depository Participant

Your Demat account holds your shares electronically. Problems here affect your entire portfolio.

Common issues SEBI handles:

- Shares not credited after purchase

- Demat account statement errors

- Unauthorized debit of securities

- Issues in pledge/unpledge of shares

- Corporate action benefits are not received

4. Listed Company Disputes

When companies listed on stock exchanges fail to fulfill their obligations, SEBI intervenes.

These include:

- Dividends not paid to shareholders

- Rights issue shares not allotted

- Bonus shares not credited

- Share certificates not received (for physical shares)

- IPO refund delays

What Complaints SEBI Does NOT Handle?

This is where most investors get confused. And it’s crucial you understand this clearly.

SEBI cannot help you with:

- Unregistered Entities

Any person or company operating without an SEBI license falls outside their scope. This includes most Telegram channels, WhatsApp groups, and Instagram pages offering stock tips.

- Fraud Investment Schemes

Ponzi schemes, guaranteed return promises, and fake investment apps aren’t handled by SEBI directly. These require police intervention.

- Personal Loans

If someone gave you a loan and isn’t returning it, SEBI won’t help. This is a civil matter.

- Banking Disputes

Issues with your bank account, credit cards, or personal banking fall under RBI, not SEBI.

- Insurance Problems

Life insurance or general insurance complaints go to IRDAI (Insurance Regulatory and Development Authority of India).

- Forex Trading Complaints

Since forex trading is not regulated by SEBI nor authorised by RBI, any losses or issues with forex trading platforms are not handled by the Securities & Exchange Board of India.

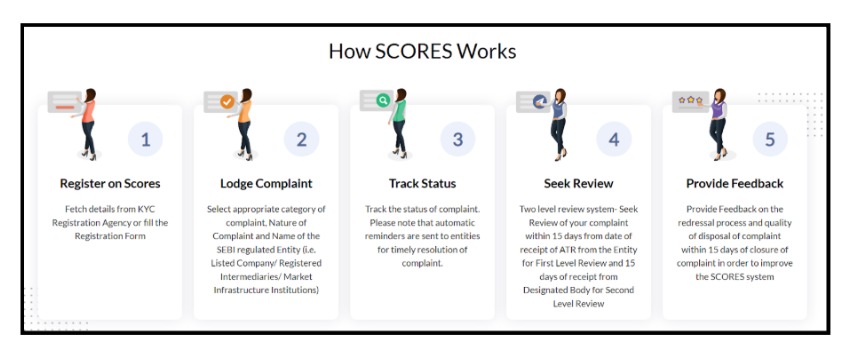

How SEBI’s Complaint System Actually Works?

Let us walk you through the exact process of filing a complaint in SCORES.

It’s simpler than you think.

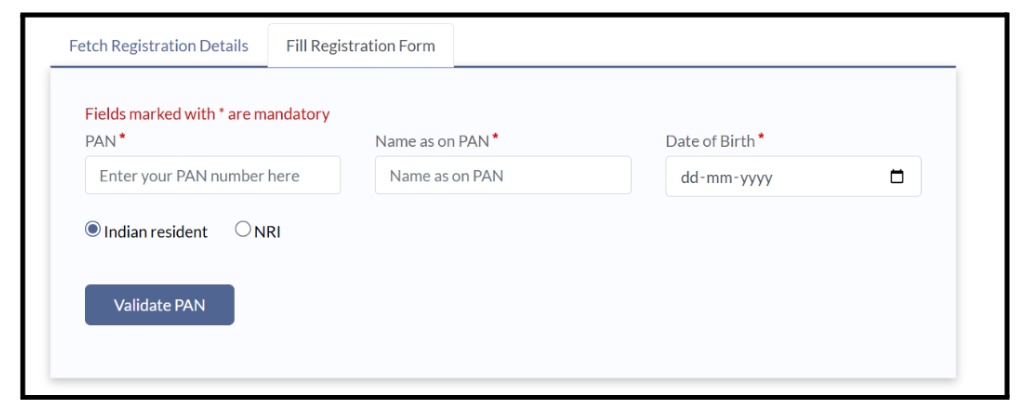

Step 1: Register on SCORES Portal

Visit its website from any device.

The registration is straightforward.

You’ll need:

- Valid email address

- Mobile number (for OTP)

- PAN card details

- Basic investment information

The registration takes about 5 minutes. Once done, you can file unlimited complaints.

Step 2: File Your Complaint

After logging in, click on “Register a Complaint.” You’ll see a form.

Fill in these details:

- Type of entity (broker, mutual fund, etc.)

- Name of the company

- Your specific problem

- Transaction details

- Amount involved

Step 3: Upload Supporting Documents

This is critical. Your complaint strength depends on the evidence.

Upload:

- Bank statements showing transactions

- Contract notes or transaction receipts

- Email communication with the company

- Screenshots of your account

- Any written agreements

According to SEBI guidelines, PDF and JPEG formats work best. Keep file sizes under 2 MB.

