A lot of investors feel reassured the moment they see one line on a website- “SEBI Registered Research Analyst.” It sounds official, regulated, and safe.

But here’s the real question:

Does SEBI registration automatically mean that everything else, refund policy, disclosures, terms, service structure, is investor-friendly?

But registration alone doesn’t answer every question.

Before subscribing to any research service, it’s important to understand how it operates, what its policies say, and whether its structure aligns with investor protection norms.

In this article, we take a closer look at Ethical Research Analyst based on publicly available information from its website.

If you are considering subscribing to Ethical Research Analyst, or any similar research service, this review will help you ask the right questions before paying any subscription fee.

Ethical Research Analyst Review

If you’ve been exploring stock market research services, chances are you’ve come across names that claim to be SEBI-registered, professional, and reliable.

Ethical Research Analyst is one such platform.

On the surface, it presents itself as a SEBI-registered research entity offering paid stock market recommendations through SMS and subscription plans. That immediately creates a sense of legitimacy.

But here’s the thing: in the stock market, registration alone doesn’t answer every question.

Before subscribing to any research service, it’s important to pause and ask: What exactly am I paying for?

How transparent are their policies? What happens if I want to exit?

In this review, we’re not here to attack or defend. We’re simply going to look at the publicly available information on Ethical Research Analyst’s website, their SEBI registration details, refund policy, terms & conditions, disclosures, and how their service actually works.

The idea is simple: help you think clearly before making a financial decision.

Is Ethical Research Analyst Safe?

That’s the real question, right?

When money is involved, especially in the stock market, “safe” doesn’t just mean legally registered. It means transparency, consistent disclosures, and fair policies. It means knowing your rights as an investor.

Ethical Research Analyst does show SEBI registration details on its website and offers subscription-based research calls. But safety isn’t judged by one line on a footer.

It depends on the overall structure, refund rules, contractual clauses, conflict disclosures, and onboarding process.

So instead of jumping to conclusions, let’s break it down calmly and see how everything is structured.

We’ll start with the most basic layer of trust, SEBI registration.

Perfect. Continuing in the same structured, conversational tone.

Ethical Research SEBI Registration Status

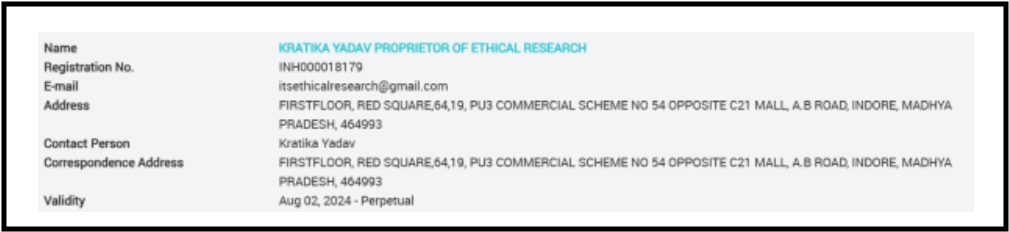

On its website footer, Ethical Research Analyst displays the following: SEBI Research Analyst No: INH000018179

This indicates that the entity is registered under SEBI’s Research Analyst Regulations, 2014. In simple terms, this means it has obtained regulatory approval to provide research recommendations in the securities market.

At this stage, many investors feel reassured. And that’s understandable. Even the official SEBI website displays the same.

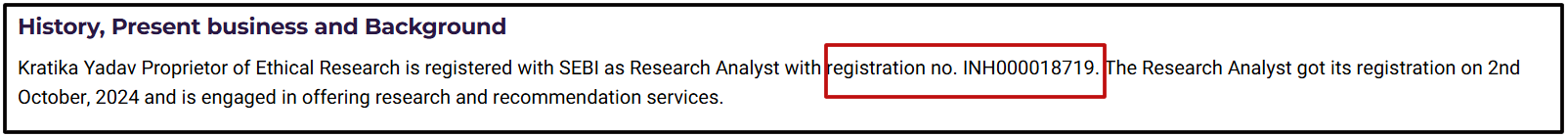

But while reviewing the Disclosure page on the same website, another registration number appears: INH000018719

Now, the difference may look minor, just two digits rearranged. However, registration numbers are official identifiers. Investors often verify them directly on SEBI’s registry before subscribing to paid services.

Because of that, such details are generally expected to remain consistent across all official communications.

This brings us to an important clarification.

SEBI registration allows a research analyst to operate legally. It confirms that the entity has been granted permission under the regulatory framework.

A Research Analyst is required to display the correct registration number wherever it operates.

However, a registration number is only the baseline for compliance, not a guarantee of ethical conduct or profit.

Under the SEBI Guidelines for Research Analyst operations, these entities are strictly prohibited from promising “guaranteed returns” or managing a client’s demat account directly.

The regulatory framework is designed to ensure that recommendations are based on objective analysis, yet many registered firms still face scrutiny for aggressive sales tactics or hidden fee structures that catch retail investors off guard.