Step 4: Complaint Gets Forwarded

Once submitted, SEBI forwards your complaint to the concerned entity. The company gets a notification.

They must respond within 30 days.

This is mandatory as per SEBI rules.

You’ll receive an acknowledgment number. Use this to track your complaint status online.

Step 5: Track and Respond

The company will respond to your complaint. You’ll get a notification at your registered email.

Review their response carefully.

You have three options:

- Accept if satisfied

- Reject if unsatisfied

- Seek clarification

The platform allows back-and-forth communication until resolution.

Step 6: Closure

Once both parties agree, SEBI marks the complaint as resolved. If the company doesn’t respond or you’re unsatisfied, SEBI can take enforcement action.

How to File a Complaint in SEBI?

Different problems need different approaches.

Here’s what to do in various scenarios:

Scenario 1: Issue with Registered Broker

Your broker has a SEBI license but isn’t resolving your issue.

Immediate steps:

- Send a written email to their grievance cell

- Wait 7 days for a response

- If no response, file a SCORES complaint immediately

- Keep all transaction proofs ready

- Note down specific trade dates and amounts

Expected timeline: 30-45 days for resolution.

Scenario 2: Lost Money to an Unregistered Advisor

Someone on Telegram promised guaranteed returns. Now they’ve disappeared with your money.

What to do:

- Don’t waste time on SCORES (won’t work)

- File an FIR at your nearest police station immediately

- Inform your bank to track the beneficiary account

- Join hands with other victims if possible

Scenario 3: Mutual Fund Redemption Delayed

You requested redemption, but the money hasn’t arrived in your bank account.

Action plan:

- Check if 3 business days have passed (standard time)

- Contact AMC customer care first

- If they don’t respond in 48 hours, file a SCORES complaint

- Mention your folio number and redemption request date

- Attach a bank statement showing no credit

Most mutual fund complaints resolve within 15 days.

Scenario 4: Unauthorized Trading in Your Account

You see trades you never authorized in your trading account.

Critical steps:

- Take screenshots immediately of all unauthorized trades

- Change your trading password right away

- Send an immediate email to the broker, marking it urgent

- File SCORES complaint the same day

- Mention specific trade IDs and times

Time is crucial here. Act within 24 hours for best results.

Scenario 5: Fake Investment App Scam

You invested through an app that looked legitimate, but now it’s not working.

Recovery process:

- Don’t uninstall the app yet (evidence needed).

- Take screenshots of everything.

- File a cyber crime complaint first.

- Register FIR at the local police station

- Alert your bank about the fraudulent transaction.

- Check if SEBI has issued any warning about that app.

Need Help?

Losing money hurts. But what hurts more? The silence that follows. The ignored calls. The vanished contacts.

Filing a SEBI complaint sounds simple on paper. But when you’re already stressed and confused, even simple tasks feel like climbing a mountain.

You don’t have to face this alone. Register with us today.

We’ve walked this path with hundreds of investors who felt exactly like you do right now. Uncertain. Frustrated. Hoping for justice.

Here’s exactly how we support you through the entire process:

- Complete Document Support: Getting your paperwork in order is half the battle won.

We help you identify what evidence you need, transaction receipts, email exchanges, bank records, screenshots, agreements, account statements, and anything else that strengthens your case.

We guide you on how to organize everything properly so nothing important gets missed. - Complaint Drafting Assistance: Your complaint needs to be precise and factual, not emotional or vague.

We help you structure your statement clearly and present your case in a way that gets taken seriously. - SCORES Portal Navigation: The online filing system can be confusing if you’ve never used it before.

We guide you step-by-step through registration, form filling, document uploading, and final submission. - Ongoing Case Management: Our support continues after filing.

We help you monitor your complaint status, prepare responses when the company replies, handle clarifications if SEBI asks for more information, and keep the momentum going until you resolve.

Don’t let confusion stop you from seeking justice. Connect with us now and let’s start your recovery journey together.

Conclusion

So, does SEBI handle customer complaints? Yes, they absolutely do, but only for registered market entities.

The SCORES system is efficient, transparent, and free. If your issue involves a SEBI-registered broker, mutual fund, or depository participant, your chances of resolution are very high.

You can also track your SEBI complaint status to stay updated on the progress of your grievance.

However, for unregistered fraudsters, Telegram scammers, and fake investment apps, SEBI’s reach is limited. You’ll need to involve cyber crime authorities and the police.

The most important lesson? Always verify SEBI registration before investing a single rupee. Check the SEBI website. Ask for registration certificates. Don’t fall for guaranteed return promises.

Remember, legitimate investment advisors don’t operate through Telegram only. They have proper offices, websites, and most importantly, SEBI registration numbers.

Stay alert. Verify everything. And if something feels too good to be true, it probably is.

Your money, your responsibility. Make informed decisions.