However, SEBI registration does not guarantee:

- Profit on recommendations

- Accuracy of every call

- Risk-free trading

- Automatic refund rights

In short, registration is a license to operate, not a performance certificate.

That’s why it becomes equally important to examine the company’s policies and service structure beyond just the registration number.

Ethical Research Refund Policy

One of the most important things investors check before subscribing to any research service is simple, what happens if I want to cancel?

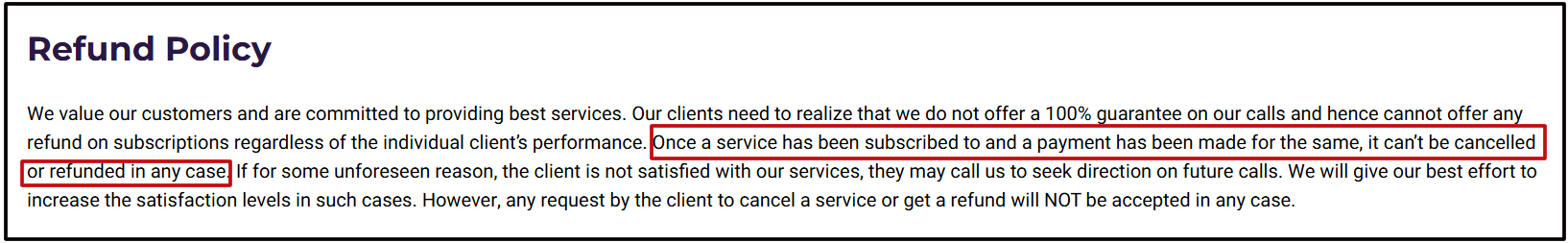

On the Ethical Research Analyst website, the refund policy clearly states that once a subscription is taken and payment is made, it cannot be cancelled or refunded under any circumstances.

The wording specifically mentions that requests for cancellation or refund “will NOT be accepted in any case.”

This is where investors need to slow down and read carefully.

Under SEBI’s regulatory framework for Research Analysts, clarity around fees, duration of service, and termination terms is considered important. Investors generally expect to understand:

- Whether fees are refundable in case of early exit

- Whether services can be discontinued midway

- What rights the subscriber retains after payment

A blanket no-refund clause may raise questions about exit flexibility.

Even if performance is not guaranteed, which is clearly mentioned by the company, investors typically look for transparent and fair termination terms before committing their funds.

This does not automatically imply wrongdoing. But it does mean that anyone considering a subscription should clearly understand that once payment is made, recovery of that amount may not be possible under the stated policy.

Refund rights are often one of the biggest practical concerns in subscription-based research services.

Terms & Conditions Analysis

Beyond the refund policy, the broader Terms & Conditions section gives further insight into how the service is structured.

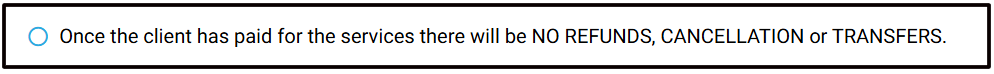

One key clause clearly states: “Once the client has paid for the services, there will be NO REFUNDS, CANCELLATION or TRANSFERS.”

This reinforces what we saw in the refund policy section: that subscriptions are treated as final once payment is made.

Another clause states: “The decision of the management of the company shall be final & binding on the customers.”

From an investor’s perspective, such wording can feel one-sided.

While companies are free to define service rules, investors generally expect that regulatory complaint mechanisms and statutory rights remain available, regardless of contractual language.

There is also an interesting point regarding advice versus opinion. The terms mention that suggestions provided in certain cases should be treated as an “opinion (not advice).”

At the same time, the company markets itself as a SEBI-registered Research Analyst offering research recommendations.

This makes it important for investors to clearly understand what they are subscribing to: structured research services or informal opinions.

Again, none of these clauses automatically implies misconduct. But they do highlight the importance of reading contractual terms carefully before making any payment.

Conflict Disclosure Review

Conflict disclosure is an important part of how research analysts are expected to operate. Investors typically want clarity on whether the analyst or related persons hold positions in the securities being recommended.

On the Disclosure page, the following statement appears: “The Research Analyst or any of its officer/employee does not trade in securities which are subject matter of recommendation.”

This suggests that neither the analyst nor its officers trade in the securities that are recommended, implying no direct conflict of interest from personal positions.

However, in the Disclaimer section, another statement appears: “Analysts or any person related to Ethical Research Analyst might be holding positions in the securities recommended.”

When placed side by side, these two statements can appear inconsistent.

One suggests no trading in recommended securities.

The other acknowledges that related persons might hold positions.

For investors, clarity in conflict disclosures matters. If positions may be held, it is usually expected to be clearly explained how such conflicts are managed and disclosed in individual recommendations.

This does not automatically indicate wrongdoing. However, consistent and transparent disclosures are generally considered important for maintaining investor trust.

How Services Are Delivered

Understanding how a research service actually operates is just as important as reviewing its policies.

According to the FAQ section on the website, Ethical Research Analyst states: “All calls are given by SMS only.”

“Account gets active only after payment is received in our bank accounts.”

“You can receive the tips through SMS with name of ‘Ethical Research’ or chat room.”

This indicates that the primary mode of delivering recommendations is through SMS and possibly chat-based communication.

From an investor’s point of view, this raises a few practical considerations:

- Are detailed disclosures attached with each recommendation?

- Is risk profiling completed before activating the service?

- Are terms acknowledged formally before payment?

The FAQ also suggests that the account becomes active only after payment is received. That means onboarding appears payment-first.

While SMS-based delivery is not unusual in the industry, investors generally expect structured documentation, especially when dealing with regulated research services.

The delivery model itself is not inherently problematic. However, clarity around onboarding, documentation, and risk acknowledgment becomes important when services are subscription-based.

Now, let’s look at complaints and whether any SEBI order has been issued against the company.

Complaints & SEBI Orders

One of the first things investors usually check while evaluating a research service is whether any regulatory action has been taken against it.

Based on publicly available information, no SEBI enforcement order, suspension notice, or penalty appears to have been issued against Ethical Research Analyst at the time of writing.

That’s important to state clearly.

There also do not appear to be widely reported large-scale complaints or public enforcement actions linked to the entity. However, the absence of a SEBI order does not automatically confirm full compliance in every operational aspect.

Regulatory action typically happens only when:

- Formal complaints are filed,

- Investigations are initiated,

- And enforcement proceedings are completed.

Many structural issues, if any, may never reach the stage of public enforcement unless formally escalated.

For investors, this means one thing:

The responsibility to read, question, and verify still rests with the subscriber before making payment.

How to File a Complaint Against RIA?

Not every dissatisfaction requires escalation. Markets carry risk, and losses alone do not mean misconduct.

However, there are certain situations where an investor may consider filing a formal complaint:

- If a refund is denied despite early termination requests and policy representations appear unclear.

- If marketing claims differ significantly from actual services delivered.

- If conflict disclosures appear inconsistent or unclear.

- If risk profiling or onboarding procedures were not properly completed before payment.

- If contractual terms appear to override regulatory rights.

Before escalating, it is generally advisable to first write to the company directly and seek clarification in writing. Clear documentation helps if the matter needs to be taken further.

If concerns remain unresolved, there is a structured way to approach regulatory authorities.

Let’s look at how to file a complaint properly.

What To Do In Such Cases?

If you believe your concern has not been addressed properly, there is a structured process available.

Step 1: Write to the Company

Start by sending a written complaint to the company’s official email or support channel. Clearly mention:

- Your subscription details

- Date of payment

- Nature of the issue

- What resolution are you seeking

Keep records of all communication.

Step 2: File a Complaint on SEBI SCORES

If the matter is not resolved satisfactorily, you can approach the SEBI SCORES (SEBI Complaints Redress System) portal.

Through SCORES, investors can file complaints against SEBI-registered intermediaries, including Research Analysts.

You will need:

- Registration number of the entity

- Payment proof

- Screenshots of relevant policies or communications

- Written complaint copy

SEBI forwards the complaint to the concerned entity for a response and monitors the resolution process.

Step 3: Escalation (If Required)

If the response remains unsatisfactory, further escalation mechanisms may be available under the regulatory framework.

The key point is simple: documentation matters. The clearer your evidence, the stronger your case.

Now, if you’re unsure about your situation or need guidance on the next step, here’s what you can do.

Need Help?

If you’re confused about your rights as an investor or unsure whether a research service has followed the proper process, you don’t have to figure it out alone.

Many investors feel stuck when policies are complex, refunds are denied, or disclosures are unclear.

The key is not panic; it’s documentation and clarity.

Register with us, and we will help you to:

- Understand your available options

- Organise your evidence properly

- Draft a structured complaint

- Take the right next steps under the regulatory framework

Apart from these,

- File a complaint in Smart ODR: Assistance in navigating the Online Dispute Resolution platform for quicker resolutions when eligible.

- Monitoring SEBI complaint status: We will also check SCORES regularly to see the advisor’s response and the status of the SEBI complaint. Responses to SEBI’s requests for more information or clarification should be made as quickly as possible.

Sometimes, simply reviewing the terms carefully and responding in writing makes a big difference.

Conclusion

Ethical Research Analyst presents itself as a SEBI-registered research entity offering subscription-based stock market recommendations.

That registration does provide regulatory recognition, and at the time of writing, there is no publicly available SEBI enforcement order against the entity.

However, registration is only one part of the bigger picture. Safety in financial services is not determined by a single line on a website footer.

It depends on how policies are structured, how clearly disclosures are written, and how fairly investor rights are handled in practice.

While reviewing the publicly available information, certain aspects such as the refund structure, consistency in disclosures, and contractual wording deserve careful attention before subscribing.

These observations do not automatically imply wrongdoing, but they do underline why investors should read beyond the headline claim of being “SEBI registered.”

Before committing money to any research service, it is important to feel comfortable with the terms, understand the exit rules, and verify regulatory details independently.

In the stock market, careful reading and informed decision-making often protect investors far better than assumptions based on branding alone.